The answer is Medicare coverage can be retroactive up to 6 months, if you sign up after your 65th birthday. The rule is if you sign up after turning 65, the Medicare coverage will be retroactive to the lessor of 1) the first day of your birthday month or 2) 6 months. Of course the government makes such a cockamamie rule, but oh well.

Is Medicare retroactive for 6 months?

The Medicare website mentions the 6 months of retroactive coverage but is very vague as to how it applies. The answer is Medicare coverage can be retroactive up to 6 months, if you sign up after your 65th birthday.

Did the Social Security Administration offer me 6 months of retroactive benefits?

“The Social Security Administration offered to pay me 6 months of retroactive benefits as lump sum,” the reader explained in the email. “I didn’t expect that generosity coming from a government agency!”

When does Medicare start retroactive coverage for birthdays?

Here are some examples for someone whose birthday is March 30th: 1 Medicare starts June 1st – retroactive coverage until March 1st (birthday month). 2 Medicare starts September 1st – retroactive coverage until March 1st (birthday month). 3 Medicare starts December 1st – retroactive coverage until June 1st (6 months).

What is Medicare Part a retroactive coverage and HSA?

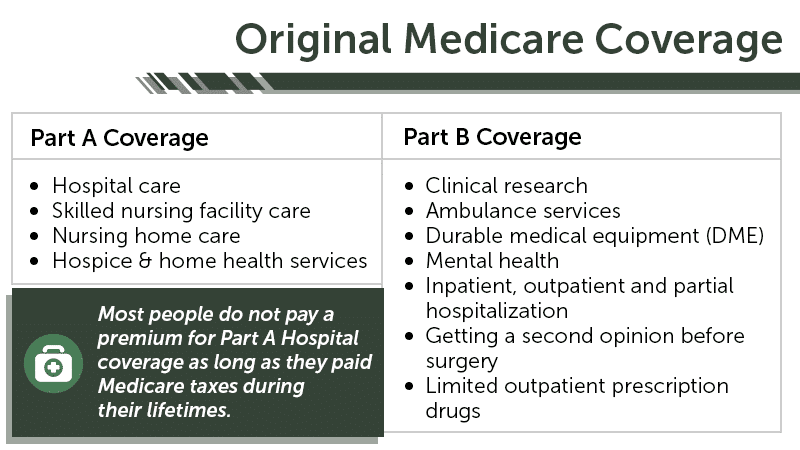

Medicare Part A Retroactive Coverage and HSA’s. Medicare Part A is a government administered health insurance plan generally for people aged 65 and older. It is a form of hospital insurance that covers inpatient hospital care, skilled nursing facilities, and other types of health care services.

Why is Medicare backdated 6 months?

Robertson: Beginning in 1983, the Department of Health and Human Services started backdating Medicare coverage retroactively for six months to ensure that people coming off of employer health coverage would not inadvertently find themselves uninsured while transitioning to Medicare.

What is retroactive Medicare?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. with an effective date in the past (retroactive). You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

Does Medicare Part B pay retroactively?

Social Security also offers you Part B coverage retroactively if you want it—while making it clear that, if you accept, you must pay backdated Part B premiums for the time period in question, which can amount to hundreds or even thousands of dollars.

Can you opt out of retroactive Medicare coverage?

Can you opt out of Retroactive Medicare coverage? You may be able to opt out of retroactive Medicare coverage by contacting the Social Security Administration.

When you enroll in Medicare Part A you receive up to six months of retroactive coverage?

Part A, and you can enroll in Part A at any time after you're first eligible for Medicare. Your Part A coverage will go back (retroactively) 6 months from when you sign up (but no earlier than the first month you are eligible for Medicare).

What is retroactive reimbursement of Medicare premium?

If you are enrolled in the QI program, you may receive up to three months of retroactive reimbursement for Part B premiums deducted from your Social Security check. Note that you can only be reimbursed for premiums paid up to three months before your MSP effective date, and within the same year of that effective date.

Is Medicare Part B retroactive to the application date?

This process allows individuals to request immediate or retroactive enrollment into Part B and the elimination of late enrollment penalties from the Social Security Administration (SSA).

Does Medicare coverage start the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

How much Medicare is taken out of your Social Security check?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.

Why was my Medicare Part A backdated?

If you enroll in Social Security retirement benefits or Medicare benefits for the first time, and you're beyond your Initial Enrollment Period (IEP) in Medicare, your Part A benefits will be backdated up to 6 months from the month you initiate the enrollment, and you might incur tax penalties associated with excess HSA ...

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How many months in advance should you apply for Social Security benefits?

four monthsYou can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

How long is Medicare retroactive?

The Medicare website mentions the 6 months of retroactive coverage but is very vague as to how it applies. The answer is Medicare coverage can be retroactive up to 6 months, if you sign up after your 65th birthday. The rule is if you sign up after turning 65, the Medicare coverage will be retroactive to the lessor of 1) the first day of your birthday month or 2) 6 months. Of course the government makes such a cockamamie rule, but oh well. Here are some examples for someone whose birthday is March 30th: 1 Medicare starts June 1st – retroactive coverage until March 1st (birthday month) 2 Medicare starts September 1st – retroactive coverage until March 1st (birthday month) 3 Medicare starts December 1st – retroactive coverage until June 1st (6 months)

How long does Medicare coverage last after 65?

