How Medicare Is Funded: Who Pays for Medicare?

- Medicare is primarily funded through the Federal Insurance Contributions Act (FICA).

- Taxes from FICA contribute to two trust funds that cover Medicare expenditures.

- The Medicare Hospital Insurance (HI) trust fund covers Medicare Part A costs.

- The Supplementary Medical Insurance (SMI) trust fund covers Medicare Part B and Part D costs.

What is the Medicare tax and how does it work?

How is it funded? Funds authorized by Congress Premiums from people enrolled in Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient... Other sources, like interest earned on the trust fund investments

How is the Medicare trust fund financed?

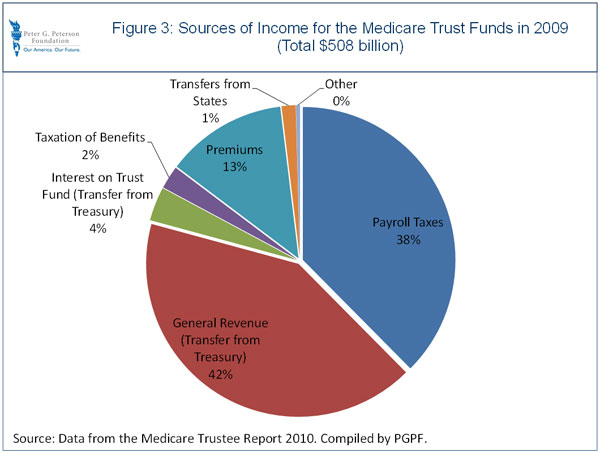

Medicare funding is provided by the United States Treasury in the form of the Medicare trust fund, which is financed using taxes from payroll and general taxes as well as premium payments from Medicare recipients. How does the Medicare Trust Fund Work? The funding for this insurance coverage is provided by two trust fund accounts that are held by the United States Treasury. …

What is the Medicare tax that is withheld from my paycheck?

Mar 16, 2022 · What Are Medicare Taxes? The Basics of Medicare Tax. FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to... Additional Medicare Tax. The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting... Medicare Tax for Self-Employed ...

Who is required to pay Medicare taxes?

Feb 24, 2022 · Medicare tax pays for Part A of the Medicare program, which includes hospital insurance for individuals age 65 or older and people who have certain disabilities or medical conditions. 2 Medicare...

What do Medicare taxes pay for?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.Mar 28, 2022

What are taxes that fund Social Security and Medicare?

As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming out of my check? An estimated 171 million workers are covered under Social Security. FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Where does the Social Security tax go?

the Social Security trust fundsWe use your taxes to pay people who are getting benefits right now. Any unused money goes to the Social Security trust funds, not a personal account with your name on it. Many people think of Social Security as just a retirement program.

Where does Medicare spend?

Part A pays for hospital care; Part B provides medical insurance for doctor's fees and other medical services; Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; Part D covers prescription drugs.

Is Medicare funded by payroll taxes?

A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

Is Medicare fully funded by FICA?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Do you pay Medicare tax on Social Security income?

There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

What age do you stop paying taxes on Social Security?

Key Takeaways. Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes.

What is Medicare budget?

Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.Dec 15, 2021

Why has Medicare spending increased?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.Aug 20, 2019

Why does the US spend so much on healthcare?

Political discourse on health spending often focuses on prescription drug prices and administrative costs as being the primary drivers of high health spending in the U.S. compared to other nations. Current policy proposals aim to address prescription drug pricing.Sep 25, 2020

