You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI Social Security Disability Insurance is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide income supplements to people who are physically restricted in their ability to be employed because of a notable disability. SSD can be supplied on either a temporary or permanent basis, usually directly correlated to …Social Security Disability Insurance

Full Answer

How much does health insurance cost at age 62?

With those things said, for a person at age 62 enrolling in individual health insurance you should not be surprised to see rates in the $400 to $800 per month range as just general ballpark estimates. Did you find these answers helpful? Go! Click here to cancel reply.

Should you take Social Security at age 62?

You can start taking it as early as age 62 (or earlier if you are a survivor of another Social Security claimant or on disability), wait until you've reached full retirement age or even until age 70.

How much does social security go up each year after age 62?

The actual year-over-year percentage gain for ages 62 to 70 are shown in the following table. Those gains range from 6.5 percent (claiming at 70 rather than 69) to 8.4% percent (claiming at 64 rather than 63).

Who can take Social Security before age 62?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

How do you qualify for Medicare at age 62?

You can only enroll in Medicare at age 62 if you meet one of these criteria:You have been on Social Security Disability Insurance (SSDI) for at least two years.You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease. ... You suffer from end-stage renal disease.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Can I get Medicare if I retire at 62?

What Are the Age Requirements for Medicare? Medicare is health insurance coverage for people age 65 and older. Most people will not qualify for Medicare at age 62. At age 62, you may meet the requirements for early retirement but have not met the requirements for Medicare coverage.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Can I get AARP health insurance at 62?

Full AARP membership is available to anyone age 50 and over.

What is the average Social Security benefit at age 62?

According to the SSA's 2021 Annual Statistical Supplement, the monthly benefit amount for retired workers claiming benefits at age 62 earning the average wage was $1,480 per month for the worker alone. The benefit amount for workers with spouses claiming benefits was $2,170 at age 62.

Can I draw Social Security at 62 and still work full time?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced.

Why retiring at 62 is a good idea?

Probably the biggest indicator that it's really ok to retire early is that your debts are paid off, or they're very close to it. Debt-free living, financial freedom, or whichever way you choose to refer it, means you've fulfilled all or most of your obligations, and you'll be under much less strain in the years ahead.

How do I apply for Social Security at age 62?

Call 1-800-772-1213 (TTY 1-800-325-0778) from 8:00 a.m. to 7:00 p.m., Monday through Friday, to apply by phone.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

When should you apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

How long does it take to get approved for Medicare?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

How old do you have to be to get Medicare?

Medicare eligibility at age 65. You must typically meet two requirements to receive Medicare benefits: You are at least 65 years old. You are a U.S. citizen or a legal resident for at least five years. In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security ...

How long do you have to be a resident to qualify for Medicare?

Medicare eligibility chart - by age. - Typically eligible for Medicare if you're a U.S. citizen or legal resident for at least 5 years. - If you won't be automatically enrolled when you turn 65, your Initial Enrollment Period begins 3 months before your 65th birthday.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium can be as high as $458 per month. Let’s say Gerald’s wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

What is the Social Security retirement rate at 65?

Your Social Security retirement benefits will be reduced to 93.3% if you take them at age 65. - Not typically eligible for Medicare, unless you receive SSA or RRB disability benefits or have ALS or ESRD.

Can a 65 year old spouse get Medicare?

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they haven’t yet qualified based on their own work history. For example, Gerald is 65 years old, but he doesn’t qualify for premium-free Part A because he did not work the minimum number ...

Who can help you compare Medicare Advantage plans?

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans (Medicare Part C) that are available where you live.

Can a 62 year old get Medicaid?

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

What is the earliest age to sign up for Medicare?

Under current law, absent certain exceptions, age 65 is the earliest age you can sign up for Medicare. This age has been set since the inception of Medicare in 1965. The discussion of lowering the age of initial eligibility has come up in the past, but it never had the necessary support to advance through the legislative process.

Who proposed the Medicare at 50 Act?

The most prominent proposal is the Medicare at 50 Act sponsored by Senator Sherrod Brown. Asking for the age to be lowered by 15 years may be too much of a stretch; other proposals call for a more moderate age 60 or 62 as the age of eligibility.

When will Medicare insolvency happen?

The Part A account that funds the hospitalization and related services faces insolvency by 2026. Insolvency means that Medicare wouldn’t be able to fully reimburse hospitals, nursing homes, and home health agencies for promised benefits.

