What is the difference between a Medicare Supplement and a Medicare Advantage plan?

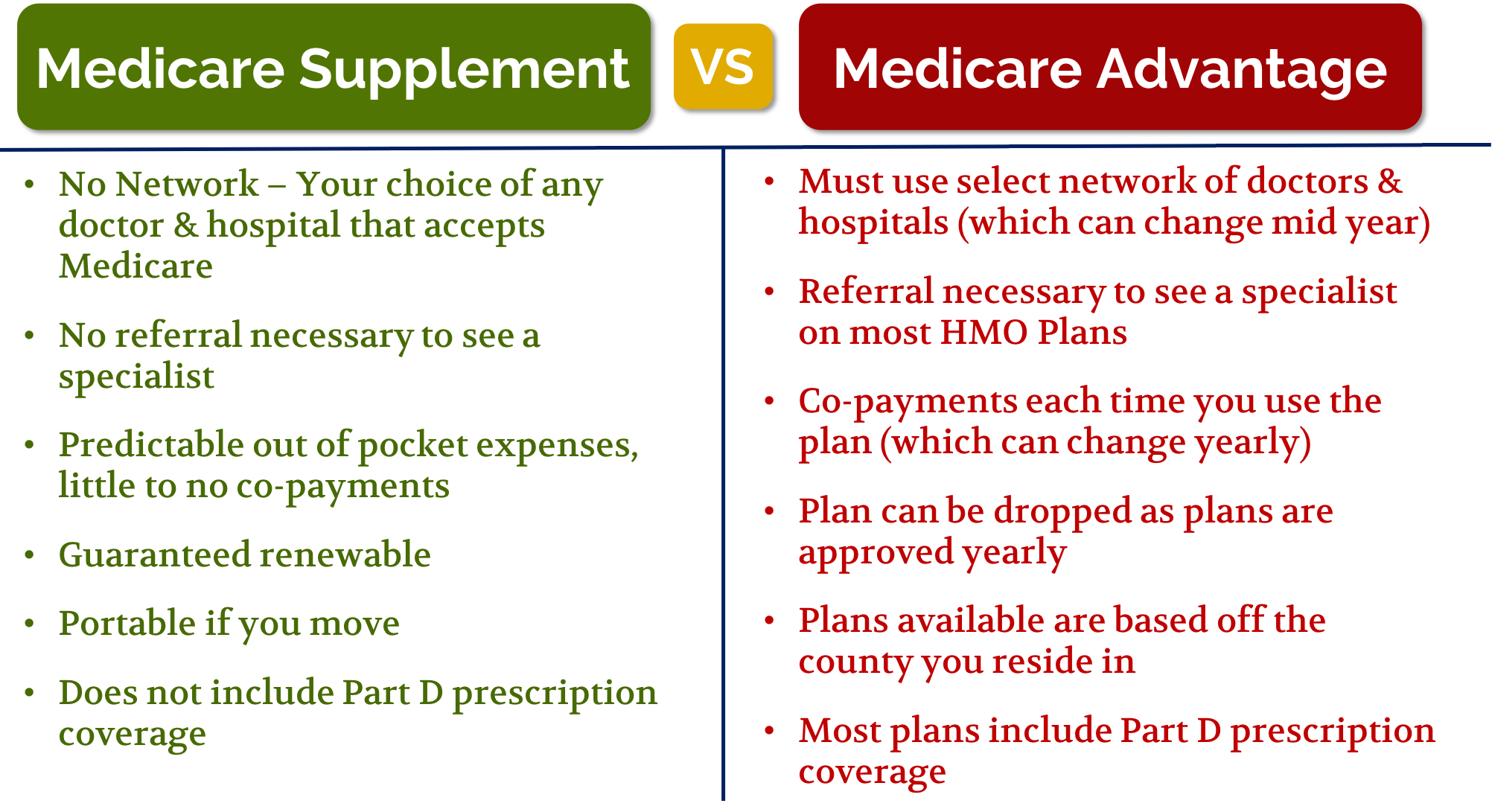

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the most popular Medicare Supplement plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Why is Medicare Advantage so cheap?

A main reason why Medicare Advantage carriers can offer low to zero-dollar monthly premium plans is because Medicare pays the private companies offering the plans to take on your health risk. But not all Medicare Advantage plans have a low premium cost.

Does Medicare cover dental?

Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the average cost of supplemental insurance for Medicare?

Medicare Supplemental Insurance (Medigap) Costs. In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Can I drop my Medicare Advantage plan and go back to original Medicare?

You can leave your Medicare Advantage plan and return to traditional Medicare Part A (hospital insurance) and Part B (medical insurance) at any time. Just give your managed care plan 30 days written notice, and they will notify Medicare.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

How to compare Medicare Advantage and Supplement?

Comparing Medicare Advantage Plans vs. Medicare Supplement Plans 1 Both types of plans are available from private insurance companies. 2 With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. 3 Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. 4 Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t. 5 You might learn some other surprising differences.

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Does Medicare Supplement cover emergency care?

Some Medicare Supplement plans may cover emergency medical care when you’re out of the country . Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t. You might learn some other surprising differences. First, let’s start with a brief description of the Medicare Advantage program ...

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

Do you have to have Medicare Part A and Part B?

When you’re enrolled in a Medicare Advantage plan , you’re still in the Medicare program. In fact, you must have Medicare Part A and Part B in order to sign up for a Medicare Advantage plan.

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

What is Medicare Advantage?

