Many out-of-pocket expenses qualify for tax-free HSA withdrawals even after you’re on Medicare. You can use the money to pay premiums for Medicare Part B, Part D prescription-drug coverage or all-in-one private Medicare Advantage plans (but not for medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Can I use my HSA funds to pay for Medicare?

If you are over 65, you can even use your HSA funds to pay for Medicare insurance premiums, although premiums for Medicare supplemental insurance (aka Medigap) are not viewed as qualified expenses.

What can I use my HSA funds for?

· The IRS won’t penalize you if you still have money in your HSA when you enroll in Medicare. You can use your HSA dollars to pay for qualified medical expenses if you want to save money on taxes. Unlike a flexible spending account (FSA), all the unused funds in your HSA will continue to roll over every year. If you try to add more money to your HSA after you enroll in …

Should you continue to use your HSA for medical expenses?

HSAs are tax-advantaged accounts that individuals can use to pay for unreimbursed medical expenses (e.g., deductibles, co-payments, coinsurance, and services not covered by insurance). Although eligibility to contribute to an HSA is associated with enrollment in a high-deductible health plan (HDHP), HSAs are trust/custodial accounts and

What can I use my HSA for after 65?

· Many out-of-pocket expenses qualify for tax-free HSA withdrawals even after you’re on Medicare. You can use the money to pay premiums for Medicare Part B, Part D prescription-drug coverage or...

What can you use HSA for when on Medicare?

Once you reach age 65, you have more options for using your HSA funds. For example, you may use your funds, free of tax and penalty, for qualified medical expenses as well as to pay for Medicare Parts A, B, D premiums and Medicare HMO premiums.

Can I use my HSA after I go on Medicare?

Once you enroll in Medicare, you're no longer eligible to contribute funds to an HSA. However, you can use existing money in an HSA to pay for some Medicare costs. You'll receive a tax penalty on any money you contribute to an HSA once you enroll in Medicare.

What can I spend my HSA on after 65?

At age 65, you can use your HSA to pay for Medicare parts A, B, D and Medicare HMO premiums tax-free and penalty-free. You cannot use your HSA to pay for Medigap insurance premiums.

Can you use HSA money for anything after retirement?

Once you hit 65, you can use your HSA to pay for any nonqualified medical expenses (including buying a boat, for example), but you don't get to take full advantage of the tax savings as you will be required to pay state and federal taxes on those distributions.

Does HSA affect Social Security?

1. While you can continue to spend from your HSA, you cannot set up or contribute to an HSA in any month that you are enrolled in Medicare. age, Social Security will give you six months of “back pay” in retirement benefits. This means that your enrollment in Part A will also be backdated by six months.

At what age can you no longer contribute to an HSA?

age 65If a worker is already collecting Social Security upon turning age 65, he or she will be automatically enrolled in Medicare and henceforth no longer be able to contribute to his or her HSA.

Can you convert an HSA to an IRA?

HSA funds can't be rolled over into an IRA account. There's also no reason to do so, because you preserve your right to use the funds tax-free for medical costs at any time with an HSA.

Can I transfer money from my HSA to my bank account?

Online Transfer – On HSA Bank's Member Website, you can transfer funds from your HSA to an external bank account, such as a personal checking or savings account. There is a daily transfer limit of $2,500 to safeguard against fraudulent activity.

Can you use HSA for dental?

HSA - You can use your HSA to pay for eligible health care, dental, and vision expenses for yourself, your spouse, or eligible dependents (children, siblings, parents, and others who are considered an exemption under Section 152 of the tax code).

Do you lose your HSA money at the end of the year?

No. HSA money is yours to keep. Unlike a flexible spending account (FSA), unused money in your HSA isn't forfeited at the end of the year; it continues to grow, tax-deferred.

What happens to unused HSA funds after death?

The funds in your HSA go to the named beneficiary of the account when you die. If there is no beneficiary, the funds will go to your estate. Who you select as a beneficiary will determine how the account gets treated after your death. You have the freedom to change your named beneficiary at any time.

