What does Medicare Supplement plan I cover?

Plan I includes the Basic Benefits, Pays the Part A deductible and Skilled Nursing Coinsurance. Plan I Includes Foreign Travel Emergency benefits. Plan I includes at home recovery.

What is the purpose of a Medicare Supplement policy?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What does a Medicare Supplement policy cover quizlet?

Medicare supplement, or Medigap, policies supplement Medicare's benefits by paying most deductibles and co-payments as well as some health care services that Medicare does not cover. They do not cover the cost of extended nursing home care. Victoria currently as a Medicare Advantage plan.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

Is there a deductible for Medicare supplemental insurance?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.Aug 6, 2021

Which of the following expenses are Medicare supplement policies not designed to cover?

Medicare Supplement Plan B covers basic benefits plus Medicare Part A deductible for hospitalization. Neither Medicare Supplement Plan A nor Plan B covers skilled nursing facility care or at-home recovery care.

What is typically covered by supplemental plans quizlet?

What is typically covered by supplemental plans: copayments, coinsurance and deductibles.

Which of the following does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the difference between Medicare Supplement and advantage?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

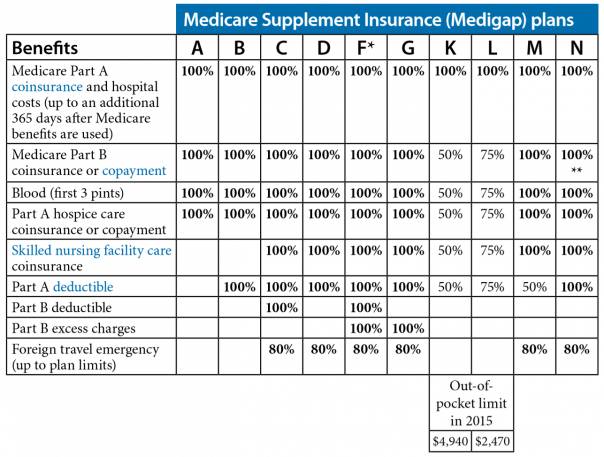

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

COVERAGE FROM ORIGINAL MEDICARE

Original Medicare, unlike Medicare Supplement insurance, offers basic coverage. It will help cover doctor’s visits, diagnostic testing, at-home physical therapy, and part-time skilled nursing care.

WHAT IS MEDICARE SUPPLEMENT INSURANCE?

Medicare Supplement insurance, which is also called Medigap, is a private insurance that you can purchase in addition to your regular Original Medicare coverage. It covers the copayments, coinsurance, and deductibles that Original Medicare may not, and it may pay for medical expenses you incurred if you traveled outside of the United States.

PURCHASING A MEDICARE SUPPLEMENT INSURANCE PLAN

When you want to purchase a Medicare Supplement insurance plan, you need to do it during open enrollment, which is six months from the first day of the month of your 65th birthday. You also need to make sure you signed up for Medicare Part B within those same six months.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as a Medigap plan, can help cover these expenses. Medigap insurance plans help people enrolled in Original Medicare pay out-of-pocket health insurance expenses, like copays, coinsurance, and deductibles.

How to decide what Medicare plan is right for you?

To decide what Medicare plans are right for you, you have to assess all of your costs and the amount of health care you expect you’ll need. Because both Advantage plans and Supplement Insurance come from private insurers, there are many plans with a wide range of costs and coverage options.

How long does it take to get a Medigap plan?

It is six months long and begins when you enroll in Medicare Part B. If you turn 65 and decide to enroll in Medicare Part A and B (Original Medicare), you will have six months from your enrollment date to buy a Medigap plan.

How much does Medigap cost?

The Medigap monthly premium might range from $21 to over $2,000 a month , depending on your state. (We’ll look at premium costs by state later.) The deductible ranges from $203 (the Part B deductible) to $2,370 for a high-deductible health plan (HDHP).

Why do people opt for Medicare Part C?

As such, some Medicare beneficiaries opt for Medicare Part C as a means to boost health coverage and potentially pare back expenses. Medigap plans are also only offered through private health insurers, but they generally don’t offer the extra health coverage like Part C plans do.

Which Medicare supplement is the most robust?

For example, compare Plan L from one Medigap insurance company with Plan L from another. Medigap Plan F is generally considered the most robust Medicare supplement insurance, since it covers the most out-of-pocket costs.

When will Medicare open enrollment start?

You can read more about Medicare open enrollment here. (Medicare open enrollment started October 15, 2020.) While you can cancel a Medicare supplement plan anytime by calling your insurer, keep in mind you might not be able to get a new Medigap policy if it is outside of Medigap open enrollment.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How many Medicare Supplement Plans are there?

There are 10 Medicare supplement plans available in most states. Each plan is designated by a letter and is called, for example, Medicare Supplement Plan A. Plan A: Coverage for Part B coinsurance or copayment, blood transfusions, and hospice care coinsurance or copayment. Plan B: Includes the same coverages as plan A, ...

What are the costs not covered by Medicare Supplement?

Typical medical costs not covered by a Medicare supplement plan include: Dental care, unless incurred during hospitalization. Eye exams.

How long does Medicare Supplement cover coinsurance?

Medicare Supplement Plans Coverage Explained. Medicare supplement plan benefits vary, but all provide coverage for coinsurance and hospital costs for up to one year after you’ve exhausted Medicare benefits. There are 10 Medicare supplement plans available in most states.

How long does Medicare cover hospital costs?

Fortunately, Medicare supplement plans are available from a variety of insurers to help pay for the following medical expenses: Coinsurance and hospital costs for up to one year after Medicare benefits are used up. Blood transfusions for up to three pints of blood. Hospice care coinsurance or copayment.

How long does Medicare cover mental health in Massachusetts?

In Massachusetts, core Medicare supplement coverage includes health care items and services under a health insurance plan, up to 60 days of inpatient time at a mental health hospital per calendar year, and various state-mandated benefits.

What is the out-of-pocket limit for Plan L?

Plan L does not pay for Part B deductibles or excess charges, or foreign travel medical expenses, and it has an out-of-pocket limit of $2,640. Plan M: Includes the same coverages as plan D, but does not cover 50 percent of Part A deductibles.

What is Medicare Part B?

Medicare Part B (medical insurance) deductible. Part B excess charge (the difference between the amount a doctor or health care provider can legally charge and the Medicare-approved amount) Medical costs incurred while traveling outside of the U.S. Out-of-pocket limit.

When did Medicare discontinue Plan J?

Medicare Supplement Plan J. Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have ...

What is the first step to Medicare?

Once eligible for Medicare coverage, the first step is signing up for Original Medicare, which includes Part A, for hospital stays and inpatient care, and Part B, for visits to the doctor’s office and outpatient care.

Does Medicare leave a shortfall?

Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits. This is why many people decide to supplement their Medicare coverage with policies from Medicare-approved private insurance carriers.

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

What is the deductible for diabetes without Plan G?

Without Plan G, your yearly cost for all that care would be the Part B deductible of $203 plus all the copays and coinsurance required for your diabetes supplies and care. With Plan G, once you pay the deductible, you are 100% covered for those costs; you never pay another dollar that year.

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is a Part B coinsurance?

Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion) Skilled nursing facility coinsurance. Foreign travel emergency care (up to plan limits of $50,000) The only thing that Plan G does not cover that Plan F does is the Part B deductible.