How much of the federal budget is spent on Medicare?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1). In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts).

What changes did Congress make to Medicare Advantage plans?

Congress also made numerous and potentially far-reaching changes to the rules for Medicare Advantage plans. That includes allowing such plans to pay for limited long-term care expenses – something that until now has not been covered by Medicare.

How much do members of Congress pay for Obamacare?

Instead, they choose a gold-level Obamacare policy and receive federal subsidies that cover 72 percent of the cost of the premiums. In short, Snopes reports that members of Congress and staff "pay approximately 28 percent of their annual healthcare premiums through pre-tax payroll deductions.".

How is Medicare funded by the government?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7). Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue).

How much money does the government contribute to Medicare?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending.

What did the Medicare Act do?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.

What benefits did Medicare provide in 1965?

On July 30, 1965, President Lyndon B. Johnson signed into law the bill that led to the Medicare and Medicaid. The original Medicare program included Part A (Hospital Insurance) and Part B (Medical Insurance).

What did Medicare accomplish?

Medicare's successes over the past 35 years include doubling the number of persons age 65 or over with health insurance, increasing access to mainstream health care services, and substantially reducing the financial burdens faced by older Americans.

Was the Medicare Act successful?

As enacted, Medicare provided hospital and medical care for everyone older than 65 years. It was, and is, popular; when it went into effect in 1966, 19 million people soon signed up.

Why was Medicare created?

The Medicare program was signed into law in 1965 to provide health coverage and increased financial security for older Americans who were not well served in an insurance market characterized by employment-linked group coverage.

Which president started Social Security and Medicare?

Meeting this need of the aged was given top priority by President Lyndon B. Johnson's Administration, and a year and a half after he took office this objective was achieved when a new program, "Medicare," was established by the 1965 amendments to the social security program.

Which president signed Medicare into law?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law. His gesture drew attention to the 20 years it had taken Congress to enact government health insurance for senior citizens after Harry Truman had proposed it.

Is Medicare under Social Security?

If you're on SSDI benefits, you won't have to pay a Medicare Part A premium. If you are eligible for Medi-Cal and Medicare, you will automatically be enrolled in Medicare Part D.

How did Medicare impact the United States?

Medicare and Medicaid have greatly reduced the number of uninsured Americans and have become the standard bearers for quality and innovation in American health care. Fifty years later, no other program has changed the lives of Americans more than Medicare and Medicaid.

Why was Medicare so important?

#Medicare plays a key role in providing health and financial security to 60 million older people and younger people with disabilities. It covers many basic health services, including hospital stays, physician services, and prescription drugs.

What has Medicaid accomplished?

Evidence shows that Medicaid expansion saves lives. According to a 2019 study, Medicaid expansion was associated with 19,200 fewer deaths among older low-income adults from 2013 to 2017; 15,600 preventable deaths occurred in states that did not expand Medicaid.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

How much of Obamacare premiums are paid by Congress?

In short, Snopes reports that members of Congress and staff “pay approximately 28 percent of their annual healthcare premiums through pre-tax payroll deductions.”.

How much does a 21 year old make on Obamacare?

That’s a pretty good deal, especially given that the average 21-year-old making $25,000 a year would be charged $282 per month for a silver Obamacare plan, and pay about half of that, or $142, thanks to subsidies, according to the Kaiser Family Foundation.

Do congressional members get free health care?

As the myth busting website Snopes points out, “contrary to popular belief, Congressional members do not receive free health care.”. Instead, they choose a gold-level Obamacare policy and receive federal subsidies that cover 72 percent of the cost of the premiums.

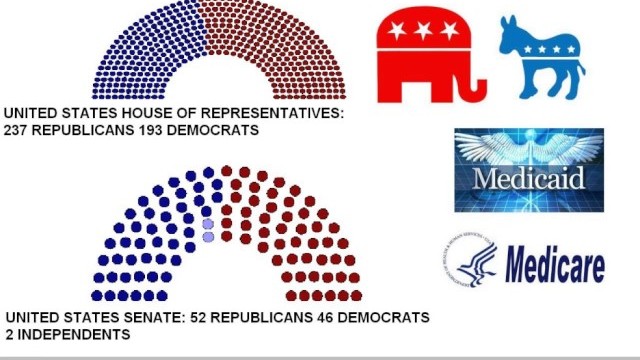

Roll-call votes on significant Medicare legislation

Are individual members of Congress working to preserve Medicare as we know it, or to weaken this key component of the social safety net? We’ve selected key votes, revealed how each member of Congress voted and then told you how we think they should have voted.

House of Representatives

04/10/2014 Establishing the budget for the United States Government for fiscal year 2015 and setting forth appropriate budgetary levels for fiscal years 2016 through 2024.

United States Senate

11/25/2003 Medicare Prescription Drug, Improvement, and Modernization Act of 2003

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical and projected Medicare spending data published in the 2018 annual repor…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased ...

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…