There are five different types of Medicare Advantage plans:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private-Fee-for-Service (PFFS)

- Medicare Savings Account (MSA)

- Special Needs Plan (SNP)

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What are the most popular Medicare Advantage plans?

6 rows · Aug 19, 2021 · Most Medicare beneficiaries who get an Advantage plan enroll in one of two types: HMO ...

How to pick the best Medicare Advantage plan?

Mar 27, 2022 · When you enroll in a Medicare Advantage plan you do not lose Medicare, you just get your benefits in a different way. There are four types of Medicare Advantage plans in Iowa: HMO , POS , PPO , PPFS , and SNP . In addition, a special type of health plan called a Cost Plan is offered in some counties.

What are the best Medicare Advantage programs?

There are several different types of Medicare Advantage plans. HMO (Health Maintenance Organizations) HMOs account for the largest share (64%) of Medicare Advantage enrollment and have been available under Medicare for several years.

Should you choose a Medicare Advantage plan?

Is offered by a private company. Contracts with Medicare to provide Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, ... Provides these benefits to people with Medicare who enroll in the plan.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the difference between Medicare Advantage and Medicare Advantage Plus?

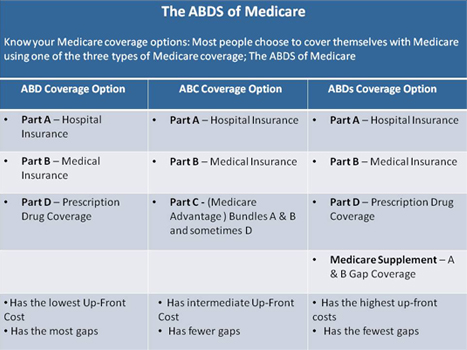

Keep in mind that Medicare Supplement insurance plans can only be used to pay for Original Medicare costs; they can't be used with Medicare Advantage plans. In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you're still in the Medicare program.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the difference between a Medicare supplement plan and a Medicare Advantage plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

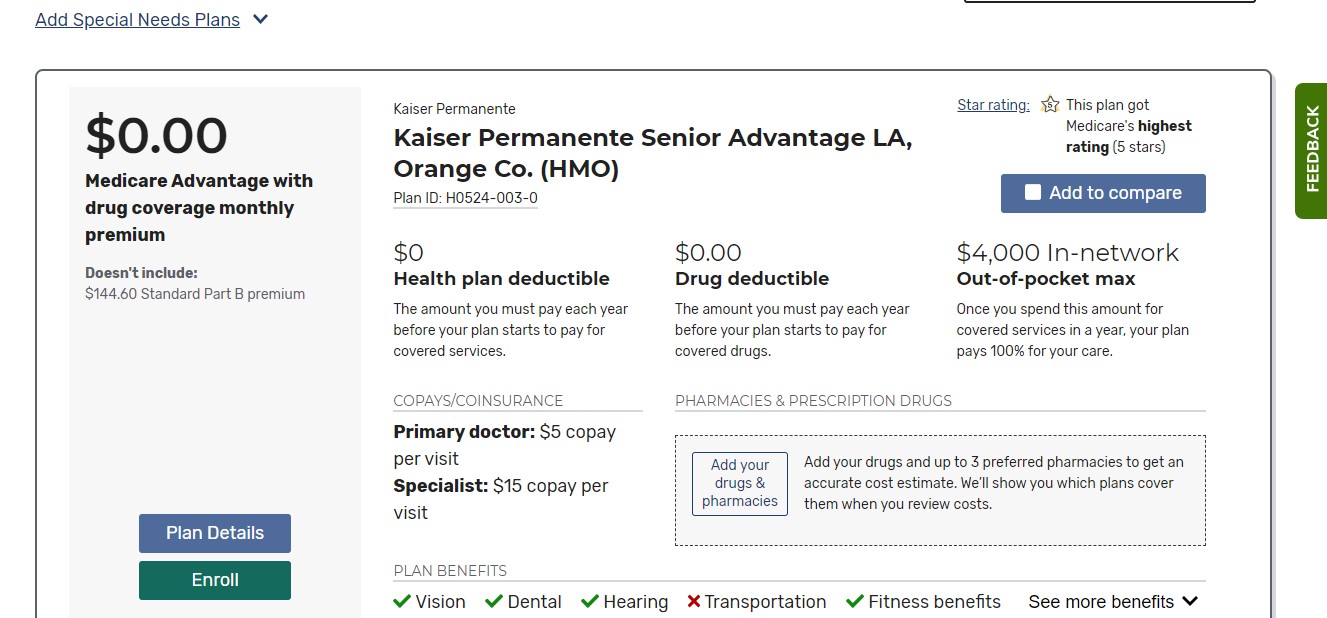

How can Medicare Advantage plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How do I choose an Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What is Medicare Advantage?

For those who qualify for Medicare — including individuals ages 65 and up and younger people with disabilities — Advantage plans, or Part C, are an alternative way to get covered.

How does Medicare Advantage differ from regular Medicare?

Unlike with original Medicare, there are geographic restrictions on the Advantage plans available to you and the healthcare providers they cover. That generally means you’ll have less choice or need to spend more to see a physician outside your plan’s network. “Beneficiaries who travel a lot within the U.S.

Why do Medicare Advantage plans get a bad rap? The Medigap disadvantage

Medigap is the supplemental insurance available to people with original Medicare. It fills in coverage gaps by covering things like deductibles (what you pay before insurance kicks in) and copays (the set amount you pay for a doctor’s visit and other services).

What are the six types of Medicare Advantage plans?

