Scroll for more

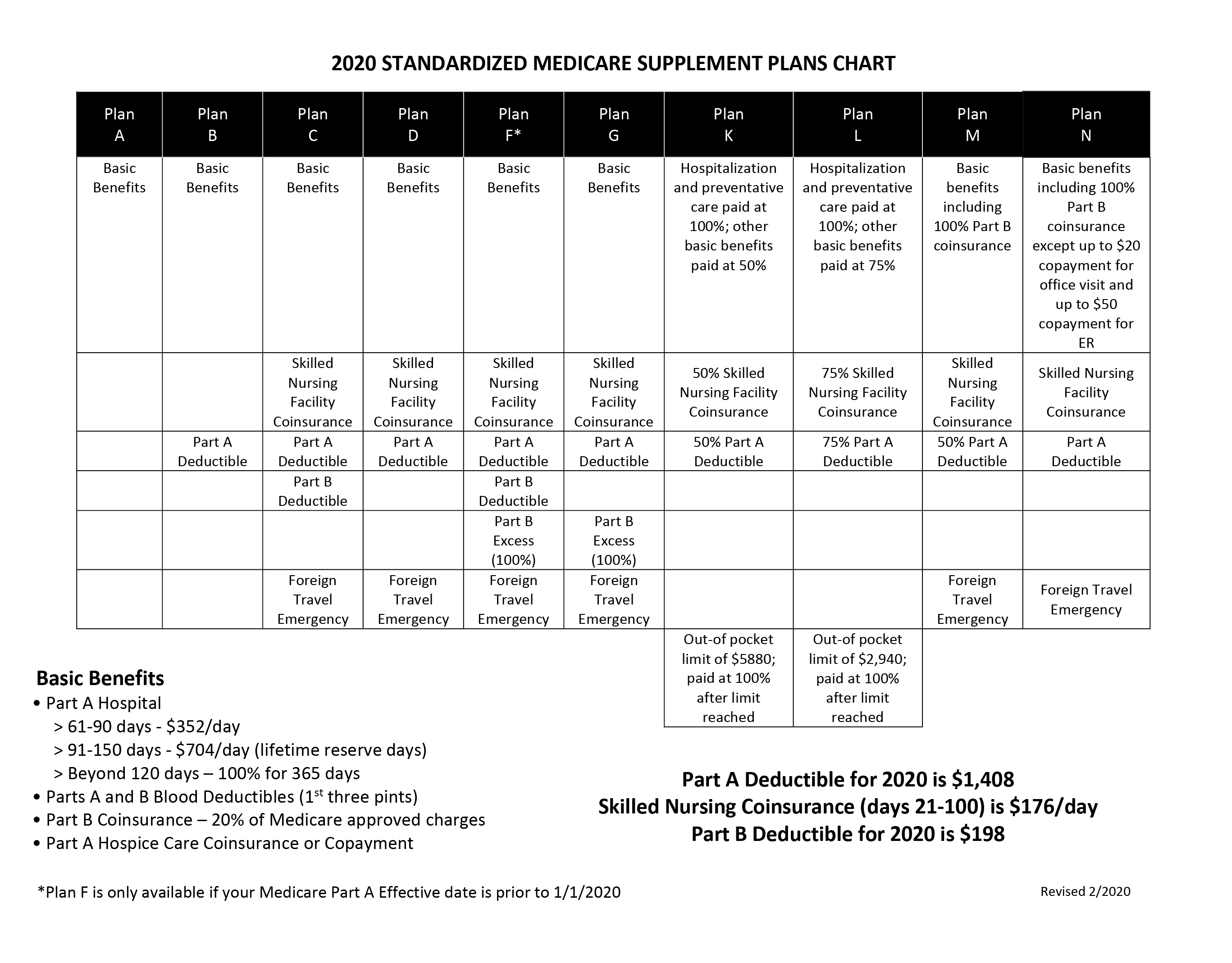

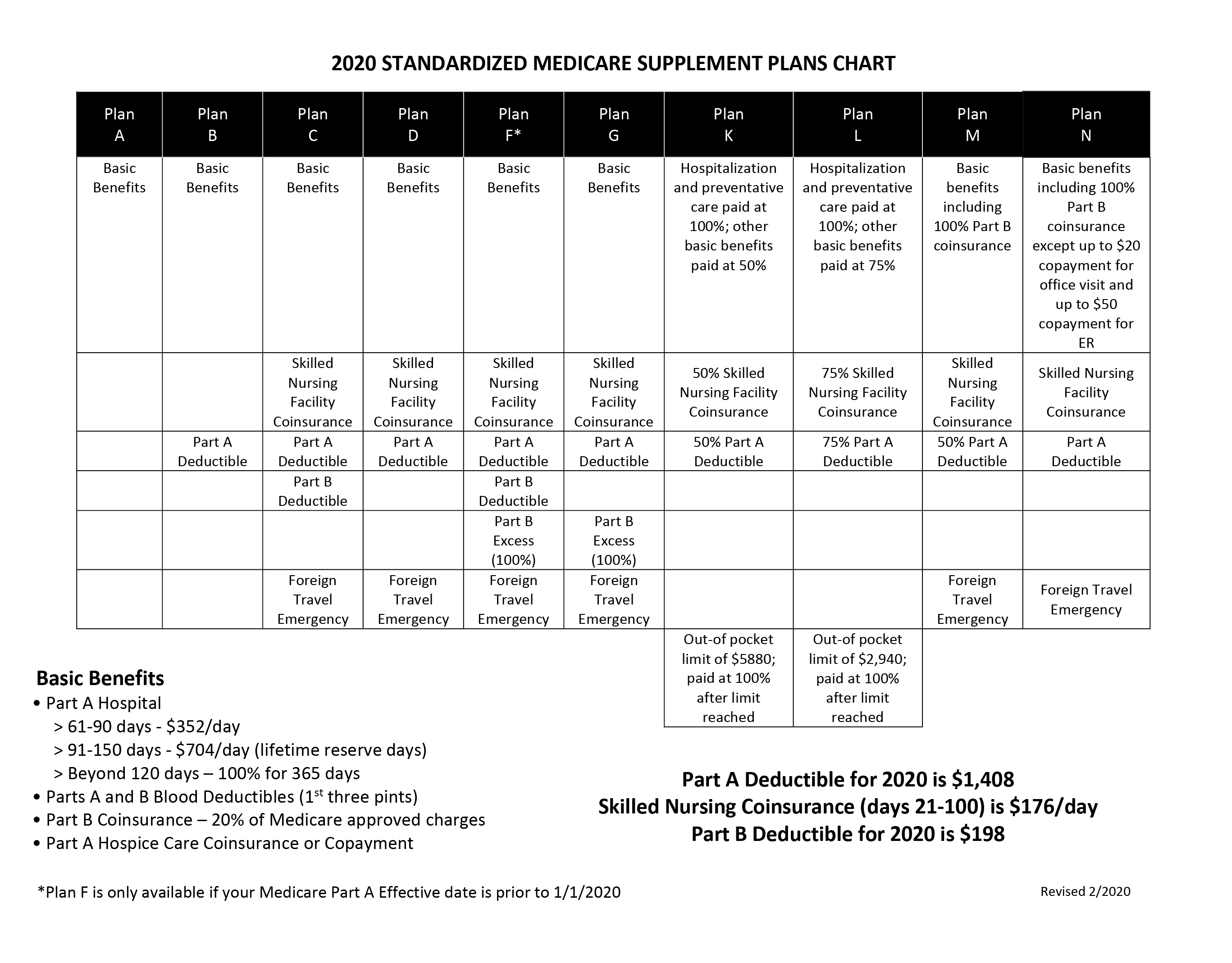

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50 % | 75 % |

| Part A hospice care coinsurance or copay ... | 50 % | 75 % |

| First 3 pints of blood | 50 % | 75 % |

- AARP / United Health Group. PLUSES. ...

- Mutual of Omaha. PLUSES. ...

- CVS/Aetna. PLUSES. ...

- Anthem Blue Cross Blue Shield. PLUSES. ...

- Healthcare Services Corp. PLUSES. ...

- CIGNA. PLUSES. ...

- CNO Financial (Resource Life Insurance Co.) PLUSES. ...

- Wellmark. PLUSES.

