The best Medicare Supplement or Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are the best Medicare supplement insurance plans in North Carolina?

For many North Carolina Medicare beneficiaries, the best Medicare Supplement insurance plan is Medicare Plan G, in terms of the fullest coverage. For years, Medicare Plan F was considered the gold standard among Medicare Supplement plans in North Carolina because it is the most comprehensive.

Which companies offer the best Medicare supplement plans?

Top-Rated Medicare Supplement Companies Manhattan Life Medicare Supplement Plans Continental Life Insurance Medicare Supplement Plans Humana Medicare Supplement Plans Blue Cross Blue Shield Medicare Supplement Plans Anthem Medicare Supplement Plans Mutual of Omaha Medicare Supplement Plans Aetna Medicare Supplement Plans

What Medicare supplement insurance plans does Medico sell?

Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

How does open enrollment work for Medicare Supplement Insurance in North Carolina?

Under North Carolina law, the private insurance companies selling Medicare Supplement insurance plans in North Carolina must offer beneficiaries a chance to enroll without worrying about whether they’ll be accepted. This is known as your Medigap Open Enrollment Period. Here’s how open enrollment works:

How much is plan G in North Carolina?

$87-$290How Much Do Medigap Policies Cost?Plan TypePremium RangePlan F$108-$308Plan G$87-$290Plan N$68-$274

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Which Medicare plan is best in North Carolina?

The best-rated Medicare Advantage plans in North Carolina are from HealthTeam Advantage and Blue Cross Blue Shield. These companies have impressive ratings of 4.5 to 5 stars. The cheapest companies in the state are Alignment Health Plan and Experience Health, which only offer $0 plans.

What is the most basic Medicare Supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the difference between Medicare Advantage and Medigap?

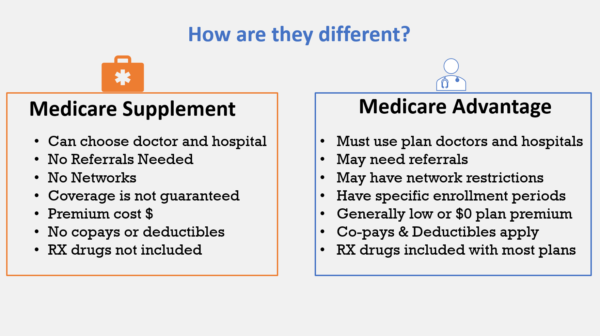

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What is Plan G Medicare supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Does Aetna have a Medicare supplement plan?

Aetna offers highly-rated policies for Medicare beneficiaries. Aetna Medicare policies range from Medicare Supplement plans (Medigap) and Medicare Advantage plans to Medicare Part D coverage and ancillary products.

How much does Humana Medicare Supplement cost?

between $120 and $314 per monthHow much does a Humana Medicare Supplement plan cost? The average cost for Humana Medicare Supplement Plan G (our recommendation for the best overall plan) is between $120 and $314 per month. For the cheapest coverage available to new enrollees, Plan K costs between $59 and $174 per month, on average.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Is Plan F better than Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is Medicare Supplement?

What is a Medicare Supplement (or Medigap) Plan? Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare (Parts A and B).

What is the number to call for Medicare Supplement?

Are you considering a Medicare Supplement Plan? For a comparison of Medicare Supplement plans that might be right for you, call one of our trained SHIIP counselors Monday through Friday from 8am to 5pm toll-free at 1-855-408-1212.

How long can you wait to apply for Medicare Supplement?

The insurance company may impose a pre-existing condition waiting period, but it cannot be longer than six months . This would include any health condition diagnosed or treated six months prior to the Medicare supplement application. If a person has prior creditable coverage, the waiting period must be waived.

Does North Carolina have Medicare?

North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability. North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020.

Does Medicare cover disability?

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility ...

When Can You Enroll in Medigap?

Like most health insurance policies, Medigap has an Open Enrollment Period, but you can potentially enroll outside of that period, too. 5 The Medigap Open Enrollment Period begins the month that you turn 65 and enroll in Medicare Part B, and goes on for six months.

What Are the Most Popular Medicare Supplement Plans?

The 10 available standardized Medigap policies offer slightly different coverage, but they all help to cover healthcare expenses like hospital costs, blood transfusion, and Medicare Part B copays and coinsurance. 8 Plans F, G, and N are some of the most popular options.

