What Medicare Part B costs. For Part B beginning in 2017, most people will have to pay a monthly premium of $134 a month. This could be more or less depending on your income. Some services are covered under Medicare Part B at no additional cost to you if you see a doctor that accepts Medicare.

Full Answer

What medications are not covered by Medicare?

Some examples of medications that may not be covered by Medicare include: Weight loss or weight gain medications Medications used to treat cold or cough symptoms Fertility medications Vitamins and minerals (with the exception of prenatal vitamins or fluoride preparation products) Medications used ...

What items are covered by Medicare?

- Durable medical equipment (DME)

- Prosthetic devices

- Leg, arm, back and neck braces (orthoses) and artificial leg, arm and eyes, including replacement (prostheses)

- Home dialysis supplies and equipment

- Surgical dressings

- Immunosuppressive drugs

- Erythropoietin (EPO) for home dialysis patients

- Therapeutic shoes for diabetics

- Oral anticancer drugs

What drugs does Medicare Part B and Part D cover?

Transplant / immunosuppressive drugs. Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

What is not covered by Medicare?

Some of the items and services Medicare doesn't cover include: Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes.

What does Medicare generally cover?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare cover 100% of costs?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

Does Medicare cover all costs?

En español | No. Even though Medicare can cover many of your health care costs, you will still have some out-of-pocket expenses, including premiums, deductibles, copayments and coinsurance.

What does Part B of Medicare pay for?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

Does Medicare have an out of pocket max?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

Does Medicare cover eye exams?

Eye exams (routine) Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Does Medicare cover surgery?

Does Medicare Cover Surgery? Medicare covers surgeries that are deemed medically necessary. This means that procedures like cosmetic surgeries typically aren't covered. Medicare Part A covers inpatient procedures, while Part B covers outpatient procedures.

Does Medicare only covers 80 percent?

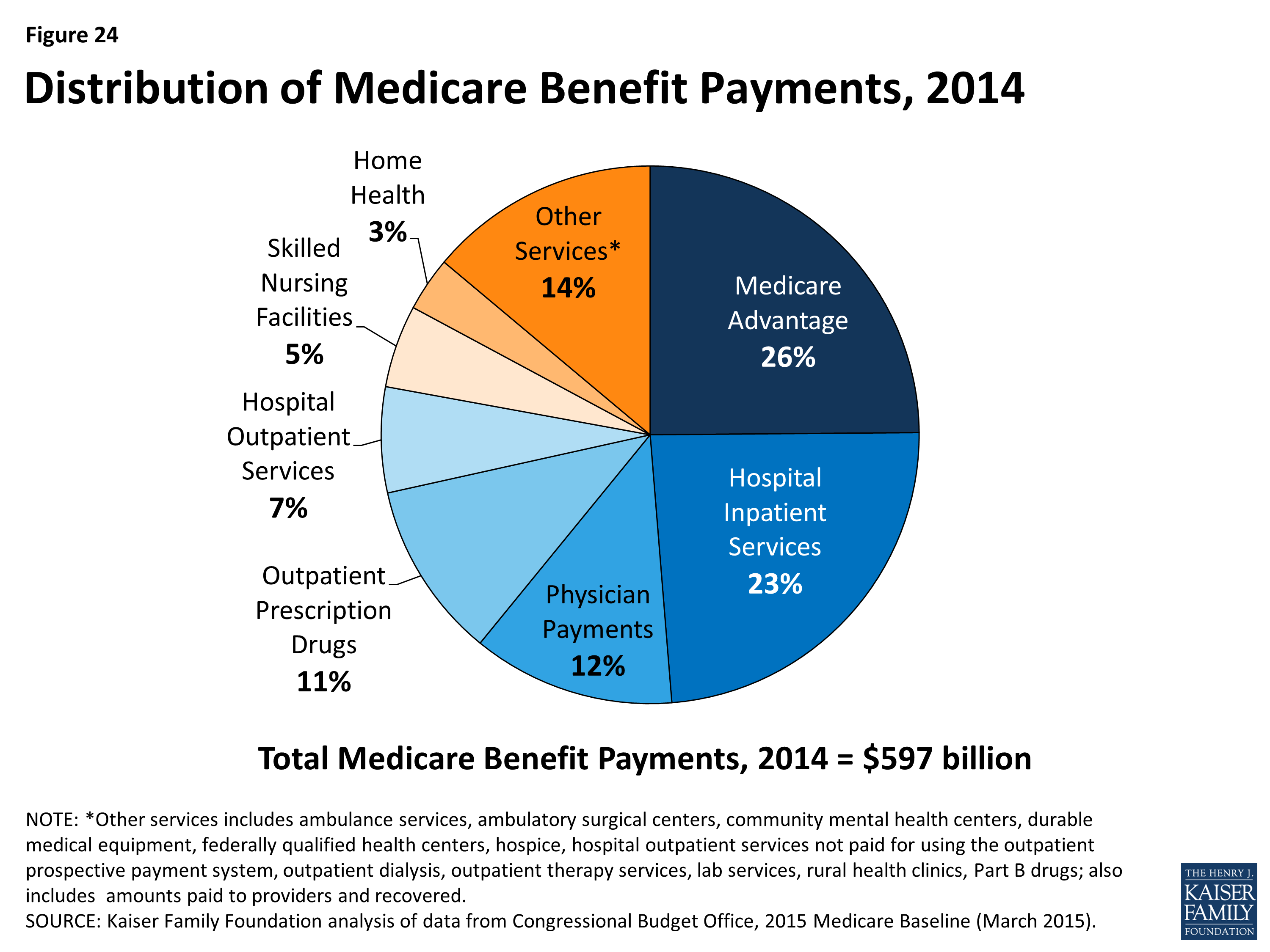

Original Medicare only covers 80% of Part B services, which can include everything from preventive care to clinical research, ambulance services, durable medical equipment, surgical second opinions, mental health services and limited outpatient prescription drugs.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What health-care costs does Medicare Part A cover?

Medicare Part A may pay health-care costs when you’re a hospital inpatient. There’s a deductible amount that you typically need to pay. This is not an annual amount, but an amount you generally pay once per benefit period.

What health-care costs does Medicare Part B cover?

Medicare Part B may pay health-care costs for doctor visits, preventive care, certain lab tests, some medical equipment and supplies, and certain other medically necessary services and items.

Health-care costs: what can you do?

If you’d like to protect yourself against unlimited health-care cost spending, here are a few options to consider.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How much is coinsurance for 2020?

As of 2020, the daily coinsurance costs are $352. After 90 days, you’ve exhausted the Medicare benefits within the current benefit period. At that point, it’s up to you to pay for any other costs, unless you elect to use your lifetime reserve days. A more comprehensive breakdown of costs can be found below.

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.