Let’s discuss the most common plans:

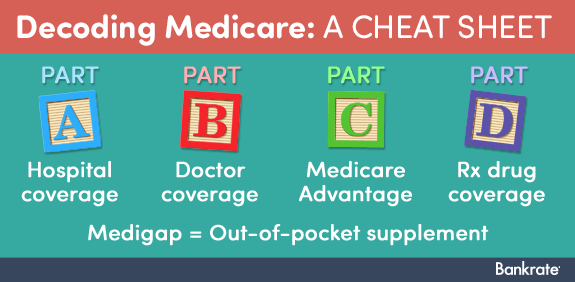

- Medicare Part A: Medicare Part A covers inpatient hospital care. ...

- Medicare Part B: Medicare Part B is optional and requires that people who enroll pay a monthly premium. ...

- Part C – Medicare Advantage Plans: Medicare Advantage Plans are offered by private companies and approved by Medicare. ...

Full Answer

What's the best Medicare plan?

Medicare health plans include: Medicare Advantage Plans Other Medicare health plans Medicare Cost Plans Demonstrations/Pilot Programs Programs of All-inclusive Care for the... Medicare Cost Plans Demonstrations/Pilot Programs Programs of All-inclusive Care for the Elderly (PACE)

What Medicare plan should I Choose?

Apr 12, 2022 · Medicare Advantage Plans. Medicare Advantage (Part C) plans combine your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) in one plan and usually include prescription drug coverage. These plans often also offer additional benefits such as dental, vision and fitness. Learn more about Medicare Advantage plans

What are the most popular Medicare HMO plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

How do I know what Medicare plan I have?

Below are the most common types of Medicare Advantage Plans. Health Maintenance Organization (HMO) Plans Preferred Provider Organization (PPO) Plans; Private Fee-for-Service (PFFS) Plans; Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include Hmo Point Of Service (Hmopos) Plans and a

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the 2 types of Medicare plans?

What's a Medicare health plan? Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is the difference between Medicare Part B and Medicare Advantage plan?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Are there different levels of Medicare?

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor's visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments.

What is AARP Medicare plan?

AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs.

Can you have both Medicare Part C and D?

Can you have both Medicare Part C and Part D? You can't have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you'll be unenrolled from Part C and sent back to original Medicare.

What is Part A and B Medicare?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

Does Medicare Part A and B cover 100 percent?

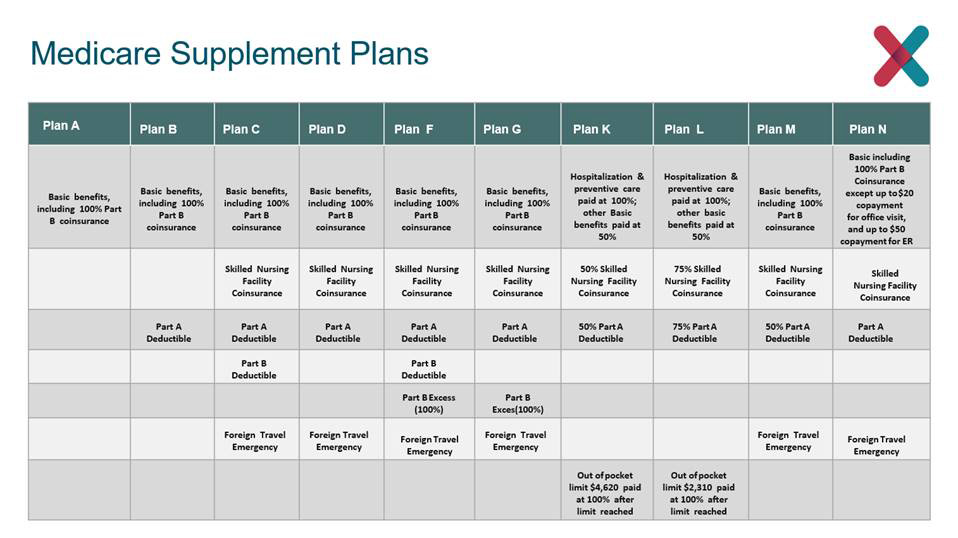

All Medicare Supplement insurance plans generally pay 100% of your Part A coinsurance amount, including an additional 365 days after your Medicare benefits are used up.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

How long does it take to get Medicare if you are 65?

