What factors affect Medicare reimbursement?

Factors Affecting ReimbursementType of Insurance Policy. - The patient's insurance may be covered either by a federally funded program such as Medicare or Medicare or a private insurance program. ... The Nature of the Disorder. ... Who is Performing the Evaluation. ... Medical Necessity. ... Length of Treatment.

How are Medicare reimbursements determined?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

Are Medicare reimbursements decreasing?

The decline in reimbursements for 2020 was $13.9 billion, according to the AMA. Overall, Medicare spending on physician services totaled $82.9 billion in 2020, down from $95 billion the year prior, and below the $96.9 billion that was projected for the year.Dec 7, 2021

Did Medicare reimbursement go up in 2021?

On December 27, the Consolidated Appropriations Act, 2021 modified the Calendar Year (CY) 2021 Medicare Physician Fee Schedule (MPFS): Provided a 3.75% increase in MPFS payments for CY 2021.

What are Medicare reimbursements?

Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment.Dec 9, 2021

What reimbursement system uses the Medicare fee schedule?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).Dec 1, 2021

How does reimbursement affect healthcare?

Healthcare providers are paid by insurance or government payers through a system of reimbursement. After you receive a medical service, your provider sends a bill to whoever is responsible for covering your medical costs.Feb 27, 2020

Why are reimbursements declining?

There are several factors that are currently playing a role in reimbursement declines for hospitals. Fee schedule reductions for Medicare and Medicaid as well as lower rates for commercial plans are key causes, in addition to initiatives found in the Affordable Care Act (ACA) such as readmission penalties.Aug 8, 2014

Does Medicare increase reimbursement?

For care management services, however, CMS is adopting the American Medical Association (AMA) RVU Update Committee's (RUC) recommended increases in the assigned relative value units. As a result, there will be significant increases in Medicare reimbursement for these services in 2022.

Did Medicare reimbursement go up in 2022?

On Dec. 16, the Centers for Medicare and Medicaid Services (CMS) announced an updated 2022 physician fee schedule conversion factor of $34.6062, according to McDermott+Consulting. This represents a 0.82% cut from the 2021 conversion factor of $34.8931.Feb 7, 2022

Has the 2022 Medicare fee schedule been released?

The Centers for Medicare & Medicaid Services (CMS) has released the calendar year (CY) 2022 Medicare Physician Fee Schedule (MPFS) Final Rule, which goes into effect Jan. 1, 2022.Nov 17, 2021

What is the Medicare Economic Index for 2021?

The 2021 MEI percentage released by CMS on October 29, 2020, lists RHCs at 1.4% while the 2021 MEI percentage released by CMS on December 4, 2020, lists FQHCs at 1.7%. Healthy Blue will update our systems to reflect the new rates by July 30, 2021.Jul 21, 2021

How much did Medicare increase in 2017?

New payment adjustments to the Medicare Inpatient Psychiatric Facilities Prospective Payment System will increase aggregate claims reimbursements by 2.2 percent, or $100 million, in the 2017 fiscal year, according to a CMS fact sheet.

How much is the CMS increase in rehabilitation?

In a final rule issued on July 29, CMS stated that providers in the Inpatient Rehabilitation Facilities Prospective Payment System will receive an overall 1.9 percent, or $145 million, increase in payments in fiscal year 2017.

How much did the Medicare Skilled Nursing Facility increase in 2017?

The federal agency estimated that total payments to skilled nursing facilities will increase by $920 million, or 2.4 percent.

When will Medicare change to 2021?

The changes, which would go into effect on or after Jan. 1, 2021, could ultimately translate to increased compensation ...

Does WRVU increase pay?

For providers that more heavily weight productivity in their compensation models, wRVU increases are going to command a significant pay increase for providers with little to no offsetting revenue – threatening more compressed margins for medical groups.

What is the data base for Medicare enrollees?