A Medicare Advantage covers all the hospital and medical services that Original Medicare covers and usually includes prescription drug benefits as well. Medicare Advantage plans also all have out-of-pocket maximums, so you may be spared from high medical bills.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

Does Medicare cover vision?

There may be some services that Original Medicare generally doesn’t cover , such as routine vision care. You may also have to pay coinsurance amounts, like 20% for most covered doctor services.

Does Medicare Supplement cover out of pocket?

Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs if you face a serious health setback.

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

What is deductible insurance?

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Why are networks important?

Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like. However, you don’t need to worry about networks in the case of an emergency.

Is Medicare Advantage cheaper than Medicare Supplement?

All in all, the pros and cons of these two options can be summarized quickly and concisely: A Medicare supplement is more costly but with better benefits (leading to less hassle and more peace of mind); while a Medicare Advantage plan is inexpensive, but with fewer benefits (often leading to unexpected costs and stress).

How much is Medicare Supplement 2020?

Medicare Supplement (Cons) Higher Premium – Medicare supplement premiums can range from around $70-270 with the average Medicare supplement premium in 2020 hanging around $134 a month for people aged 65-70. This is significantly higher than the average Medicare Advantage plan premium.

Is Medicare the primary payer?

However, Medicare is still the primary payer of your claims. On the other hand, Medicare Advantage is an alternative; it replaces original Medicare as the primary payer of your claims and is offered through subsidized private insurance companies that have contracted with Medicare.

How much does Medicare Advantage cost in 2020?

Medicare Advantage (Pros) Low to No Premium – The Average Medicare Advantage plan cost in 2020 is about $36 per month in 2020 and a few are offered at no cost! Built-in Prescription Drug Plan – Almost all Advantage plans include a drug plan, which means less hassle and no extra premium.

Does Medicare Advantage cover out of pocket expenses?

Medicare Advantage (Cons) High Out-of-Pocket Spending – Medicare Advantage may appear to cover more because they offer perks like vision, dental, and hearing (which are usually not worth covering ). They may even throw in a free gym membership. However, they usually cover less, employing more of a pay-as-you-go approach.

Who is Dan Hoelscher?

Dan is a Certified Financial Planner™ Practitioner and holds Certified Senior Advisor (CSA)© and Certified Kingdom Advisor™ certifications. Since founding Seniormark, Dan has helped thousands of retirees throughout Ohio.

What is Medigap?

The Medigap definition is easy: Medigap and Medicare Supplement are the same thing. In this article, we’ll use “Medicare Supplement” to keep things simple.

What is Medicare Part C?

Here is another easy one. Medicare Part C and Medicare Advantage are the same thing. This article will use “Medicare Advantage”. So far, so good.

What is Medicare Supplement?

Medicare Supplement is just that, a supplement to Medicare coverage. In order to use Medicare Supplement, you must have Original Medicare coverage (Medicare Parts A and B).

What plan is more affordable?

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits too —such as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

What is an Enrollment Period?

If you just became eligible for Medicare, you can enroll in a Medicare Advantage plan right away.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

What are the out-of-pocket expenses?

Depending on the plan you choose, you may receive coverage for many out-of-pocket expenses that Part A (hospital) and Part B (doctor) don’t cover, such as: 1 Deductibles 2 Coinsurance 3 Copayments (copays)

What is Medicare Advantage?

Medicare supplement plans can only be used with original Medicare. Medicare Advantage insurance combines the benefits of Medicare parts A and B. It can also provide prescription drug coverage. A person with this type of plan pays a premium, copayments, and a deductible.

What is Medicare Supplement Insurance?

Medicare supplement insurance, also called Medigap, helps fill in the gaps in original Medicare’s coverage, including some copayments, deductibles, and coinsurance. Some supplement insurance, or Medigap, policies cover added services, such as those a person receives while travelling outside the country.

What is Medicare insurance?

Medicare is a federal insurance plan. It helps cover the costs of healthcare for people who: 1 are aged 65 or older 2 are younger than 65 but receive social security benefits 3 have certain health issues, such as end stage renal disease

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What are the different types of Medicare?

Medicare has several parts, each of which covers different aspects of healthcare. Though there are exceptions and nuances, the general breakdown is as follows: 1 Part A covers hospital care. 2 Part B covers outpatient services. 3 Part C is also called Medicare Advantage. 4 Part D covers prescription drugs.

Do you have to give your Medicare number?

A person must give their Medicare number and information about when parts A and B began for them when they sign up for a Medigap policy. This information is on a person’s Medicare card. A company should never ask for financial information, including credit card or banking information, over the phone.

When does Medicare open enrollment end?

This begins 3 months before a person turns 65 and ends 3 months after their birthday. After this open enrollment period, the prices may go up.

What is Medicare Advantage?

Medicare Advantage plans combine the components of Original Medicare — Part A and Part B — into a single plan, while Medicare supplements help pay for costs that Medicare doesn’t cover. Seniors looking for lower costs or better coverage may want to explore their Medicare Advantage options.

What is Medicare Supplement?

Medicare Supplements. Medicare supplements are ideal for seniors who have Original Medicare and need help paying some of their out-of-pocket costs. Known as Medigap insurance, a Medicare supplement covers things like co-payments, coinsurance payments and deductibles.

Does Medicare Advantage have coinsurance?

Medicare Advantage plans may also have lower co-payments or coinsurance requirements than Original Medicare, which can reduce a senior’s out-of-pocket medical costs. Finally, many Medicare Advantage plans have annual out-of-pocket maximums, which limit a senior’s out-of-pocket expenses.