The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less.

Full Answer

What are the requirements to enroll in Medicare Part B?

Individuals who must pay a premium for Part A must meet the following requirements to enroll in Part B: Be age 65 or older; Be a U.S. resident; AND Be either a U.S. citizen, OR

What is a Medicare Part B premium?

Part B premiums. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Who is eligible for premium part a and Part B?

To be eligible for premium Part A, an individual must be age 65 or older and be enrolled in Part B. Enrollment in premium Part A and Part B can only happen at certain times. (The section titled Enrollment Periods and When Coverage Begins explains the times when someone can enroll).

What is the standard Medicare Part B premium for 2020?

The standard Medicare Part B premium for medical insurance in 2020 is $144.60. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2020 Social Security benefits.

Are Medicare Part B premiums standard for everyone?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the 3 qualifying factors for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

How do you qualify to get $144 back on your Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I get my Part B premium back?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

How does adjusted gross income affect Medicare premiums?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What Factors Can Affect My Medicare Part B Premium?

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2018, t...

What Is The Medicare Part B Late Enrollment Penalty?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enr...

How Will I Know How Much My Medicare Part B Premium Will be?

The Social Security Administration (SSA) – or the Railroad Retirement Board, if that applies to you – will tell you how much your Part B premium wi...

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

What age do you have to be to get a Social Security card?

Understanding the Rules for People Age 65 or Older. To be eligible for premium-free Part A on the basis of age: A person must be age 65 or older; and. Be eligible for monthly Social Security or Railroad Retirement Board (RRB) cash benefits.

When do you have to be 65 to get Medicare?

Most people who are eligible for Medicare are automatically enrolled in Original Medicare (Part A and Part B) at age 65, if they’re receiving Social Security or Railroad Retirement Board benefits.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium is $148.50.

What happens if you don't sign up for Medicare?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enroll into Part B, for as long as you get Medicare Part B benefits. The penalty adds 10% to your Part B premium for each year (12-month period) that you could have signed up for Part B, but didn’t enroll.

Do you pay more for Medicare if you have high income?

You might pay more if you have a high income. See details below. The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify. If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see ...

Is Medicare Part B automatically deducted from Social Security?

In most cases, your Medicare Part B premium is automatically deducted from your benefits payment, which makes managing your premium payment easy. If you’re billed for your Part B premium each month (that is, if it’s not automatically deducted from your Social Security benefits), your premium payment might be somewhat higher than if it were ...

Do you have to pay late enrollment penalty for Part B?

If you qualify for a Special Enrollment Period to enroll in Part B, you may not have to pay a late-enrollment penalty. For example, if you delayed Part B enrollment because you were still covered by an employer’s plan (either your employer or your spouse’s), you might qualify for an SEP when you can enroll in Part B without a penalty.

Does Medicare Part B have a premium?

Medicare Part B typically comes with a premium. If you’re new to Medicare or becoming eligible soon, you might be wondering how much your Part B premium will be. The amount can vary depending on your situation.

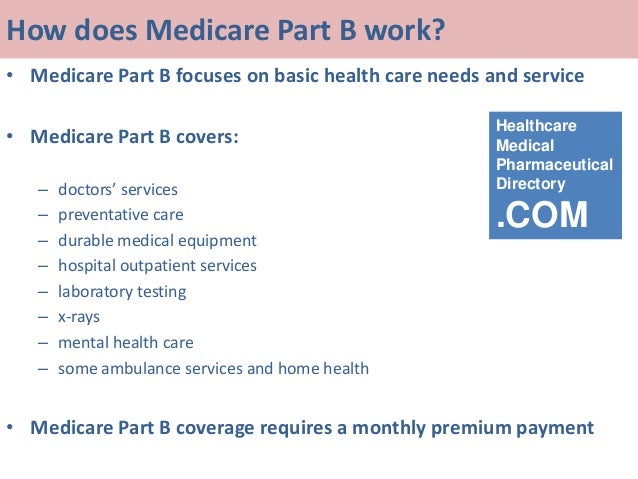

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

How long do you have to be a resident to be eligible for Medicare?

And, a U.S. citizen or a legal resident who has lived in the U.S. for at least five years. Note, however, that if you do not enroll in Part A when you are first eligible for Medicare and you have to pay a premium for Part A, you can only enroll later if you have a Special Enrollment Period, or during the General Enrollment Period .

How to contact Medicare in New York?

If you live in New York and have questions about cost-saving programs, call the Medicare Rights Center’s free national helpline at 800-333-4114.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...