Medicare Part A and Part B share some characteristics, such as: Both are parts of the government-run Original Medicare program. Both may cover different hospital services and items. Both may cover mental health care (Part A may cover inpatient care, and Part B may cover outpatient services). Both may cover home health care.

How do you get Medicare benefits?

You can also get Medicare Part A when you turn 65 with no premiums if you: Receive Social Security or Railroad Retirement benefits

What are the benefits of Medicare?

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- First three pints of blood

- Hospice care coinsurance or copayment

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Is Medicare Part of Social Security benefits?

Workers who have earned the necessary work credits can apply for Social Security retirement benefits as early as age 62. Your Medicare eligibility date, however, is later. You are eligible to sign up for both Medicare Part A and Part B at age 65 ...

What are the benefits of having Medicare A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Does Medicare Part B pay everything?

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive. The medically necessary coverage encompasses a variety of tests, procedures, and care options.

What does Medicare Part B entitle you to?

Medicare Part B (Medical Insurance) Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

What does Medicare type A pay for?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare cover 100 percent of hospital bills?

Medicare generally covers 100% of your medical expenses if you are admitted as a public patient in a public hospital. As a public patient, you generally won't be able to choose your own doctor or choose the day that you are admitted to hospital.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.)

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Does Medicare cover cataract surgery?

Medicare generally does not pay for vision care, but it will cover certain medically necessary services, such as cataract surgery. If you have Original Medicare, these services are covered under Part B, which covers outpatient services.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare cover eye exams?

Eye exams (routine) Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Does Medicare pay for hospital stay?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

How much is Medicare Part B?

On the other hand, most people do pay a monthly premium for Medicare Part B. The standard premium in 2019 is $135.50, but you may pay more if your income is above a certain level. If you have a low income or no income, in some cases Medicaid might pay your Part B premium.

How much does Medicare pay if you work for 10 years?

If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium. If you worked 30-39 quarters, you’ll generally pay $240 in 2019. If you worked fewer than 30 quarters, you’ll generally pay $437 in 2019. On the other hand, most people do pay a monthly premium for Medicare Part B.

How many Medicare Supplement Plans are there?

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

Does Medicare Part A and B have monthly premiums?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare.

Is Medicare Part A automatically enrolled?

If you’re eligible for Medicare Part A and Part B, you might be enrolled automatically.

Do you have to pay deductibles?

You may have to pay a deductible amount and/or coinsurance or copayment.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

Does Medicare cover home health care?

Medicare Part A may cover part-time home health care if you’re homebound and you get these services through a Medicare-certified ...

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When is Medicare paid first?

When you’re eligible for or entitled to Medicare because you have End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, the group health plan or retiree coverage pays first and Medicare pays second. You can have group health plan coverage or retiree coverage based on your employment or through a family member.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is Medicare for seniors?

Medicare is the national health insurance program available to people age 65 or older, younger people with disabilities, and people with end-stage renal disease.

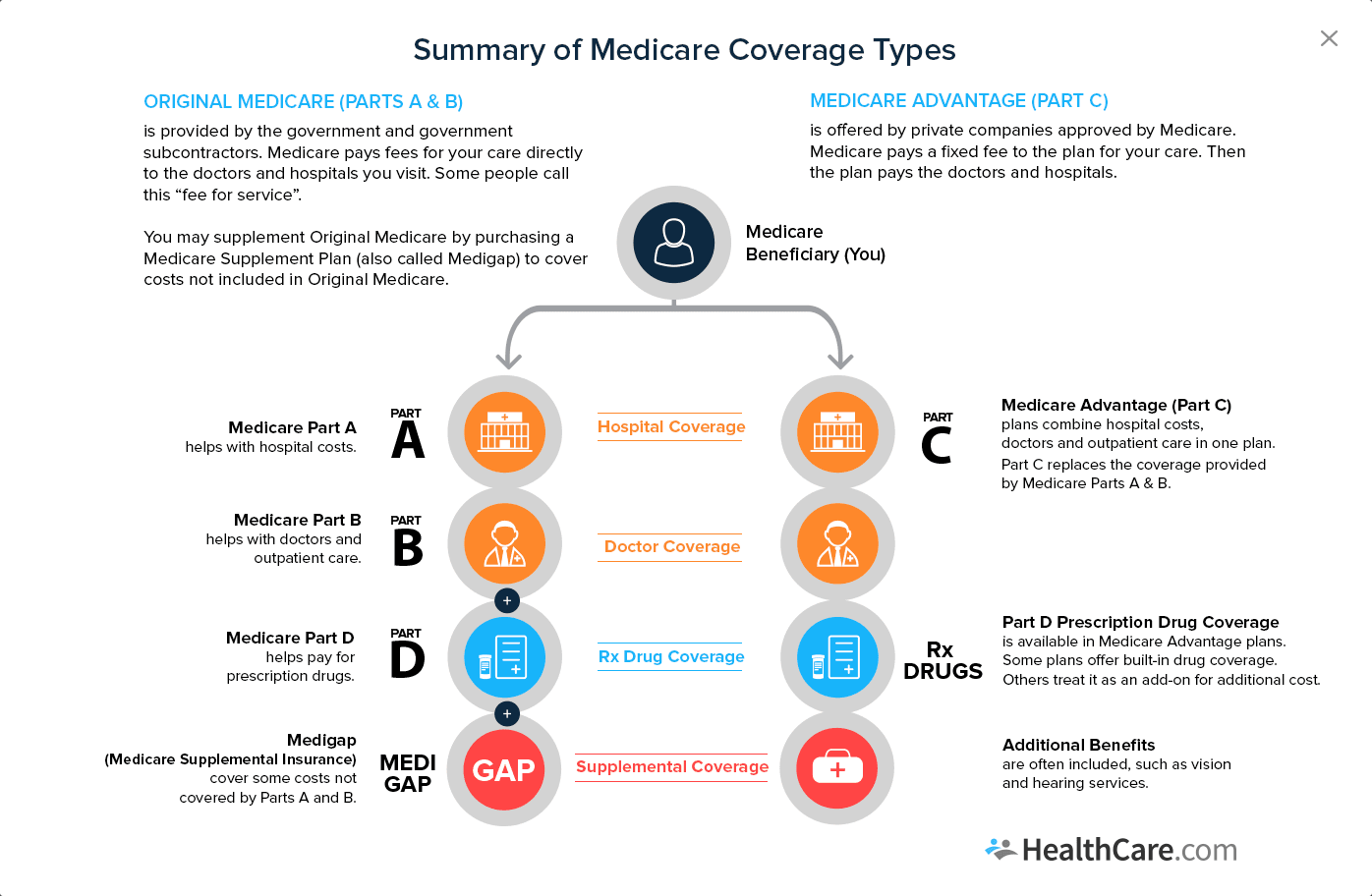

What are the different types of Medicare?

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor's visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1

What is the coverage gap for Medicare?

For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions. 24

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

How many days do you have to pay deductible?

Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses. If you're admitted to the hospital multiple times during the year, you may need to pay a deductible each time. 8 .

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.