Full Answer

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How to calculate your Medicare Part B premium?

The standard monthly premium for Part B is $148.50 for 2021. The total Medicare cost is what you get out of Medicare. Simply add up the Original Medicare (Part A and B) costs and the other benefits you get.

How does Medicare calculate my premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How are Medicare premiums calculated?

When parents fail to pay their Medicare premiums, everyone suffers. The sandwich generation, those who are parents and also have aging parents, face many responsibilities. One of the most important may be checking that their parents are paying Medicare premiums. Here are two examples that demonstrate what can go wrong.

Why is my Medicare Part B bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Are Medicare Part B premiums the same for everyone?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

Does Medicare Part B depend on income?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI.

Is Medicare Part B based on gross or net income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the cost of Medicare Part B in 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

Are Medicare premiums based on total income or adjusted gross income?

The cost of Medicare B and D (prescription drug coverage) premiums are based on your modified adjusted gross income (MAGI). If your MAGI is above $87,000 ($174,000 if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA).

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

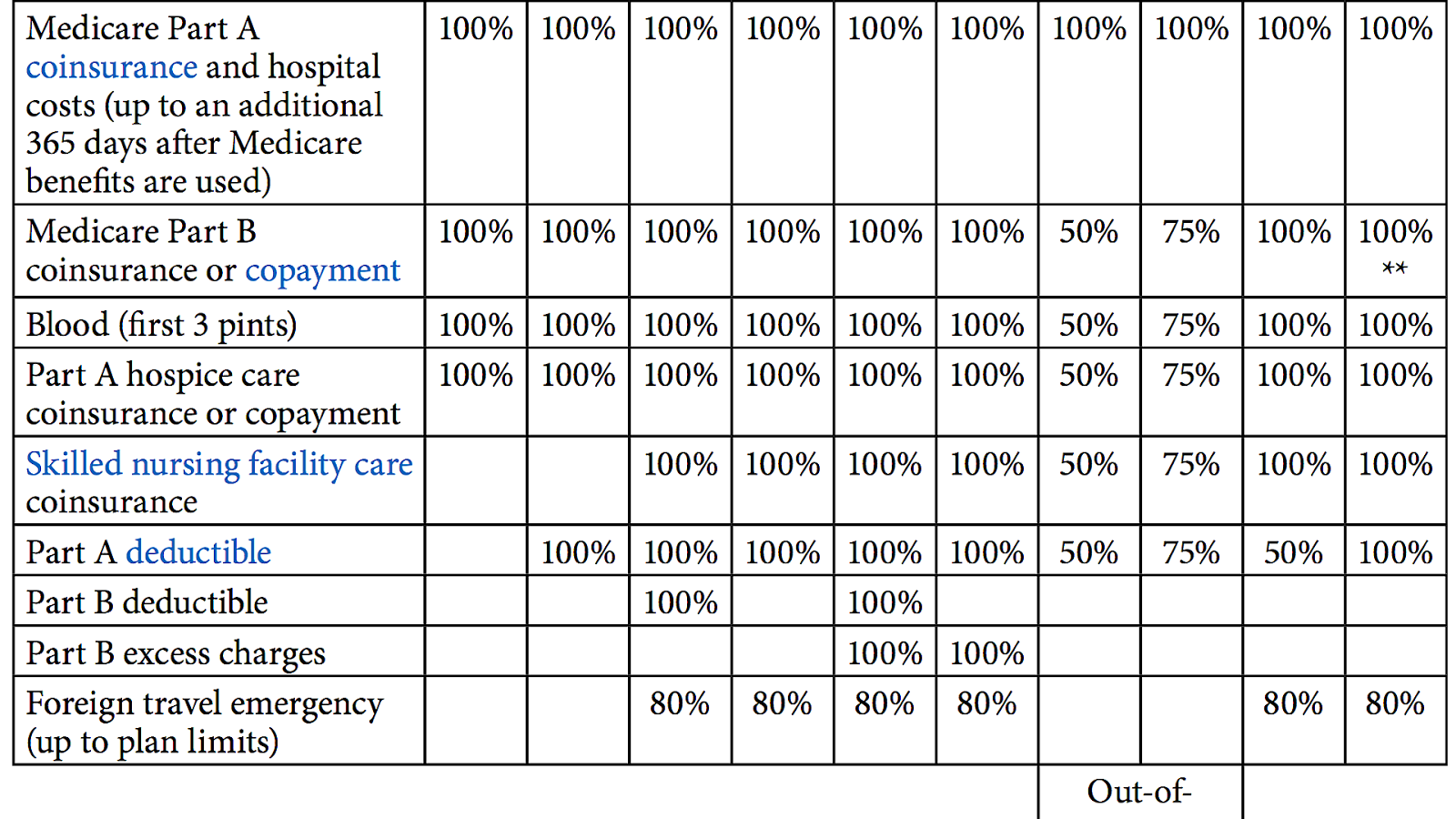

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

Does Medicare cover wheelchairs?

Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health. Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost. Part B can also cover wheelchairs and other medically necessary equipment.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

What is the penalty for not enrolling in Part A?

The Part A late enrollment penalty is 10 percent ...

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Do high income people pay higher Medicare premiums?

Learn about other Medicare costs and how they are calculated. If you are a high-income earner, you could potentially pay higher premiums for Medicare Part B (medical insurance) and Medicare prescription drug coverage.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much do you pay a month if you are married in 2020?

between $87,000 and $413,000, you pay $462.70 a month in 2020. more than $413,000, you pay $491.60 a month in 2020.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

Does Medicare go up in 2020?

2020’s changes to the Medicare Part B premium may also be dependent on the recipient’s tax filing status for 2018.

Can Medicare be combined with Medicaid?

Medicare benefits can be combined with Medicaid for certain low-income recipients, which also includes covering cost-sharing obligations like the deductible. Medicare Advantage plans can also offer lower deductibles as part of the benefits paid by the monthly premium they charge on top of the requisite Part B premium.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.