Two major data bases on Medicare enrollees' inpatient episodes were used in this study: information from hospital bills that come to the Health Care Financing Administration (HCFA) through its intermediaries and discharge abstract data sent to the Commission on Professional and Hospital Activities (CPHA) from its subscriber hospitals. The latter data base is known as the Professional Activity Study

What Medicare files were used in 1981?

We used two different Medicare files for 1981 and 1984-85: MEOPAR and PATB1LL.2 We do not describe the MEDPAR file here, because it has been used extensively by researchers for some time (Pettengill and Vertrees, 1982.)

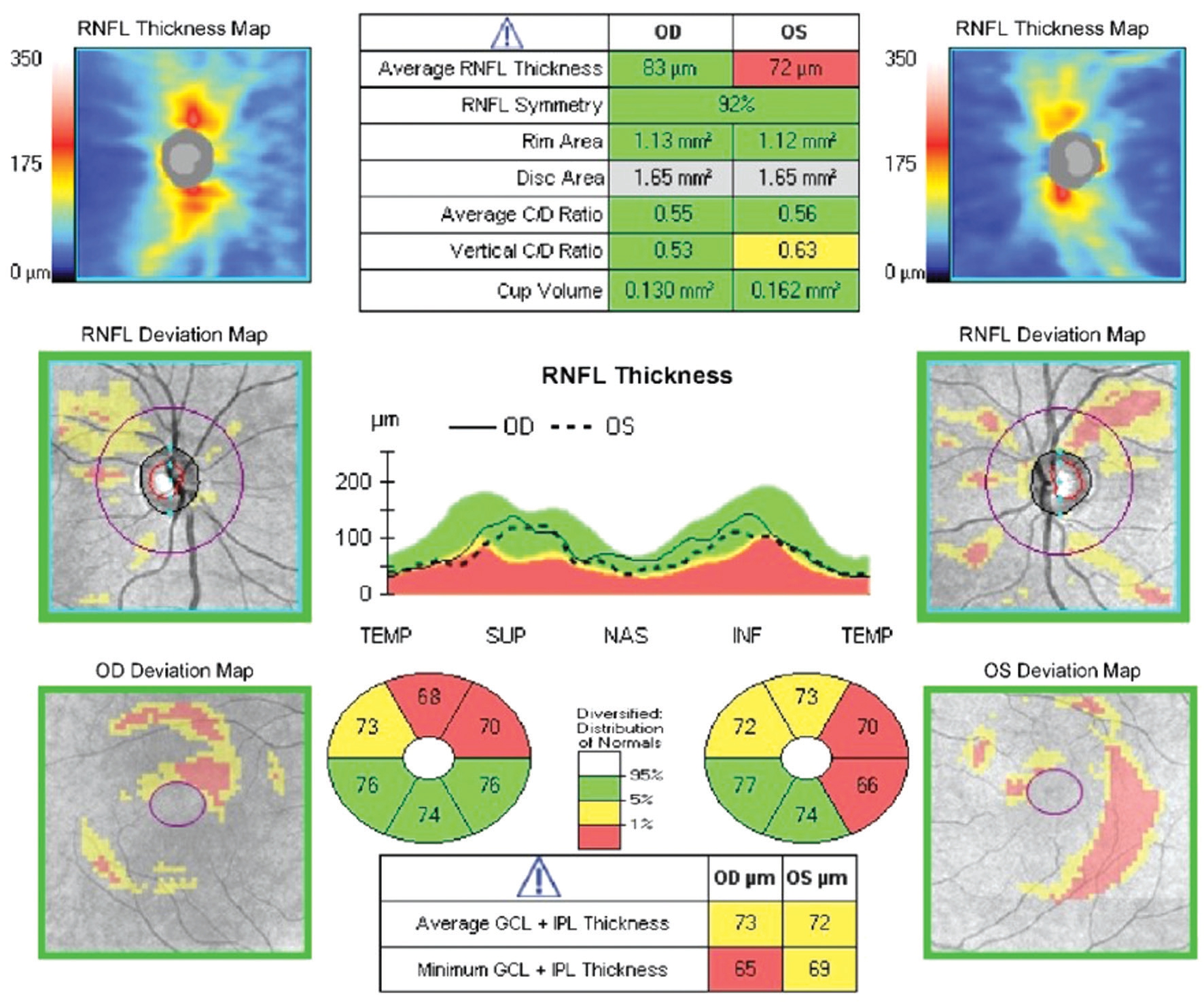

What is Medicare case mix index?