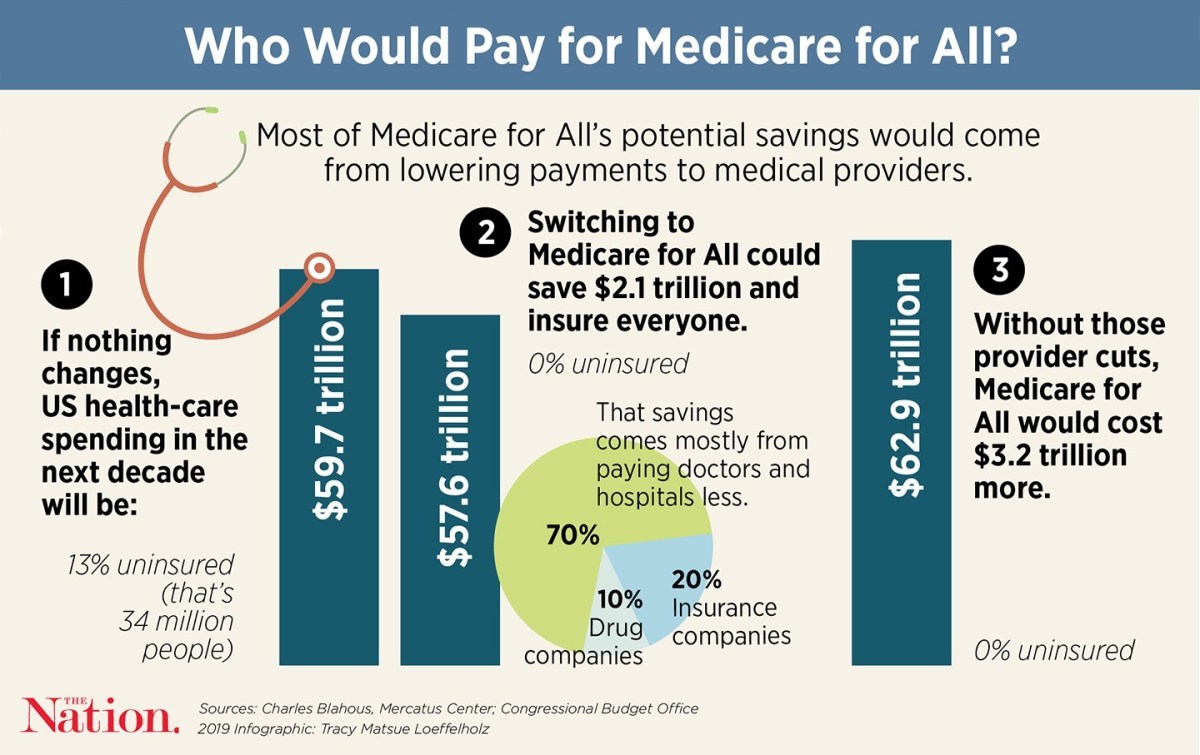

Can Medicare cut provider payments?

There’s no way around this. You cannot cut provider payments for medical services without impacting the beneficiaries of those services .

How old do you have to be to get medicare?

The Medicare eligibility requirements can change, but in 2020, people age 65 or older can qualify. Other eligibility requirements include U.S. citizenship or permanent legal residency in the U.S. for at least five years. Although you must be age 65 to qualify for Medicare, exceptions allow some people under age 65 to apply.

How long do you have to wait to get medicare?

However, if you do not meet these specific requirements, you will have to wait until age 65 to receive your Medicare benefits. The good news is you can begin signing up for Medicare three months before your 65thbirthday. Healthcare Alternatives If You Don’t Qualify Before 65.

What is Medicare Part B?

Medicare Part Bcovers 80% of most medical services, including preventative care, outpatient care and medical devices. Medicare Part B also covers some prescription drugs. In addition to Medicare Parts A and B, there are several supplemental insurance plans that people can purchase.

What is the third option for health insurance?

The third option for health insurance in retirement is through the Consolidated Omnibus Budget Reconciliation Act(COBRA). COBRA mandates that employers offer coverage equal to the benefits that the employee received while employed. However, employers are not required to subsidize the premiums, so it is often an expensive option for retirees. Additionally, COBRA provisions typically last up to 18 months, so it may not cover all a retiree’s medical needs.

Can you get group health insurance if you are employed?

If you were employed while working, you might have had access to group health insurance . Typically, when someone retires, he will have the option to continue his healthcare coverage with the same provider. With this option, the employee will pay for continued coverage out-of-pocket until they are eligible for Medicare, or a fixed period.

Can you get Medicare at age 65?