If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer.

How much will you pay for prescriptions after the doughnut hole is closed?

A: Once the doughnut hole is closed in 2020, you will pay approximately 25 percent of the cost of your prescriptions until you reach the last phase or catastrophic coverage level. — Read Full Answer

How much did you pay for drugs in 2017?

When you and the drug plan have paid a total of $3,700 for drugs in 2017, you enter the coverage gap or doughnut During this second phase, you will pay no more than 40 percent of the plan's price for a brand-name drug and 51 percent for a generic drug. — Read Full Answer.

Does Medicare Supplemental Insurance cover deductibles?

A: Medigap or Medicare supplemental insurance is sold by private insurance companies and helps pay some of the health care costs original Medicare doesn’t cover, including some or most Medicare deductibles and coinsurance. — Read Full Answer.

Can I buy Medicare Supplement Insurance?

A: If you have a Medicare Advantage plan, you cannot buy a Medicare Supplement Insurance or Medigap plan. — Read Full Answer. Q: Do Medicare Advantage plans provide the same coverage as Original Medicare? A: Medicare Advantage plans cover all Medicare-covered services and must include both Part A and Part B benefits.—.

When can I change my Medicare plan?

A: You can change plans or join original Medicare once a year during the annual open enrollment period, from Oct. 15 through Dec. 7, and your new coverage will begin Jan. 1 of the following year. — Read Full Answer.

When will the doughnut hole be closed?

A: The coverage gap or doughnut hole will gradually narrow, if the current law continues as scheduled, until in 2020 and beyond you will pay no more than 25 percent of the cost of any covered drug in the doughnut hole. — Read Full Answer.

Medicare Part A and Part B

Medicare Part A and Part B is offered by the federal government. It provides basic inpatient and outpatient health coverage. You must be 65 years or older to be eligible. Those under 65 may qualify if they are disabled.

Private Medicare

Private Medicare insurance is a great way to lower your out-of-pocket costs and get additional health care benefits. In other words, Private Medicare Insurance helps provide additional coverage where Medicare Part A and Part B do not provide coverage.

There are three types of Private Medicare plans

Medigap plans, also known as Medicare Supplement plans, are purchased in addition to your Medicare Part A and Part B coverage. These plans may lower your out-of-pocket costs. Medigap plans will pay for your Medicare Part A deductible of $1,408 per hospital visit.

What is Medicare Advantage?

Medicare Advantage (Part C) plans combine your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) in one plan and usually include prescription drug coverage. These plans often also offer additional benefits such as dental, vision and fitness.

What is a special needs plan?

Special Needs Plans are Medicare Advantage plans designed for specific needs that include prescription drug coverage. Plans may also include other benefits like care coordination. There are four types of Special Needs Plans including Dual Special Needs Plans for people with both Medicare and Medicaid.

Does Medicare cover dental?

Original Medicare (Parts A & B) doesn't cover everything you may need to live a healthy lifestyle. Medicare Part A and Part B do not provide prescription drug coverage, nor do they offer other health care benefits such as for dental, vision or hearing that you may consider important to your health. There are plans offered by private insurance companies that can either supplement Original Medicare or be chosen as an alternative that may help you get the additional coverage you need.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is Medicare Advantage?

For those who qualify for Medicare — including individuals ages 65 and up and younger people with disabilities — Advantage plans, or Part C, are an alternative way to get covered.

How does Medicare Advantage differ from regular Medicare?

Unlike with original Medicare, there are geographic restrictions on the Advantage plans available to you and the healthcare providers they cover. That generally means you’ll have less choice or need to spend more to see a physician outside your plan’s network. “Beneficiaries who travel a lot within the U.S.

Why do Medicare Advantage plans get a bad rap? The Medigap disadvantage

Medigap is the supplemental insurance available to people with original Medicare. It fills in coverage gaps by covering things like deductibles (what you pay before insurance kicks in) and copays (the set amount you pay for a doctor’s visit and other services).

What are the six types of Medicare Advantage plans?

These plans cover care and services by providers within a defined network. For care outside the network, you usually have to pay the entire bill.

The bottom line

If you’re considering enrolling in a Medicare Advantage plan, you’ll want to compare not only individual plans but also different types of coverage. HMOs are the most popular option and can save you money, but they also come with restrictions.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.