MLS income thresholds and rates 2013–14

| Threshold | Base tier | Tier 1 | Tier 2 | Tier 3 |

| Single thresholds | $88,000 or less | $88,001 – $102,000 | $102,001 – $136,000 | $136,001 or more |

| Family thresholds | $176,000 or less | $176,001 – $204,000 | $204,001 – $272,000 | $272,001 or more |

| Medicare levy surcharge | 0% | 1% | 1.25% | 1.5% |

- cost sharing tier 1: most generic prescription drugs; lowest copayment.

- cost sharing tier 2: preferred, brand name prescription drugs; medium copayment.

- cost sharing tier 3: nonpreferred, brand name prescription drugs; higher copayment.

What are Tier 1 and 2 drugs?

What is a Tier 1 and Tier 2 drug? Tier 1. The prescription drug tier which consists of the lowest cost tier of prescription drugs, most are generic. Tier 2. The prescription drug tier which consists of medium-cost prescription drugs, most are generic, and some brand name prescription drugs.

What does Tier 1 drugs mean?

Tier 1: The prescription drug tier which consists of the lowest cost tier of prescriptions drugs, most are generic. Tier 2: The prescription drug tier which consists of medium-cost prescription drugs, most are generic, and some brand-name prescription drugs. Tier 3

What is a Tier 6 drug?

Tier 6 Non Preferred Specialty drugs* *Specialty drugs ─ filled by a specialty pharmacy and limited to a 30-day supply ─ are prescription medications that often require special storage, handling and close monitoring

What is Medicare Tier 1?

Tier 1 usually includes a select network of providers that have agreed to provide services at a lower cost for you and your covered family members. Tier 2 provides you the option to choose a provider from the larger network of contracted PPO providers, but you may pay more out-of-pocket costs.

What are Tier 1 Tier 2 and Tier 3 drugs?

There are typically three or four tiers: Tier 1: Least expensive drug options, often generic drugs. Tier 2: Higher price generic and lower-price brand-name drugs. Tier 3: Mainly higher price brand-name drugs.

Are there different tiers of Medicare?

Each plan can divide its tiers in different ways. Each tier costs a different amount. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. A type of Medicare prescription drug coverage determination.

What are Tier medications?

Drug tiers are a way for insurance providers to determine medicine costs. The higher the tier, the higher the cost of the medicine for the member in general. If you look at your insurance card, you'll see the copay values for all the tiers under your insurance plan.

What are Tier 3 medications?

What does each drug tier mean?Drug TierWhat it meansTier 3Preferred brand. These are brand name drugs that don't have a generic equivalent. They're the lowest-cost brand name drugs on the drug list.Tier 4Nonpreferred drug. These are higher-priced brand name and generic drugs not in a preferred tier.4 more rows•Apr 27, 2020

