Different parts of Medicare cover different services. Part A covers hospital expenses, Part B covers doctor and outpatient services, while Part D covers prescription drugs. Upon becoming eligible for Medicare coverage, it is essential to have an understanding of its different parts so you can select the coverage that will be right for you.

Full Answer

What does each part of Medicare cover?

Medicare is broken out into four parts. What does each part of Medicare cover? Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled nursing facility care. Together, Medicare Parts A and B are called Original Medicare.

What does Medicare Part A and Part C cover?

1 Part A covers inpatient care. 2 Part B covers outpatient care. 3 Part C covers everything parts A and B do and often includes Part D as well. 4 Part D covers prescription drugs.

What are Medicare Parts A and B?

The Medicare program offers basic coverage to help pay for things like doctor visits, hospital stays and surgeries. When you’re eligible, you can enroll in Medicare Parts A and B – also known as Original Medicare – through the Social Security Administration.

What are the different types of Medicare?

Figuring out how Medicare works feels a little like learning the alphabet for the first time. There are the four general parts of Medicare: A, B, C, and D. Then you have the 10 types of Medicare supplementplans: A, B, C, D, F, G, K, L, M, and N. As confusing as that might seem, it's important to take the time to educate yourself.

What are the four parts of Medicare what do they cover?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What do Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

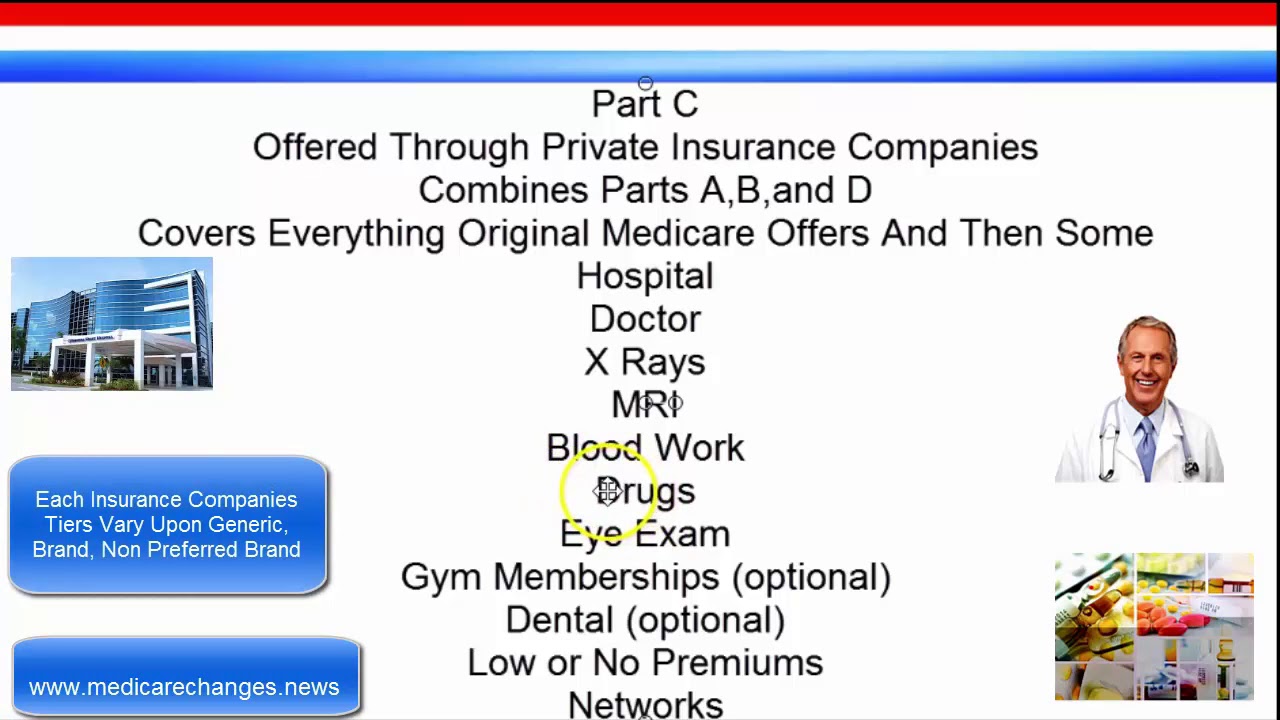

What do Medicare Parts C and D deal with?