What happens to my HSA once I enroll in medicare?

When you enroll in Medicare, you can continue to withdraw money from your HSA. The money is yours forever. Your HSA dollars can cover qualified medical expenses — 100% tax-free — if your insurance doesn’t reimburse you.

Are there penalties for having both an HSA and Medicare?

The IRS won’t penalize you if you still have money in your HSA when you enroll in Medicare. You can use your HSA dollars to pay for qualified medical expenses if you want to save money on taxes. Unlike a flexible spending account (FSA), all the unused funds in your HSA will continue to roll over every year.

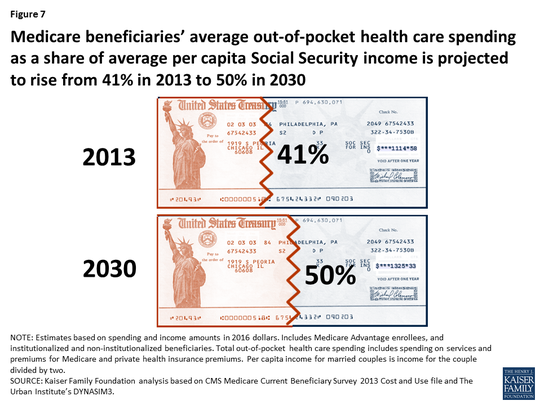

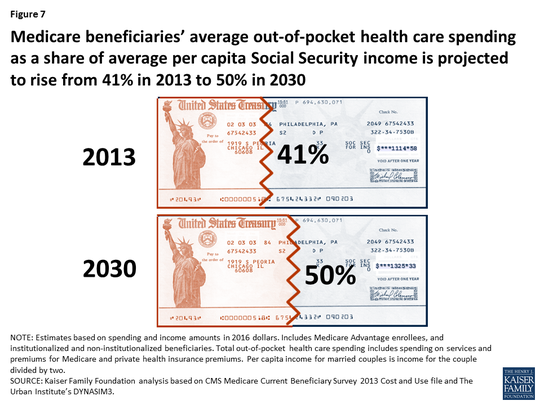

What costs are not covered by Medicare?

Before you apply for Medicare, you should review your major out-of-pocket costs. This will help you determine the best time to apply for coverage.

What happens when I buy an eligible expense vs. an ineligible expense with HSA funds?

When you turn 65, you will have more flexibility over how you use the funds in your HSA. You can pay for all qualified expenses, free of taxes. You’ll have to pay income tax on money you withdraw to pay for nonqualified expenses. If you’re under 65, you may also owe a 20% tax penalty.

Are my withdrawals for HSA tax-free?

One of the benefits of an HSA is that your withdrawals can be tax-free if used for qualified medical expenses. All nonqualified expenses will be subject to federal and state income taxes.

The bottom line

Enrolling in Medicare can affect your ability to make contributions to a health savings account (HSA). Before you sign up for Medicare, make sure you understand HSA rules to avoid unexpected taxes and penalties. Although Medicare beneficiaries cannot contribute to an HSA, they can still withdraw money from the account.

Can I switch to a different health plan?

During your employer's annual open enrollment period, you can switch to a different health plan if it would better suit your needs. You may find that the HDHP is still your best choice. But after losing one of the primary benefits of an HDHP (i.e., the ability to contribute to an HSA), a different health plan might make more sense.

Can an employer offer HDHP?

That also assumes that your employer provides more than one plan choice, but it's rare for an employer to offer only an HDHP — almost all employers that offer HDHPs also offer at least one other coverage option.

What is HSA in Medicare?

As you get close to retiring, it’s essential to understand how Health Savings Accounts work ...

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

How long can you contribute to a health savings account?

Health Savings Account beneficiaries can contribute until the first day of the month; Medicare is sufficient. It’s your responsibility to prorate both your regular contribution and the catch-up contribution if applicable.

How to calculate prorate for Medicare?

