Monthly Medicare Premiums for 2022

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount | Prescription drug coverage monthly premi ... |

| Individuals with a MAGI of less than or ... | 2022 standard premium = $170.10 | Your plan premium |

| Individuals with a MAGI above $91,000 up ... | Standard premium + $68.00 | Your plan premium + $12.40 |

| Individuals with a MAGI above $114,000 u ... | Standard premium + $170.10 | Your plan premium + $32.10 |

| Individuals with a MAGI above $142,000 u ... | Standard premium + $272.20 | Your plan premium + $51.70 |

How to calculate Medicare premiums?

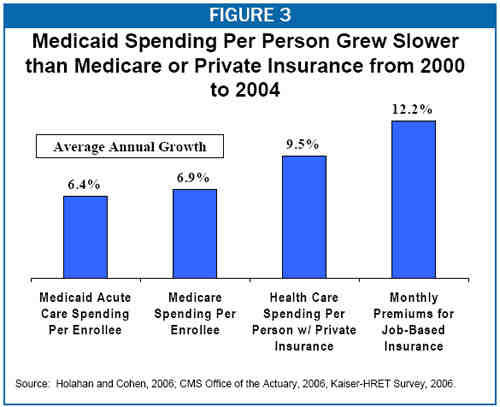

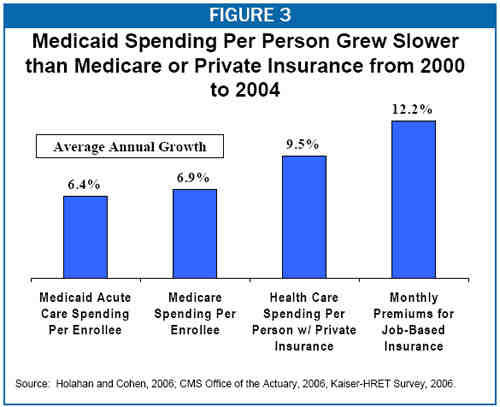

Dec 21, 2021 · There are six income tiers for Medicare premiums in 2022. As stated earlier, the standard Part B premium amount that most people are expected to pay is $170.10 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium. Here’s a table with the 2022 numbers.

How does Medicare calculate my premium?

Jan 22, 2020 · $252 per month for those who paid Medicare taxes for 30-39 quarters. Medicare Part B premium While zero-premium liability is typical for Part A, the standard for Medicare Part B is a premium that changes annually, determined by modified adjusted gross income and tax filing status. For 2020, the standard monthly rate is $144.60.

How to calculate your Medicare Part B premium?

If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance

How are Medicare premiums calculated?

Dec 11, 2018 · It could be the difference of hundreds of dollars a month. The cost of Medicare B and D (prescription drug coverage) premiums are based on your modified adjusted gross income (MAGI). If your MAGI is above $87,000 ($174,000 if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA).

At what income level do my Medicare premiums increase?

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI above $91,000 up to $114,000 Married couples with a MAGI above $182,000 up to $228,000 | Standard premium + $68.00 | Your plan premium + $12.40 |

What triggers higher Medicare premiums?

Do people pay different amounts for Medicare?

Monthly premiums vary based on which plan you join. The amount can change each year. You must keep paying your Part B premium to stay in your plan. Deductibles, coinsurance, and copayments vary based on which plan you join.

Are Medicare premiums the same for everyone?

Why is my Medicare Part B premium so high?

Are Medicare premiums recalculated every year?

Does Social Security count as income for Medicare premiums?

How much is deducted from Social Security for Medicare?

How is modified adjusted gross income for Medicare premiums calculated?

Do 401k withdrawals count as income for Medicare?

Does everyone pay the same for Medicare Part B?

How do I get my $144 back from Medicare?

How much is Medicare premium for 2020?

For those who do not meet the criteria and have to pay a premium, the rates for 2020 is as follows: $458 per month for those who paid Medicare taxes for less than 30 quarters. $252 per month for those who paid Medicare taxes for 30-39 quarters.

Is Social Security the same as Medicare?

The formula for determining a person’s qualification for Social Security and Medicare is the same . It is based on income earned and taxes paid for the duration of working life. The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

How many years do you have to work to qualify for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare. The Social Security statement available to registered users on ssa.gov reveals if you have earned enough credits to qualify for Medicare when you reach age of 65.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the Medicare premium for 2020?

Medicare Premium Rates. Most beneficiaries enrolled in Part B in 2020 will have a premium of $144.60/month. Medicare Part B premiums are calculated as a share of Part B program costs.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare coverage is broken down into different parts.

How much is Medicare Part B 2020?

Most beneficiaries enrolled in Part B in 2020 will have a premium of $144.60/month. Medicare Part B premiums are calculated as a share of Part B program costs.

Does Medicare cover hospice?

Medicare Part A is free to most beneficiaries and covers hospital stays, care in a skilled nursing facility, hospice care, and some health care. However, premiums for Part B and Part D depend on a beneficiary’s income. In other words, beneficiaries with higher incomes pay higher premiums.

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

What happens if you don't sign up for Medicare Part B?

Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how long you went without this Medicare coverage.

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What happens if you don't enroll in Part A?

If you aren’t eligible for premium-free Part A don’t enroll in Part A when you’re first eligible but decide to enroll later, your Part A late enrollment penalty will be calculated based on how long you went without Part A coverage.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.