These plans cover care and services by providers within a defined network. For care outside the network, you usually have to pay the entire bill.

The bottom line

If you’re considering enrolling in a Medicare Advantage plan, you’ll want to compare not only individual plans but also different types of coverage. HMOs are the most popular option and can save you money, but they also come with restrictions.

What is SNP in medical?

SNPs were created specifically to serve individuals with special needs, including institutional ized individuals (individuals residing or expecting to reside for 90 days or longer in a long-term care facility), dual eligible (tho se individuals receiving both Medicare and Medicaid benefits), and other individuals with severe or disabling chronic conditions.

Why are PFFS more flexible than HMOs?

PFFS plans are more flexible than HMOs and PPOs because they are not required to establish provider networks. Patients can see “any willing Medicare-approved provider” if the provider accepts the plan’s terms and conditions. However, some PFFS Plans now have a network. You can also choose an out-of-network doctor, hospital, or other provider, who accepts the plan’s terms, but you may pay more.

Does MSA have Medicare Part D?

MSA plans do not offer Medicare Part D prescription drug coverage.

What is an HMO and PPO?

HMO (Health maintenance Organization) PPO (Preferred Provider Organization) SNP (Special Needs plan) These types of plans have different rules about seeing providers in-network and choosing a primary care physician. They also may have different costs and qualifications.

What is Medicare Advantage?

Medicare Advantage (also called Part C) plans are a way to get your Original Medicare benefits from a private insurance company. Most Medicare Advantage plans offer extra benefits, such as prescription drug coverage, routine dental, routine hearing, routine vision, and fitness benefits.

What are the different types of Medicare Advantage plans?

Summary: The three major types of Medicare Advantage plans are: These types of plans have different rules about seeing providers in-network and choosing a primary care physician. They also may have different costs and qualifications. Medicare Advantage (also called Part C) plans are a way ...

What is MSA in health insurance?

MSA (Medical Savings Account) In an MSA, a high-deductible health plan is combined with a bank account for you. Medicare deposits an amount of money each year into the bank account, and you can use the money to pay for any health care expenses throughout the year.

How many trips can Medicare Advantage take?

Some Medicare Advantage plans may offer transportation benefits, such as 36 trips a year by taxi or van to a plan-approved health location. There are three major types of Medicare Advantage plans. Not all types may be available in your area.

What is a SNP plan?

SNP (Special Needs plan) People who qualify for Special Needs Plans must meet certain qualifications. Special Needs plans are generally only for: People with certain chronic conditions. For example, some SNPs are for people with diabetes. In most cases, SNPs, like HMOs, require you to have a primary care doctor.

Is SNP coverage for out of area dialysis?

SNP Summary: Need to use network providers to be covered: generally yes except emergencies and out of area dialysis. Less common plan options include PFFS (Private Fee for Service) HMO Point-of-Service (HMO POS) and Medical Savings Account (MSA) plans.

What is SNP membership?

SNP membership is limited to those meeting the criteria of any of the following groups: Residents of institutions (like a nursing home) or in need of nursing care at their home. Individuals eligible for both Medicare and Medicaid. Patients diagnosed with certain chronic or disabling conditions, such as: Diabetes.

What is an HMO plan?

However, there are certain types of HMO plans, called HMO Point-of-Service (HMOPOS) plans, that cover some services out-of-network. It is also common for HMO plans ...

Is a PPO a HMO?

But, a PPO network is typically larger than that of an HMO. Additionally, with a PPO, patients can receive partial coverage for out-of-network services and often do not require a referral to see a specialist.

What is PFFS plan?

PFFS plans are different from other types of Advantage plans. Beneficiaries can seek health care from any Medicare doctor, or hospital that agrees to the plan’s payment terms and grants treatment of services. Nevertheless, not all doctors will accept the payment terms. Of course, the cost will be higher; but you have options for out-of-network ...

What are the different types of Medicare Advantage Plans?

The Different Types of Medicare Advantage Plans. Medicare Advantage plans include HMO, PPO, SNP, PFFS, and MSA. These plans and plan types come with a ton of information. Medicare Advantage Plans are private insurance plans that help with gaps in Medicare coverage.

Why do people choose Advantage over Medigap?

About 30% of recipients choose Advantage plans over Medigap plans due to the cost of premiums being much lower. The only premium cost you must pay for MA is your monthly Part B premium. Your Advantage plan will pay for the cost of healthcare bills, rather than Medicare. Beneficiaries pay expenses for services from providers in the plan’s network.

What is a SNP?

Special Needs Plans (SNP) Special Needs Plans restrict enrollment to individuals with specific diseases or disabilities. These plans adjust doctor choices, benefits, and drug formularies to meet best the medical needs of the group they serve. SNPs have specialists in the diseases or conditions that their members endure.

Can you get HMO care from out of network doctor?

For beneficiaries with HMO plans to receive coverage for care, you must receive services from doctors in your plan’s network. Some plans allow you to get care from an out-of-network doctor; although, the cost will be higher.

Do PPO plans pay less?

With PPO plans, you’ll pay less when visiting doctors, hospitals, or any health care provider when they belong to the plan’s network. Each PPO gives freedom to go to hospitals and see specialists/doctors that aren’t on your plan’s list. Be mindful, though, as these services come with additional costs.

Do you need a referral for a mammogram?

Members will need a referral from their doctor before seeing a specialist. Yearly mammogram screenings, in-network Pap test, and pelvic exams have coverage at least every other year. Beneficiaries with specific disabling or severe conditions may join a Special Needs Plan at any time, once they qualify.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.