Plan G

Plan G offers most of the same coverage as Plan F, but it excludes the Part B deductible:

Plan N

Plan N also has most of the same coverage as Plan F. Plan N excludes the Part B deductible and Part B excess charges:

How to Choose a Medicare Supplement Plan?

Medigap policies offer slightly different coverage, available at different premiums and with different deductibles. Consider using a third-party comparison tool like HealthCare.com to easily see the differences between each plan.

How Much Do Medigap Policies Cost?

Medigap policy cost will vary depending on the policy and other factors like your age and whether or not you smoke. The following prices reflect quotes for a 65-year-old female in North Carolina who doesn’t use tobacco. 10 They can give you an idea of what you might pay for a Medigap policy:

What If You Want to Change Your Medigap Policy?

Once you choose a Medigap policy, you’ll only be able to change that policy at certain times. 11 You can change your policy if you’re still within the open enrollment period. Certain special circumstances or guaranteed issue rights can also qualify you to change your policy, such as if you move to another state.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

What is Medicare Supplement in North Carolina?

Medicare Supplement plans in North Carolina help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

What happens if you have a Medicare Advantage policy?

If you have a Medicare Advantage policy and it’s discontinued. If you have a Medicare Advantage policy and you move out of its coverage area. If you have Original Medicare and you’re retiring from group coverage. If your Medigap insurance company decides not to renew your policy.

Is there a deductible for Medicare Part B in 2021?

There is not a deductible on Medicare Plan G, you are simply required to pay the Medicare Part B deductible before outpatient care is covered. For 2021, the Part B deductible is $203.00.

Does Medicare Supplement cover preventive care?

Some Medicare Supplement insurance plans offer preventive care. These differences in health care coverage are why it’s essential that you closely compare the Medigap policies offered in your area before you enroll. Medigap policies supplement the Medicare benefits you receive through Original Medicare. Here are some of the benefits Medigap ...

Is Plan G the most popular health insurance in North Carolina?

Since Plan F is no longer sold to new Medicare beneficiaries, Plan G is becoming the most popular Medicare Supplemental health insurance plan in North Carolina and nationwide. Over the past five years, its enrollment has grown tremendously, jumping 39% from 2017 to 2018. Several things make Plan G popular:

Does Medicare Supplement cover prescriptions in North Carolina?

Medicare Supplement insurance plans in North Carolina do not include prescription drug coverage. Medicare beneficiaries must buy separate Medicare Part D drug plans to cover medications. Just like Medigap plans in North Carolina, prescription drug plans differ in monthly premiums and the drugs covered. When you compare policies, make sure that the ...

How many people in North Carolina have Medicare?

Almost 2 million people in North Carolina have Medicare. Your situation will determine if Medigap or Medicare Advantage coverage is more beneficial. Then, there are some people that just have Medicare. The downside to only Medicare is the lack of Maximum Out of Pocket coverage; so, there is no limit to the amount of money you’ll spend on care.

How many Medicare Part D plans are there in North Carolina?

North Carolina Medicare Part D Plans. There are 28 Part D options in the state of North Carolina. You don’t have to be a specific age to enroll in Part D, as long as you’re Medicare-eligible. No matter which state you live in, you’ll want to enroll in Part D as soon as you’re eligible.

What is the most common Medigap policy?

As you may have heard, Plan F, G , and N are the most common Medigap policies. These are the same top plans across the United States. Plan F is the most comprehensive, but eligibility isn’t for everyone; only those that aren’t newly eligible. Next, Plan G is the second most comprehensive policy.

Is Medicare Supplement available in North Carolina?

But, Medigap isn’t the only option in North Carolina. Beneficiaries can opt for a Medicare Advantage plan if that’s their preference. Although, most people will have more peace of mind with Medigap. Below we’ll discuss the different options for those in North Carolina and in the end you can choose the best for you.

Is Medigap better than Social Security?

If you want steady coverage that doesn’t change and is predictable, Medigap will be the best option for you. If you can’t afford Medigap or you don’t qualify, some coverage is always better than none. Also, if the Medicare Advantage plan has a premium, you can choose to have that deducted from Social Security.

Does North Carolina have Medicare Advantage?

