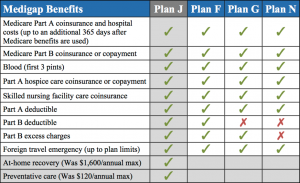

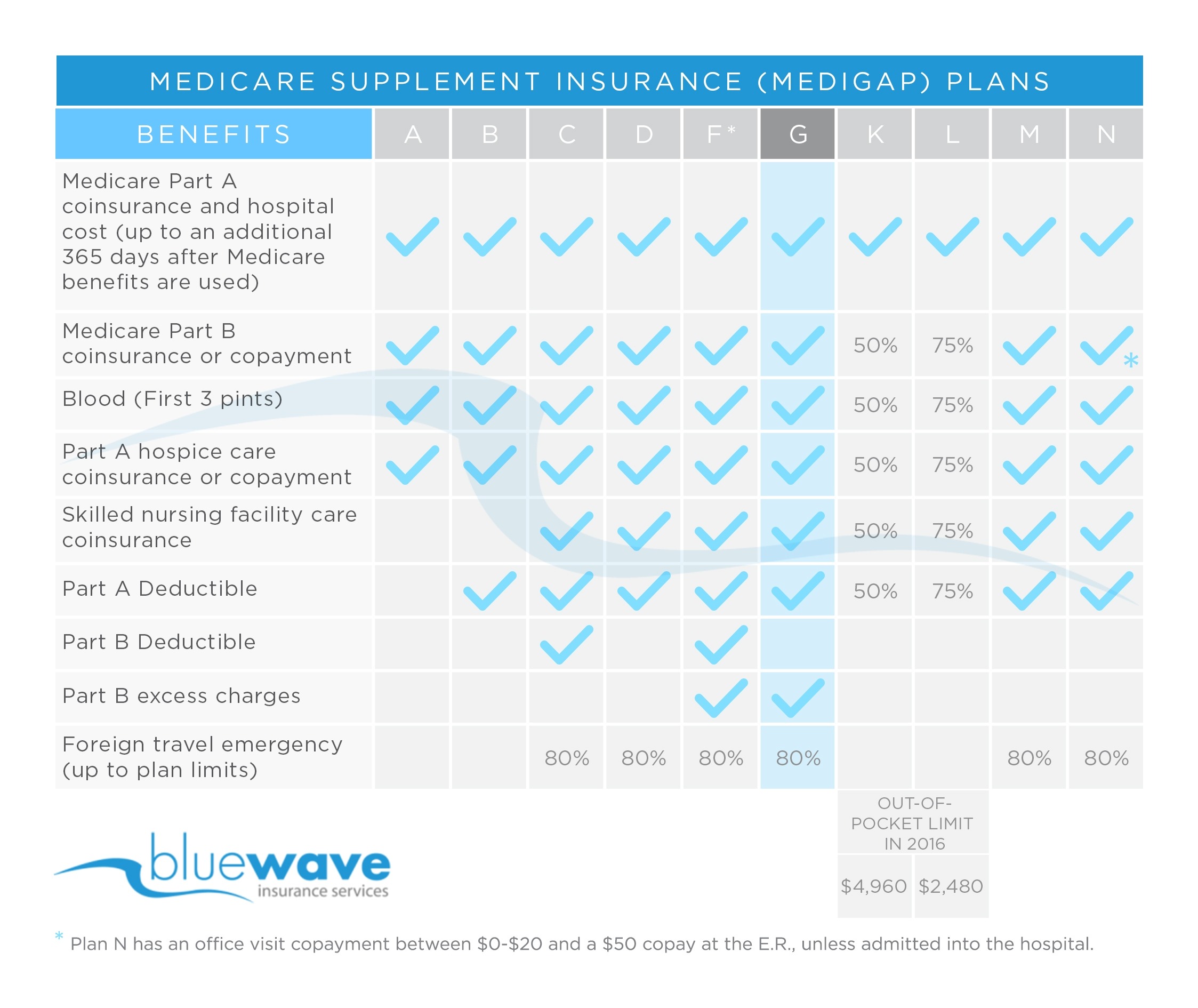

For Missouri seniors who need help covering the out-of-pocket costs that remain after Medicare reimbursement, a Medicare supplement plan (Medigap) may be the answer. Designed to work alongside Medicare Part A and B, Medigap insurance pays for up to 100% of expenses such as deductibles or the copays for hospital or outpatient care.

