Beneficiaries who use covered Part A services may be subject to deductible and coinsurance (percent of costs that the enrollee must pay) requirements. A beneficiary is responsible for an inpatient hospital deductible amount which is deducted from the amount payable by the Medicare program to the hospital for inpatient hospital services provided in a spell of illness.

Full Answer

What is Medicare's typical coinsurance?

Medicare costs at a glance

- $1,484 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 coinsurance per day of each benefit period

- Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days: all costs

Does Medicare have a yearly deductible?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022 ($445 in 2021). Some Medicare drug plans don't have a deductible.

Do I have to pay the annual Medicare deductible?

Medicare Advantage plans may have their own deductible, but you will not be responsible for the Medicare Part B deductible if you are enrolled in a Medicare Advantage plan. You will only be responsible for paying your Medicare Advantage plan deductible.

What is the annual deductible for Medicare?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

What is Medicare coinsurance and deductible?

Coinsurance is the percentage of costs you pay after you've met your deductible. A deductible is the set amount you pay for medical services and prescriptions before your coinsurance kicks in fully. Out-of-pocket expenses are the medical expenses you must pay yourself.

Do Medicare patients have coinsurance?

Do Medicare Advantage Plans Have Coinsurance? Medicare Advantage plans (Part C) share costs with plan members, but it's mostly with copays rather than coinsurance. Copays are a small fee that you pay when you receive a health care service.

What kind of deductible does Medicare have?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is Medicare typical coinsurance?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

Does Medicare have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

How do deductibles work with Medicare?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020.

Does Medicare have copays?

Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs. There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs.

Does Medicare have a maximum out-of-pocket?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the Medicare coinsurance rate for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61 st through 90 th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).

What is the Medicare deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

Does Medicare pay primary insurance deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is coinsurance in Medicare?

Coinsurance. Unlike flat-fee copays, coinsurance is a percentage of the price of service you’ll pay. For example, after you have paid the Medicare Part B (medical insurance) deductible for the year ($198 in 2020), you will be required to pay 20 percent of each service covered by Part B, and Medicare pays the remaining 80 percent.

How much is Medicare coinsurance?

For Medicare Part A (hospital insurance), coinsurance is a set dollar amount that you pay for covered days spent in the hospital. Here are the Part A coinsurance amounts for 2020: Days 1 – 60: $0. Days 61 – 90: $352. Days 90 – lifetime reserve days: $704 per day until you have used up your lifetime reserve days ...

What is the copay for Part D?

Copays in Part D are when you pay a flat fee (for example, $10) for all drugs in a certain tier. Generic drugs usually have a lower copay amount than brand-name drugs. Coinsurance in Part D means that you pay a percentage of the drug’s cost (for example, 25 percent). Catastrophic coverage in Part D for 2020 is $6,350.

How much can you pay out of pocket with Medicare?

Original Medicare – No out-of-pocket limit. Medicare Advantage – No Medicare Advantage plan can have a maximum out-of-pocket limit higher than $6,700, but many plans charge the full $6,700 amount. Medigap – Some Medigap plans pay the Part A deductible and coinsurance so that your out-of-pocket costs don’t get too high.

What is the maximum out of pocket limit for healthcare?

The maximum out-of-pocket limit (MOOP) is the dollar amount beyond which your plan will pay for 100 percent of your healthcare costs. Copays and coinsurance payments go toward this limit, but monthly premiums do not. The 2020 maximum out-of-pocket limits are:

How much is catastrophic coverage for 2020?

Catastrophic coverage in Part D for 2020 is $6,350. Once you pay this amount out of pocket, you will pay the copay on your prescription drugs, or 5 percent coinsurance, whichever is greater. Read your benefits summary carefully to see how your plan handles copays, coinsurance, and deductibles so you won’t be hit with any surprises.

How much is Medicare Part B deductible?

A deductible is the money you will pay before your benefits kick in. For 2020, the Medicare Part B deductible is $198. This amount will be paid only once per year.