Medicare Part C combines Medicare Parts A and B. Medicare Part D provides prescription drug coverage. Medicare Part C helps cover hospital visits (inpatient and outpatient), doctor visits, home health, and a stay in a skilled nursing facility. Medicare Part C coverage may also include a Part D, prescription drug plan.

What is difference between Medicare Parts A and B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What Medicare Part A does not cover?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Is Medicare Part C or D better?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Can you have both Medicare Part C and D?

Can you have both Medicare Part C and Part D? You can't have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you'll be unenrolled from Part C and sent back to original Medicare.

Does Medicare cover 100% of Part A?

What does Medicare Supplement cover? All Medicare Supplement insurance plans generally pay 100% of your Part A coinsurance amount, including an additional 365 days after your Medicare benefits are used up.

Why do I need Medicare Part B?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary.

Who is eligible for Medicare Part B?

You automatically qualify for Medicare Part B once you turn 65 years old. Although you'll need to wait to use your benefits until your 65th birthday, you can enroll: 3 months before your 65th birthday.

How many parts does Medicare have?

Medicare is broken out into four parts.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

How long does it take for Medicare to cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test.

How often do you have to have a colonoscopy for Medicare?

Colonoscopies. Medicare covers screening colonoscopies. Test frequency depends on your risk for colorectal cancer: Once every 24 months if you have a high risk. Once every 10 years if you aren’t at high risk.

What is hospice care?

Medicare Part A covers hospice care for terminally ill patients who will live six months or less. Patients agree to receive services that focus on providing comfort and that replace the Medicare benefits to treat an illness.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Can you get Medicare and Medicaid in Minnesota?

If you’re age 65 or older and are dual eligible for Medicaid and Medicare, you may be able to get all your services in one plan. In Minnesota, this plan is called Minnesota Senior Health Options (MSHO). An MSHO plan covers medical, prescription drugs, dental, long-term care, and home and community-based services.

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

What is Medicare Part A?

Part A coverage. Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D. Part A coverage includes: hospital stays and procedures. hospice care.

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What age does Medicare cover?

Medicare is a health insurance program for people ages 65 and older , as well as those with certain health conditions and disabilities.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.

What are the parts of Medicare?

Medicare now features four major parts: Parts A and B (original Medicare) and optional add-ons Part C (Medicare Advantage, an alternative that bundles the parts together) and Part D (prescription drug coverage).

What are the two major parts of Medicare?

Here’s a shortcut to remembering Medicare’s major components: The two biggies are Parts A and B. The twin parts make up original Medicare, the government-run pillars that hold up the rest of the program. Hospital insurance (Part A) and medical insurance (Part B) were first on the scene when Medicare started. Lawmakers struggled for years after that to add lasting prescription drug coverage .

