What does Medicare Supplement insurance cover?

- Pays Part A Hospital copayment ($371 per day for 61-90 days and $742 per day for 91-150 days in 2021)

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment (usually 20% of the Medicare approved amount)

Full Answer

Do I really need a Medicare supplement?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. These costs can include: Your Medicare deductibles ; Your coinsurance ; Hospital costs after you run out of Medicare-covered days

What are the top 5 Medicare supplement plans?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. Get help with Part A & Part B costs If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

Which Medicare supplement plan should I buy?

Sep 13, 2019 · Medicare Supplement (Medigap) plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. Medicare Supplement plans are sold by private insurance companies, but they have standard benefits designed by the …

What is the average cost of Medicare supplement insurance?

Dec 17, 2020 · Some Medicare Supplements require that you pay a copay for certain healthcare services. On Supplement Plan N for example, the copay amount is about $20 to see your primary care doctor or specialist. The copay for emergency room visits that do not result in an inpatient hospital admission is $50.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

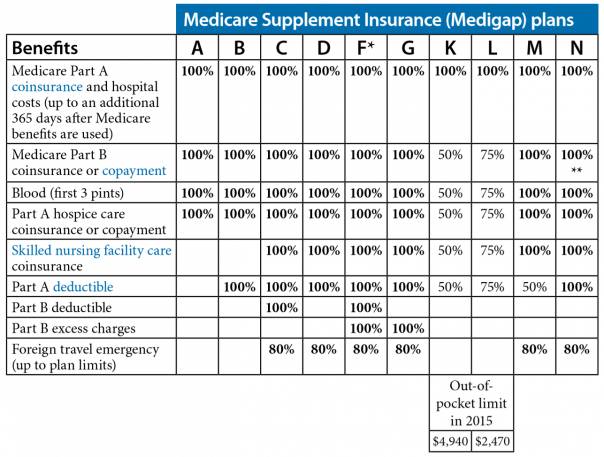

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

Medicare Crossover

Crossover refers to the process by which Medicare automatically forwards your Supplement insurance carrier the portion of your claim that it is responsible for paying. If you don’t know how Medicare Supplements work you can read about them here.

Will you get a bill?

Medicare has guidelines in place that require healthcare providers to allow time for the crossover process to take place automatically.

Items for Which You Might Receive a Bill

After Medicare and your Supplement pay their portion of your claims they are responsible for, you could receive a bill for the following:

Deductibles

Most Medicare Supplements do not pay your annual Part B deductible ($198 in 2020). This amount is updated every year here.

Copayments

Some Medicare Supplements require that you pay a copay for certain healthcare services.

Summary

Many of our clients like Medicare Supplements as additional coverage because they do not have to be involved in the claims process.

About the Author: Eugene Marchenko

Eugene obtained his license in 2010 while working in the banking industry. After the decline of the economy in 2008 and countless conversations with folks about ways to keep their homes, Eugene realized it is time to focus on an industry that actually helps people.

How old do you have to be to get Medicare?

You must be enrolled in Original Medicare Part A and Part B, and most plans require you to be 65 years of age or older. If you are under 65 years old and receive Medicare benefits, you can check the Medigap plans sold in your state to see if any are available for you.

Does Medicare have a monthly premium?

While Original Medicare does offer coverage for an array of different medical services and supplies, the costs associated with them often include a monthly or annual premium and an annual deductible.

Can you cancel Medicare Supplement?

Medicare Supplement policies cannot be canceled by the providing company. This means that as long as you continue to pay your premiums, the insurance company is not able to cancel your insurance plan regardless of your current state of health or the usage of your plan. Related articles: What is Medicare Parts A & B.

Does Medicare help offset coinsurance?

Medigap plans can help offset these costs, making your healthcare more affordable and giving you more access to services you might otherwise be unable to afford. Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments.

Does Medicare Supplement Plan cover emergency medical?

There might be items and services that a Medicare Supplement plan may cover that Medicare doesn’t typically approve for coverage. An example is emergency medical treatment outside the country (80% of costs up to plan limits). However, Medicare might need to approve the treatment even if it doesn’t pay for it.

Does Medicare Supplement Insurance cover copayments?

Summary: With most of its benefits, Medicare Supplement insurance depends on Medicare’s approval in order to help pay Medicare copayments and coinsurance. If Medicare doesn’t cover it, in most cases, neither will Medicare Supplement insurance.

Does Medicare Supplement pay for deductibles?

Medicare Supplement insurance typically helps pay for Medicare Part A and Part B coinsurance and copayments. It also may help pay Original Medicare deductibles and certain other out-of-pocket costs . Medicare Supplement insurance only works alongside Original Medicare, Part A and Part B. As the name implies, it’s a supplement – it adds ...

Does Medicare Supplement cover hospital stays?

If you have a medical service that’s not Medicare-approved, a Medicare Supplement insurance plan generally won’t cover it. For example, Medicare Supplement plans generally cover Medicare Part A coinsurance/copayments for inpatient hospital stays. Suppose you have a hospital stay for a procedure that’s not covered or approved by Medicare.