It states that if you sign up for Medicare Part A after you turn 65, the coverage will retroactively be applied up to 6 months into the past.

How long after a HSA is disqualified can you be retroactively disqualified?

In essence, you can be following the rules as an HSA eligible individual, and 6 months after the fact be retroactively disqualified (made HSA ineligible) due to Medicare Part A. If you are familiar at all with how HSA tax Form 8889 works, you know that this can pose some serious risks to your financial well being.

When did Paul get Medicare Part A?

Because Paul was 67 when he signed up for Medicare Part A on May 1st, 2017, the coverage retroactively applied 6 months prior to November 1st, 2016. This means that he was not HSA eligible from November 2016 – April 2017.

When does Medicare Part A coverage go into effect?

1) The first day of the month you turn 65. 2) The month before you turn 65 (if your birthday is on the 1st of the month). After turning 65, you’re coverage will be in effect (retroactively) the lessor of 1) 6 months or 2) your 65th birthday. It is that last clause that can really affect HSA holders. It states that if you sign up for Medicare Part A ...

Can Medicare Part A be retroactive?

Given the fact that Medicare Part A can retroactively disqualify you from being HSA eligible , it is best to prepare for such an event and plan accordingly. This involves a combination of 1) knowing if you are at risk for retroactive coverage and 2) planning your preceding and current HSA actions appropriately.

Does Medicare Part A end HSA?

While this not only ends your HSA eligibility (see next section), it may affect your HSA eligibility in previous months.

How long is Medicare Part A backdated?

This would work the same way when he finally enrolls in Medicare Part A and Part B in the future. His Medicare Part A will be backdated 6-months from the month he submits the enrollment to Social Security.

Is HSA deductible for Medicare?

Well, it depends.If you’re like many employees enrolled in a high deductible health plan (HDHP) that includes a Health Savings Account (HSA), you could run into a big surprise when Medicare-eligible. Here’s the deal...If you enroll in Social Security retirement benefits or Medicare benefits for the first time, and you’re beyond your Initial ...

How many extensions of time triggers are there for Medicare?

If the beneficiary and the provider or supplier is notified on different days about the beneficiary’s retroactive Medicare entitlement, there will be two extensions of time triggers. One extension of time trigger is when the beneficiary is first notified about the beneficiary’s retroactive Medicare entitlement and the other extension ...

Can a CMS claim be extended?

The time for filing a claim will be extended if CMS or one of its contractors determines that a failure to meet the filing deadline is caused by all of the following conditions:#N#(a) At the time the service was furnished the beneficiary was not entitled to Medicare.

Can a provider furnish services to an individual who was not entitled to Medicare?

Thus, a provider or supplier may have furnished services to an individual who was not entitled to Medicare. More than a year later, the individual receives notification from SSA that he or she is entitled to Medicare benefits retroactive to or before the date he or she received services from the provider or supplier.

Social Security & Medicare Questions: Retroactive Benefits

Q: Can you explain the rules about working after starting Social Security, and retroactive benefits? My older brother received 6 months in retroactive benefits when he filed for benefits after turning 66. I turn 66, my full retirement age in August. I normally earn about $46,000.

Emergency Senior Stimulus

The Senior Citizens League will collect both online and print petitions and bring a collective voice to members of Congress urging them to issue a $1,400.00 stimulus check to Social Security recipients. Sign the Emergency Senior Stimulus Petition today!

William G. (Bill) Stuart Follow

When you enroll in Medicare Part A, your coverage may start retroactively. Here's what you need to know about this confusing topic if you're funding a Health Savings Account.

William G. (Bill) Stuart

A provision in Medicare coverage understood by few people can compromise your eligibility to fund a Health Savings Account up to six months before your Medicare enrollment becomes effective. Learn more about how to diagnose and address this issue in this week's edition of HSA Wednesday Wisdom.

William G. (Bill) Stuart

It’s something that few financial advisors and CPAs understand. Medicare is its own oool of sharks. Few people from other fields venture into the deep end and come out alive. Thank goodness you did!

Thomas Wright

I appreciate your efforts, Bill. Couldn't agree more. The growth of the age 65+ workforce- combined with their expanded HSA participation- has collided with Medicare's outdated, illogical, and inflexible enrollment process. And it's a big mess...

William G. (Bill) Stuart

Thank you, Tom. Trying to spread the word on this oft-misunderstood (or not understood) aspect of the retro rule. It never affected anyone’s financial planning before Health Savings Accounts. But Niw it does.

Roy Ramthun

We have got to get the Medicare Handbook fixed. It is very misleading!

The Basics Of Social Security Retirement Benefits

To be entitled to a Social Security Retirement Benefit, an individual must generally earn 40 or more Social Security work history “credits”. These credits are earned quarterly, and thus, it takes 10 or more years of total work for most individuals to earn their 40 quarterly credits to qualify to receive a Retirement Benefit.

