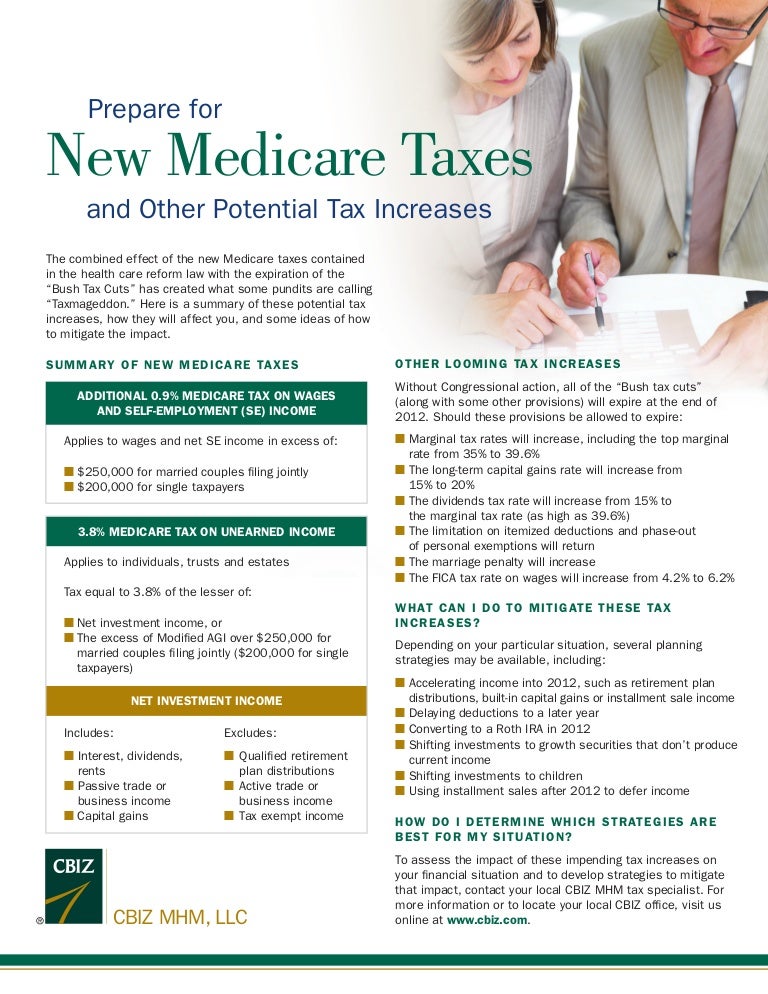

The additional Medicare tax applies to individuals whose earned income—including wages, compensation, and self-employment income—exceeds certain thresholds. For example, single filers who earn more than $200,000 and married couples filing jointly who earn more than $250,000 are subject to an additional Medicare tax. 9

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

Do employers match additional Medicare tax?

An employer must begin withholding Additional Medicare Tax in the pay period in which the wages or railroad retirement (RRTA) compensation paid to an employee for the year exceeds $200,000. The employer then continues to withhold it each pay period until the end of the calendar year. There's no employer match for Additional Medicare Tax.

Why is there a cap on the FICA tax?

Key Takeaways

- Social Security and Medicare payroll withholding are collected as the Federal Insurance Contributions Act (FICA) tax.

- Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit.

- The cap limits how much high earners need to pay in Social Security taxes each year.

When do you pay additional Medicare tax?

While everyone pays some taxes toward Medicare, you’ll only pay the additional tax if you’re at or above the income limits. If you earn less than those limits, you won’t be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

What wages are subject to additional Medicare tax?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

How is additional Medicare calculated?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

Do employers have to pay the additional Medicare tax?

Employers are required to begin withholding Additional Medicare Tax in the pay period in which the employer pays wages in excess of $200,000 to an employee.

How do I avoid Medicare surtax?

Despite the complexity of this 3.8% surtax, there are two basic ways to “burp” income to reduce or avoid this tax: 1) reduce income (MAGI) below the threshold, or 2) reduce the amount of NII that is subject to the tax.

Is there additional Medicare tax in 2021?

2021 updates. 2.35% Medicare tax (regular 1.45% Medicare tax + 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

What is the Imputed Cost of Life Insurance?

The imputed cost of coverage in excess of $50,000 is subject to social security and Medicare taxes, and to the extent that, in combination with other wages, it exceeds $200,000, it is also subject to Additional Medicare Tax withholding. However, when group-term life insurance over $50,000 is provided to an employee (including retirees) after his or her termination, the employee share of Social Security and Medicare taxes and Additional Medicare Tax on that period of coverage is paid by the former employee with his or her tax return and is not collected by the employer. In this case, an employer should report this income as wages on Form 941, Employer’s QUARTERLY Federal Tax Return (or the employer’s applicable employment tax return), and make a current period adjustment to reflect any uncollected employee social security, Medicare, or Additional Medicare Tax on group-term life insurance. Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, an employer may not report the uncollected Additional Medicare Tax in box 12 of Form W-2 with code N.

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Do you have to include fringe benefits in wages?

The value of taxable noncash fringe benefits must be included in wages and the employer must withhold the applicable Additional Medicare Tax and deposit the tax under the rules for employment tax withholding and deposits that apply to taxable noncash fringe benefits.

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

How much Medicare tax is on 80,000?

They would be liable for the additional Medicare tax only on $80,000, which is the amount in excess of $250,000. The total Medicare tax payment would be 1.45% or $3,625 on the $250,000, plus 2.35% or $1,880 on the $80,000, totalling $5,505 in Medicare taxes for the year.

What is the threshold for Medicare 2020?

The 2020 tax year thresholds are as follows: Status. Tax threshold. single , head of household, or a qualifying widow (er) $200,000. married tax filers, filing jointly.

How much Medicare tax do self employed people pay?

A person who is self-employed will pay 2.9% standard Medicare tax, and an additional Medicare tax of 0.9%, for a total of 3.8%. Employers do not have to contribute any amounts through the additional Medicare tax. A person is liable for the additional Medicare tax after their total income goes above the threshold for their filing status.

How much is Medicare for married couples?

The limit is $250,000 for married couples. This article explains the Medicare standard tax and the Medicare additional tax. It also looks at who pays the additional tax, how the IRS calculates it, and how the government uses the money.

What is the donut hole in Medicare?

With the Affordable Care Act, a person enrolled in Medicare no longer had to worry about the Medicare Part D coverage gap, also known as the donut hole. The Affordable Care Act also expanded Medicare Part B preventive services to include: abdominal aortic aneurysm and cardiovascular disease screenings.

Do higher earners have to pay more for Medicare?

In 2013, the IRS announced that some higher-earning taxpayers would have to pay more money into Medicare through the additional Medicare tax, as part of the Affordable Care Act.