How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services. Who pays a higher premium because of income?

How much is Medicare Part B monthly?

$170.10The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Is Medicare Part B free of charge?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do patients pay for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

What is the cost of Medicare Part B for 2021?

$148.50 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why is my Medicare bill for 5 months?

You have been charged for 5 months of Medicare Part B premiums because you are not receiving a Social Security check to have your Medicare premiums deducted. Security has lumped your months together in the bill which was sent.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

When does Medicare Part B start?

If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesn’t begin until July.

How to reduce Medicare premiums?

One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

What happens if you miss your Medicare enrollment window?

What happens if you miss your initial enrollment window? If you delay Medicare Part B enrollment, then you’ll have to wait to enroll when the general enrollment period starts. In this example, your birthday is March 8. Because you missed your initial window, you’ll have to wait until January of the following year to enroll and July of the following year to start receiving coverage.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is the out of pocket cost of Medicare Part B?

Other out-of-pocket Part B costs include: The annual Medicare Part B deductible is $203 in 2021. You must pay this amount before Part B benefits begin.

What is Medicare Part B based on?

For example, your Medicare Part B premium in 2021 is based on your reported 2019 total annual income, and your 2021 premium would be based on your reported 2018 income, and so on.

How much do you have to pay for Medicare after you have met your deductible?

You typically have to pay 20% of the Medicare-approved amount for medical services after your Part B deductible is met. Part B excess charges. Some health care service providers choose not to accept Medicare assignment, which means that they do not accept the Medicare-approved amount as payment in full for their services.

What happens if you don't sign up for Medicare Part B?

In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible. This penalty will be enforced for the rest of the time that you receive Part B coverage, and could increase by up to 10 percent for each 12-month period that you didn't enroll in Part B once you became eligible.

How much is Medicare Part B 2021?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

What happens if a doctor doesn't accept Medicare?

If you receive medical services from a physician who doesn't accept Medicare assignment, they could charge you up to 15 percent more than what Medicare will pay. In this situation, you are responsible for paying the difference in cost, which is referred to as Medicare Part B excess charges.

Do you have to pay Medicare Part B premium?

You'll have to pay the standard premium if you are enrolling in Medicare Part B for the first time. Other reasons you might have to pay the standard Part B premium amount include: In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible.

How much is Part B medical insurance?

Part B medical insurance is associated with monthly premium payments, an annual deductible, and coinsurance payments for services. In 2020, the base monthly premium payment is $144.60. This amount applies to anyone making less than $87,000 annually as an individual or $174,000 for those filing jointly. If you exceed these numbers, your premium ...