Although you must be age 65 to qualify for Medicare, exceptions allow some people under age 65 to apply. For example, if a person has a disability and has been receiving disability benefits for at least 24 months, or has a severe illness, they may qualify for Medicare early. The severe illnesses Medicare covers include end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s Disease.

How long does it take to get Medicare if you are 65?

Individuals under the age of 65 that are receiving Social Security Disability Income or Railroad Retirement Board Disability income have a two year , sliding scale, waiting period to qualify for Medicare insurance beginning at age 62.

What age do you have to retire without health insurance?

If someone retires without a continuing employer-provided health insurance plan, they will need to purchase an individual or family health plan that will meet their medical expectations until reaching the qualifying age of 65 . Medicare Coverage Due to Disease or Disability. Disease Eligibility.

How much does Medicare cost a month?

Depending on the number of quarters worked, the monthly premiums can range from $252 a month for an individual who have worked 30 to 39 quarters, and up to $458 a month for an individual who worked less than 30 quarters. Medicare Part B.

What is the income basis for Part B?

The income basis for Part B premiums allows for individual and family programs. For example, an individual with annual earnings of $87,000 or less and a married couple with annual earnings of $174,000 or less will have the same monthly premium cost of $144.60. The monthly premiums with the extra fees will increase at various levels based on the higher income of individuals or couples up to a maximum monthly premium of $491.60.

When was Medicare signed into law?

Medicare was signed into law by President Lyndon B. Johnson in 1965 . The program was designed to provide insurance coverage of hospital expenses through Part A, and of medical costs through Part B. Medicare covers senior citizens aged 65 and older and younger individuals with specific disabilities. Medicare is available for legal permanent residents that have met the qualifying number of years worked. Those eligibilities remain in effect today.

Is Medicare Part A premium free?

Cost of Medicare. Medicare Part A. Individuals are provided premium-free Medicare Part A Hospital Insurance if the individual or a spouse paid the payroll Medicare tax for a defined period of time while working. If someone does not qualify for the premium-free Part A, they may be able to purchase Part A for a monthly premium, ...

Does Medicare Part B change?

The monthly premiums for Medicare Part B are subject to change from one year to another. There is a standard monthly premium. If an individual’s modified adjusted gross income exceeds the standard income bracket, that person will pay an extra charge for Part B that is calculated on the amount of the additional income.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How much less will Social Security be at 62?

However, even though your monthly benefit will be 25% to 30% less if you begin collecting retirement benefits at age 62, you might receive the same or more total lifetime Social Security benefits as you would have had you waited until full retirement age to start collecting benefits. That's because even though you'll receive less money per month, ...

What is the earliest age you can collect Social Security?

Is 62 your lucky number? If you're eligible, that's the earliest age you can start receiving Social Security retirement benefits. If you decide to start collecting benefits before your full retirement age, you'll have company. According to the Social Security Administration (SSA), approximately 69% of Americans elect to receive their Social ...

What will your retirement benefit be?

Your Social Security retirement benefit is based on the number of years you've been working and the amount you've earned. Your benefit is calculated using a formula that takes into account your 35 highest earnings years. If you earned little or nothing in several of those years (if you left the workforce to raise a family, for instance), it may be to your advantage to work as long as possible, because you'll have the opportunity to replace a year of lower earnings with a higher one, potentially resulting in a higher retirement benefit.

What happens if your SSA benefits are reduced?

That's because the SSA recalculates your benefit when you reach full retirement age, and omits the months in which your benefit was reduced.

How many people get Social Security benefits early?

According to the Social Security Administration (SSA), approximately 69% of Americans elect to receive their Social Security benefits early. (Source: SSA Annual Statistical Supplement, 2019). Although collecting early retirement benefits makes sense for some people, there's a major drawback to consider: if you start collecting benefits early, ...

How to check Social Security retirement?

If you want to estimate the amount of Social Security benefits you will be eligible to receive in the future under current law (based on your earnings record) you can use the SSA's Retirement Estimator. It's available at the SSA website at socialsecurity.gov. You can also sign up for a my Social Security account to view your online Social Security Statement at the SSA website. Your statement contains a detailed record of your earnings, as well as estimates of retirement, survivor's, and disability benefits, and other information about Social Security. If you're not registered for an online account and are not yet receiving benefits, you'll receive a statement in the mail every five years, from age 25 to age 60, and then annually thereafter.

How does age affect joint retirement?

The age at which you begin receiving benefits may significantly affect the amount of lifetime income you and your spouse receive, as well as the benefit the surviving spouse will be entitled to, so you'll need to consider how your decision will affect your joint retirement plan.