- Part A premium will be $458 (many qualify for premium-free coverage)

- Part B premium will increase to $144.60.

- Part B deductible will rise to $198.

- Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.

What are the Medicare costs changing in 2020?

Dec 28, 2019 · What Changes Are Coming to Medicare in 2020? As expected, Medicare costs will increase in 2020. Additionally, there will be a change in Medigap that will affect those new to Medicare. Medigap (Medicare Supplement Insurance) Plans in 2020 Medicare has announced that Medigap plans may no longer include the Part B deductible as part of the coverage.

What changes are coming to Medigap in 2020?

Mar 31, 2021 · A few things are changing about the Medicare Donut Hole in 2020: You will have to spend more on your covered drug costs before you reach the donut hole in 2020. In 2019, Part D beneficiaries entered the donut hole coverage gap after spending $3,820 on covered drugs.

Can I apply for Medicare supplement plans after January 1 2020?

Some of the most important 2020 Medicare changes include: Part A premium will be $458 (many qualify for premium-free coverage) Part B premium will increase to $144.60 Part B deductible will rise to $198 Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020

How is Medicare Part D prescription drug coverage changing for 2021?

According to Medicare Resources, in 2020, the standard premium for Medicare Part B was increased to $144.60 (up from $135.50 in 2019). This increase is due to the Social Security cost of living adjustment at 1.6% for 2020. This raised benefits by around $24/month, which is more than enough to cover the premium increase for Part B enrollees.

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What changes are being made to Medicare?

The annual Part B deductible will be $233 this year, an increase of $30. For Medicare Part A, which covers hospitalizations, hospice care and some nursing facility and home health services, the inpatient deductible that enrollees must pay for each hospital admission will be $1,556, an increase of $72 over 2021.Jan 3, 2022

What changes are there in Medicare for 2022?

Coverage changes include an increased number of telehealth services, additional help covering insulin and the potential coverage for an Alzheimer's drug. It's estimated that 29.5 million people will enroll in a Medicare Advantage plan in 2022 — an increase of roughly 10 percent.Mar 7, 2022

Is Medicare going up 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

What are the changes to Medicare in July 2021?

The MBS indexation factor for 1 July 2021 is 0.9%. Indexation will be applied to most of the general medical services items, all diagnostic imaging services, except nuclear medicine imaging and magnetic resonance imaging (MRI) and two pathology items (74990 and 74991).Jun 30, 2021

What is the deductible for Medicare 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.Nov 12, 2021

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

How much does Medicare cost in 2022 for seniors?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Are we getting new Medicare cards for 2022?