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

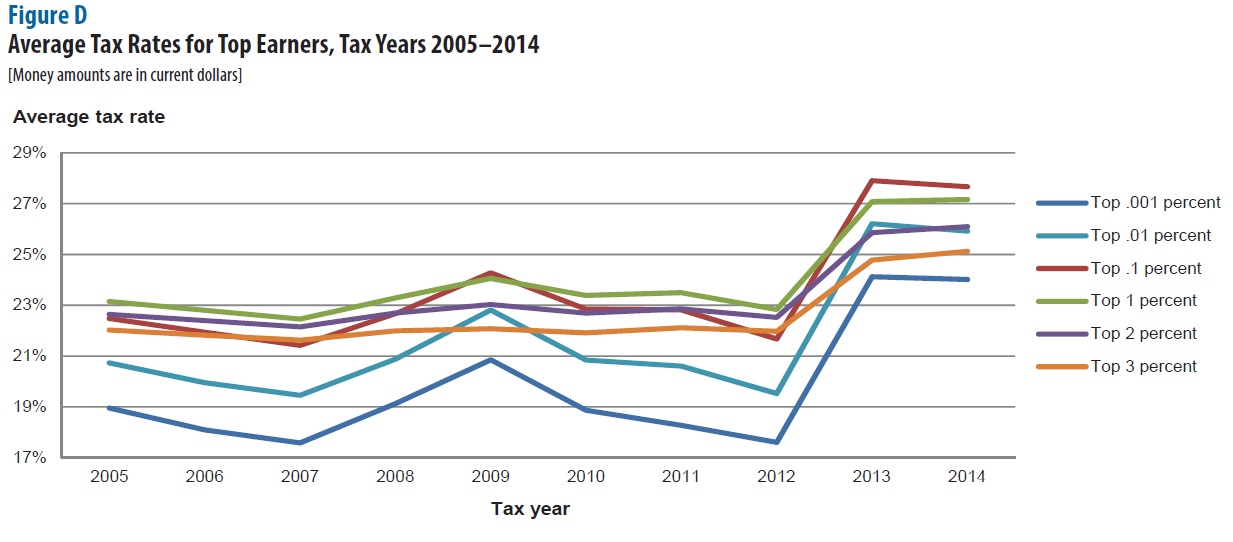

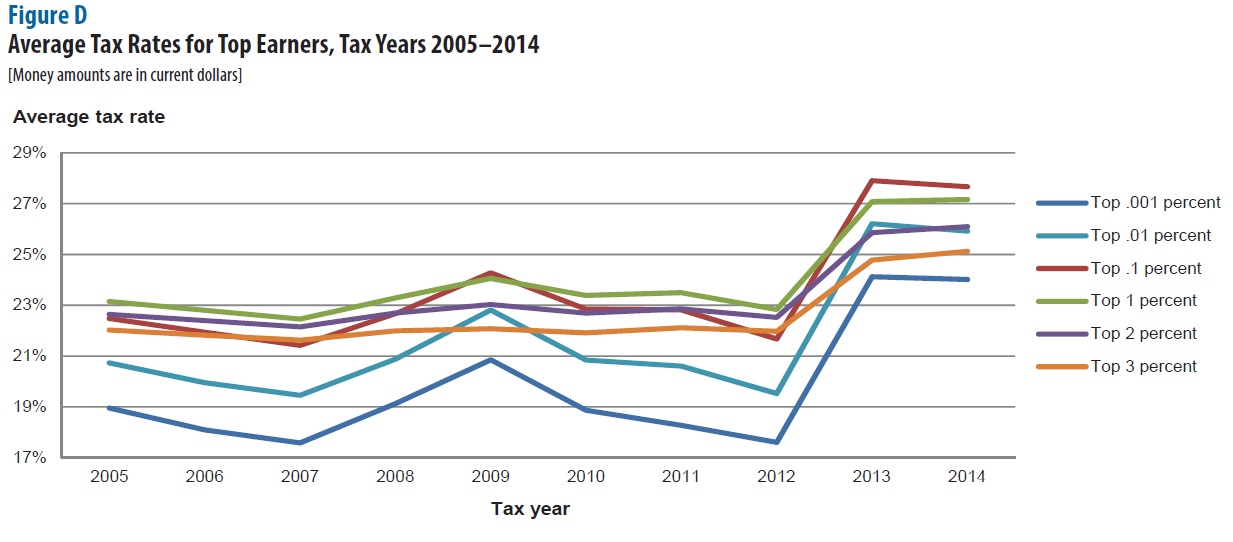

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

When did the Medicare tax become effective?

It became effective on November 29, 2013. 5

What is the purpose of FICA tax?

The bulk of the FICA tax revenue goes to funding the U.S. government's Social Security trusts. These trusts are solely designated to fund the programs administered by the Social Security Administration, including: Retirement benefits. Survivor benefits.

What are the deductions on W-2?

Most W-2 employees' pay stubs detail the taxes and deductions that are taken from their gross pay. You'll almost certainly see two items among these deductions, in addition to federal and state or local income taxes: Social Security and Medicare taxes.

How are FICA taxes paid?

How FICA Taxes Are Paid. You, the employee, pay half the FICA taxes, which is what you see deducted on your pay stub. Your employer must match these amounts and pay the other half to the government separately at regular intervals. 1 2.

How much will Social Security be taxed in 2021?