The Medicare case-mix index (CMI) reflects the costliness of a hospital's Medicare patient mix. The costs are based on the diagnosis-related group (DRG) in which each patient is classified and the weight that Medicare has applied to each DRG to reflect patients' relative costs. For Medicare patients for whom payment was made under the prospective payment system (PPS) in States not waived from the Medicare reimbursement system, the CMI for fiscal year 1984 was 9.2 percent higher than that for calendar year 1981. Because the calculatiorn; of budget neutrality that underlaid the PPS rates for 1984 assumed that the CMI would increase by only 3.4 percent, Medicare paid 5.6 percent more per PPS admission in that year than had been planned. 1 To guide the Health Care Financing Administration (HCFA) in how to deal with the unexpectedly large increase in the CMI, we undertook a study of the components of the increase. We sought to assess what part of the increase resulted from changes in coding practices, what part from changes in medical practices, and what part from changes in Medicare patients' resource needs.

Is there a shift from inpatient to outpatient?

Because those patients who would have been admitted to the hospital in the past would typically have been classified into diagnosis-related groups with weights lower than average, the movement to outpatient settings tends to increase the

Why should insurance coverage decrease the cost of health care?

In theory, insurance coverage should decrease the cost of health care because everyone is paying premiums and sharing the cost of treatment across beneficiaries, thus reducing the financial risk that families face. However, this results in a lack of transparency of the true cost of health care.

What are the factors that affect the cost of health care?

Another factor affecting the cost of health care is the use of the emergency room for primary care. In general, three groups of individuals access health care through the emergency room: Medicaid recipients, underinsured individuals, and uninsured individuals.

How do insurance companies discourage overuse?

Insurance companies are attempting to discourage overuse by making subscribers more price sensitive through high deductibles, co-pays, and co-insurance (the portion of the health care bill for which the subscriber is responsible after the deductibles have been met).

What is the return on investment in healthcare?

Return on investment (ROI) is an economic term focused on the real or perceived value of devoting time, money, or effort toward a specific purpose. With the United States investing more money and effort in health care services than any other country, the absence of ROI is very significant in many ways. First and foremost, the trajectory of health care expense growth over the last 30 years is unsustainable. The fact that 36 countries—all of whom spend less of their GDP percentage on health care than the United States does—have much better ROI than the United States signifies that there is significant waste or abuse within the system. The basic structure of our health care system is a contributor to the reduced ROI in that there are four main components of the system—the physician, the patient, the hospital, and the insurance company, each with differing financial interests. The patient's expectation is that medical treatment should cure or ameliorate the effects of illness, chronic disease, or trauma. But that does not appear to be happening, as evidenced by the number of repeat admissions to hospitals. Approximately 20% of Medicare patients are readmitted within 30 days with the same diagnosis (American College of Emergency Physicians, 2015). This suggests that the treatment delivered the first time and for the majority of these patients was not effective or appropriate.

What does it mean when Medicare assumes a service is being used as a cash cow?

When Medicare administrators take note that the use of a particular service rises quickly over time, they automatically assume that the service is being used as a "cash cow" and is therefore being overpaid. This assumption often results in a reevaluation of the CPT code and a lower reimbursement rate.

What is the unintended consequence of insurance coverage?

Having insurance coverage has also created an unintended consequence called price sensitivity —the degree to which the price of a product affects consumer purchasing behaviors.

What factors were considered in the rating of France?

Some of the factors that went into the rating included infant mortality, permanent handicaps as a result of disease, high-risk teen pregnancies, cardiac disease, and many others. France ranked number one in the world, with expenditures of less than 12% of GDP.