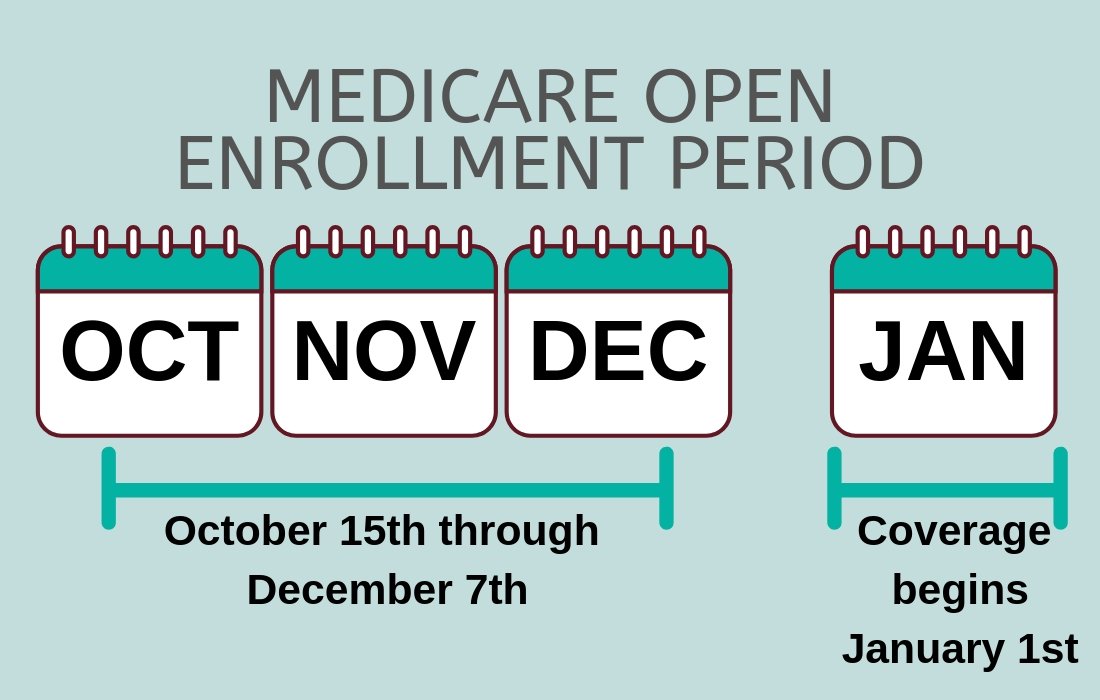

7, the more than 63 million Medicare beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa. Any coverage changes made during this period will go into effect Jan. 1, 2022.Oct 15, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Medigap First-Dollar Coverage Plans Will Be Discontinued for New Medicare Beneficiaries in 2020

January 1, 2020, is a key date for many newly eligible Medicare beneficiaries.

What Is the Medicare Access and CHIP Reauthorization Act (MACRA)?

The new rule that discontinues Plan F and Plan C enrollment for new Medicare beneficiaries in 2020 is a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

High-Deductible Medigap Plan G Will Be a New Plan Option in 2020

Beginning in 2020, Medigap Plan G will feature a new high-deductible plan option.

The Medicare Part D Donut Hole Will Shrink in 2020

The Medicare Part D “donut hole” is a temporary lapse in Part D prescription drug coverage once your out-of-pocket prescription drug spending has reached a certain amount for the year.

Medicare Advantage plans continue to add additional benefits

Medicare Advantage (Medicare Part C) plans provide the same benefits as Original Medicare, and some plans may offer a number of benefits not found in Original Medicare.

Find 2019-2020 Medicare Supplement Plans in Your Area

You can call today to speak with a licensed insurance agent who can help you compare the costs, benefits and coverage of Medicare Supplement plans that are available where you live.

What are the changes to Medicare?

Summary: Medicare 2020 changes may affect your Medicare Supplement plan options and Medicare Part A, Part B and Part D costs. Some of the most important 2020 Medicare changes include: 1 Part A premium will be $458 (many qualify for premium-free coverage) 2 Part B premium will increase to $144.60 3 Part B deductible will rise to $198 4 Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020 5 Medicare will begin closing the Medicare Part D Donut Hole in 2020

What is the Medicare premium for 2020?

Some of the most important 2020 Medicare changes include: Part A premium will be $458 (many qualify for premium-free coverage) Part B premium will increase to $144.60. Part B deductible will rise to $198. Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

When will Medicare change?

Why are Changes Coming to Medicare in 2020? Whether Medicare has been your health care plan for many years, or you expect to be eligible for Medicare on or after January 1, 2020, the changes coming to Medicare Supplement plans and the Donut Hole may affect you. Legislation established these changes in 2015 to try and reduce unnecessary costs ...

Does Medicare Part B cover outpatient services?

Medicare Part B covers your outpatient services, like your annual wellness exam at your doctor’s office. Lawmakers believe that making people responsible for paying a small deductible ($198 in 2020) will encourage them to only visit the doctor when necessary, thereby saving Medicare money.

What is the gap in Medicare Part D?

The gap in Medicare Part D drug plans is often referred to as the “Donut Hole.”. The Donut Hole varies in size depending on the plan, but the high out-of-pocket costs negatively affect enrollees that entered it.

How to check if you qualify for Medicare?

You can check your eligibility by looking at the Medicare Part A start date on your Medicare card. If your Medicare Part A began before the cut-off date, you will be eligible to apply for Plan F, Plan F High-Deductible, or Plan C even after 2020.

What is the Medicare premium for 2020?

Part B premiums increased. According to Medicare Resources, in 2020, the standard premium for Medicare Part B was increased to $144.60 (up from $135.50 in 2019). This increase is due to the Social Security cost of living adjustment at 1.6% for 2020.

How to compare Medicare plans?

