Full Answer

How much does a Medicare supplement insurance plan cost?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. These costs can include: Your Medicare deductibles ; Your coinsurance ; Hospital costs after you run out of Medicare-covered days

What are the benefits of a Medicare supplement plan?

Sep 13, 2019 · All Medicare Supplement plans typically cover: Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted; Some or all of your Medicare Part B coinsurance; Some or all of your Part A hospice coinsurance; Some or all of your first three pints of blood; Medicare Supplement Plan A is the …

Should you buy supplemental health insurance?

What Does A Medicare Supplement Plan Cover? Medicare Supplement Plans work differently from most of the other health insurance plans. With them, health benefits are not covered. However, these plans help in covering costs that you are responsible for with Original Medicare.

Does Medicare pay primary insurance deductible?

After Medicare Part A and Part B pay their share, Medicare Supplement plans cover some additional costs that would typically be the beneficiary’s responsibility. Medicare Part A and Medicare Part B have deductibles, coinsurance, and copays for which beneficiaries are responsible. Medicare Supplement plans help cover these costs.

What must be included in a Medicare Supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things:Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up.Medicare Part B copayment or coinsurance expenses.The first 3 pints of blood used in a medical procedure.More items...

What does Medicare Supplement plan I cover?

Plan I includes the Basic Benefits, Pays the Part A deductible and Skilled Nursing Coinsurance. Plan I Includes Foreign Travel Emergency benefits. Plan I includes at home recovery.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What Medigap plan covers the most?

Plan FPlan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.Sep 25, 2021

Does Medicare pay 100 percent of hospital bills?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

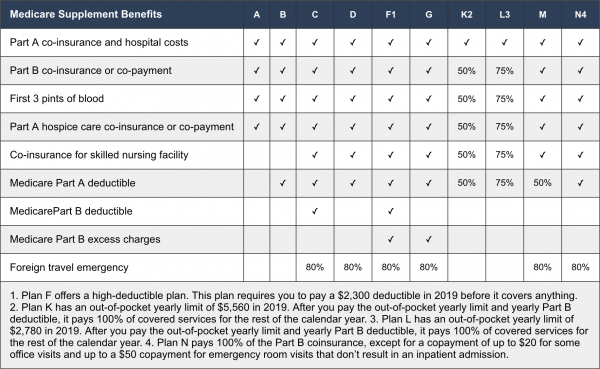

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Can I see a doctor outside of my network?

No network rules. You can see any doctor that accepts Medicare. Some plans won't cover care you get outside their network. Medicare supplement plans don't include Part D prescription drug coverage. So if you're thinking about buying one of these plans, you'll want to make sure you buy a separate Part D plan.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

How old do you have to be to get Medicare Supplement?

Anyone can get a Medicare supplement plan if they need one as long as they are aged 65 years and above. However, if you are nearing the age of 65 or are almost retiring, you might be interested in the available Medicare enrollment options. Usually, the standard coverage beneficiaries receive Medicare Part A and Part B.

What is covered by Part A and Part B?

Part A deals with coverage for hospitals, hospice care, and skilled nursing facilities. Part B, on the other hand, includes doctor visits, outpatient therapy , medical equipment, and ambulances as well. It's worth noting that both Parts A and B have deductibles and co-payments/coinsurance.

What is a skilled nursing facility coinsurance?

Skilled nursing facility care coinsurance. Medicare deductibles. Out of pocket limit. Any hospice care coinsurance or co-payment. Hospital costs that you may incur after running out of Medicare-covered days. The above are some of the situations that a Medicare supplement plan comes in handy.

What is Plan F?

Usually, Plan F represents a high-deductible option, and its enrollees are expected to pay Medicare-covered costs up to $2,240. That is before their Medicare supplement insurance can step in to pay for anything.

What is the difference between Plan M and Plan N?

Plan N: it has the same coverage as Plan A with a few exceptions. For instance, it includes foreign travel exchange up to 80 percent and fully covers Part B coinsurance or co-payments.

When will Medicare stop paying for Plan F?

That is before their Medicare supplement insurance can step in to pay for anything. Just like Plan C, Plan F will be put to a stop as of January 1, 2020. Signing up from next year will be impossible. Plan G: it is like a replica of Plan F except for Part B deductible coverage.

Can you renew Medicare Supplements for life?

You can renew Medicare supplements for life as long as you pay the premiums. Here there is no such thing as lifetime maximums, and the policy holder cannot be canceled due to high-dollar or frequent claims. The benefits of the plan are "locked," which means they never change throughout the policy's life.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

When did Medicare discontinue Plan J?

Medicare Supplement Plan J. Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have ...

What is the first step to Medicare?

Once eligible for Medicare coverage, the first step is signing up for Original Medicare, which includes Part A, for hospital stays and inpatient care, and Part B, for visits to the doctor’s office and outpatient care.

What caused the demise of Plan J?

Changes in Original Medicare caused the demise of Plan J. Once Original Medicare began to cover wellness visits, home health services and introduced Part D for prescription drug coverage, the appeal of Plan J declined. However, the plan is grandfathered for those already enrolled.

Does Medicare leave a shortfall?

Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits. This is why many people decide to supplement their Medicare coverage with policies from Medicare-approved private insurance carriers.

What Do Medicare Supplement Plans Cover?

Medigap plans cover all or some of the following costs, with a few exceptions:

What Do Medicare Supplement Plans Cost?

The costs of Medicare Supplement plans vary by state and by insurance company. The main factors that determine cost are your location and age. Keep in mind that a policy that looks less expensive at age 65 could become the most costly at age 85, so ask the insurance company how they set their premium pricing.

How to Apply for a Medicare Supplement Plan

The best time to apply for a Medicare Supplement plan is during your six-month open enrollment period. Open enrollment begins during the first month you’re 65 and enrolled in Medicare Part B. After this one-time open enrollment, you may not be able to purchase a Medigap plan or you might pay a lot more.