Popular Medigap Plans: Plan F vs. Plan G vs. Plan N vs. Plan C

| Popularity Ranking* | Plan Name | Share of Total Medigap Enrollment** |

| 1 | F | 49% |

| 2 | G | 22% |

| 3 | N | 10% |

| 4 | C | 5% |

- Blue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ...

- AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ...

- Humana.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What is the best Medicare supplement insurance?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care.

What is the most widely accepted Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is Medicare Plan G better than plan C?

If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

Who is Aflac's largest competitor?

Aflac's top competitors include Old Mutual, Manulife, Prudential, MetLife, Allstate and Colonial Life.

What is the difference between Medicare Advantage and Medigap?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Why does AARP recommend UnitedHealthcare?

AARP/UnitedHealthcare's PPO plans are a very good deal, with average prices that are far below the industry. Not only are the PPO plans affordable, but they're also desirable because they provide more flexibility about which doctors you use because they cover both in-network and out-of-network health care.

Is AARP UnitedHealthcare good?

Credit rating agency AM Best gives UnitedHealth Group an A- or “excellent” financial strength rating. That kind of trustworthiness is another reason that in 2018, the latest year for which data is available, AARP sold its Medigap products to almost 35% of the people who chose to buy Medigap insurance.

Does AARP own UnitedHealthcare?

UnitedHealth Group not only owns UnitedHealthcare, it also owns one of the country's largest PBMs, OptumRx, with whom AARP also has a revenue-generating, branded prescription drug plan.

What Is a Medicare Supplement Plan?

To help cover your out-of-pocket expenses after using Original Medicare (such as your 20% coinsurance), you can purchase a Medicare Supplement plan from an insurance company. These are also known as Medigap plans.

