Local PPO, regional PPO, and PFFS plan costs all were higher than expected costs under traditional Medicare—$3.8 billion higher in aggregate. Geographic Concentration of Relatively Low-Cost Medicare Advantage Plans

Full Answer

Why Choose Medicare Advantage over Medicare?

Why choose Medicare Advantage over original Medicare? When relying solely on original Medicare, seniors can incur significant out-of-pocket costs after seeing a doctor or staying at the hospital. This is why many Medicare beneficiaries choose Medicare Advantage plans in order to improve their health care coverage.

What is the average cost of Medicare Advantage?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What are the best Medicare Advantage plans?

What to Know About the Best Medicare Advantage Plans

- Most Medicare Advantage plans are PPO and HMO. Most Medicare Advantage plans are either PPO or HMO, representing 46% and 39% of available plans. ...

- Most Medicare Advantage plans include prescription drug coverage. ...

- Vision, dental and hearing benefits are widespread. ...

- Just over half of Medicare Advantage plans have $0 premiums. ...

What are the advantages and disadvantages of Medicare?

What Are the Pros of a Medicare Advantage Plan?

- Additional Benefits. As mentioned above, Medicare Advantage plans can provide additional benefits that are not found in Original Medicare.

- Out-Of-Pocket Protection. ...

- Coordinated Care. ...

- Plan Selection. ...

- Customized Coverage. ...

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Advantage more expensive?

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

Are Medicare Advantage plans more expensive than regular Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

Does Medicare Advantage have lower out-of-pocket costs?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

Is Medicare Advantage less expensive than traditional Medicare?

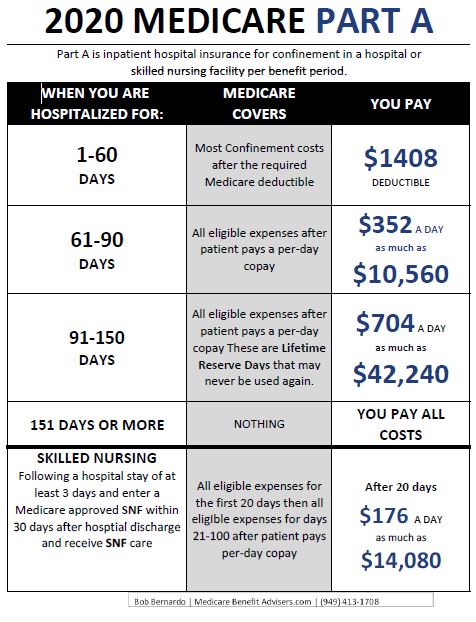

In 2021, virtually all Medicare Advantage enrollees (99%) would pay less than the traditional Medicare Part A hospital deductible for an inpatient stay of 3 days, and these enrollees would pay $747 on average (Figure 3).

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

Can you switch back from Medicare Advantage to regular Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Do Medicare Advantage plans cover hospital stays?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does Medicare Advantage have copays?

Copayment: MA Plans usually charge a copayment (copay) for doctor's visits, instead of the 20% coinsurance you pay under Original Medicare. Keep in mind that MA Plans cannot charge higher copays than Original Medicare for certain care, including chemotherapy, dialysis, and skilled nursing facility (SNF) care.

Do Medicare Advantage plans cover surgery?

Medicare Part B and Medicare Advantage plans generally cover physician services, including surgeons and anesthesiologists who participate in the inpatient surgery but who are not employees of the hospital.

What is the average cost of Medicare Advantage plans by state?

As you can see in the chart below, the average cost of a Medicare Part C plan can vary significantly from one state to another.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

Why do people choose Medicare Advantage?

Millions of people opt for a Medicare Advantage plan for a number of reasons, one of which may be the cost savings that some Medicare Advantage plans may offer. Review this detailed examination of Medicare Advantage costs to learn more about how you may be able to find the right plan for you.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

How much do Medicare Advantage plans cost?

Each insurance company that offers Medicare Advantage plans sets its own costs when it comes to premiums, deductibles, and more. In other words, costs tend to vary by plan and location.

What is Medicare Advantage?

Medicare Advantage plans are offered by Medicare-approved private insurance companies and are an alternative way to get your Original Medicare, Part A and Part B, benefits. Each plan must offer the same level of coverage as the federal health insurance program, but may also cover additional benefits like prescription drugs, ...

What is the difference between Medicare Part C and Medicare Advantage?

One key difference between Medicare Part C and Original Medicare is that all Medicare Advantage plans must have a yearly out-of-pocket limit that caps your health-care costs. This maximum is the total amount you can expect to pay in a given year. Once you’ve reached this limit, your plan will cover all costs for covered services for the remainder of the year.

What is a yearly deductible?

Annual deductible: this is a set amount you may need to pay out of pocket before your plan begins to cover costs. You typically need to pay for all health-care expenses until you’ve reached the yearly deductible.

What is the average Medicare premium?

The average Medicare Advantage premium in 2019 was $8, according to eHealth research. This was a result of the popularity of $0 premium plans.

How much does Medicare cover out of pocket?

Once you’ve reached this limit, your plan will cover all costs for covered services for the remainder of the year. The average out-of-pocket limit for Medicare Advantage plans decreased from $5,815 in 2018 to $5,164 in 2019, according to eHealth research. Source: Medicare 2019 Open Enrollment: Costs and Sentiments.

Do all Medicare Advantage plans require a premium?

Not all plans require a premium. Some Medicare Advantage plans may have premiums as low as $0; however, keep in mind that even if your service area offers a Medicare Advantage plan with a $0 premium, you may have other costs, such as deductibles, coinsurance or copayments. Regardless of whether you pay a premium for your Medicare Advantage plan, ...

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

What medical services pay 20%?

We often see this come into play for bigger ticket items, like durable medical equipment, diagnostic imaging, chemotherapy, radiation and dialysis.

Is each plan's summary of benefits hidden?

Each plan’s summary of benefits lists these expenses, so they aren't really hidden -- you just need to know where to look for them. Knowledge is power when it comes to choosing the right Medicare coverage.

Does Medicare Advantage have a PPO?

Most Medicare Advantage plans today have either an HMO or PPO network. Members use that network for their healthcare. In return, they can get access to lower premiums and, in many plans, a built-in Part D benefit.

Is Medigap the same as Medicare Advantage?

Medigap plans have been around forever and are relatively easy to understand. Medicare Advantage plans work differently but generate much interest due to premiums which are often lower than Medigap plans.

Is Medicare Advantage back end?

While the lower premiums and extras are attractive, there are back-end costs in Medicare Advantage plans. These might be minimal while you are healthy. However, they can add up quickly in years when you need more healthcare services, so it’s important to be aware of them.

Does Medicare Advantage have deductibles?

Deductibles. Medicare Advantage plans cover the same Part A and B services that are offered by Medicare. Some plans have deductibles for medical services or drugs before your benefits begin. Check the plan’s Summary of Benefits to see what expenses you’ll be responsible for upfront.

Can Medicare Advantage plans change their benefits each year?

Medicare Advantage plans refile their benefits with Medicare each year. The benefits, drug formulary, pharmacy network, provider network, premiums, copays and coinsurance can change for the following year.