In August 2019, The Medicare Plan Finder tool was upgraded. According to CMS, the new tool will make it easier for beneficiaries to see 2020 Medicare changes and to: 1 Compare pricing between Original Medicare, Medicare prescription drug plans, Medicare Advantage plans, and Medicare Supplement Insurance (Medigap) policies; 2 View different coverage options on their smartphones and tablets; 3 Compare up to three drug plans or three Medicare Advantage plans side-by-side; 4 Get plan costs and benefits, including which Medicare Advantage plans offer extra benefits; 5 Build a personal drug list and find Medicare Part D prescription drug coverage that best meets their needs.

How much is the 2020 Part B deductible?

The Part B deductible will increase by $13 to a total of $198 in 2020. If you are enrolled in Part B, you may have supplemental coverage that pays your deductible.

How much is coinsurance for Part A?

This additional coinsurance charge is $352 per day for the 61st through 90th day of inpatient care. Beyond that, coinsurance for inpatient care will cost $704 in 2020 (for up to a total of 60 days), which is up from $682 in 2019. After you use up your lifetime reserve days, you pay all costs.

Can you keep Medigap plans?

In a summary of changes from Medicare Resources, their website explains that you can keep Medigap Plans C or F if you already have them. However, in an attempt to curtail the overutilization of services , these plans are no longer available to those who are newly-eligible for Medicare after January 1, 2020. A new high-deductible plan, Plan G, has been made available to replace the high deductible Plan F.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much will Medicare copay be in 2021?

The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.70 for generics and $9.20 for brand-name drugs. Medicare beneficiaries with Part D coverage (stand-alone or as part of a Medicare Advantage plan) will have access to insulin with a copay of $35/month in 2021.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Does Medicare cover hospitalization?

Medicare Part A covers hospitalization costs. Part A has out-of-pocket costs when enrollees need hospital care, although most enrollees do not pay a premium for Part A. But you’ll have to pay a premium for Part A if you don’t have 40 quarters of work history (or a spouse with 40 quarters of work history).

Is Medicare Advantage available for ESRD?

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease (ESRD) unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Is there a donut hole in Medicare?

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a “hole” for brand-name or generic drugs: Enrollees in standard Part D plans pay 25 percent of the cost (after meeting their deductible) until they reach the catastrophic coverage threshold.

What is the maximum deductible for Part D?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans will be $445 in 2021, up from $435 in 2020. And the out-of-pocket threshold (where catastrophic coverage begins) will increase to $6,550 in 2021, up from $6,350 in 2020.

What is the Medicare donut hole?

If you have a Medicare Part D prescription drug plan, you’ve probably heard of the coverage gap that’s sometimes called the Medicare donut hole. This means that after you and your Medicare drug plan have spent a certain amount of money for covered prescription drugs, you may have to pay for some or all the costs of your prescriptions up to a certain limit. There are exciting changes to the donut hole scheduled between now and 2020. Basically, the amount you will have to pay in the donut hole will decrease each year. Which means that a year and a half from now, you’ll pay no more than 25 percent for covered brand-name and generic drugs in the donut hole!

Does Medicare have a new card?

Instead, the cards will have a new Medicare Beneficiary Identifier (MBI) that will be used for billing and for checking your eligibility and claims status. Medicare is finally doing its part to strengthen fraud protection and ensure your personal information is secure.

When will Plan C be discontinued?

Although Plan C is being discontinued at the beginning of 2020, this does not mean anyone already eligible for Plan C coverage will automatically lose access to this plan. Existing Plan C recipients can keep their coverage unless the insurance carriers that offer it leave their coverage area.

Can you keep Medigap Plan C?

Existing enrollees in a Medigap Plan C policy may be able to keep their Plan C benefits, but should be aware of any potential changes to Plan C and what their options are if they wish to change their coverage.

What will be the Medicare changes in 2021?

Another change coming to Medicare in 2021 is an update to the income brackets. Income brackets are specific ranges of income that determine things like your tax rate or what you may be required to pay for Medicare.

