How can I see basic costs for people with Medicare?

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder. For specific cost information (like whether you've met your Deductible, how much you'll pay for an item or service you got, or the status of a Claim ), log into your secure Medicare account.

What is a Medicare payment amount?

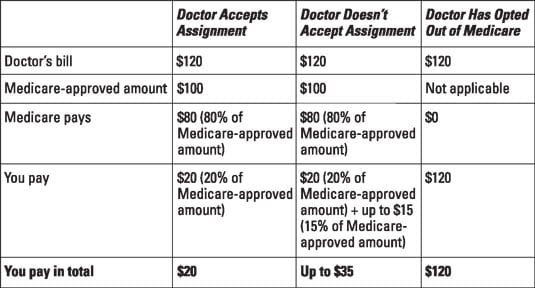

In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

How does Medicare determine reimbursement rates?

How Does Medicare Determine Reimbursement Rates? The reimbursement rates are the monetary amounts that Medicare pays to health care providers, hospitals, laboratories, and medical equipment companies for performing certain services and providing medical supplies for individuals enrolled in Medicare insurance.

How are Medicare and Social Security premiums determined?

In reality, there are variations in the premiums people pay, if they pay any at all. The formula for determining a person’s qualification for Social Security and Medicare is the same. It is based on income earned and taxes paid for the duration of working life.

Does Medicare pay doctors less?

Fee reductions by specialty Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

How does Medicare determine allowed amount?

The GPCIs are applied in the calculation of a fee schedule payment amount by multiplying the RVU for each component times the GPCI for that component. The Medicare limiting charge is set by law at 115 percent of the payment amount for the service furnished by the nonparticipating physician.

Who determines Medicare reimbursement?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

How is the allowed amount determined?

If you used a provider that's in-network with your health plan, the allowed amount is the discounted price your managed care health plan negotiated in advance for that service. Usually, an in-network provider will bill more than the allowed amount, but he or she will only get paid the allowed amount.

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentUnder Part B, after the annual deductible has been met, Medicare pays 80 percent of the allowed amount for covered services and supplies; the remaining 20 percent is the coinsurance payable by the enrollee.

What is Medicare reimbursement based on?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

Do Medicare reimbursement rates vary by state?

Over the years, program data have indicated that although Medicare has uniform premiums and deductibles, benefits paid out vary significantly by State of residence of the beneficiary. These variations are due in part to the fact that reimbursements are based on local physicians' prices.

How does Medicare decide what to cover?

Local coverage decisions made by local companies in each state that process claims for Medicare. These companies decide whether an item or service is medically necessary and should be covered in that area under Medicare's rules. There may be other coverage rules and policies that also apply.

Why do doctors not want Medicare patients?

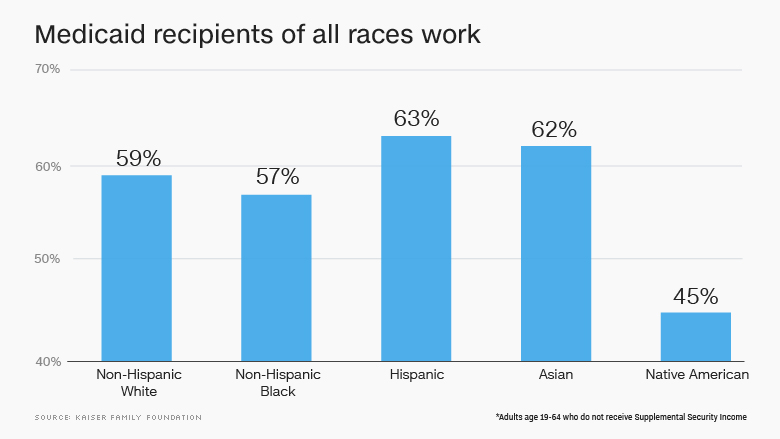

Medicaid has long paid less than Medicare, making it even less attractive. If doctors accept patients in these programs, there's no negotiation over rates. The government dictates prices on a take-it-or-leave-it basis.

Why would Medicare pay more than the approved amount?

If you use a nonparticipating provider, they can charge you the difference between their normal service charges and the Medicare-approved amount. This cost is called an “excess charge” and can only be up to an additional 15 percent of the Medicare-approved amount.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

How Much Are Medicare Premiums in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

Is Medicare premium based on income?

Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare. However, about 7% of Medicare beneficiaries pay higher-than-standard premiums based on the income shown in their tax returns from two years ago. If your 2021 Medicare premiums include a high-income surcharge, it’s calculated based on your 2019 tax returns.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What is periodic payment?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

Why is it difficult to know the exact cost of a procedure?

For surgeries or procedures, it may be dicult to know the exact costs in advance because no one knows exactly the amount or type of services you’ll need. For example, if you experience complications during surgery, your costs could be higher.

Does Medicare cover wheelchairs?

If you’re enrolled in Original Medicare, it’s not always easy to find out if Medicare will cover a service or supply that you need. Generally, Medicare covers services (like lab tests, surgeries, and doctor visits) and supplies (like wheelchairs and walkers) that Medicare considers “medically necessary” to treat a disease or condition.

How many doctors did Medicare pay in 2012?

CMS on Wednesday publicly released Medicare physician payment data for the first time since 1979, showing how the program paid out $77 billion to more than 880,000 health care providers in 2012.

How much did a physician get paid in 2012?

Some individual physicians received particularly high sums. For example, 100 physicians in 2012 accounted for $610 million in reimbursements, including an ophthalmologist who was paid $21 million under the program and several dozen eye and cancer specialists who each received more than $4 million.

How much did Medicare pay for outpatient visits in 2012?

Altogether, the released data show that Medicare paid $12 billion for about 214 million office and outpatient visits in 2012. Most providers received relatively modest Medicare payouts, according to the Los Angeles Times. However, about 2% of physicians and other individual providers accounted for almost one-quarter of the $77 billion total.

Does CMS release information on providers with fewer than 11 patients?

The amount providers were paid for the services. The data do not include any patient information. Further, CMS will not release any information on providers with fewer than 11 patients who are Medicare beneficiaries.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

How much did doctors make in 2012?

The trove of billing records shows that thousands of physicians made more than $1 million each from Medicare in 2012. Dozens billed for more than $10 million. Billing for a large amount is not necessarily a sign of wrongdoing. Doctors may be unusually efficient, may perform procedures that require high overhead, ...

Can doctors perform high overhead?

Doctors may be unusually efficient, may perform procedures that require high overhead, or may treat an especially large number of Medicare patients. Government inspectors, however, have recommended greater scrutiny for high billers.

How many pages are there in the Medicare 2019 rule?

The proposed 1,473 page rule from the Centers for Medicare and Medicaid Services (you can read it here ), addresses two broad issues: 2019 payment rates for Medicare providers and more fundamental changes in the way the Trump Administration wants to compensate doctors, hospitals, and nursing homes.

Can small physician practices opt out of Medicare?

But small physician practices and even larger groups with few Medicare patients may opt out of the new payment system. CMS is also said it wants to experiment with excluding physicians in Medicare Advantage managed care plans from MIPs participation.