What are the top 5 Medicare supplement companies?

companies best medicare advantage company; alabama: viva medicare: arizona: cigna: arkansas: cigna: california: essence healthcare: kaiser permanente: scan health plan: sharp health plan: wellcare...

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Who are the best Medicare supplement providers?

Top 10 Supplemental Medicare Insurance Companies in 2021

- Mutual of Omaha – Best Overall

- Aetna – High-Quality Nationwide Options

- Cigna – Superior Customer Care

- United American – Best Enrollment Experience

- GPM – Superior Coverage Options

- UnitedHealthcare – Wide Variety of Plan Options

- Manhattan Life – Best Website Experience

- Bankers Fidelity – Best Senior Expertise

- Blue Cross Blue Shield – Best Mobile App

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Is Medicare Plan G better than plan C?

If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What does Medigap G pay for?

Medigap supplemental insurance covers the cost of Original Medicare deductibles, coinsurance, and copays. It may also cover a range of services excluded from Original Medicare coverage. Medigap Plan G is also available in some states as a high-deductible plan.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What states have 5 star Medicare Advantage plans?

States where 5-star Medicare Advantage plans are available:Alabama.Arizona.California.Colorado.Florida.Georgia.Hawaii.Idaho.More items...•

What is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4

What to know before comparing Medicare Supplements?

As we mentioned above, Medicare supplements are standardized. This means that a Plan G from one company has the same benefits as a Plan G from another company. However, financial ratings and rate increase histories will be different.

Why are Medicare benefits standardized?

After all, benefits are standardized so that the benefits for each plan letter are the same from company to company. Medicare supplement companies also pay your bills like clockwork because Medicare is the decision maker, so we never hear that any of them have slow-pay issues like the Medicare Advantage plans often do.

Is United Healthcare a Medicare Supplement?

While many other insurance companies offer the same standardized Medigap plans, United Healthcare Medicare Supplement plans are the only ones co-branded with a nationally known senior organization. United Healthcare Medicare Supplement plans are some of the most popular in the nation.

Is Cigna a Medicare Supplement?

Cigna has been innovating since 1982. Always offering competitive monthly premiums, Cigna is a top choice for Medicare Supplement plans. Cigna’s main priorities consist of creating an easy experience, bettering the well-being of their clients, and providing top notch service.

Does Manhattan Life offer Medicare Supplements?

Manhattan Life Medicare Supplements in 2021. Discounts are always appreciated when it comes to Medicare, and Manhattan Life knows this. That’s why they offer a household discount of 7% just for having a roommate. If you live with someone and you both are sixty or older, you can apply for this discount.

Is Mutual of Omaha Medicare Supplements in 2021?

Mutual of Omaha Medicare Supplements in 2021. Mutual of Omaha has some of the longest experience in Medicare Supplement plans. Since they have dealt with Medicare from the beginning, Mutual of Omaha knows and understands the system extremely well. Another great thing about Mutual of Omaha is that they have several subsidiary companies.

Is it difficult to compare Medicare supplements?

Comparing Medicare supplements ratings is a little more difficult than it is for Medicare Advantage companies, which have an easy 5-star ratings system. With Medigap plans, you are left to compare financial ratings, and as you can see, there are a whole bunch with A and B ratings.

What is Medicare Supplement 2020?

Top 10 Medicare Supplement Companies in 2020. As a senior, having a Medicare Supplement Insurance plan (also known as a Medigap plan) is a crucial step in taking care of your health care bills. This plan covers some or all of the expenses Original Medicare does not cover in Part A and B coverage. All the benefits under the plan are standardized, ...

How many states does Blue Cross Blue Shield cover?

Blue Cross Blue Shield (BCBS) has coverage in 36 states in the United States. The company is one of the oldest providers, dating back to the 1980s. Some of the plans include Plan A, F, G, K, L, and N. Plan A covers basic benefits, including foreign emergency travel and nursing coinsurance.

What are the benefits of Plan F?

Some of the benefits under the plans include: Plan F is comprehensive and covers all gaps, including Part B coinsurance, Part A and B deductibles, blood, hospice coinsurance, deductibles, and excess charges.

How many states does Humana have?

Since its creation in 1961, Humana has continued to thrive in the healthcare industry. The company has providers in 22 states in the country. You can enjoy Plan A, B, C, F, G, and K Medigap plans by Humana.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.