Top 20 Medicare Supplement Companies by Direct Premiums Earned (Individual and Group Policies)

| Name of company | Direct premiums earned | Market share | Number of lives covered |

| UnitedHealthcare Insurance Company | 3,300,829,731 | 14.4% | 1,348,238 |

| Health Care Service Corporation, A Mutua ... | 1,597,753,683 | 7% | 635,527 |

| United of Omaha Life Insurance Company | 943,150,225 | 4.1% | 334,781 |

Full Answer

Who has the best Medicare supplement plans?

21 rows · Feb 15, 2022 · Below is a guide to 10 Medicare Supplement Insurance companies to help you choose the best ...

Which Medicare supplement plan should I Choose?

Feb 10, 2022 · This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015.

What is the best supplemental insurance plan for Medicare?

Manhattan Life sells 5 Medicare Supplement Insurance plans, including the popular Plan F, Plan C and Plan G. The company also sells a variety of other insurance products, including a dental, vision and hearing package that can be paired with a Medigap plan to give you some extra benefits that Original Medicare (Medicare Part A and Part B) doesn’t typically cover.

Which is the best Medicare supplement?

Feb 22, 2022 · A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that ...

What is the most comprehensive Medicare Supplement plan?

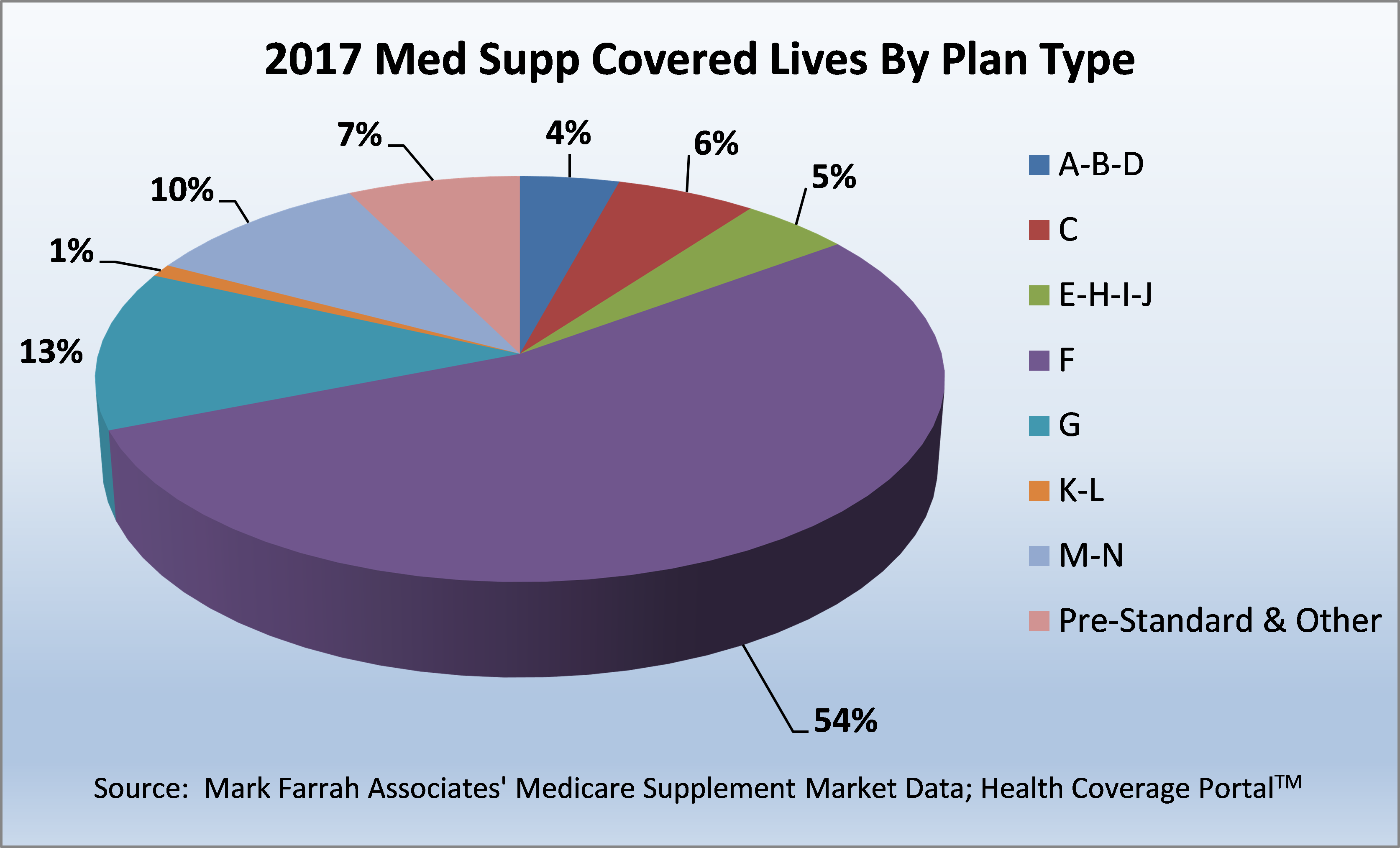

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most popular Medigap insurance company?

