How do Medicare Part D premiums work?

Although the CMS decides what the Medicare portion of your premium will be, you'll make a single payment each month directly to your insurer. This payment includes both the Medicare portion and the insurer portion of your premium. Your Part D plan may include a yearly deductible.

Does Medicare Part D still exist?

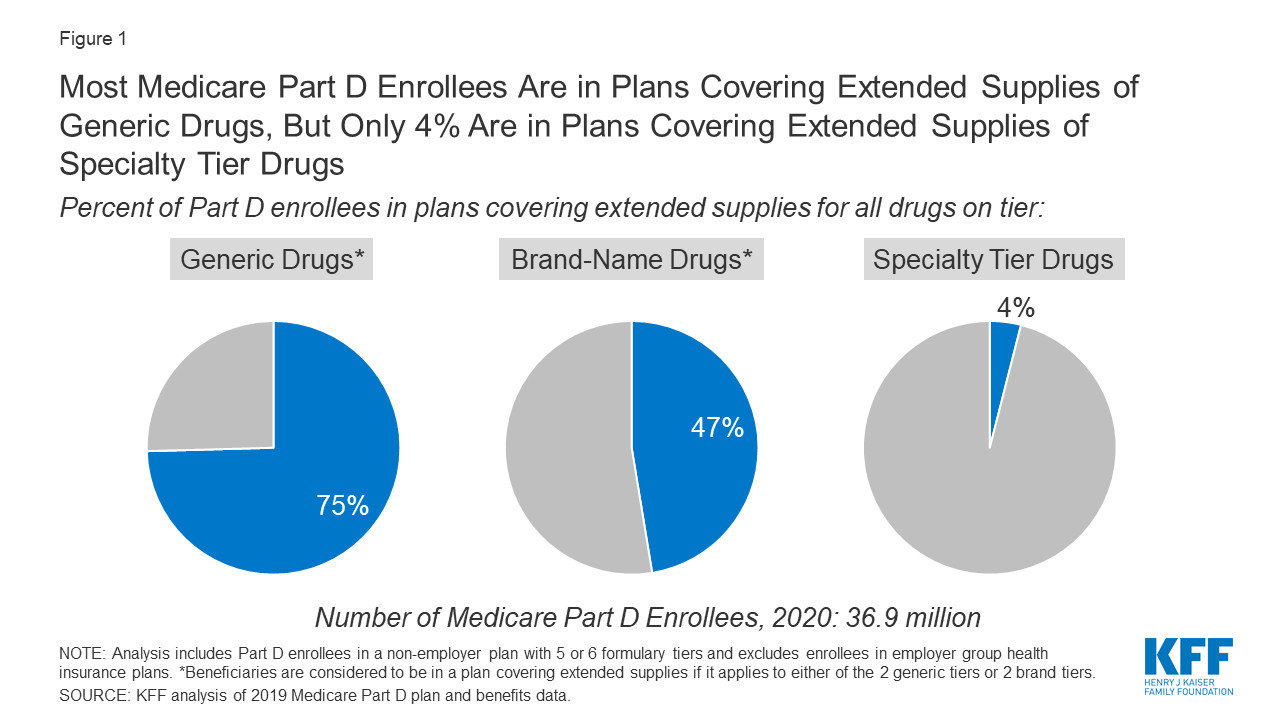

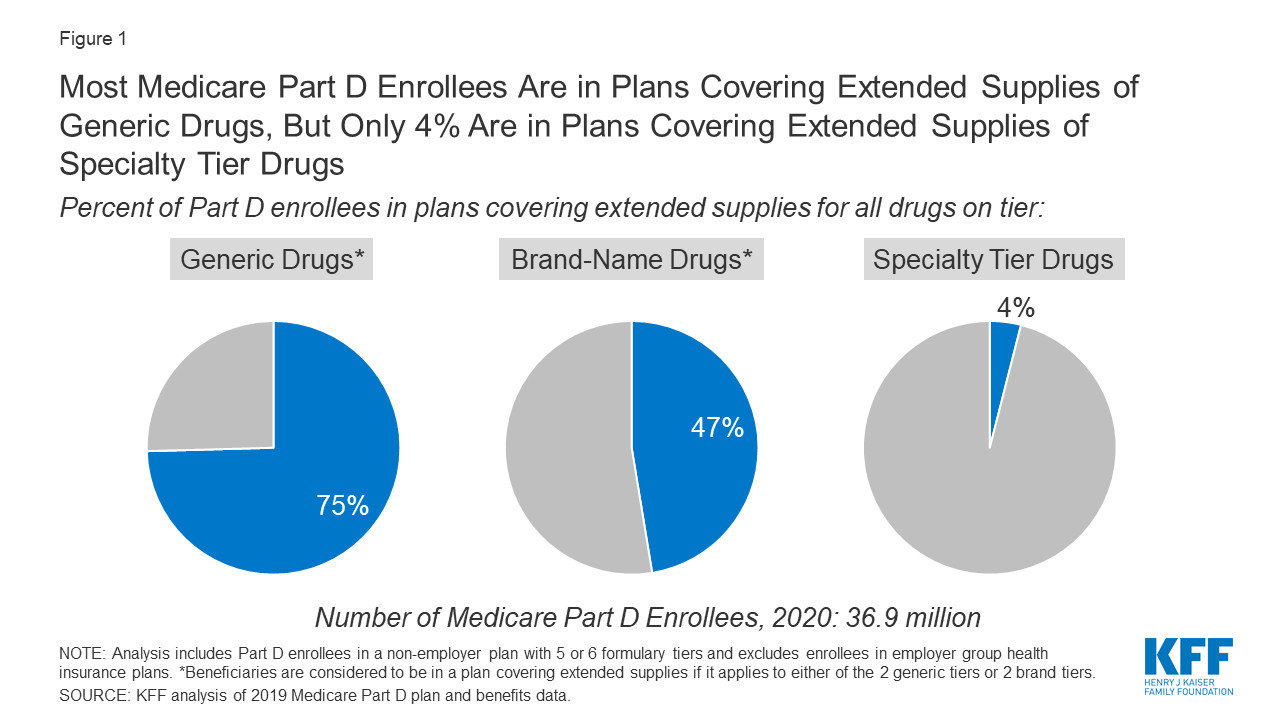

Part D remains one of Medicare’s most popular programs, with more than 48 million Medicare beneficiaries enrolled for prescription drug coverage. CMS continues to analyze changes to the Part D program carefully, and engages with stakeholders to identify opportunities for improvements, particularly for reducing costs.

How much does Medicare Part D prescription drug coverage cost?

Part D prescription drug coverage helps millions of Original Medicare beneficiaries pay for their medication costs. Those benefits, however, come at a price. Nationwide, the average monthly Part D premium in 2020 is $30. 1 If you find a plan that’s cheaper, it might be tempting to snag it and call it a day.

How do I compare Medicare Part D plans?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com. 2 How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is a typical Part D premium?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What is the standard Medicare Part D premium for 2021?

$33.06As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

What is the standard Medicare Part D premium for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

How are Part D premiums determined?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Is SilverScript a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

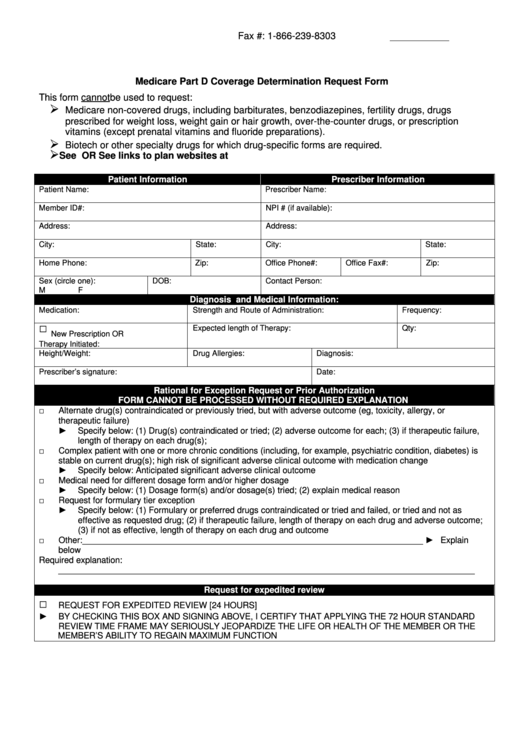

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is Part D copayment?

Copayments and coinsurance are similar: they represent the portion of costs you pay for your Medicare prescription drugs after you meet your deductible. The difference is in the way insurers calculate those portions. Copayment: a set dollar amount—such as $10—that you pay for covered prescription drugs.

What is the difference between copayment and coinsurance?

Copayment: a set dollar amount—such as $10—that you pay for covered prescription drugs. Coinsurance: a percentage of the cost—like 20%—that you pay for prescription drugs. Generally, your copayment or coinsurance will change depending on what drugs you take.

How long does it take for a prescription drug to start accruing?

If your current prescription drug coverage ends soon, start the enrollment process for Part D as soon as you can. Penalties start accruing just 63 days after your creditable coverage ends.

