The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year. Beyond that, you shouldn’t need to do much of anything with the actual form. You retain the document simply as proof of coverage in case some questions arise later.

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care.

How do I report additional Medicare tax on my taxes?

Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.

What is the Medicare tax?

Medicare taxes apply to all earned income...and then some. Half the Medicare tax is paid by employees through payroll deductions and half is paid by their employers. In other words, 1.45 percent comes out of your pay and your employer then matches that, paying an additional 1.45 percent on your behalf for a total of 2.9 percent.

What should I do with my Medicare Form 1095-B?

If you receive one, it should come to you pre-filled by Medicare or your Medicare Advantage provider. The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year. Beyond that, you shouldn’t need to do much of anything with the actual form.

How does the Medicare tax work if you're self-employed?

Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, paying an additional 1.45% on your behalf, for a total of 2.9%. You'll take something of a double hit on the Medicare tax if you're self-employed.

Do you include Medicare tax on tax return?

Yes. Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040 or 1040-SR),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.

Where does Medicare go on tax return?

If you're self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden.

Do I need my 1095-B to file taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

What does my Medicare tax go to?

Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you'll get when you're a senior.

Does Social Security and Medicare count as federal tax?

The Social Security tax is a tax on earned income, and it is separate from federal income taxes. The Social Security tax only applies to earned income, like your wages, salaries and bonuses, but not to unearned income like interest, dividends or capital gains.

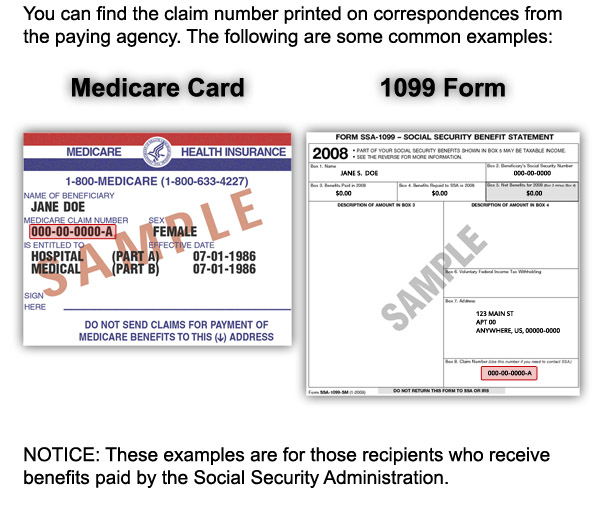

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

What happens if I don't file my 1095-B?

Good news the 1095-B does not need to be filed! You don't need your form 1095-B to file your tax return. TurboTax will ask you questions about your health coverage but your form 1095-B isn't needed. Just keep the form for your files.

How do I file a 1095-B on my tax return?

If you and your dependents had qualifying health coverage for all of 2021:Check the “Full-year coverage” box on your federal income tax form. You can find it on Form 1040 (PDF, 147 KB).If you got Form 1095-B or 1095-C, don't include it with your tax return. Save it with your other tax documents.

How does a 1095-B affect my taxes?

Form 1095-B is a tax form that reports the type of health insurance coverage you have, any dependents covered by your insurance policy, and the period of coverage for the prior year. This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage.

Why do I have to pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Can I opt out of Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

What's the purpose of the W 4 form?

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

Do you get a 1095 for Medicare?

If you were enrolled in Medicare: For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

Are Medicare premiums included in taxable income?

The IRS permits someone to deduct many medical expenses from their income tax return. This includes the premiums, coinsurance, copays, and deductibles associated with Medicare programs. A person may also deduct some healthcare expenses that Medicare does not cover.

Are Medicare Part B premiums deducted from Social Security tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction.

Is Social Security taxed before or after Medicare is deducted?

Is Social Security Taxed Before Or After the Medicare Deduction? You may not pay federal income taxes on Social Security benefits if you have low-income. But for most, your Social Security benefits are taxable. That means you'll pay taxes before Medicare premiums are deducted.

What is Medicare Advantage?

Original Medicare Part A and Medicare Advantage programs provide minimum essential coverage required by law as defined by the Affordable Care Act. The government provides a slightly different form to individuals with this coverage, which can include Medicare Part A, Medicare Advantage, Medicaid, CHIP, Tricare, and more.

What is a 1095-B form?

The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

What is a 1095A?

In short, the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The form includes basic personal information, such as your name, address, and insurance provider. It also lists anyone covered on the insurance policy, such as you, your spouse, and any children.

Does the 1095-B cover insurance?

Since the 1095-B form also covers certain employer-sponsored plans, it provides space for other people covered by the insurance plan . These extra spaces typically shouldn’t apply to you or be a source of concern.

Does Medicare provide a 1095-A?

Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

Form 8962, Premium Tax Credit

If you had Marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for.

Health coverage tax tool

You’ll need to use this tool when filing your 2020 taxes only if the information on your health care tax Form 1095-A about your “second lowest cost Silver plan” (SLCSP) is missing or incorrect. See how to find out if this applies to you.

What is a 1095-B form?

The 1095-B form provides information about your prior year health coverage. Use the information contained on the 1095-B form to determine if you and your family members had health coverage that satisfies the individual shared responsibility provision.

Who is sent a 1095-B?

The 1095-B form is sent to individuals who had health insurance coverage for themselves and/or their family members that is not reported on Form 1095-A or 1095-C. The 1095-B is sent by the Health Care Providers such as: Employers who provide health coverage known as "self-insured coverage" but are not required to send form 1095-C to the individual.

What line is shared responsibility on 1040?

This will be shown on line 61 of your 1040 Individual Tax Return Form. The individual shared responsibility does not apply for tax year 2020. You do not need to wait for Form 1095-B to file your tax return if you already know this information. Form 1095-B is not included in your tax return.

Is Form 1095-B included in my tax return?

Form 1095-B is not included in your tax return. Please keep a copy of form 1095-B with your tax records for future reference. If you have any questions about your 1095-B form, please contact the issuer of the form.

How is personal income tax determined?

Your personal income taxes are determined by your total adjusted gross income. If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.

Why is there no tax withholding on 1099?

You may be wondering why there was no tax withholding on your 1099-NEC form. That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances.

What is self employment tax?

For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income. .

What is the 1099-NEC used for?

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

When do non-employees get 1099?

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more.

Do you report 1099 income on Schedule C?

If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business. When you complete Schedule C, you report all business income and expenses.

Do employers withhold Social Security taxes?

Employers also do not withhold Social Security and Medicare taxes from non-employees. . . Because no taxes are withheld on 1099 income during the year, you may have to pay quarterly estimated taxes on this income. Failing to pay taxes during the year can result in fines and penalties for underpayment.