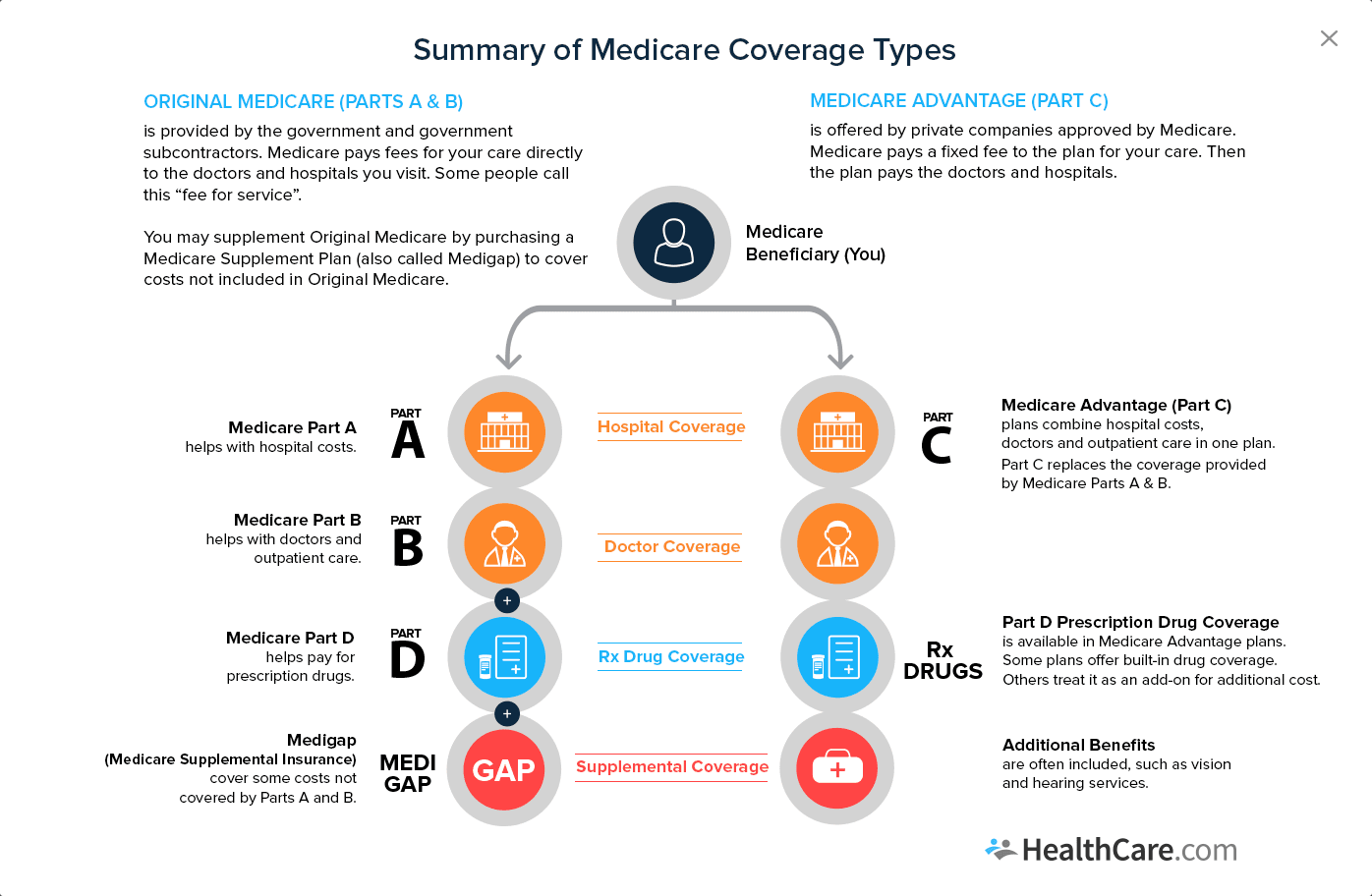

What is Medicare Part A and Part B?

Medicare Part A and Part B are designed to cover inpatient and outpatient expenses. Part A is designed specifically for inpatient stays in hospitals, skilled nursing facilities, and hospice care.

How much is Medicare Part B 2020?

In addition to the premium payments, Medicare Part B also requires an annual deductible to be met. In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services.

How much coinsurance do you pay for Medicare?

Once you have met your deductible, you will then pay a coinsurance of 20 percent of the Medicare-approved amount. This amount is pre-set by Medicare and sets a limit as to the maximum amount they will pay for a service.

What is covered under Part B?

Injections, physical therapy, or other modalities are also often covered under Part B as they are used to treat a condition. Durable medical equipment required after an injury, procedure, or diagnosis is also covered.

Does Part B cover hearing aids?

Part B does not provide any coverage related to vision, dental, or hearing care. This means that you will not receive any reimbursement for routine dental checkups, fillings, or dentures; routine vision care, including eye exams, glasses, or contacts; or hearing appointments and hearing aids. Part B also does not cover elective procedures, massage ...

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How to contact Medicare helpline?

For more information, contact the Medicare helpline 24 hours a day, seven days a week at 1-800- MEDICARE (1-800-633-4227) , TTY 1-877-486-2048.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What about Medicare Advantage plans?

The price for Medicare Advantage (Part C) plans greatly varies. Depending on your location, you may have dozens of options, all with different premium amounts. Because Part C plans don’t have a standard plan amount, there are no set income brackets for higher prices.

What about Medicaid?

If you qualify for Medicaid, your costs will be covered. You won’t be responsible for premiums or other plan costs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What age does QDWI pay Medicare?

The QDWI program helps pay the Medicare Part A premium for certain individuals under age 65 who don’t qualify for premium-free Part A.