The Rules For Retroactively Claiming Benefits Change At Full Retirement Age

When most people think about “Full Retirement Age,” the first thing that typically comes to mind is the age at which a full Social Security benefit can be received. While that is certainly true, an individual’s FRA is also meaningful because it marks the time when many of the rules surrounding Social Security benefits change.

How long can you get a retroactive pension?

For retirement benefit claims, those who've reached full retirement age have the ability to ask for benefits to be paid for up to six months on a retroactive basis. However, retroactive payments can only be made back to the month in which you reach full retirement age.

How does Social Security work?

How Social Security generally works. Usually, when you claim your Social Security, you start receiving monthly payments one at a time. The earlier you claim your benefits, the smaller your check will be. Waiting gives you a larger check, but you'll also forego the benefits you could have received during the time that you waited.

Can you get Social Security retroactively?

Under the program, you might be entitled to receive monthly benefits retroactively for a period going back from when you filed your application with the Social Security Administration.

Is Social Security retroactive money free?

However, they're definitely not free money. By understanding what you give up by taking retroactive benefits, you'll be able to make a more fully informed choice that reflects what you really want and need from Social Security. The Motley Fool has a disclosure policy. Prev. 1.

Is it worth giving up $60 a month?

In some cases, giving up $60 a month for the rest of your life might be worth it to get a $9,000 lump sum. But when you think about it, retroactive benefits rarely make sense. After all, in the example above, the worker could have just filed at full retirement age and gotten those six $1,500 payments on a monthly basis. In effect, the worker gave the government an interest-free loan to hold on to the early payments for several extra months.

How long can you get a full 6 month retroactive benefit?

If your full retirement age is 66 and you file at 66 and 6 months or beyond, you can get the full 6 months of retroactive benefits. If you file at 66 and 3 months, you’ll only be eligible for 3 months of retroactive payments because payments can’t be paid for months before your full retirement age.

How long can you receive Social Security benefits?

The next critical concept to understand is that the Social Security Administration rules state that anyone who files for retirement benefits after full retirement age can be paid up to 6 months of retroactive benefits… but in no case can you ever receive payments for months that occurred before your full retirement age.

Can you get lump sum retirement benefits at full retirement age?

The next thing to know is that a lump sum retirement benefit can only be paid to individuals who have reached full retirement age.

Can you get retroactive Social Security?

There are some cases where you can receive retroactive Social Security benefits, usually delivered via a one-time lump sum payment when you file for your retirement benefit. Overall, this can sound like a great deal. It might feel like a little extra, and the lump sum means you can do what you want with that money right away instead ...

Does taking lump sums lower your monthly benefits?

The first thing to understand is that taking the lump sum lowers the base amount of benefits that the annual cost of living adjustment is applied to moving forward. This means that not only is your monthly benefit lower, it doesn’t grow as fast as it would from the compounding effect of the increases.

Do you have to take lump sum when filing for retirement?

Second and more importantly, taking the lump sum when you go to file for your retirement benefits will lower the amount of eventual survivor benefits if you’re the higher earner. This might be very important to consider depending on your financial and health situations.

Definition

Examples

- The Medicare website mentions the 6 months of retroactive coverage but is very vague as to how it applies. The answer is Medicare coverage can be retroactive up to 6 months, if you sign up after your 65th birthday. The rule is if you sign up after turning 65, the Medicare coverage will be retroactive to the lessor of 1) the first day of your birthd...

Retirement

- On May 1st, 2017, Paul plays the last show of his final farewell tour and decides to officially retire. He takes some of the proceeds from the show and contributes 4 months worth of a contribution to his HSA for 2017. No longer working, Social Security seems like a good deal so he signs up to start receiving benefits. This also enrolls him in Medicare Part A, which seems like free governm…

Controversy

- The next year, Paul gets a call from his tax accountant telling him his HSA Form 8889 is a mess and he may owe penalties and taxes. Because Paul was 67 when he signed up for Medicare Part A on May 1st, 2017, the coverage retroactively applied 6 months prior to November 1st, 2016. This means that he was not HSA eligible from November 2016 April 2017. His accountant informs hi…

Preparation

- Given the fact that Medicare Part A can retroactively disqualify you from being HSA eligible, it is best to prepare for such an event and plan accordingly. This involves a combination of 1) knowing if you are at risk for retroactive coverage and 2) planning your preceding and current HSA actions appropriately. As such, we recommend the following:

Prevention

- If you are in your 60s, you should be thinking about when you will sign up for Medicare Part A coverage, keeping in mind that this is also triggered by beginning Social Security benefits. If this occurs when you are age 65 and 1/2 or older, you are in the danger zone of having retroactive coverage applied. If this is the case, you will want to work backwards 6 months to plan your HS…

Risks

- Retroactive Medicare Part A coverage wrecks the most havoc on HSA contributions that contain a Testing Period. These include the use of the Last Month Rule (to contribute more than normal in a partial coverage year) or the Qualified Funding Distribution (contribute to your HSA from an IRA). Both of these contributions require that you maintain HSA coverage for a given amount of time k…