What states have Medicare Advantage plans?

State Differences in Medicare Advantage Medicare Advantage plans are private policies that you can buy to replace Original Medicare coverage. The federal government requires them to cover everything Original Medicare covers in all 50 states.

Is Medicare Advantage in every state?

Did you know the Medicare Advantage (Medicare Part C) program is available in almost every state, and lets you get your Original Medicare benefits through a private, Medicare-approved insurance company instead of directly from the government?

Why do some areas not have Medicare Advantage plans?

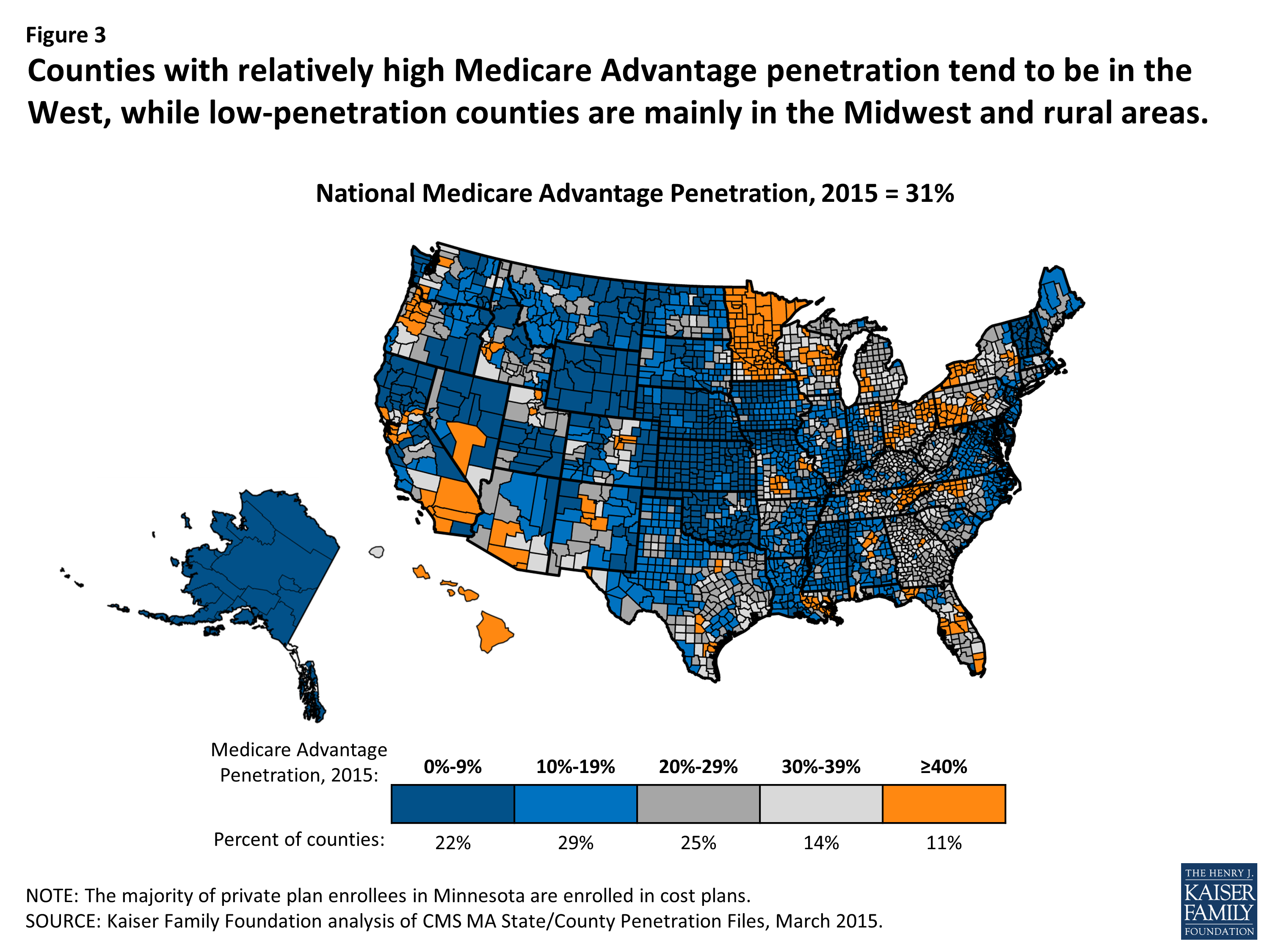

The increase in the number of counties without a Medicare Advantage plan appears to be primarily due to the withdrawal of Private Fee-For Service (PFFS) plans in relatively rural areas, following new network requirements for these plans.

Which Medicare Part is advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What percent of seniors choose Medicare Advantage?

Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation.