What's notable: Around one out of every three Medigap beneficiaries are enrolled in a plan from UnitedHealthcare and AARP. UnitedHealthcare is one of the top two largest insurance companies in the world....Top 10 Best Medicare Supplement Insurance Companies.AARP/UnitedHealthcare ProsAARP/UnitedHealthcare ConsGenerous plan selectionMust be an AARP member to enroll1 more row

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is Humana star rating?

Humana increased the number of contracts that received a 5-star rating on CMS's 5-star rating system from one contract in 2021 to four contracts in 2022, the most in the company's history, including HMO plans in Florida, Louisiana, Tennessee and Kentucky covering approximately 527,000 members.Oct 8, 2021

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.Nov 11, 2020

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Does Plan G have copays?

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance. If you don't need that level of coverage, though, you might want a plan with less coverage.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

What is Medicare Supplement 2020?

Top 10 Medicare Supplement Companies in 2020. As a senior, having a Medicare Supplement Insurance plan (also known as a Medigap plan) is a crucial step in taking care of your health care bills. This plan covers some or all of the expenses Original Medicare does not cover in Part A and B coverage. All the benefits under the plan are standardized, ...

How many states does Blue Cross Blue Shield cover?

Blue Cross Blue Shield (BCBS) has coverage in 36 states in the United States. The company is one of the oldest providers, dating back to the 1980s. Some of the plans include Plan A, F, G, K, L, and N. Plan A covers basic benefits, including foreign emergency travel and nursing coinsurance.

What is a Plan F?

Plan F covers Plan A and Part A deductible for inpatient care, Part B deductible for hospital care and outpatient services, excess charges for Part B, and foreign travel. 4. United Healthcare. The United Healthcare Medicare Supplement plans are some of the most popular in the United States.

What is Aetna insurance?

Aetna. Aetna is an international insurance provider with a long history of success, dating back to the 1960s. The company offers several Medigap plans, including Plan A, B, F, G, and N. With Aetna, you can enjoy the following benefits: An extra 365-day coverage after Medicare runs out.

What is the difference between Plan A and Plan G?

Plan F is comprehensive and includes copayments, coinsurance, deductibles, and Part B excess charges. Plan G is like Plan F but does not cover Part B excess charges.

How many states does Humana have?

Since its creation in 1961, Humana has continued to thrive in the healthcare industry. The company has providers in 22 states in the country. You can enjoy Plan A, B, C, F, G, and K Medigap plans by Humana.

What are the benefits of Plan F?

Some of the benefits under the plans include: Plan F is comprehensive and covers all gaps, including Part B coinsurance, Part A and B deductibles, blood, hospice coinsurance, deductibles, and excess charges.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

There are thousands of Medicare Advantage Plans available to seniors, but which companies are the most popular providers of this type of plan?

The Kasier Family Foundation reported that in 2020 there were over 3,000 Medicare Advantage Plans available to those eligible across the United States. With twenty-six percent of plans available belonging to United Healthcare, the company was the largest provider.

Which companies provide the greatest number of Medicare Advantage Plans?

This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015. This year 3,834 plans are available in total, and almost ninety percent include coverage to reduce the costs of prescription drugs.

Which states have seen the greatest and decrease increase in the number of plans?

Compared to data from 2021, Florida (+32) and Texas (+41) have seen the largest increase in the number of plans available. For the first time since 2010, Alaska will be able to offer more than one plan to Medicare members in that state. However, the news is not all good.

What states have Medicare Supplement Plans?