You—and your employer—would pay the Social Security tax on only the first $142,800 in 2021 if you earned $143,000, for example. That remaining $200 is Social Security tax-free. The Social Security tax will apply again on January 1 of the new year until your earnings again reach the taxable minimum.

Why do we invest money in trusts?

The money is put in the trusts and invested to pay for future program benefits when this occurs . Investments made from the funds placed in these trusts allow the federal government to essentially borrow against the surplus to fund other parts of the government.

Can you deduct Medicare taxes from your paycheck?

An Additional Medicare Tax can be deducted from some employees’ pay as well. After federal and state income taxes, Social Security and Medicare, or FICA taxes, make up the bulk of taxes that are routinely withheld from your paychecks.

How is Medicare funded?

The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

Why is trust fund balance important for SMI?

Because the bulk of SMI’s funding comes from the general fund, the trust fund balance mainly serves to cover temporary shortfalls and is kept low. High reserves are not required as long as general fund revenues and borrowing automatically rise with costs.

What is HI trust fund?

The hospital insurance (HI) trust fund, also known as Part A of Medicare, finances health care services related to stays in hospitals, skilled nursing facilities, and hospices for eligible beneficiaries —mainly people over age 65 with a sufficient history of Medicare contributions.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

When was the Social Security tax rate set?

The tax rate for Social Security was originally set in 1937 at 1 percent of taxable earnings and increased gradually over time. The current rate was set in 1990, although it has been modified twice in response to economic downturns.

What is the maximum amount of Social Security tax?

For 2021, the maximum earnings subject to the Social Security payroll tax is set at $142,800, an increase of $5,100 from the 2020 level.

What will be the payroll tax in 2021?

Apr 8, 2021. Payroll taxes fund social insurance programs including Social Security and Medicare and are the second-largest source of revenues for the federal government. In 2019, the most recent year for which data were not affected by temporary distortions resulting from the pandemic, payroll taxes made up 36 percent of total federal revenues.

Why are payroll taxes important?

Payroll taxes are an important component of America’s system of taxation and they fill an essential role in keeping social insurance programs funded and operational. Payroll taxes represent the second-largest source of federal revenues, after income taxes. On the household level, payroll taxes are often the primary federal tax an individual will ...

How much is Social Security payroll tax in 2021?

In 2019, Social Security received $914 billion in revenue from payroll taxes, or 4.3 percent of gross domestic product (GDP).

What is the difference between FICA and SECA?

The rates for SECA taxes are identical to those for FICA taxes, with the only difference being that the individual is responsible for paying both employee and employer portions of the tax.

What is the federal unemployment tax rate?

Federal Unemployment Tax Act (FUTA) taxes are only paid by employers, at a rate of 6 percent for the first $7,000 of earned income per employee. FUTA taxes support funding for state-administered unemployment insurance programs. Railroad Retirement Act taxes are paid by railroad employees and employers to fund retirement programs for railroad ...

Why does the federal government collect taxes?

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

What percentage of the federal budget is Social Security?

As the chart below shows, three major areas of spending make up the majority of the budget: Social Security: In 2019, 23 percent of the budget, or $1 trillion, paid for Social Security, which provided monthly retirement benefits averaging $1,503 to 45 million retired workers in December 2019. Social Security also provided benefits ...

What is Medicare 570?

This category consists of the Medicare function (570), including benefits, administrative costs, and premiums, as well as the “Grants to States for Medicaid” account, the “Children’s health insurance fund” account, the “Refundable Premium Tax Credit and Cost Sharing Reductions,” and two other small accounts supporting the Affordable Care Act’s marketplace subsidies (all in function 550).

How much of the federal budget is interest on debt?

In 2019, these interest payments claimed $375 billion, or about 8 percent of the budget.

How much did the federal government spend in 2019?

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount ($984 billion) was financed by borrowing. As the chart below shows, three major areas of spending make up ...

What are the benefits of a retired federal employee?

These include providing health care and other benefits to veterans and retirement benefits to retired federal employees, ensuring safe food and drugs, protecting the environment, and investing in education, scientific and medical research, and basic infrastructure such as roads, bridges, and airports.

Do we distinguish programs financed by general revenues from those financed by dedicated revenues?

Because we discuss total federal spending, we do not distinguish programs financed by general revenues from those financed by dedicated revenues (e.g., Social Security). For more information, see Policy Basics: Federal Payroll Taxes.