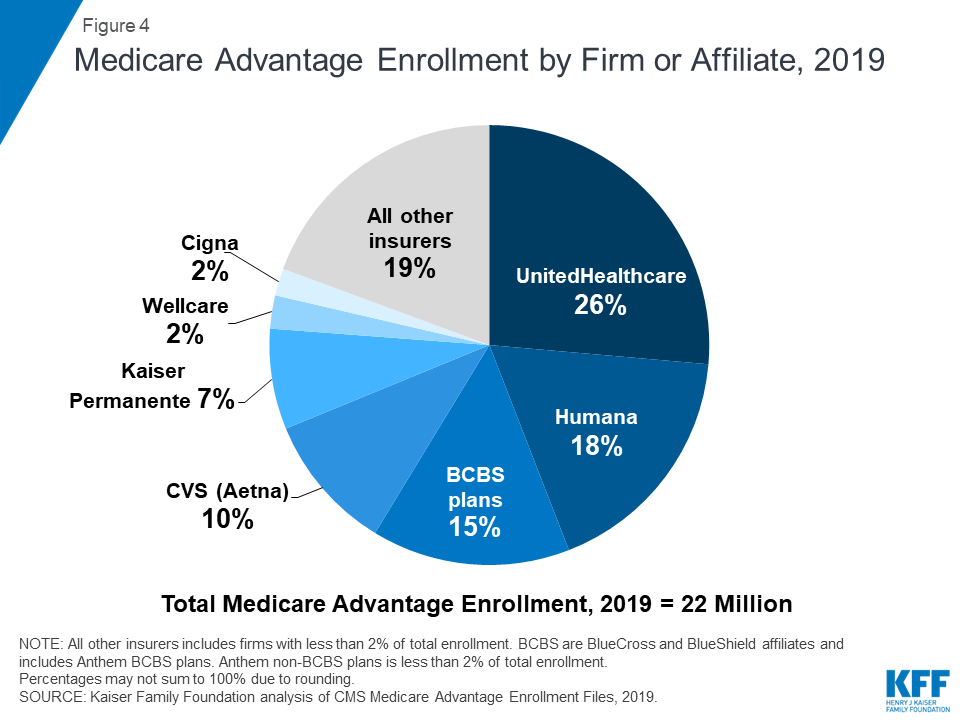

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What is the biggest disadvantage of Medicare Advantage?

The takeaway There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.

What to know about Medicare Advantage?

Things to know about Medicare Advantage Plans. You're still in the Medicare Program. You still have Medicare rights and protections. You still get complete Part A and Part B coverage through the plan. Some plans offer extra benefits that Original Medicare doesn ’t cover – like vision, hearing, or dental. Your out-of-pocket costs may be lower in ...

Can you pay more for a Medicare Advantage plan than Original Medicare?

Medicare Advantage Plans can't charge more than Original Medicare for certain services like chemotherapy, dialysis, and skilled nursing facility care. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

Is Medicare Advantage covered for emergency care?

In all types of Medicare Advantage Plans, you're always covered for emergency and. Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening.

Does Medicare cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you're always covered for emergency and Urgently needed care.

What is Medicare Advantage?

Medicare Advantage is the private portion of Medicare, covering everything that Original does (by law) plus additional benefits that vary by plan. Since these plans are sold by private companies, coverage varies widely. Where you live determines your plan options.

What is the number to call for Medicare?

1-800-810-1437 TTY 711. You’ve got options for health insurance as you get older that go beyond Original Medicare. As a reminder, Original Medicare, which is also called traditional Medicare, is made up of two parts: Part A (hospital insurance) and Part B (medical insurance).

Do Advantage plans charge a premium?

But some Advantage plans don’t charge a premium. You can get all the benefits of Original, plus the added benefits offered by a private plan, without any extra money per month. That’s because Advantage is still partly funded by the federal government even though it’s the private portion of Medicare.

Can I supplement my original Medicare?

You can supplement Original with a Medigap policy (for picking up out-of-pocket costs, not covering added benefits), buy a Part D plan for prescription drugs or enroll in Medicare Advantage as an alternative. Medicare Advantage is the private portion of Medicare, covering everything that Original does ...

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

How much has Medicare Advantage decreased since 2017?

Since 2017, the average monthly Medicare Advantage premium has decreased by an estimated 27.9 percent. This is the lowest that the average monthly premium for a Medicare Advantage plan has been since 2007 right after the second year of the benchmark/framework/competitive-bidding process.

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How to change Medicare plan?

The Medicare Open Enrollment Period provides an annual opportunity to review, and if necessary, change your Medicare coverage options. Coverage becomes effective on January 1. During Open Enrollment, some examples of changes that you can make include: 1 Join a Medicare Advantage (Part C) plan. 2 Discontinue your Medicare Advantage plan and return to Original Medicare (Part A and Part B). 3 Change from one Medicare Advantage plan to another. 4 Add or Change your Prescription Drug Coverage (Part D) plan if you are in Original Medicare.

What is a copayment in Medicare?

Copays. A copayment may apply to specific services, such as doctor office visits. Coinsurance. Cost sharing amounts may apply to specific services. Out-of-Pocket Expenses. All Medicare Advantage plans have an annual limit on your out-of-pocket expenses, which is a feature not available through Original Medicare.

What is the initial enrollment period for Medicare?

The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible. After you are enrolled in Medicare Part A and Part B, you can select other coverage options like a Medicare Advantage plan from approved private insurers.

Does Medicare Advantage have copayments?

Medicare Advantage plans may have copayments or cost sharing amounts on Medicare covered services that differ from the cost sharing amounts in Original Medicare. Medicare Advantage plans may change their monthly premiums and benefits each year. This also occurs in Original Medicare, as Part B premiums, standard deductibles ...

Does Medicare Advantage have geographic service areas?

Limits. Medicare Advantage plans have defined geographic service areas and most have networks of physicians and hospitals where you can receive care. Ask your physicians if they participate in your health insurance plan’s Medicare Advantage network.

Do you have to enroll in Medicare before joining a Medicare Advantage plan?

You must first enroll in Medicare Part A and Part B before joining a Medicare Advantage plan. Contact your local Blue Cross Blue Shield company for help choosing a Medicare Advantage plan and getting enrolled.

How many people are in Medicare Advantage?

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How many stars does Medicare have?

Quality is important to consumers, and in eight states, at least 75% of their MAPD plans score four stars or better for quality measures by the Centers for Medicare and Medicaid Services.

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.