When a health care provider bills Medicare to seek reimbursement, they will use CPT codes to list the various treatments they delivered. The CPT codes used to bill for medical services and items are part of a larger coding system called the Healthcare Common Procedure Coding System (HCPCS).

Full Answer

What are place of service codes for Medicare?

Place of Service Codes are two-digit codes placed on health care professional claims to indicate the setting in which a service was provided. The Centers for Medicare &… Home Finding Medicare fee schedule – HOw to Guide Gastroenterology, Colonoscopy, Endoscopy Medicare CPT Code Fee LCD and procedure to diagnosis lookup – How to Guide

What are CPT codes for Medicare?

CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare to seek reimbursement, they will use CPT codes to list the various treatments they delivered.

What type of coding system is used in outpatient facilities?

The three main coding systems used in the outpatient facility setting are ICD-10-CM, CPT ®, and HCPCS Level II. These are often referred to as code sets. ICD-10-CM in the Outpatient Facility Setting

What are the CPT® Modifiers used in facility coding?

Coding rules, including modifier use, also can vary by setting. The AMA CPT ® code book includes a section called Modifiers Approved for Ambulatory Surgery Center (ASC) Hospital Outpatient Use. Facility coders should be sure to use the correct, approved modifiers to prevent billing issues, checking payer policies, as well.

Is POS 10 facility or non facility?

Database (updated September 2021)Place of Service Code(s)Place of Service Name07Tribal 638 Free-standing Facility08Tribal 638 Provider-based Facility09Prison/ Correctional Facility10Telehealth Provided in Patient's Home54 more rows

Is POS 24 facility or non facility?

By definition, a “facility” place-of-service is thought of as a hospital or skilled nursing facility (SNF) or even an ambulatory surgery center (ASC) (POS codes 21, POS 31 and POS 24, respectively), while “non-facility” is most often associated with the physician's office (POS code 11).

Is POS 19 facility or non facility?

However, for a service rendered to a patient who is an inpatient of a hospital (POS code 21) or an outpatient of a hospital (POS codes 19 or 22), the facility rate is paid, regardless of where the face-to-face encounter with the beneficiary occurred.

Is POS 13 facility or non facility?

POS 13 may be used when the place of service is an assisted living facility. This facility is a congregate residential facility with self contained living units. Resident needs an support is provided on a 24/7 basis and some health care is delivered.

Is POS 65 a facility or non facility?

65 End-Stage Renal Disease Treatment Facility A facility other than a hospital, which provides dialysis treatment, maintenance, and/or training to patients or caregivers on an ambulatory or home-care basis.

Is POS 22 a facility?

POS 22: On Campus-Outpatient Hospital Descriptor: A portion of a hospital's main campus which provides diagnostic, therapeutic (both surgical and nonsurgical), and rehabilitation services to sick or injured persons who do not require hospitalization or institutionalization.

What is the difference between POS 19 and 22?

Beginning January 1, 2016, POS code 22 was redefined as “On-Campus Outpatient Hospital” and a new POS code 19 was developed and defined as “Off-Campus Outpatient Hospital.” Effective January 1, 2016, POS 19 must be used on professional claims submitted for services furnished to patients registered as hospital ...

What is Facility vs non facility?

In general, Facility services are provided within a hospital, ambulatory surgery center, or skilled nursing facility. Non Facility services are provided everywhere else and include outpatient clinics, urgent care centers, home services, etc.

What is a facility type code?

The first digit of the facility code indicates the type of facility; i.e., 1 = Hospital, 2 = Skilled Nursing Facility, etc. The second digit of the facility code indicates the bill classification; i.e., 1 = Inpatient (Medicare Part A), 2 = Inpatient (Medicare Part B), etc.

What is the difference between POS 31 and POS 32?

Use POS 31 when the patient is in a skilled nursing facility (SNF), which is a short-term care/rehabilitation facility. Use POS 32 when the patient is in a long-term nursing care facility. Keep in mind that, one facility can provide BOTH types of care.

What is the difference between POS 22 and 11?

I think it would be POS 11 even if it is owned by the hospital it is offsite and in an office. 22 POS to me is when a service is performed in the hospital and the patient is never admitted.

What is the difference between POS 21 and 22?

However, for a service rendered to a patient who is an inpatient of a hospital (POS code 21) or an outpatient of a hospital (POS code 22), the facility rate is paid, regardless of where the face-to-face encounter with the beneficiary occurred.”

What is a C code in Medicare?

Medicare created C codes for use by Outpatient Prospective Payment System (OPPS) hospitals. OPPS hospitals are not limited to reporting C codes, but they use these codes to report drugs, biologicals, devices, and new technology procedures that do not have other specific HCPCS Level II codes that apply.