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

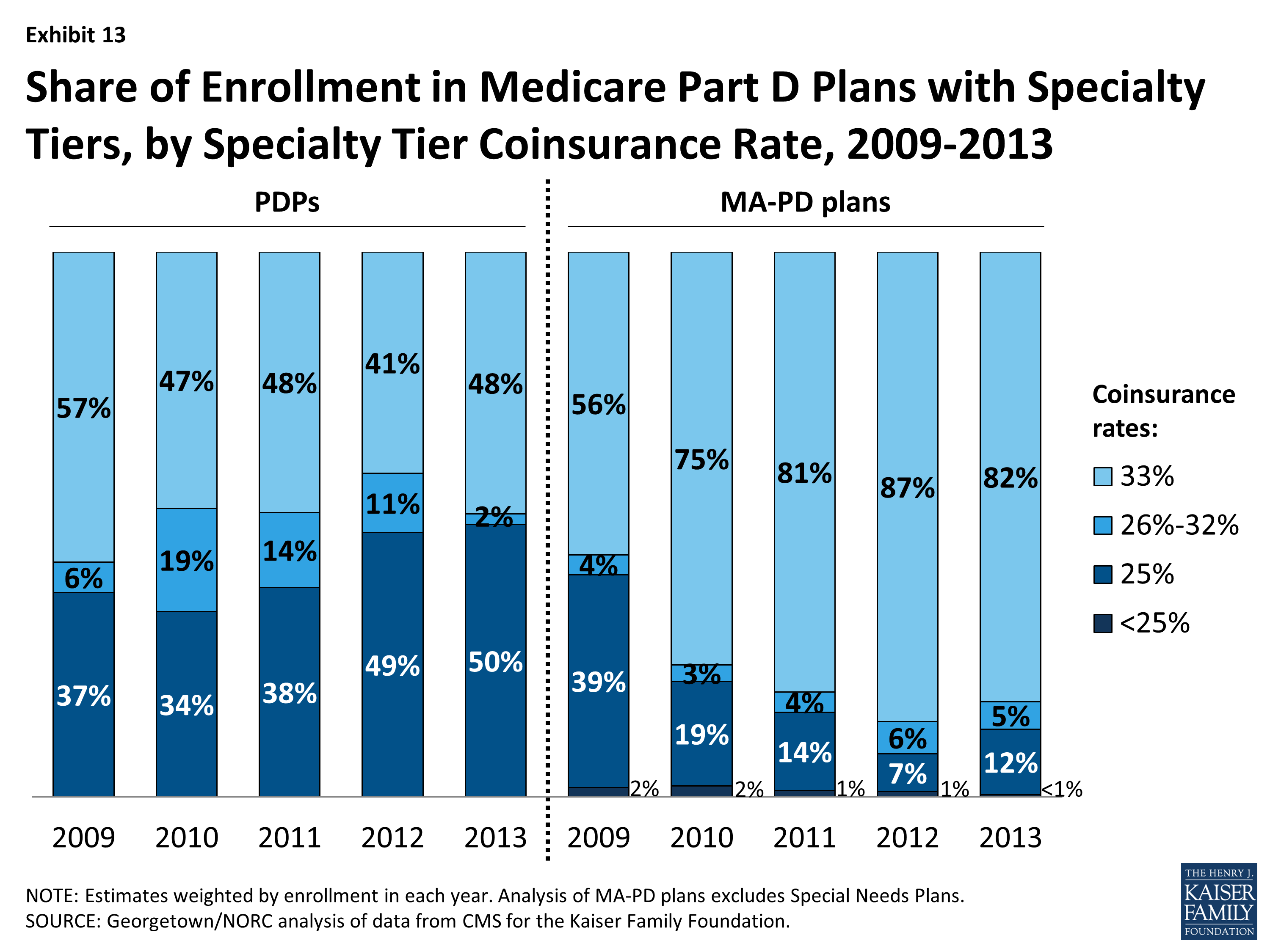

How many tiers are there in Medicare Part D?

five-tierThe typical five-tier formulary design in Part D includes tiers for preferred generics, generics, preferred brands, non-preferred drugs, and specialty drugs.

What does Tier 1 and Tier 2 mean in health insurance?

Tier 1 usually includes a select network of providers that have agreed to provide services at a lower cost for you and your covered family members. Tier 2 provides you the option to choose a provider from the larger network of contracted PPO providers, but you may pay more out-of-pocket costs.

What is a Tier 1 medication?

Tier 1 - Generic: All drugs in Tier 1 are generic and have the lowest possible copayment. A copayment is a fixed amount you pay when you get a prescription filled or receive other health care services. Drugs listed as Tier 1 are preferred because they offer the best combination of value and effectiveness.

What tier is metformin?

What drug tier is metformin typically on? Medicare prescription drug plans typically list metformin on Tier 1 of their formulary. Generally, the higher the tier, the more you have to pay for the medication. Most plans have 5 tiers.

What is a Tier 1 and Tier 2 drug?