Medicare Supplement Plans Must Adhere to State and Federal Laws

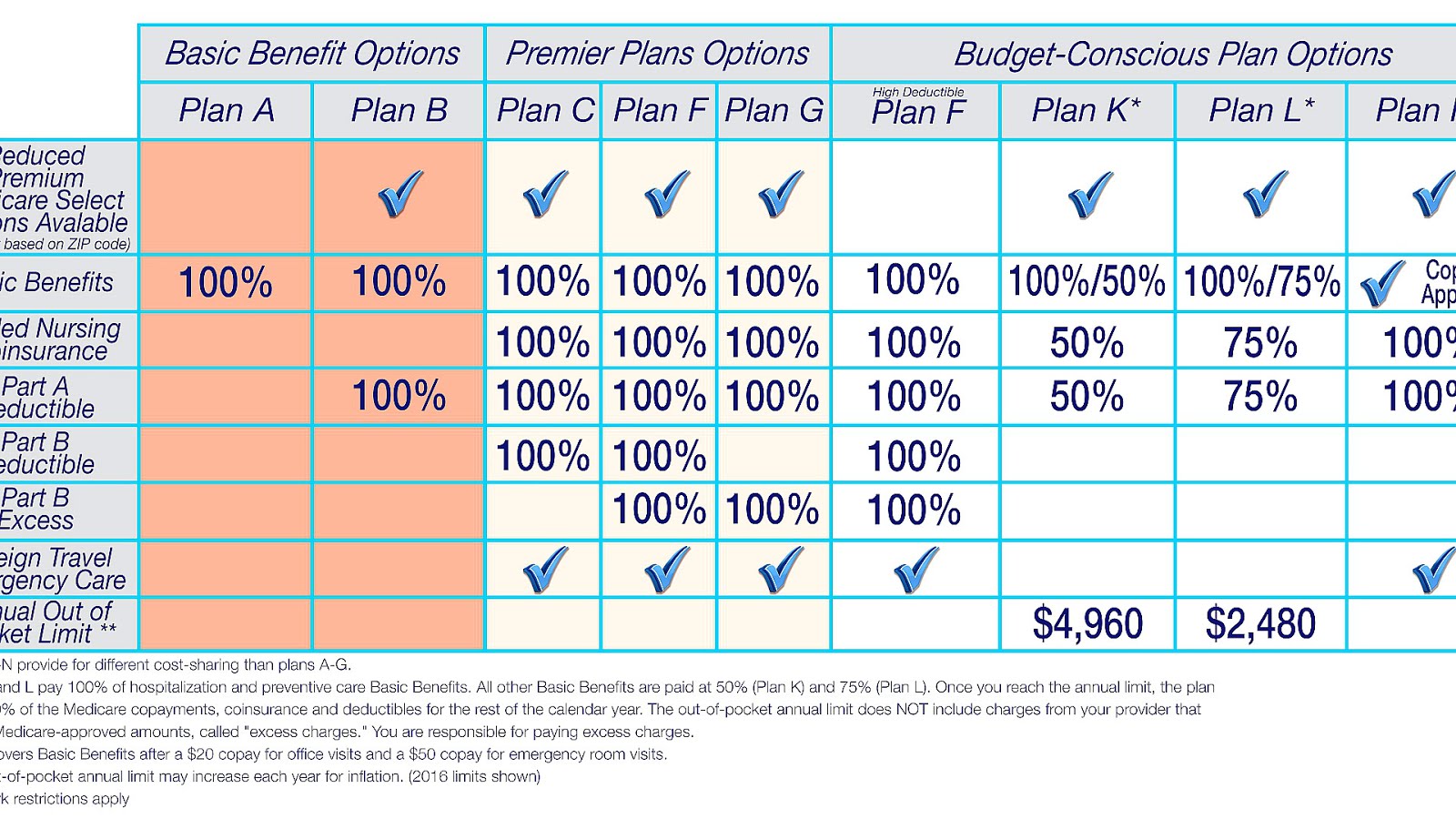

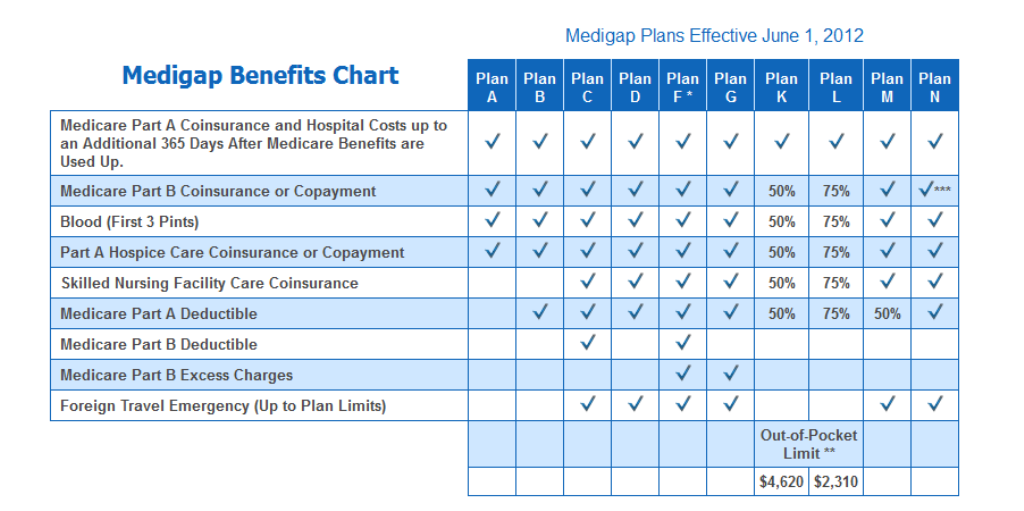

Every Medicare Supplement plan must follow strict federal and state laws. The federal government has 10 standardized Medicare Supplement plans. Below is a chart from the Centers for Medicare and Medicaid Services (CMS) describing what these plans might cover:

Three Popular Medicare Supplement Plans

To help you find the best Medicare Supplement plan for you, we’ve highlighted three of the most popular plans below.

How to Find the Best Medicare Supplement Plan for You

What else should seniors know about choosing Medicare Supplement plans? Neither Medicare nor Medicare Supplement plans offer long-term care insurance. This means you must look elsewhere for this on your own, or speak to your insurance provider.

What do the most popular Medigap plans cover?

Medicare Supplement Insurance provides coverage in areas where Original Medicare (Part A and Part B) requires some out-of-pocket spending in the form of deductibles, copayments and coinsurance. There are nine such out-of-pocket costs that a Medigap plan can cover in part or in full, if at all.

Plan F: Traditionally the most popular Medigap plan

Plan F has been the most popular Medicare Supplement Insurance plan over recent years. Plan F offers the most comprehensive coverage, for which its popularity may be attributed. Plan F beneficiaries typically face little to no out-of-pocket costs when seeking Medicare-covered services or items.

Plan G: Becoming the new most popular plan

There’s no doubt that Plan F has been the most popular Medicare Supplement Insurance plan for years. Even going back to 2012, Plan F accounted for 53% of the Medigap market share with no other plan garnering more than 13%.

Plan N and other popular Medicare Supplement plans

Any discussion of the most popular Medigap plans deserves a mention of Plan N. Plan N has maintained about a 10% share of the Medigap market over the years, making it the clear-cut favorite after Plan F and Plan G.

