Providers can prevent and detect health care fraud through several methods, including: Staying up to date on all health care laws and regulations Provide accurate billing practices to patients and insurers

Who commits health care fraud?

Health care fraud can be committed by medical providers, patients, and others who intentionally deceive the health care system to receive unlawful benefits or payments. The FBI is the primary agency for investigating health care fraud, for both federal and private insurance programs.

What is Medicare fraud and abuse?

Medicare Fraud and Abuse: A Serious Problem That Needs Your Attention Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk.

Why do we need laws to combat health care fraud and abuse?

Health care professionals who exploit Federal health care programs for illegal, personal, or corporate gain create the need for laws that combat fraud and abuse and ensure appropriate, quality medical care. Physicians frequently encounter the following types of business relationships that may raise fraud and abuse concerns:

How can we prevent Medicare and Medicaid provider fraud?

The creation of a standardized, rigorous registration process for Medicare and Medicaid providers is one of the greatest opportunities for fraud prevention. CMS has implemented the Automated Provider Screening (APS) system in an effort to identify high-risk providers; meanwhile, each state has its own system for onboarding.

How can Medicare fraud be prevented?

There are several things you can do to help prevent Medicare fraud.Protect your Medicare number. Treat your Medicare card and number the same way you would a credit card number. ... Protect your medical information. ... Learn more about Medicare's coverage rules. ... Do not accept services you do not need. ... Be skeptical.

How does CMS fight fraud and abuse?

Creating a rigorous screening process for providers and suppliers enrolling in Medicare, Medicaid or CHIP to keep fraudulent providers out of those programs. Incorporating sophisticated new technologies and innovative data sources to identify patterns associated with fraud and avoid paying fraudulent claims.

What was developed by the federal government to reduce or eliminate fraud in healthcare?

Fact sheet. The Health Care Fraud and Abuse Control Program Protects Consumers and Taxpayers by Combating Health Care Fraud. Since inception in 1997, the Health Care Fraud and Abuse Control (HCFAC) Program has been at the forefront of the fight against health care fraud, waste, and abuse.

What strategies can be used to combat fraud and abuse in coding?

Fraud and Abuse Prevention StrategiesMake sure that all coding staff have been properly trained and receive ongoing continuing education.Develop comprehensive internal policies and procedures for coding and billing and make sure these written procedures are kept up-to-date.More items...

Which combats fraud and abuse in health insurance and healthcare?

The HCFAC program is designed to coordinate Federal, State and local law enforcement activities with respect to health care fraud and abuse.

What organization investigates fraud waste and abuse in the Medicare system?

The Office of Inspector General (OIG) Hotline accepts tips and complaints from all sources on potential fraud, waste, and abuse.

How can healthcare fraud be controlled?

How Can I Help Prevent Fraud and Abuse?Validate all member ID cards prior to rendering service;Ensure accuracy when submitting bills or claims for services rendered;Submit appropriate Referral and Treatment forms;Avoid unnecessary drug prescription and/or medical treatment;More items...

How can healthcare leaders reduce fraud and abuse?

To prevent an organization from participating in healthcare fraud and abuse activities, providers should understand key healthcare fraud laws, implement a compliance program, and improve medical billing and business operations processes.

What is healthcare fraud prevention partnership?

The Healthcare Fraud Prevention Partnership (HFPP) is a voluntary public-private partnership that helps detect and prevent healthcare fraud through data and information sharing.

How can we prevent coding errors in healthcare?

Ensure Patient Information is Correct and Properly Aligned with Data. ... Avoid Upcoding. ... Utilize the Latest Medical Coding Manual. ... Avoid Duplicate Billing. ... Verify Insurance Benefits and Coverage in Advance. ... Hire A Professional Medical Biller. ... Improve Your Medical Billing and Coding Systems With Coronis Health.

How does HIPAA prevent fraud?

HIPAA also helps protect patients from harm. In the event that health information is exposed, stolen, or impermissibly disclosed, patients and health plan members must be informed of the breach to allow them to take action to protect themselves from harm, such as identity theft and fraud.

What are the four explanations for fraud in the healthcare system?

