Among other benefits, the Affordable Care Act (ACA) helps individuals on Medicare to save money with preventative care and brand-name drugs. Starting in January 2014, Medicare began covering many preventative services with no out-of-pocket expense.

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care.

What does the Affordable Care Act (ACA) mean for You?

The ACA also prevents new physician-owned hospitals from contracting with Medicare, and prohibits current physician-owned hospitals (that work with Medicare) from expanding.

Does ACA (Obamacare) affect Medicare coverage?

If you’ve been asking these questions about ACA (Obamacare) and Medicare, this post is for you. Confusion over Medicare and the Affordable Care Act (ACA) has been common among beneficiaries since the passage of the legislation. If you have an ACA plan through the Marketplace, you can keep that plan until your Medicare coverage starts.

Will the ACA’s reforms make Medicare more viable?

While the ACA’s reforms hold significant potential to make Medicare more viable and successful in the future, Medicare’s long-term fiscal solvency, complexity, and gaps in coverage remain unaddressed. As millions of Americans age into Medicare, federal budgetary pressures will inevitably focus attention on more fundamental reform of the program.

Is Medicare Part A covered under Affordable Care Act?

Get A Quote. In many instances, Medicare coverage meets the Affordable Care Act’s requirement that all Americans have health insurance. For example, those who have Medicare Part A (hospital insurance) are considered covered under the law and don’t need to purchase a Marketplace plan or other additional coverage.

What is the difference between Form 1095-B and 1095-C?

Form 1095-B – Individuals who have health coverage outside of the Marketplace will get this form (except for employees of applicable large employers that provide self-insured coverage, who will receive Form 1095-C instead). Form 1095-C - Individuals who work full-time for applicable large employers will get this form.

What is the difference between 1095-A and 1095-B?

If you have a 1095-B, a form titled Health Coverage, the IRS does NOT need any details from this form. You can keep any 1095-B forms you get from your health insurance company or the government agency that sponsors your plan for your records. The form 1095-A is for Obamacare.

What is a 1095-B form used for?

The Form 1095-B is used as proof of Minimum Essential Coverage (MEC) when filing your state and/or federal taxes. It should be kept with your other tax information in the event the Internal Revenue Service (IRS) or Franchise Tax Board (FTB) requires you to provide it as proof of your health care coverage.

How does Medicare work with ACA?

The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare.

Do you need a 1095 if you are on Medicare?

coverage is considered to be qualifying health coverage under the Affordable Care Act. If you have Part A, you can ask Medicare to send you an IRS Form 1095-B. In general, you don't need this form to file your federal taxes.

Is ACA 1095-B?

Form 1095-B is an Internal Revenue Service (IRS) form that may be sent to taxpayers who receive minimum essential health insurance coverage as defined by the Affordable Care Act (ACA).

What happens if I don't file my 1095-B?

Good news the 1095-B does not need to be filed! You don't need your form 1095-B to file your tax return. TurboTax will ask you questions about your health coverage but your form 1095-B isn't needed. Just keep the form for your files.

Do I need a 1095-B to file my taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

Who receives a Form 1095-B?

Those who have health insurance that meets the standards of the law may receive Form 1095-B directly from their health care insurer and from employers who have less than 50 full-time employees (small businesses).

Did the ACA expand Medicare?