Enrolling in the Most Popular Plan

The most popular Medigap plan may not always be the best plan for you. Each plan is designed with different health care needs and budgets in mind, so it’s important to examine each plan carefully to determine how it may fit your own needs.

What is the most popular Medicare plan?

Plan F, Plan G, and Plan N are the most popular plans because they ensure predictable out-of-pocket Medicare costs. No matter which of these plans you choose, you know how much you’ll pay when you receive healthcare. The Medicare Plan Finder is a great resource for comparing plans in your area.

What is the most comprehensive Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is best suited for: 1 People who first became eligible for Medicare before January 1, 2020 2 People who don’t want to pay any out-of-pocket costs for covered healthcare services 3 People who see providers that don’t accept assignment and are billed for Part B excess charges

What is the most surprising thing about Medicare?

What’s the most surprising thing about Original Medicare? Most enrollees say it’s the unpredictable out-of-pocket costs. Medicare deductibles, coinsurance, and copayment costs can wreak havoc on a carefully planned budget. That’s why over 40 percent of people enrolled in Original Medicare buy a Medicare Supplement plan.

What is Plan N?

Plan N is a value-priced plan with comprehensive benefits. It covers 100 percent of your out-of-pocket costs under Part A and Part B, except for the Part B deductible and Part B excess charges. The one catch with Plan N is that you pay a small copayment each time you see a doctor or visit the emergency room.

What is the cost of Plan F?

Plan F is also available in a high-deductible option. With the high-deductible plan, you pay the first $2,340 (in 2020) of your out-of-pocket costs, then your plan covers 100 percent of your share for covered Medicare services.

When is Vermont Medicare Supplement Plan F best suited for?

Vermont. Medicare Supplement Plan F is best suited for: People who first became eligible for Medicare before January 1, 2020. People who don’t want to pay any out-of-pocket costs for covered healthcare services. People who see providers that don’t accept assignment and are billed for Part B excess charges.

What are the different Medicare Supplement plans?

Medicare Supplement plans offer different coverage to close the Medicare gaps. They are Plans A, B, C, D, F, G, K, L, M and N.

Why is Medicare Supplement Plan important?

That is why a Medicare supplement plan is so important because it provides you generally speaking with an out of pocket max. Yes, if you were in the hospital for more than 365 consecutive days you would then have exceeded both your Medicare and supplement insurance coverage and you would have to pay all the costs.

How much is Medicare Part B deductible in 2021?

That aside, you would have a out of pocket max. The Medicare Part B annual deductible is $203 in 2021. This may seem small compared to the Part A deductible. It is, but the real cost under B is the coinsurance which is where coverage matters. Part B coinsurance is different than the deductible.

How much is Medicare Part A 2021?

The annual deductible for Medicare Part A in 2021 is $1,484. This your out of pocket expense for the first 60 days of hospitalization.

Why is it important to take a high deductible?

By taking a high deductible plan, you significantly reduce your premiums, and potentially save all or most of the deductible costs in the premium savings. This may be a good option if you have low medical expenses and if you are looking to save on premium costs.

What is the most comprehensive plan?

Plan F. Plan F provides the most comprehensive coverage. Policyholders get the following benefits under Plan F: Part A benefits. Part A Deductible. Part A hospital and co-insurance costs up to an additional 365 days after Medicare benefits are exhausted. Part A hospice care co-payment or co-insurance. Part B benefits.

How much is coinsurance in Medicare?

There is a 20% coinsurance under Medicare Part B. For example, if you are sent to a specialist for care, you would pay the first 20% of the charges, and Medicare would pick up the other 80%. This is different than a co-payment, where you would pay a fixed amount for service.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Medicare Supplement Plan F

This Medicare Supplement plan provides the most coverage of any Medicare Supplement plan. Here are the benefits covered by Medicare Plan F:

Medicare Supplement Plan G

Medicare Supplement Plan G is at present the most popular and sought after Medicare Supplement plan because it provides the same comprehensive coverage offered by Medigap Plan F except for the Medicare Part B deductible. The Medicare Supplement Plan G premium is also less expensive compared to Plan F.

Medicare Supplement Plan N

This is another popular and fast-selling Medicare Supplement plan because it provides a good balance between affordable premiums and protection against out-of-pocket costs. With Medicare Supplement Plan N, you have all the same benefits covered by Medicare Supplement Plan F except:

Need Medigap? We Can Help

Advocate Health Advisors can help you get the right Medicare Supplement plan for your needs. If you need help comparing these plans, as well as any other Medicare plans, reach out to us today. Our goal is to help you get the coverage you need and deserve.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.