What is the difference between deductible and coinsurance?

Understanding the difference between deductible and coinsurance is a critical part of knowing what you’ll owe when you use your health insurance. Deductible and coinsurance are types of health insurance cost-sharing; you pay part of the cost of your health care, and your health plan pays part of the cost of your care.

What is a deductible for Medicare?

A deductible is a fixed amount you pay each year before your health insurance kicks in fully (in the case of Medicare Part A —for inpatient care—the deductible applies to " benefit periods " rather than the year). Once you’ve paid your deductible, your health plan begins to pick up its share of your healthcare bills.

How do you know if you have a coinsurance plan?

You know when you enroll in a health plan exactly how much your deductible will be. Although you’ll know what your coinsurance percentage rate is when you enroll in a health plan, you won’t know how much money you actually owe for any particular service until you get that service and the bill.

How much coinsurance do you have to pay for a prescription?

Let’s say you’re required to pay 30% coinsurance for prescription medications. You fill a prescription for a drug that costs $100 (after your insurer's negotiated with the pharmacy is applied). You pay $30 of that bill; your health insurance pays $70. Since coinsurance is a percentage of the cost of your care, if your care is really expensive, ...

What is coinsurance in healthcare?

Coinsurance is another type of cost-sharing where you pay for part of the cost of your care, and your health insurance pays for part of the cost of your care. But with coinsurance, you pay a percentage of the bill, rather than a set amount. 2 Here’s how it works. Let’s say you’re required to pay 30% coinsurance for prescription medications.

Is coinsurance fixed or variable?

The deductible is fixed, but coinsurance is variable. Your deductible is a fixed amount, but your coinsurance is a variable amount. If you have a $1,000 deductible, it’s still $1,000 no matter how big the bill is. You know when you enroll in a health plan exactly how much your deductible will be. Although you’ll know what your coinsurance ...

Do you have to pay coinsurance for deductible?

You may still have to pay other types of cost-sharing like copayments or coinsurance, but your deductible is done for the year. You’ll continue to owe coinsurance each time you get healthcare services. The only time coinsurance stops is when you reach your health insurance policy’s out-of-pocket maximum.