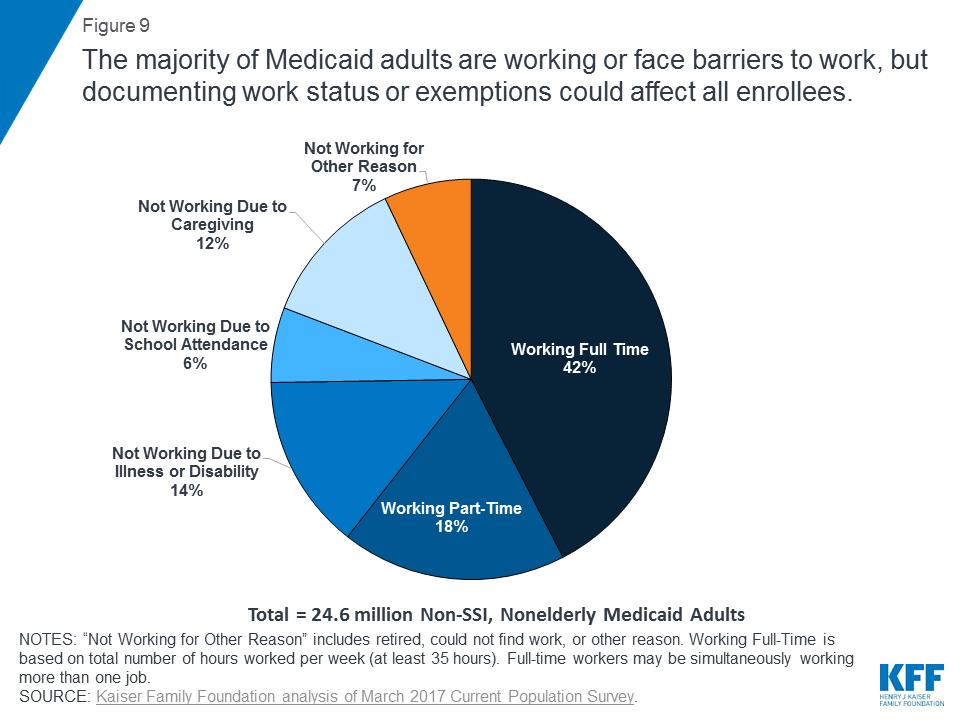

The Affordable Care Act's (ACA) Medicaid expansion expanded Medicaid coverage to nearly all adults with incomes up to 138% of the Federal Poverty Level ($17,774 for an individual in 2021) and provided states with an enhanced federal matching rate (FMAP) for their expansion populations.

How would ACA repeal affect Medicare beneficiaries?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

Is Medicare considered ACA?

Are Obamacare and Medicare the Same Thing? Medicare and Obamacare are very different things. Compare Medicare and the Affordable Care Act (ACA) to learn the differences. The Affordable Care Act (ACA, also commonly called Obamacare) and Medicare are two very different concepts.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long will the Medicare Trust fund be extended?

The Affordable Care Act Ensures the Protection of Medicare for Future Years. Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

When does Medicare Part B start?

Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

When did the ACA open enrollment start?

The first open enrollment on the new health insurance Marketplaces created by the Affordable Care Act began October 1st, 2013 and ran until March 31st, 2014. Next year's open enrollment is November 15 th, 2015 to January 15 th, 2016.

Do you have to visit the Marketplace for Medicare?

People with Medicare do not need to visit the Marketplace — their Medicare coverage, whether they receive it through a Medicare Advantage plan or Original Medicare, isn’t changing because of the Affordable Care Act and the Marketplaces.

What is the impact of the Affordable Care Act on Medicare?

Among other benefits, the Affordable Care Act (ACA) helps individuals on Medicare to save money with preventative care and brand-name drugs. Starting in January 2014, Medicare began covering many preventative services with no out-of-pocket expense. This coverage includes an annual wellness visit ...

What is the Medicare donut hole?

This refers to a temporary limit on prescription drug coverage, where the policy holder needs to pay a higher percentage of his or her medications after reaching this limit.

When will Medicare Part D donut hole close?

Medicare recipients will see some changes in their out-of-pocket expenses as the Medicare Part D donut hole is incrementally lowered to finally “close” in the year 2020. At that time, Medicare recipients will pay 25 percent of the drug cost.

Is Medicare considered a dual insurance?

If you are “Dual Eligible,” generally Medicare would be billed first or considered your primary insurance, and then Medicaid would be billed for the balance acting as a secondary insurance. Please contact your local Department of Human Resources to determine if you qualify.

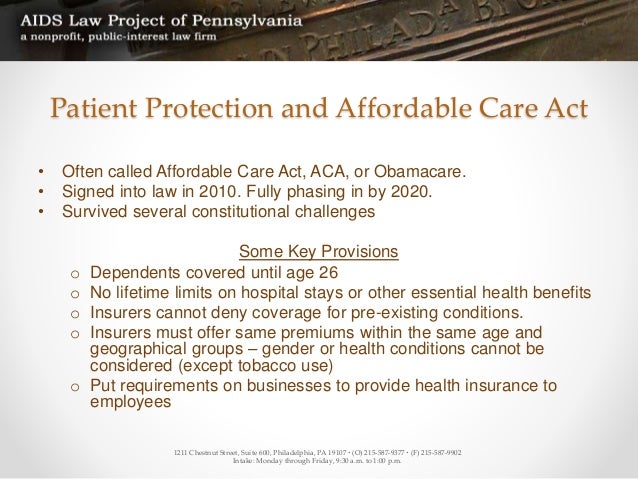

What is the ACA 111-148?

The Patient Protection and Affordable Care Act (ACA, P.L. 111-148, as amended) made a number of changes to Medicaid. Perhaps the most widely discussed is the expansion of eligibility to adults with incomes up to 133 percent of the federal poverty level (FPL). 1

What is the minimum FPL for Medicaid?

