Full Answer

Do I qualify for assistance in paying Medicare premiums?

If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage.

How does Medicare determine your income?

How Does Medicare Determine Your Income? Original Medicare is two-fold, comprised of Part A (hospital insurance) and Part B (medical insurance). They differ not only in the Medicare benefits covered but also in how the premiums are determined.

How much will I Owe for Medicare Part D?

Most people will pay the standard amount for their Medicare Part B premium. However, you’ll owe an IRMAA if you make more than $88,000 in a given year. For Part D, you’ll pay the premium for the plan you select.

How do I get help paying for Medicare Part D?

If you need help with Medicare Part D including finding a plan, applying, paying for coverage, or if you have a complaint, visit Medicare’s resources section. If you need more assistance paying for your prescriptions under Medicare Part D, you may qualify for the Extra Help program.

What counts as income for Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How is income measured for Medicare?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the threshold for Medicare?

Monthly Medicare Premiums for 2022Modified Adjusted Gross Income (MAGI)Part B monthly premium amountIndividuals with a MAGI above $170,000 and less than $500,000 Married couples with a MAGI above $340,000 and less than $750,000Standard premium + $374.205 more rows

Does Medicare check income?

We use your modified adjusted gross income (MAGI) from your federal income tax return to determine your income-related monthly adjustment amounts. Your MAGI is the total of your adjusted gross income and tax-exempt interest income.

How do you calculate modified adjusted gross income for Medicare?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What happens when you reach your Medicare threshold?

When you spend certain amounts in gap and out of pocket costs, you'll reach the thresholds. Once you've reached the thresholds, you'll start getting higher Medicare benefits. This means you'll get more money back from us for certain Medicare services. Only verified payments count towards the threshold.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

What is the Medicare safety net threshold for 2020?

Medicare Safety Net Thresholds from 1 January 2020Safety NetConcessional individuals and families*All other individuals and familiesOriginal Medicare Safety Net$477.90$477.90Extended Medicare safety Net$692.20$2,169.20Apr 2, 2020

What is your modified adjusted gross income?

Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items — like exempt or excluded income and certain deductions. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans. MAGI can vary depending on the tax benefit.

How do I calculate my modified adjusted gross income?

To calculate your MAGI:Add up your gross income from all sources.Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ... The resulting number is your AGI.More items...

What happens if I overpaid my Medicare premium?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

Do Medicare premiums change each year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

Is Medicare based on assets?

Older People with Low Incomes Generally Have Few Assets In determining eligibility for Medicaid and the Medicare Savings Programs, countable assets include items such as money in checking or savings ac- counts, bonds, stocks, or mutual funds.

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $222,000 but less than or equal to $276,000$297.00More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.9012 more rows•Dec 6, 2021

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

Update your application online

Get screen-by-screen uploading directions, with pictures (PDF, 398 KB), or follow these steps:

Update your application by phone

Contact the Marketplace Call Center and a representative can help you update your application.

Update your application with in-person help

Find someone in your community who can work with you to help make changes to your application.

More Answers: How to make updates when your income or household changes

Do I need to report changes if I’m getting coverage elsewhere, like if I’m now eligible for Medicare or got an offer of job-based insurance?