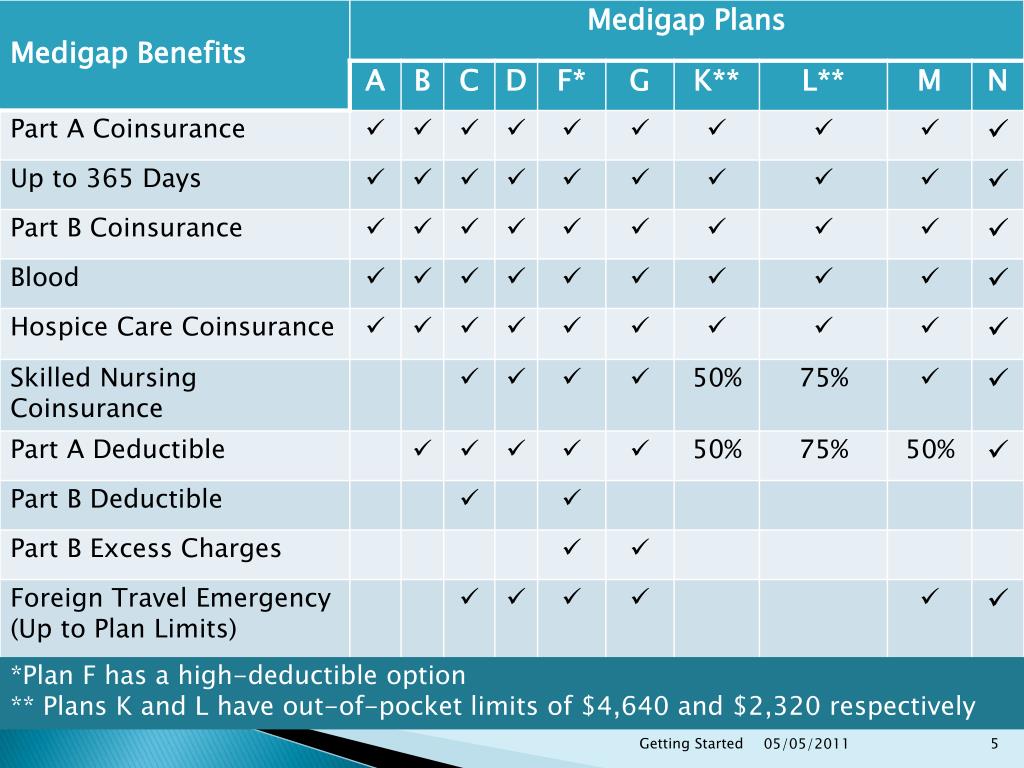

What is Medicare supplement insurance?

Medigap is the nickname for Medicare supplement insurance, which covers out-of-pocket costs for Medicare Parts A and B. There are 10 nationally standardized Medigap plans, and some share alphabetical names with the major Medicare parts.

What is Medicare Advantage plan MA?

MA plans package Medicare Parts A and B and, in most cases, a prescription drug benefit together in one private plan — often for a monthly cost of no more than the Part B premium. Medicare Advantage plans with or without an extra premium average $21 a month. There are 6 types of Medicare Advantage plans, and they comprise their own alphabet soup of names. Health maintenance organization (HMO) and preferred provider organization (PPO) plans are the most common types. But enrollment in special needs plans (SNPs) — for enrollees with low income or who have chronic medical conditions and need coordinated care — is growing.

What to do if you are Medicare eligible?

If you’re Medicare-eligible or take care of someone who is, you can contact the State Health Insurance Assistance Program, or SHIP, with questions on anything Medicare related . Its trained benefits counselors offer unbiased guidance for free.

What does Medicare Part B cover?

Medicare Part B covers the care you get outside the hospital. It also covers some drugs and vaccines that Part D doesn’t cover, such as:

When did Medicare start?

When Medicare became law in 1965 , it also started at the beginning of the alphabet with Parts A and B. Part A covered hospital and associated services, and Part B was insurance for doctor visits and outpatient services. Simple enough. But as the program grew, so did the number of parts — and letters — associated with it.

How many Medigap plans are there?

There are 10 Medigap plans, which vary in what and how much they cover. Each is identified by a letter: A, B, C, D, F, G, K, L, M, and N. They're standardized, which means a Plan A offered by one company has the same benefits as a Plan A sold by another one. Your premiums may differ, though. To find out what benefits are offered under each plan, go to the Medicare website.

Who decides what Medigap plan to sell?

Each insurance company decides which Medigap plans it wants to sell, although some states’ laws require them to offer certain plans there.

What is a Part D plan?

All Part D plans must offer a range of prescription drugs that people with Medicare often take, plus more specialized medications like cancer drugs and insulin. Each Part D plan publishes a list of its covered drugs, called a formulary. In each formulary, drugs are organized into different levels with varying costs.

How often can Medicare change out of pocket fees?

Your Medicare Advantage insurer can make changes to your out-of-pocket fees as often as once a year.

How many people does each insurance cover?

Each policy covers just one person. Your spouse will need a separate one if you both want coverage.

How much of the cost of medical services is coinsurance?

Typically, 20% of the costs for each medical service (as coinsurance)

When does Medicare start?

This is the 7-month period that starts 3 months before the month of your 65 th birthday and ends 3 months after.

Specialist referrals

You may need a referral to see a specialist. You'll pay more to see one outside of the provider's network.

Penalties

There are no penalties with a Medicare Advantage plan, but you must sign up to Original Medicare Part B when you first become eligible.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How many standardized benefits are there for Medicare Supplement?

The 9 standardized benefits that may be offered by a Medicare Supplement Insurance plan include the following:

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What are the factors to consider when shopping for Medicare Supplement Insurance?

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.