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

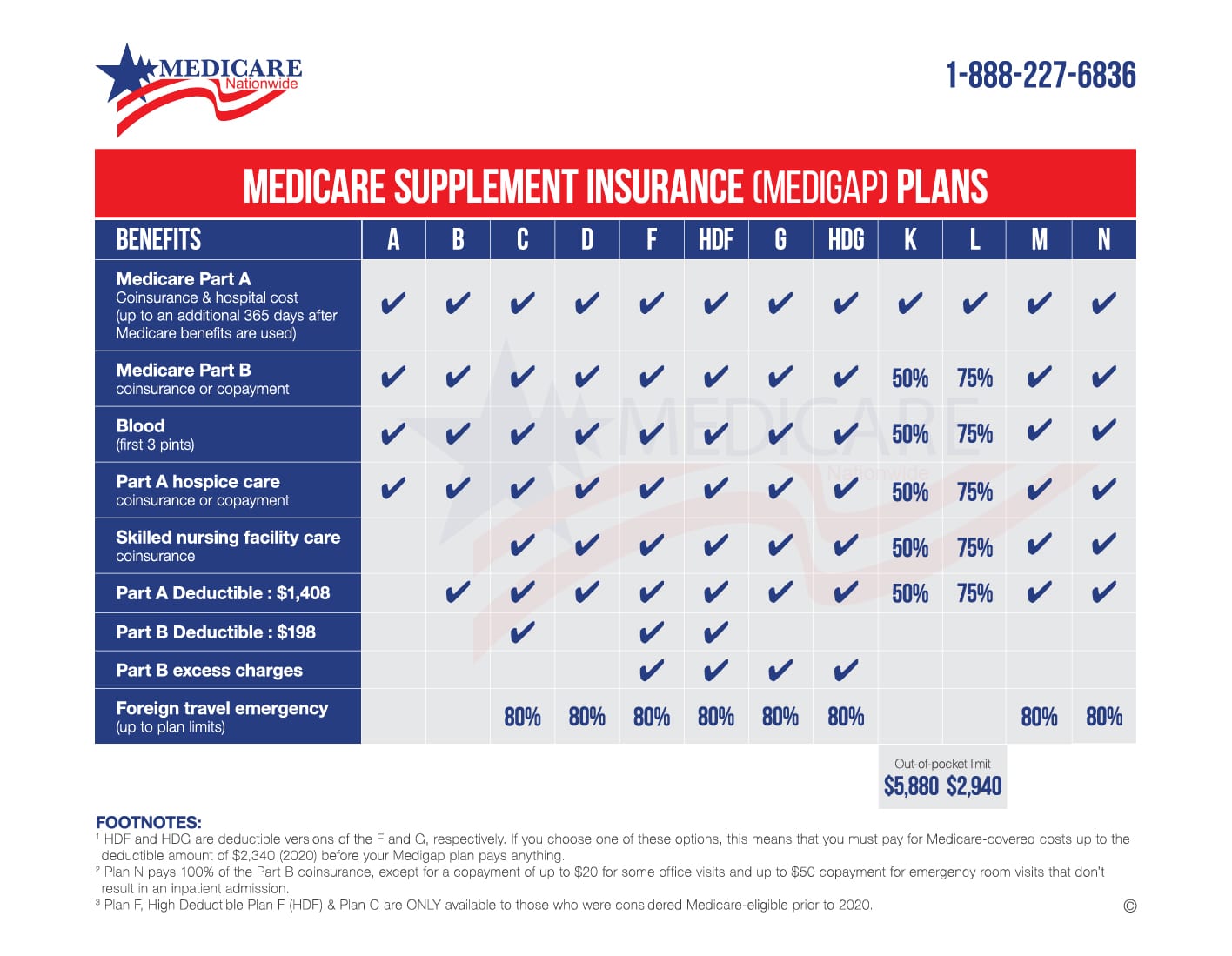

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What is the deductible for John's doctor appointment?

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth ...

What is the most important thing to know about Medicare?

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

Does Medicare Advantage include coinsurance?

Medicare Advantage plans typically include coinsurance. Many Medicare beneficiaries choose to get their benefits through a privately-sold Medicare Advantage plan (Medicare Part C), which provides the benefits of Original Medicare combined into one plan.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

What percentage of coinsurance is required?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20% ). , these amounts may vary throughout the year due to changes in the drug’s total cost. The amount you pay will also depend on the.

How much does a lower tier drug cost?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. level assigned to your drug. Once you and your plan spend $4,130 combined on drugs (including deductible), you’ll pay no more than 25% of the cost for prescription drugs until your out-of-pocket spending is $6,550, under the standard drug benefit.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is the deductible for Part D in 2021?

Part D. Deductibles vary according to plan. However, Part D deductibles are not allowed to exceed $455 in 2021, and many Part D plans do not have a deductible at all. The average Part D deductible in 2021 is $342.97. 1.

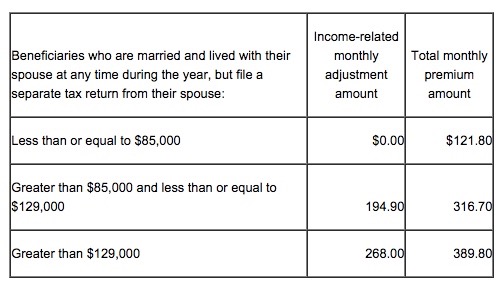

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

How much is a copayment for a mental health facility?

For an extended stay in a hospital or mental health facility, a copayment of $371 per day is required for days 61-90 of your stay, and $742 per “lifetime reserve day” thereafter.