The ACA also aligned states’ minimum Medicaid eligibility threshold for children at 133 percent FPL, requiring some states to shift older children from separate CHIP programs into Medicaid. Prior to the ACA, the mandatory eligibility levels for children in Medicaid differed by age: States were required to cover infants and children between ...

Did Sebelius expand Medicaid?

Sebelius effectively made the Medicaid expansion an option. To date, almost three-quarters of states have opted to expand. Beyond the Medicaid expansion, the ACA sought to increase the number of Americans with health insurance by providing new premium tax credits for the purchase of private health insurance and made a number ...

Does the ACA require a single application for Medicaid?

The ACA also included provisions to streamline eligibility, enrollment, and renewal processes, for example, by requiring a single application for Medicaid, CHIP, and subsidized exchange coverage. In part due to these changes, enrollment and spending in Medicaid has increased in all states, regardless of whether the state expanded coverage ...

How long do you have to wait to cancel ACA?

Don’t be tempted to gamble with your health by cancelling your ACA plan early. If you have more than a 63-day window between when your ACA plan ends and your Medicare begins, then when you enroll in a Medigap plan, they can impose a waiting period for pre-existing conditions.

What happens if you don't enroll in Medicare at 65?

Even worse, if you fail to enroll in Medicare at age 65 because you choose to keep your Obamacare plan instead, you will later owe a Part B late enrollment penalty that will stay with you for as long as you remain enrolled in Medicare. It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65).

How much is the penalty for Medicare if you wait two years?

It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65). So if you waited two years, your would pay a 20% higher monthly premium for Part B for the rest of your life. This can be disappointing news if you’ve been getting your ACA plan very inexpensively due to a subsidy.

What happens if you miss your window to switch to Medicare?

If you miss your window to switch to Medicare, the federal government will catch up to you soon enough. When it finds that you should have moved to Medicare at age 65, it will assess you a fine to make you pay back any subsidy dollars that you have received toward your ACA coverage since you turn 65.

Does ACA cover Medicare?

Your ACA coverage was never meant to replace Medicare. If you do not sign up for Medicare during your Initial Enrollment Period, you will be subject to substantial penalties when you later enroll in Medicare.

Can you cancel ACA coverage once you join Medicare?

So if you are enrolled in either an ACA plan or a short term medical plan, you’ll likely want to cancel that coverage once you join Medicare. Many people use short-term health insurance plans to bridge the gap between when their employer coverage ends and when they turn 65 and become eligible for Medicare.

Can I cancel my ACA plan if I am on Medicare?

If I am on Medicare, do I need to do anything to avoid an ACA penalty? Once you enroll in Medicare, you should simply cancel your ACA plan. You do not need both coverages. Cancellation is not automatic, though, so you need to actively cancel your ACA coverage by calling the Healthcare Exchange and requesting cancellations.

When does Medicare coverage take effect?

If you complete the enrollment process during the three months prior to your 65th birthday, your Medicare coverage takes effect the first of the month you turn 65 ( unless your birthday is the first of the month ). Your premium subsidy eligibility continues through the last day of the month prior to the month you turn 65.

When will Medicare be sent to you?

Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, includes the month you turn 65, and then continues for another three months. (Note that you’ll need to enroll during the months prior to your birth month in order to have coverage that takes effect the month you turn 65.

What happens if you don't sign up for Medicare?

And if you keep your individual market exchange plan and don’t sign up for Medicare when you first become eligible, you’ll have to pay higher Medicare Part B premiums for the rest of your life, once you do enroll in Medicare, due to the late enrollment penalty.

How long does it take to get Medicare if you are not receiving Social Security?

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll have a seven-month window during which you can enroll in Medicare, which you’ll do through the Social Security Administration. Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, ...

When does Medicare subsidy end?

If you enroll in Medicare during the final three months of your initial enrollment period, your premium subsidy will likely end before your Part B coverage begins, although your Part A coverage should be backdated to the month you turned 65.

When will Medicare be enrolled in Social Security?

Here are the details: If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you’ll automatically be enrolled in Medicare with an effective date of the first of the month that you turn 65. As is the case for people who enroll prior to the month they turn 65, premium subsidy eligibility ends on ...

When will Medicare be sent out to my 65 year old?

If you’re already receiving Social Security or Railroad Retirement benefits, the government will automatically enroll you in Medicare Part A the month you turn 65, with your Medicare card arriving in the mail about three months before you turn 65. If you’re not yet receiving Social Security or Railroad Retirement benefits, ...