And, just about 36% of beneficiaries in North Carolina have a Medicare Advantage policy. While none of the options are 5-star plans, there are plenty of 4.5-star plans throughout the state; including plans by top carriers like Aetna and Humana. There are advantages and disadvantages to Part C plans, so before you jump into a policy read ...

Is Medicare Savings Account available in select counties?

Also, there are some Medicare Savings Account plans available in select counties. Both these plans change on an annual basis, so each year you’ll want to compare coverage options. The best plan for you isn’t always the best plan for someone else.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

What to know before comparing Medicare Supplements?

As we mentioned above, Medicare supplements are standardized. This means that a Plan G from one company has the same benefits as a Plan G from another company. However, financial ratings and rate increase histories will be different.

Why are Medicare benefits standardized?

After all, benefits are standardized so that the benefits for each plan letter are the same from company to company. Medicare supplement companies also pay your bills like clockwork because Medicare is the decision maker, so we never hear that any of them have slow-pay issues like the Medicare Advantage plans often do.

Is United Healthcare a Medicare Supplement?

While many other insurance companies offer the same standardized Medigap plans, United Healthcare Medicare Supplement plans are the only ones co-branded with a nationally known senior organization. United Healthcare Medicare Supplement plans are some of the most popular in the nation.

Is Cigna a Medicare Supplement?

Cigna has been innovating since 1982. Always offering competitive monthly premiums, Cigna is a top choice for Medicare Supplement plans. Cigna’s main priorities consist of creating an easy experience, bettering the well-being of their clients, and providing top notch service.

Does Manhattan Life offer Medicare Supplements?

Manhattan Life Medicare Supplements in 2021. Discounts are always appreciated when it comes to Medicare, and Manhattan Life knows this. That’s why they offer a household discount of 7% just for having a roommate. If you live with someone and you both are sixty or older, you can apply for this discount.

Is Mutual of Omaha Medicare Supplements in 2021?

Mutual of Omaha Medicare Supplements in 2021. Mutual of Omaha has some of the longest experience in Medicare Supplement plans. Since they have dealt with Medicare from the beginning, Mutual of Omaha knows and understands the system extremely well. Another great thing about Mutual of Omaha is that they have several subsidiary companies.

Is it difficult to compare Medicare supplements?

Comparing Medicare supplements ratings is a little more difficult than it is for Medicare Advantage companies, which have an easy 5-star ratings system. With Medigap plans, you are left to compare financial ratings, and as you can see, there are a whole bunch with A and B ratings.

Which is the best Medicare supplement company?

Best Claims Experience. Mutual of Omaha is one of the best Medicare supplement companies with coverage available in all 50 states. It’s sixth in terms of direct premiums earned. 16 The company covers more than 150,000 people. One of the main selling points of Mutual of Omaha , however, is that 98% of claims are paid out within 12 hours.

When did CVS buy Aetna?

Aetna was acquired by CVS in 2018. 21 Aetna is the fifth-largest Medigap provider by direct premiums earned and covers more than 169,000 people. 22 Especially noteworthy are low-cost Plan G and Plan N, which are cost-effective because they offer reasonably broad coverage at a lower premium.

What is United Healthcare?

UnitedHealthcare is the largest Medicare Supplement company by premiums earned, and they cover more than 308,000 people. 11 United Healthcare is known for its easy-to-use online portal, as well as its partnership with AARP. In fact, when you go to AARP to look for Medigap plans, they send you to United Healthcare.

How many people does Cigna cover?

Cigna covers more than 230,000 people with its supplemental Medicare insurance, making it the fourth-biggest insurer when measured by direct premiums earned for policies issued from 2016 to 2018. 1 Cigna is available in all 50 states and provides access to a variety of discounts and other perks. Cigna offers a lot of information through its web ...

What to consider when choosing Medicare supplement insurance?

When choosing Medicare supplement insurance, it’s important to consider your personal needs and preferences. While your premium is a big factor, it’s also important to look at other items, including whether you have to worry about copays and coinsurance, and what out-of-pocket costs you’ll have.

Is Medicare good for seniors?

Medicare is a great option for seniors. In fact, those 65 and older who qualify for Medicare often cite it as one of the best health plans. However, it doesn’t take care of everything. In fact, you may need extra insurance, known as Medicare Supplement or Medigap, to fully manage your healthcare issues as you age.

Which state has the highest direct premiums?

The state with the highest rate of direct premiums earned is Delaware, where just over 3,000 people purchased policies. 13.