To determine the prorate maximum contribution, add the IRS maximum plus the catch-up amount. Then, divide that number by 12 months and multiply by the number of months you won’t have Medicare .

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.

Is Medicare considered an HSA?

HSA is only for those enrolled in a high-deductible plan. Since Medicare is not considered an HDHP, enrolling makes you ineligible to contribute to an HSA .

How long do you have to stop HSA before enrolling in Medicare?

There is a six - month lookback period (but not before the month of reaching age 65) when enrolling in Medicare after age 65, so a best practice is for workers to stop contributing to their HSA six months before enrolling in Medicare to avoid penalties. See the examples below for more on this.

When did HSA start?

Image by Roy Scott/IKON Images. Before the tax - savings wonder that is the health savings account (HSA) was introduced in 2003, it was a generally accepted best practice for any worker who wasn't already collecting Social Security at the age of 65 to go ahead and sign up for Medicare Part A (hospital insurance), regardless of other coverage.

What happens if you miss the deadline for Medicare?

In other words, getting the Medicare Special Enrollment Period wrong risks a gap in coverage plus a lifetime of penalties.

Can I deduct HSA contributions?

There are lots of quirks involved when determining whether a taxpayer is eligible to make contributions to an HSA (which are always tax - deductible as long as they are allowed), most of them having to do with health care plan design. But a separate rule that often trips up taxpayers is that HSA contributions are disallowed when a taxpayer has other coverage in addition to an HSA - eligible plan (Sec. 223 (c) (1) (A) (ii)).

Is Medicare enrollment in order?

A high-level overview of the Medicare enrollment rules is in order. According to Medicare.gov:

Can HSA funds be used for medical expenses?

See the examples below for more on this. Funds already in the HSA can still be used for qualified medical expenses upon enrollment in Medicare, including to reimburse taxpayers for Medicare premiums (but not premiums for Medicare supplemental insurance) as well as to pay for long - term - care costs and insurance.

What is an HSA account?

An HSA is a type of savings account that lets you set aside money on a pretax basis (that is, before taxes are deducted from your income) to help cover the cost of qualified medical expenses.

How much is HDHP 2021?

For 2021, the IRS defines an HDHP as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

Can you use qualified medical expenses to pay for qualified medical expenses?

You can use that money to pay for qualified healthcare expenses during the year, or you can save the money to use for qualified medical expenses.

Is Medicare free for retirement?

Finally signing up for Medicare can be an exciting event. While it can be a lifeline for many people in retirement, Medicare isn’t free and unexpected health expenses can take a pretty big bite out of your budget.

How long do you have to stop contributing to HSA before you can get Medicare?

According to CMS (the agency that oversee’s the Medicare program,) you should stop contributing to your HSA 6 months before you sign up for premium free Part A. This is because Premium-free Part A retroactively backdates 6 months.

What is an HSA?

HSA, with stands for a Health Savings Account, is a companion fund used when you sign up for a High Deductible Health Plan. These plans have large out of pocket costs before you receive any coverage.

Why can't Tom contribute to HSA?

Tom can no longer contribute to his HSA fund because he has Medicare as his insurance plan. However, h is account continues to grow because the funds that are inside are accruing interest.

How much is HDHP 2020?

According to Healthcare.gov, 2020 HDHP plans must have a minimum deductible of $1,400 for an individual and $2,800 for a family. The maximum out of pocket is $6,900 for an individual, $13,800 for a family (not including out of network service.) Due to their high deductibles, premiums for these plans are incredibly inexpensive.

What is an example of cost savings?

Example Of Cost Savings. Tom has a Health Savings Account with $60,000 and enters Medicare. Tom can no longer contribute to his HSA fund because he has Medicare as his insurance plan. However, h is account continues to grow because the funds that are inside are accruing interest.

How much can Tom withdraw from his HSA?

However, because Tom has such a large savings in his HSA, he can safely withdrawal up to $2,400 a year (based on the 4% rule) without touching the principal of $60,000.

Is HSA tax deferred?

Investment gains in the HSA are tax deferred (like your 401k plan.)