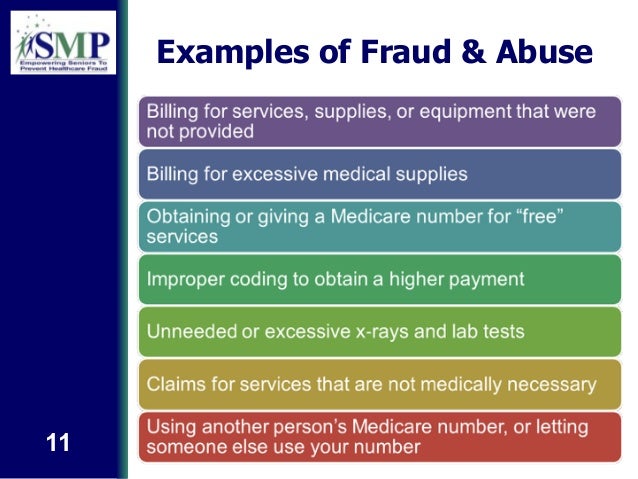

CMS categorizes fraud and program integrity issues into 4 categories: (1) mistakes resulting in administrative errors, such as incorrect billing; (2) inefficiencies causing waste, such as ordering excessive diagnostic tests; (3) bending and abuse of rules, such as upcoding claims; and (4) intentional, deceptive fraud, ...

What are the 4 categories of CMS program integrity violations?

The 4 categories of CMS program integrity violations can result from unintentionally false or mistaken documentation submitted for reimbursement or from negligent or intentionally false documentation. Billing errors and mistakes, misclassification of a diagnosis or procedure, or improper documentation can indicate lack of program integrity education. 16, 17, 18 Inaccurate coding or errors in documentation can result from improper or incomplete interaction with the patient’s electronic health record (EHR) if the physician merely copies and pastes text, if the EHR self-populates from previous encounters, or if the algorithm prompts the physician to offer the patient potentially unnecessary or inappropriate services. 16, 17 When do these types of behaviors become fraud?

Do physicians support fraud?

Although most physicians oppose outright fraud, such as billing for services never rendered or subjecting patients to medically unnecessary tests, procedures, or medications, the marketplace is rife with behaviors that inflate health care system costs, produce inefficiencies, and harm patients.

What is the ACA?

The Affordable Care Act ("ACA"), the health reform legislation passed in 2010, [4] contains fraud, waste and abuse provisions to aid the federal government in combating improper payments in Medicare, Medicaid and the Children's Health Insurance Program ("CHIP"). The ACA increases screening requirements for providers that want to participate in ...

Who must share and match data in the systems of records maintained by the Social Security Administration, the Department of Veterans Affairs,

The Secretary must share and match data in the systems of records maintained by the Social Security Administration, the Department of Veterans Affairs, the Department of Defense, and the Indian Health Service. The Secretary may impose an administrative penalty if a Medicare beneficiary or a CHIP or Medicaid recipient knowingly participates in ...

How much was Medicare in 2010?

Conclusion. The federal government estimates that improper payments under Medicare and Medicaid totaled $70.4 billion in 2010. Approximately $34.3 billion in payments come from traditional Medicare (10.5% improper payment rate); another $22.5 billion in payments come from Medicaid (9.4% improper payment rate); and $13.6 billion ...

Can the Secretary of Health suspend Medicare?

The Secretary may suspend Medicare and Medicaid payments pending investigation of credible allegations of fraud. Additional funds are appropriated to the HHS, the Department of Justice, the Office of the Inspector General, the FBI, and the Medicare Integrity Program to fight fraud and abuse. The Secretary is required to maintain a national health ...

Is Medicare overpayment phased out?

Vast overpayments to private Medicare Advantage plans are phased out to come more into line with traditional Medicare costs. The Secretary of the Department of Health and Human Services (the Secretary) must establish screening procedures for medical providers and suppliers of medical equipment.

How does Medicare fraud affect the healthcare industry?

In fact, it impacts the entire healthcare industry. From wasting funds that could be going towards more medical staff to treat patients to people being denied life-saving procedures , this type of fraud is incredibly dangerous, and one that adds up to millions annually.

How much did Medicare fraud cost in 2018?

In 2018, government and law enforcement agencies participated in one of the largest fraud take downs in healthcare. The fraudulent schemes led to over $2 billion in Medicare and Medicaid losses. Over 600 defendants were charged.

What are the consequences of fraud?

Healthcare professionals also suffer. Not only does fraud make patients highly suspicious of any medications, treatments or procedures, but it can also lead to people not seeking treatment when they need it.