What is CPT code?

The CPT ® code set, developed and maintained by the American Medical Association (AMA), is used to capture medical services and procedures performed in the outpatient hospital setting or to capture pro-fee services, meaning the work of the physician or other qualified healthcare provider.

What is an outpatient facility?

Outpatient facility coding is the assignment of ICD-10-CM, CPT ®, and HCPCS Level II codes to outpatient facility procedures or services for billing and tracking purposes. Examples of outpatient settings include outpatient hospital clinics, emergency departments (EDs), ambulatory surgery centers (ASCs), and outpatient diagnostic and testing departments (such as laboratory, radiology, and cardiology).

What is the primary outpatient hospital reimbursement method?

However, the primary outpatient hospital reimbursement method used is the OPPS.

What is an ambulatory surgery center?

An ambulatory surgery center (ASC) is a distinct entity that operates to provide same-day surgical care for patients who do not require inpatient hospitalization. An ASC is a type of outpatient facility that can be an extension of a hospital or an independent freestanding ASC.

What is the official coding guidelines?

Official coding guidelines provide detailed instructions on how to code correctly; however, it is important for facility coders to understand that guidelines may differ based on who is billing (inpatient facility, outpatient facility, or physician office).

What is a patient registered?

1. Patient is registered by the admitting office, clinic, or hospital outpatient department. This includes validating the patient’s demographic and insurance information, type of service, and any preauthorization for procedures required by the insurance company, if not already completed prior to the visit. 2.

What is POS code?

Physicians are required to report the place of service (POS) on all health insurance claims they submit to Medicare Part B contractors. The POS code is used to identify where the procedure is furnished. Physicians are paid for services according to the Medicare physician fee schedule (MPFS).

What is a place of service?

Place of Service: A two-digit code used on health care professional claims to indicate the setting in which a service was provided. Place of Service Codes are two-digit codes placed on health care professional claims to indicate the setting in which a service was provided. The Centers for Medicare & Medicaid Services (CMS) maintain POS codes used ...

Why did physicians not implement internal controls?

Many physicians had not implemented internal controls to prevent billing with incorrect placeof-service codes. Physicians and their billing personnel or agents told us that they had coded the place of service incorrectly for one or more of the following reasons, which are consistent with alack of adequate controls:

What is the revenue code for inpatient admissions?

Revenue code – In relation to inpatient admissions. • Revenue Code 760 is not allowed because it fails to specify the nature of the services. • Revenue Code 761 is acceptable when an exam or relatively minor treatment or procedure is performed.

Why is it important to bill with the correct NPI?

It is important to bill with the correct NPI for the service you provided or this could delay payment or even result in a denial of a claim. Patient Status The appropriate patient status is required on an inpatient claim. An incorrect patient status could result in inaccurate payments or a denial.

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

CMS National Coverage Policy

Title XVIII of the Social Security Act, §1833 (e) prohibits Medicare payment for any claim which lacks the necessary information to process the claim

Article Guidance

The information in this article contains billing, coding or other guidelines that complement the Local Coverage Determination (LCD) for Respiratory Therapy (Respiratory Care) L34430.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.

Value Based Purchasing Program for Ambulatory Surgical Centers

The Affordable Care Act requires the Secretary of Health and Human Services to develop a plan to implement a value-based purchasing (VBP) program for payments under the Medicare program for ambulatory surgical centers (ASCs). The Secretary submits a report to Congress containing this plan.

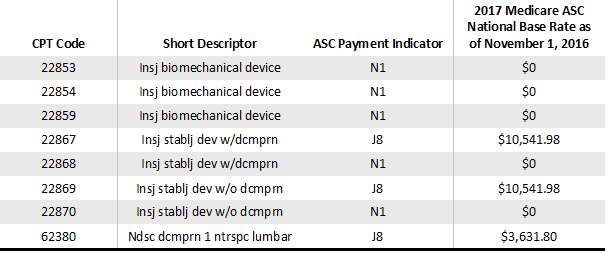

Ambulatory Surgical Center (ASC) Approved HCPCS Codes and Payment Rates

These files contain the procedure codes which may be performed in an ASC under the Medicare program as well as the ASC payment group assigned to each of the procedure codes. The ASC payment group determines the amount that Medicare pays for facility services furnished in connection with a covered procedure.

ASC CENTER

For a one-stop resource for Medicare Fee-for-Service (FFS) ambulatory surgical centers, visit the Ambulatory Surgical Centers (ASC) Center page.