Full Answer

What does Medicare supplement insurance cover in Missouri?

Some Missouri seniors purchase a Medicare Supplement Insurance policy, also known as Medigap. These plans are intended to fill in the gaps Original Medicare doesn’t cover. Some of these gaps include medical coverage while overseas, Part A and Part B copays, and excess Part B charges.

How much does Medicare cost in Missouri?

In Missouri, there are over 740,000 people enrolled in Original Medicare. While monthly premiums vary depending on factors such as your income and how long you paid Medicare taxes, the Part A premium can be as high as $471 per month, and the Part B premium is $148.50.

Does Medigap cover prescription drugs in Missouri?

Neither Medigap nor Medicare offer prescription drug coverage. By purchasing a Missouri Medicare Part D Plan, you’ll have coverage on necessary drugs. Medicare Part D costs between $15-$120 a month, depending on the policy you select. Beneficiaries with no medications or certain generic drugs could benefit from the $15 monthly policy.

How do I Change my Missouri Medicare supplement plan?

Plan changes are simple and can be done over the phone. Keeping up with policy comparison can save you money every year. The best time to sign up for Missouri Medicare Supplement Plans is during the Medigap Open Enrollment Period.

What benefits do Missouri state employees get?

Which benefits does State of Missouri provide?Insurance, Health & Wellness. Health Insurance. 4.2★ ... Financial & Retirement. Retirement Plan. 3.6★ ... Family & Parenting. Family Medical Leave. 4.5★ ... Vacation & Time Off. Vacation & Paid Time Off. 4.5★ ... Perks & Discounts. Employee Assistance Program. ... Professional Support. Diversity Program.

What insurance do Missouri state employees have?

Missouri Consolidated Health Care Plan (MCHCP) provides coverage to employees and retirees of most state agencies as well as public entities that have joined MCHCP. Over 100,000 state and public entity members are covered by MCHCP.

Is mosers a lifetime benefit?

Pension. Your MOSERS defined benefit pension is based on a formula and provides a lifetime monthly benefit in retirement.

What is retiree medical coverage?

Retiree insurance is a form of health coverage an employer may provide to former employees. Retiree insurance almost always pays second to Medicare. This means you need to enroll in Medicare to be fully covered. Some retiree policies require you to sign up for Parts A and B once you become Medicare-eligible.

Does MoDOT have a pension?

Retirement: The MoDOT & Patrol Employees' Retirement System (MPERS) guarantees a lifetime retirement benefit upon meeting certain age and service requirements.

Does Missouri State University offer health insurance for students?

A prepaid student health fee covers the cost of basic office visits for Missouri State University students.

What type of retirement plan is mosers?

Retirement Benefits. MOSERS is a single-employer, public employee retirement plan administered in accordance with Chapter 104 of the Revised Statutes of Missouri (RSMo). As a retiree, the benefits you receive are considered a “public pension” for tax reporting purposes.

What does BackDROP mean in retirement?

BackDROP Period The period of time you elect to receive a lump-sum payment of 90% of what you would have received in pension benefits had you been retired.

Do retirees pay for Medicare?

Here's how much you may need to pay for it in retirement. To cover premiums and out-of-pocket prescription drug costs from age 65 on, you may need $130,000 if you're a man, and $146,000 if you're a woman, one study says.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the best Medicare plan available?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Does Missouri help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled (ABD) in Missouri?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in Missouri?

Missouri State Health Insurance Assistance Program Free volunteer Medicare counseling is available by contacting the Missouri State Health Insuranc...

Where can I apply for Medicaid in Missouri?

Medicaid is administered by the Department of Social Services in Missouri. You can use this website to apply for Medicaid ABD or an MSP in Missouri.

What does Medicare Supplement plans in Missouri cover?

Medicare Supplement plans may help cover some or all of the out-of-pocket costs under Original Medicare. Out-of-pocket costs under Original Medicare come in the form of deductibles, coinsurance, copayments, and Part B excess charges.

When can I enroll in Medicare Supplement plans in Missouri?

You have six months to select and buy Medicare Supplement plans in Missouri, beginning the month in which you are both age 65 or over and enrolled in Part B. This is called your Medicare Supplement Open Enrollment Period.

How much does Medicare Supplement plans in Missouri cost?

There’s no set premium for Medicare Supplement plans in Missouri as there is for Medicare Part A and Part B. Because the plans are offered by private insurers, they are free to set their own premiums. You may see a wide variation in premiums between the different plans and different insurance companies.