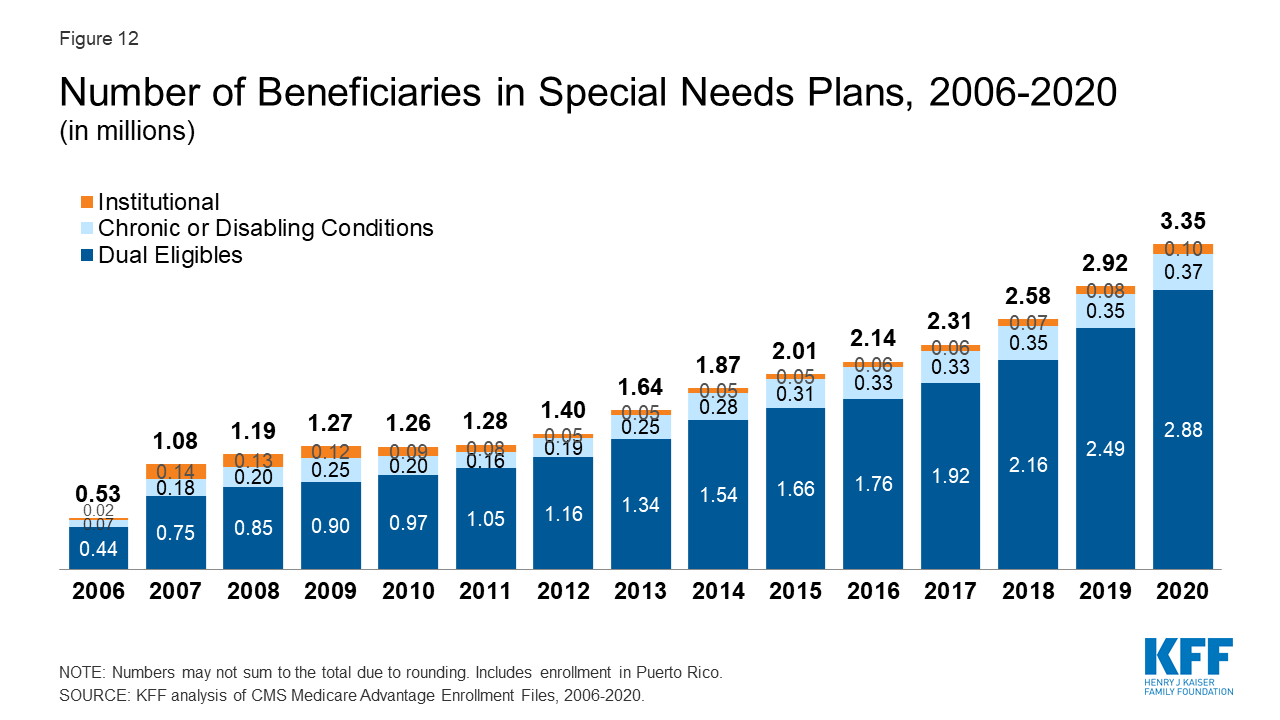

How many people will be on medicare in 2020?

In 2020, about 62.8 million people were enrolled in Medicare. It’s up to the Centers for Medicare & Medicaid (CMS), a division of the U.S. Department of Health and Human Services, to keep the needs of enrollees and the cost of the program in check as laid out in the Social Security Act.

What are the changes to Medicare?

What Are the Medicare Changes for 2021? 1 Medicare premiums and deductibles have increased across the various plans. 2 The “donut hole” in Medicare Part D was eliminated in 2020. 3 Changes have been made to Medicare coverage to respond to COVID-19.

What is Medicare Part D?

Medicare Part D is known as the prescription drug plan for Medicare. Like Medicare Part C. Part D plan costs vary by provider, and premium costs are adjusted based on your income. One big change in 2020 was the closing of the “ donut hole .”.

What is the donut hole in Medicare?

The donut hole was a gap in the plan’s prescription drug coverage that occurred once the plan had paid out a certain amount for prescription medications for the year. In 2021, there is a Part D deductible of $445, but this may vary depending on the plan you choose.

How much is Medicare Part A deductible in 2021?

This deductible covers an individual benefit period, which lasts 60 days from the first day of hospital or care facility admission. The deductible for each benefit period in 2021 is $1,484 — $76 more than in 2020.

What is Medicare Supplement?

Medicare supplement, or Medigap, plans are Medicare plans that help you pay for a portion of your Medicare costs. These supplements can help offset the costs of premiums and deductibles for your Medicare coverage. Plans are sold by private companies, so rates vary. In 2021, under Plan G, Medicare covers its share of costs, ...