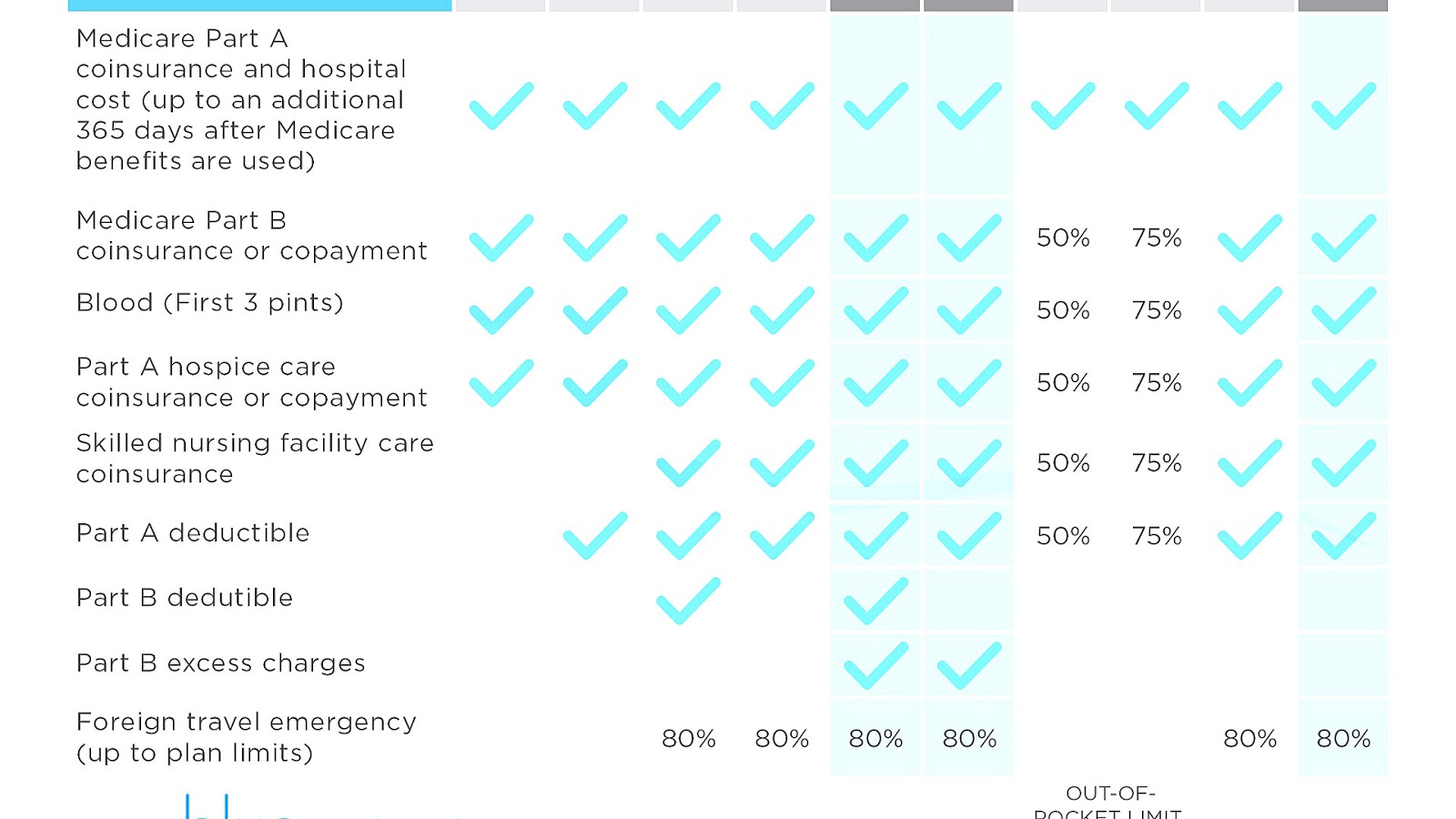

First, Medicare Supplement plans – also called Medigap – offer benefits that are standardized in every state except for Massachusetts, Minnesota and Wisconsin. This means each company’s plans pay for the same out-of-pocket Medicare costs as the same types of Medigap plans sold by other companies. Second, Medicare Supplement plan prices ...

What is the 7% discount for Medicare?

Plans aren't available in all 50 states. Offers a dental, vision and hearing plan that you can pair with your Original Medicare benefits and Medigap plan. Only offers Medigap Plans A, C, F, G and N.

How many states does Medico offer?

Medico offers 4 Medigap plans serving beneficiaries in 25 states, with a number of various discounts that may be available depending on where you live. The company supplements its Medigap selection with a lineup of related products such as short-term care insurance, hospital indemnity insurance and more. 11.

Is Aetna part of CVS?

Aetna is among the oldest health insurance companies around, with a long history of satisfied customers. Aetna recently merged with CVS Health , so plan members can pair an Aetna Medigap plan with an Aetna Part D prescription drug plan to utilize one of the largest pharmacy networks in the U.S. 4. Humana. Find Plans.

Does Bankers Fidelity offer Medicare Part D?

Doesn't offer Medicare Part D prescription drug plans. What’s notable: Bankers Fidelity has been selling Medigap plans for more than 30 years. Bankers Fidelity is unique because unlike the other insurance companies on this list, all of Bankers Fidelity insurance plans are designed specifically for seniors.

Is Mutual of Omaha in the Medicare market?

Mutual of Omaha has been in the Medicare market since Medicare was first established, and because the company also sells other types of policies such as life insurance and long-term care coverage, members can benefit from a more bundled approach. 7. Manhattan Life. Find Plans. Scroll for more.

Does every insurance company sell Medicare Supplement?

Not every insurance company sells Medicare Supplement Insurance in every state. And even each company’s plan selection can vary within the states it does serve. Choosing a Medicare Supplement Insurance company begins with choosing one that serves the area in which you live.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

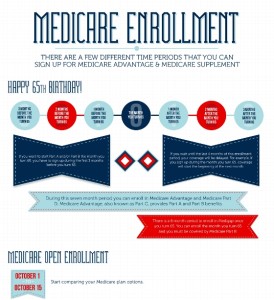

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”