Why are overworked healthcare workers not able to provide optimal care?

One final consequence is less coverage. In an effort to combat Medicare fraud, claims and necessary treatments may be denied.

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under state-financed programs and to private-pay patients.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

What is a sham consulting agreement?

Some pharmaceutical and device companies use sham consulting agreements and other arrangements to buy physician loyalty to their products. As a practicing physician, you may have opportunities to work as a consultant or promotional speaker for the drug or device industry. For every financial relationship offered to you, evaluate the link between the services you can provide and the compensation you will get. Test the appropriateness of any proposed relationship by asking yourself the following questions:

Is there a measure of fraud in health care?

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

Can you give free samples to a physician?

Many drug and biologic companies provide free product samples to physicians. It is legal to give these samples to your patients free of charge, but it is illegal to sell the samples. The Federal Government has prosecuted physicians for billing Medicare for free samples. If you choose to accept free samples, you need reliable systems in place to safely store the samples and ensure samples remain separate from your commercial stock.

How Government Can Combat Fraudulent Medical Claims

Healthcare fraud, waste, and abuse cost taxpayers tens of billions of dollars per year, with Medicare and Medicaid fraud alone estimated to cost $160 billion annually.

Understanding Healthcare Fraud Trends

Healthcare is a tempting target for thieves. Medicaid doles out $415 billion a year. Medicare spends nearly $600 billion. Total healthcare spending in America is $2.7 trillion or 17% of GDP.

1. Deploying Standardized Registration Processes

The creation of a standardized, rigorous registration process for Medicare and Medicaid providers is one of the greatest opportunities for fraud prevention. CMS has implemented the Automated Provider Screening (APS) system in an effort to identify high-risk providers; meanwhile, each state has its own system for onboarding.

2. Verifying Provider Information with Third-Party Data

No matter how rigorous, registration processes cannot provide all the information required by analytics to flag high-risk providers. One of the most common challenges Dun & Bradstreet sees with the available data is little to no external enhancement of provider profiles.

3. Tracking Business and Individual Relationships

In addition to monitoring provider organizations, understanding the relationships between individuals and business entities is critical for fraud prevention.

Public Sector Best Practices Provide a Roadmap for Private Sector Best Practices

Ultimately, neither new technology nor process improvements alone can prevent healthcare abuse, and truly effective approaches marry technology with robust claims data, provider data, and external data.

How does fraud affect health insurance?

It affects everyone—individuals and businesses alike—and causes tens of billions of dollars in losses each year. It can raise health insurance premiums, expose you to unnecessary medical procedures , and increase taxes. Health care fraud can be committed by medical providers, patients, and others who intentionally deceive ...

How to protect health insurance information?

Protect your health insurance information. Treat it like a credit card. Don't give it to others to use, and be mindful when using it at the doctor’s office or pharmacy. Beware of “free” services. If you're asked to provide your health insurance information for a “free” service, the service is probably not free and could be fraudulently charged ...

What is the DEA's documentary about the life of an opiate addict?

To combat the growing epidemic of prescription drug and heroin abuse, the FBI and DEA released Chasing the Dragon: The Life of an Opiate Addict, a documentary aimed at educating students and young adults about the dangers of addiction. Learn more at fbi.gov/chasingthedragon.

What is the FBI?

The FBI is the primary agency for investigating health care fraud, for both federal and private insurance programs. The FBI investigates these crimes in partnership with: Insurance groups such as the National Health Care Anti-Fraud Association, the National Insurance Crime Bureau, and insurance investigative units.

Is prescription fraud a crime?

Prescription Medication Abuse. Creating or using forged prescriptions is a crime, and prescription fraud comes at an enormous cost to physicians, hospitals, insurers, and taxpayers. But the greatest cost is a human one—tens of thousands of lives are lost to addiction each year.

National and State Health Care Fraud Laws

Several laws on the national and state level exist in order to combat health care fraud. These laws keep providers accountable for committing unethical acts within their communities.

How Health Care Providers Can Detect and Prevent Fraud

Health care providers can implement several precautions to help detect and prevent fraud and abuse from taking place.

Seek Guidance from the Industry Leaders in Health Care Law

While most organizations and providers operate ethically, they can unintentionally fail to comply with industry regulations. This leads to criminal and civil investigations that can negatively impact your business’s finances and reputation.