Tier 1. The prescription drug tier which consists of the lowest cost tier of prescriptions drugs, most are generic. Tier 2. The prescription drug tier which consists of medium-cost prescription drugs, most are generic, and some brand-name prescription drugs.

What tier is gabapentin?

What drug tier is gabapentin typically on? Medicare prescription drug plans typically list gabapentin on Tier 1 of their formulary. Generally, the higher the tier, the more you have to pay for the medication.

What tier is atorvastatin?

For example: atorvastatin is a generic, tier 1 drug with a quantity limit of 30 doses per 30 days. REPATHA is a brand-name, tier 3 drug. Before it's prescribed, you would need prior authorization from Medical Mutual to determine if it's covered.

What is tier 4 in Medicare?

Tier 4. Nonpreferred drug. These are higher-priced brand name and generic drugs not in a preferred tier. For most plans, you’ll pay around 45% to 50% of the drug cost in this tier. Tier 5. Specialty. These are the most expensive drugs on the drug list.

What is a drug tier?

Drug tiers are how we divide prescription drugs into different levels of cost.

How much does a tier 1 drug cost?

Preferred generic. These are commonly prescribed generic drugs. For most plans, you’ll pay around $1 to $3 for drugs in this tier. Tier 2. Generic. These are also generic drugs, but they cost a little more than drugs in Tier 1. For most plans, you’ll pay around $7 to $11 for drugs in this tier.

What is preferred brand?

Preferred brand. These are brand name drugs that don’t have a generic equivalent. They’re the lowest-cost brand name drugs on the drug list. For most plans, you’ll pay around $38 to $42 for drugs in this tier. Tier 4. Nonpreferred drug. These are higher-priced brand name and generic drugs not in a preferred tier.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

Why does Medicare change its drug list?

Your plan may change its drug list during the year because drug therapies change, new drugs are released, or new medical information becomes available.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is tiering exception?

A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier. You or your prescriber must request an exception, and your doctor or other prescriber must provide a supporting statement explaining the medical reason for the exception. .

What Is a Drug Formulary?

A drug formulary is the list of prescription drugs covered by your plan. It includes both generic and brand name medications.

What Are Drug Tiers?

Medications from the drug formulary are placed on tiers. The lowest tier has the lowest prices, with costs rising along with the tiers.

How Are Drugs Priced on the Tiers?

Prescription drug pricing varies according to the insurer. However, generally speaking, you pay either a co-pay, which is a set dollar amount, or co-insurance, which is a percentage of the drug cost.

Other Prescription Drug Plan Restrictions

In addition to the formulary and tier pricing, your insurer may place other restrictions on coverage. The most common are step therapy and prior authorization.

Why Do PDPs Have These Restrictions?

The goal of drug formularies, tier pricing, and other restrictions is to help lower costs for both you and your insurance company.

What Happens When the Formulary Changes?

Insurance companies add and remove medications from the drug formulary throughout the year, not just during Annual Enrollment. That means that you may suddenly discover a medication you've taken for years is no longer covered.

Saving Money on Your Prescriptions

The easiest way to save money on your prescriptions is to follow your plan's rules. And understanding your PDP's drug formulary, tier pricing, and other restrictions is the first step toward working within those guidelines.

What about Medicare Advantage plans?

The price for Medicare Advantage (Part C) plans greatly varies. Depending on your location, you may have dozens of options, all with different premium amounts. Because Part C plans don’t have a standard plan amount, there are no set income brackets for higher prices.

What about Medicaid?

If you qualify for Medicaid, your costs will be covered. You won’t be responsible for premiums or other plan costs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

Does Medicare Part B get deducted from Social Security?

Medicare Part B premiums are deducted from Social Security checks, and Social Security benefit amounts are adjusted annually by the cost-of-living adjustment (COLA).

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Can lower income Medicare beneficiaries afford Part D?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.