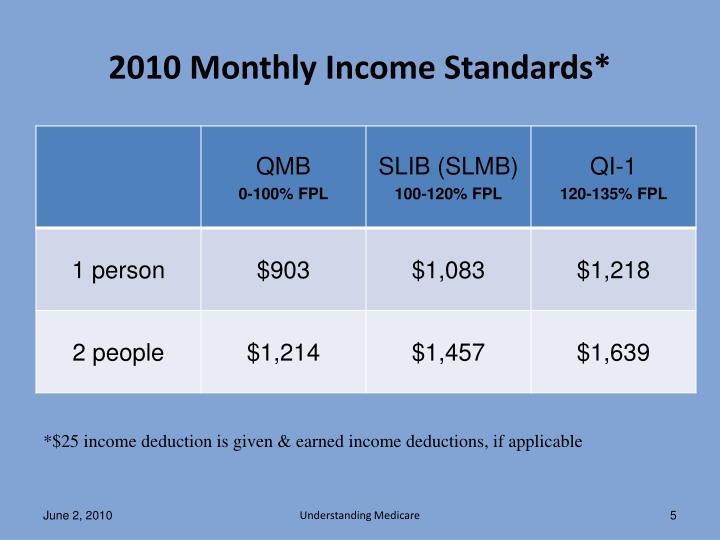

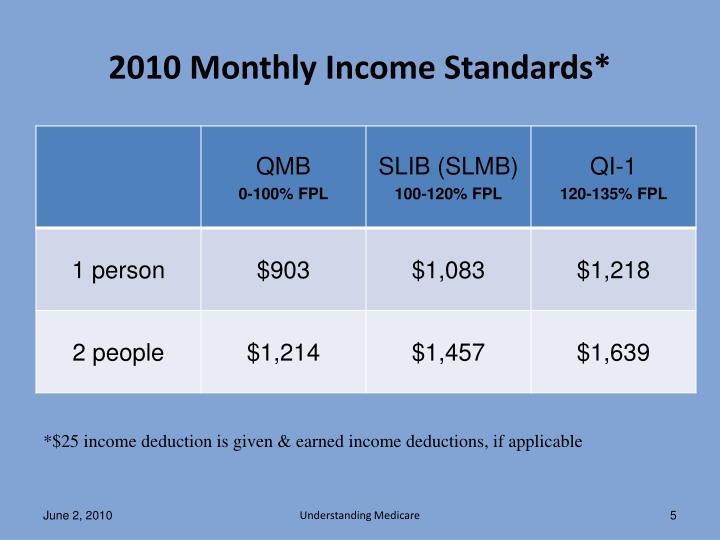

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

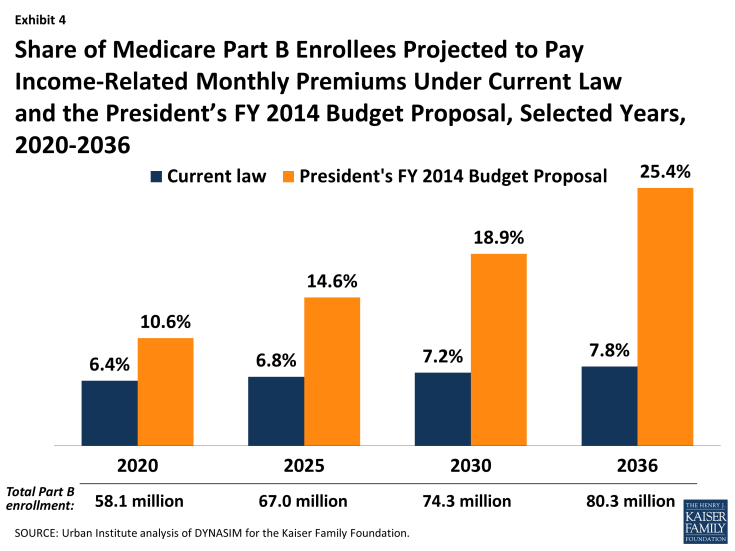

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What is a POR in Medicare?

A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities.

What is a RAR letter for MSP?

After the MSP occurrence is posted, the BCRC will send you the Rights and Responsibilities (RAR) letter. The RAR letter explains what information is needed from you and what information you can expect from the BCRC. A copy of the Rights and Responsibilities Letter can be found in the Downloads section at the bottom of this page. Please note: If Medicare is pursuing recovery directly from the insurer/workers’ compensation entity, you and your attorney or other representative will receive recovery correspondence sent to the insurer/workers’ compensation entity. For more information on insurer/workers’ compensation entity recovery, click the Insurer Non-Group Health Plan Recovery link.

What is conditional payment in Medicare?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

Why is Medicare conditional?

Medicare makes this conditional payment so you will not have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare when a settlement, judgment, award, or other payment is made.

How long does interest accrue on a recovery letter?

Interest accrues from the date of the demand letter and, if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter, is assessed for each 30 day period the debt remains unresolved. Payment is applied to interest first and principal second. Interest continues to accrue on the outstanding principal portion of the debt. If you request an appeal or a waiver, interest will continue to accrue. You may choose to pay the demand amount in order to avoid the accrual and assessment of interest. If the waiver/appeal is granted, you will receive a refund.

Can you get Medicare demand amount prior to settlement?

Also, if you are settling a liability case, you may be eligible to obtain Medicare’s demand amount prior to settlement or you may be eligible to pay Medicare a flat percentage of the total settlement. Please see the Demand Calculation Options page to determine if your case meets the required guidelines. 7.

Who must report a claim to Medicare?

Reporting a Case. Medicare beneficiaries, through their attorney or otherwise, must notify Medicare when a claim is made against an alleged tortfeasor with liability insurance (including self-insurance), no-fault insurance or against Workers’ Compensation (WC). This obligation is fulfilled by reporting the case in the Medicare Secondary Payor ...

When does Medicare focus on the date of last exposure?

When a case involves continued exposure to an environmental hazard, or continued ingestion of a particular substance, Medicare focuses on the date of last exposure or ingestion to determine whether the exposure or ingestion occurred on or after 12/5/1980.

What is a rights and responsibilities letter?

The Rights and Responsibilities letter is mailed to all parties associated with the case. The Rights and Responsibilities letter explains: What happens when the beneficiary has Medicare and files an insurance or workers’ compensation claim; What information is needed from the beneficiary;

Does Medicare cover non-ruptured implants?

For non-ruptured implanted medical devices, Medicare focuses on the date the implant was removed. (Note: The term “exposure” refers to the claimant’s actual physical exposure to the alleged environmental toxin, not the defendant’s legal exposure to liability.)

Does Medicare cover MSP?

Medicare has consistently applied the Medicare Secondary Payer (MSP) provision for liability insurance (including self-insurance) effective 12/5/1980. As a matter of policy, Medicare does not claim a MSP liability insurance based recovery claim against settlements, judgments, awards, or other payments, where the date of incident (DOI) ...

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.