What is Medicare premium based on?

The Medicare portion based on your income. The insurer’s portion, which varies from plan to plan. The Medicare portion of your premium depends on your Modified Adjusted Gross Income (MAGI) from your most recent tax return.

How much is Part D insurance in 2020?

Nationwide, the average monthly Part D premium in 2020 is $30. 1 If you find a plan that’s cheaper, it might be tempting to snag it and call it a day. Unfortunately, premiums aren’t the only cost Part D beneficiaries encounter. You may also come up against deductibles, copayments or coinsurance, and other out-of-pocket costs.

Can you see your Part D coverage?

When you apply for a Part D plan with an insurer, it might see proof of creditable coverage in your records. If not, the company sends you a form to fill out with your previous coverage information. To make this process easy on yourself, keep records of your prescription drug coverage.

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

What is Medicare Part D?

Copayment tiers. Summary. Medicare Part D is the part of Medicare that covers prescription drug costs. Medicare requires that all people aged 65 years and over have some form of creditable prescription drug coverage. A person may be able to set up prescription drug coverage through a Medicare Part D plan, a bundled Medicare Advantage plan, ...

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What happens if I don't receive my Medicare check?

If a person does not receive a check, they may have to pay a bill directly to Medicare or the Railroad Retirement Board. The IRMAA premiums vary depending on whether a person files an individual, married filing jointly, or married filing separately return.

How does Medicare determine the amount of Social Security?

Medicare determines this amount using the monthly adjusted gross income from the enrollee’s most recent tax return. A person does not pay their IRMAA to the insurance company that holds their plan. Instead, Medicare will often deduct this amount from their Social Security check.

How much is Medicare Part D 2020?

For 2020, this premium is $32.74. For 2019, the Medicare Part D premium was $33.19. However, these premiums range in cost, varying by region and plan. For example, some Part D premiums may be as low as $12.18 in California, while Part D might have a $191.40 premium in South Carolina. Medicare can collect the Part D premium from Social Security ...

What is the cost of coinsurance for 2020?

Coverage gap: Medicare Part D plans have a coverage gap or donut hole once Medicare and the individual spend a certain amount on drug costs. For 2020, this is $4,020.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.