Medicare Part B Premiums

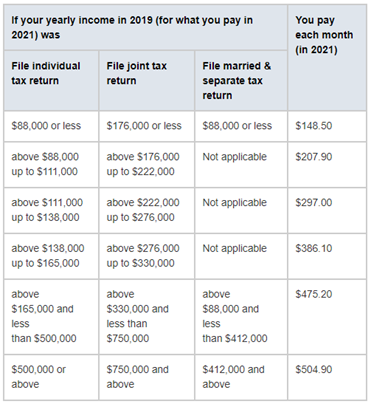

| 2019 Income Individual Filing | 2019 Income Joint Filing | 2019 Income Married Filing Separately | 2021 Premium |

| Less than $88,000 | Less than $176,000 | Less than $88,000 | $148.50 |

| >$88,000 to $111,000 | >$176,000 to $222,000 | N/A | $207.90 |

| >$111,000 to $138,000 | >$222,000 to $276,000 | N/A | $297.00 |

| >$138,000 to $165,000 | >$276,000 to $330,000 | N/A | $386.10 |

Full Answer

Who pays for Medicare Part B premiums?

Your Part B premium amount will be deducted from your monthly Social Security, Railroad Retirement Board or Civil Service benefit payment if you receive one of these. If you don’t receive any of these benefits, you’ll need to pay for Part B directly. In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill.

How are Medicare Part B premiums calculated?

More: Ask Rusty – Does Paying SS Tax Now Increase My Benefit? Although you must pay Medicare Part A and Part B premiums to the federal government to obtain a Medicare Advantage plan, all your ...

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

Are Medicare Part B premiums based on adjusted gross income?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How is Medicare B determined?

Most of Medicare Part B – about 7% – is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income.

How does Medicare determine monthly premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What income is used for Medicare Part B premiums?

modified adjusted gross incomeThe adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Are Medicare Part B premiums recalculated each year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Does everyone pay the same for Medicare Part B?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What is Medicare Part B?

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, you’ll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How many people will pay Medicare premiums in 2029?

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

How much will Medicare cost in 2021?

The official estimate from the Medicare Trustees report is that the lowest possible monthly premium for Medicare Part B—$148.50 in 2021—could rise to more than $230 per person in 2029. If your income falls into a higher IRMAA tier, Medicare estimates your monthly premium in 2029 could cost you an additional $90 to $500.

What is the Medicare premium for 2021?

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

What line is Medicare Part B based on?

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

What happens when you enroll in Medicare Part B?

When you enroll in Medicare Part B, the federal government picks up the tab for most of your health care costs. Most, but not all.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

How Much Are Medicare Premiums in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

What is the hold harmless rule for Medicare?

The Hold Harmless Rule is a stipulation to COLA that states Medicare Part B premiums cannot rise faster than what Social Security pays out.

How is COLA calculated?

COLA is calculated each year through the Consumer Price Index for Urban Wage Earners. This adjustment helps to steady cash flow for retired seniors by counteracting the effects of inflation.

Does Medicare Part A and Part B cover the same people?

Medicare Part A and Part B provide the exact same benefits for all Medicare beneficiaries throughout the country no matter their age or location. Why is it, then, that premiums for that coverage can vary greatly?

Does Social Security decrease if Medicare premiums rise?

This ensures that Social Security payments do not decrease if Medicare Part B premiums rise. “The Hold Harmless Rule is calculated based on the change in net benefits payments (Social Security benefits minus Medicare premiums).” For those who are Medicaid beneficiaries, delay Social Security, or are subject to higher premiums through the IRMAA, the rule does not apply.

Does Medicare require higher premiums?

While Medicare asks for higher premiums from higher-earning individuals, it also helps to protect those who depend upon Social Security for their main source of income via the Hold Harmless Rule.

Is Medicare premium based on 2014 tax return?

For example, the Medicare IRMAA premiums for 2016 were based on the beneficiary’s tax return filed for the 2014 tax year. That said, Medicare reports that fewer than 5% of all beneficiaries fall into this income threshold and shoulder the cost-sharing structure. [3]

Does Medicare give a beneficiary with a higher income the surcharge?

As is with most Medicare topics, there are specific situations in which Medicare won’t give a beneficiary with a higher income the surcharge. This chart shows the MAGI breakdown and what premiums will cost that beneficiary for 2017. If you have any questions, contact Social Security.

How Did Medicare Supplement Insurance Change In 2022

Medicare Supplement Insurance, or Medigap, helps pay for certain Part A and Part B out-of-pocket expenses, such as deductibles, coinsurance and copayment.

How Much Are Medicare Premiums In 2021

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket even by just $1 you are moved to the next tier and will have to pay the higher premium.

Understanding Medicare Part B Premiums

Medicare is a U.S. federal health program that is divided into two main parts, A and B. Part A covers a large portion of hospital-related costs for eligible people age 65 and over and only includes medically necessary and skilled care, not custodial care. It can include hospital stays, hospice, and skilled nursing facilities.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a persons modified adjusted gross income . For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds earnings.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

How Much Are Part B Irmaa Premiums

If an individual makes $88,000 or more or a jointly filing household makes $176,000 or more then the IRMAA assessment increases the 2021 Part B premium to the amounts shows in Table 1.

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

Does Medicare Part B premium change?

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.