What else should I know about Medicare Supplement plans in Missouri?

Medicare Supplement plan in Missouri only pays for covered expenses under Medicare Part A and Part B. It doesn’t cover your Medicare Part A and Part B premiums, or any out-of-pocket costs associated with prescription drugs, or Part D deductibles and copayments. Medicare Supplement cannot be used together with Medicare Advantage.

What is the income limit for MO HealthNet?

The Medicaid program is called MO HealthNet in Missouri. Income eligibility: The income limit is $904 a month if single and $1,222 a month if married. (Note that a higher income limit – of $1,064 a month if single and $1,437 if married – applies to applicants who are blind.) Asset limits: The asset limit is $5,000 if single and $10,000 if married.

What is the income limit for HCBS in Missouri?

The income limit for HCBS is $1,370 a month per applicant in Missouri. In Missouri in 2020, spousal impoverishment rules allow spouses who aren’t receiving LTSS (and don’t have Medicaid) to keep an allowance that is between $2,155 and $3,216 per month.

How much do nursing home enrollees pay?

Nursing home enrollees must pay nearly all their income each month toward their care, other than a small personal needs allowance ( of $50 a month) and money to pay for health insurance premiums (such as Medicare Part B and Medigap ).

How much equity can you have in a nursing home in Missouri?

Applicants for nursing home care and HCBS can’t have more than $595,000 in home equity in Missouri. In Missouri, applicants for LTSS may be penalized if they transfer or give away assets for less than their value. Missouri has chosen to pursue estate recovery for all Medicaid covered expenses.

How much can you have on Medicaid if you are married?

These asset limits are somewhat higher than in other states, where Medicaid enrollees often can’t have more than $2,000 if single and $3,000 if married.

What is extra help?

The Extra Help program lowers prescription drug costs under Medicare Part D. Beneficiaries who also have Medicaid, an MSP, or Supplemental Security Income (SSI) automatically receive this program, but other beneficiaries can apply for it themselves.

What is the income limit for SLMB?

The income limit is from SLMB levels up to $1,456 a month if single or $1,960 a month if married. Qualified Working Disabled Working Individuals (QDWI): The income limit is $2,126 a month if living alone and $2,873 a month if living with one other person.

What are the Medicare resources in Missouri?

Medicare Resources in Missouri. If you’re researching Medicare policies or signing up for a plan, several statewide agencies can help. These agencies provide free information and assistance with signing up for Medicare and affiliated programs, helping you get the health care services you need at a price that you can afford.

How many people are on Medicare in Missouri?

Once you turn 65, you become eligible for Medicare, the government-funded fee-for-service health insurance plan for retirees. In Missouri, there are over 740,000 people enrolled in Original Medicare. While monthly premiums vary depending on factors such as your income and how long you paid Medicare taxes, ...

What is Claim for Medicare?

It offers free, unbiased options counseling through volunteer counselors who are trained to answer any questions you have about your Medicare benefits, options for reducing your out-of-pocket costs, and your best options for prescription drug coverage. You can get help from CLAIM in one of three ways, including calling the toll-free number, filling out and submitting an online form, or visiting a CLAIM event in your local community.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, reduces the out-of-pocket expenses you pay when using your Part A coverage. Medigap plans are offered by private insurance companies for an additional monthly premium and reduce costs such as copays, deductibles, and coinsurance.

What is the Missouri SMP?

Missouri SMP is a program that helps you recognize, prevent and report Medicare and health care fraud, errors, or abuse. This agency organizes events throughout the state where you can learn about common scam tactics. Its counselors can also help you detect fraud by reviewing your billing statements for mistakes and charges for services that you didn’t get or weren’t ordered by your doctor. You can also call the SMP if you suspect you were a target of Medicare fraud or if you notice discrepancies in billing statements.

What is the Missouri Department of Insurance?

Missouri Department of Insurance. The Missouri Department of Insurance protects you as you purchase and use your Medicare policy. Through this department, you can get more information about Medicare and Medigap, the statewide prescription drug assistance program, and long-term care insurance.

What is legal aid in Missouri?

Legal Aid of Western Missouri is one of the state’s nonprofit agencies that provide free civil legal services and representation to qualifying individuals. This firm serves the most populous region of the state through a variety of services, including economic development, assistance with accessing public benefits, and veterans’ issues. Through this agency, you can get help with hearings and appeals related to denial or loss of Medicare coverage.