Most supplement plans pay for Medicare copayments, coinsurance, and deductibles. But the coverage may vary according to the plan you choose. Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the average cost of Medicare supplement plans?

This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015. This year 3,834 plans are available in total, and almost ninety percent include coverage to reduce the costs of prescription drugs.

What is the average cost of Medicare supplemental insurance?

The analysis reports the lowest and highest Medigap Plan G costs for men and women who ... its annual comparison of Plan G prices for Medicare Supplement insurance. Medicare Supplement is often ...

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

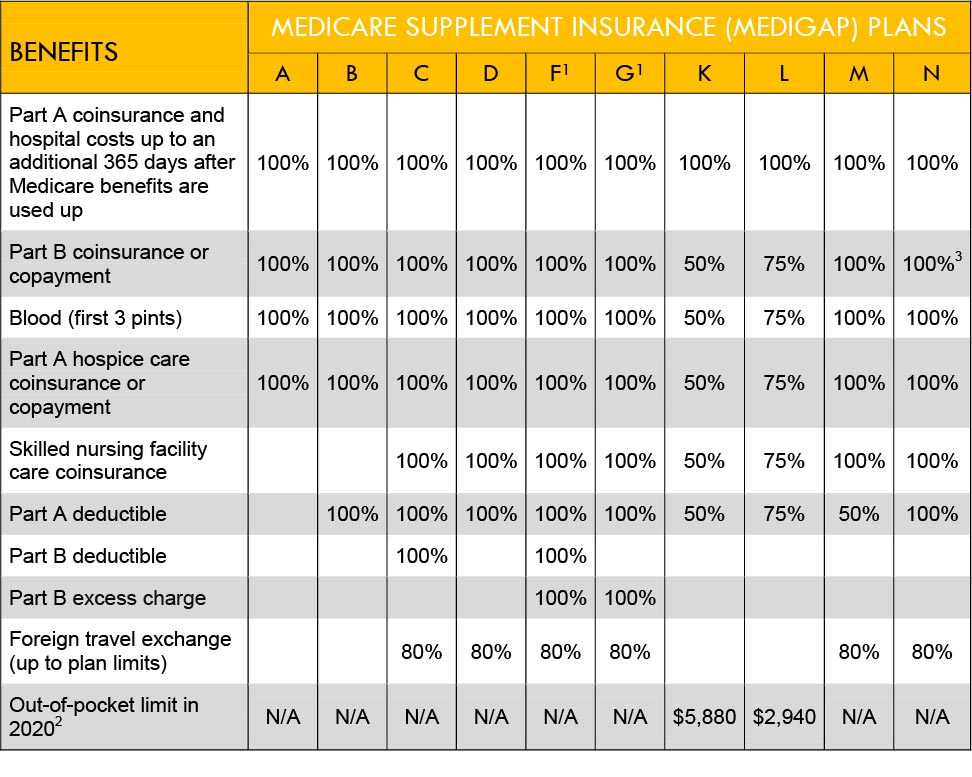

What does Medicare Supplement plan a cover?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

How is Medicare Supplement paid?

You pay your Medicare Supplement Insurance (Medigap) premium as directed by the insurance company that sold you the plan. Medicare Supplement insurance plans are sold by private insurance companies and may help you pay for out-of-pocket costs for services covered under Original Medicare (Part A and Part B).

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What does plan G pay for?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Do Medicare supplements pay the deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

Are Medicare Supplement premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What is Medicare Advantage?

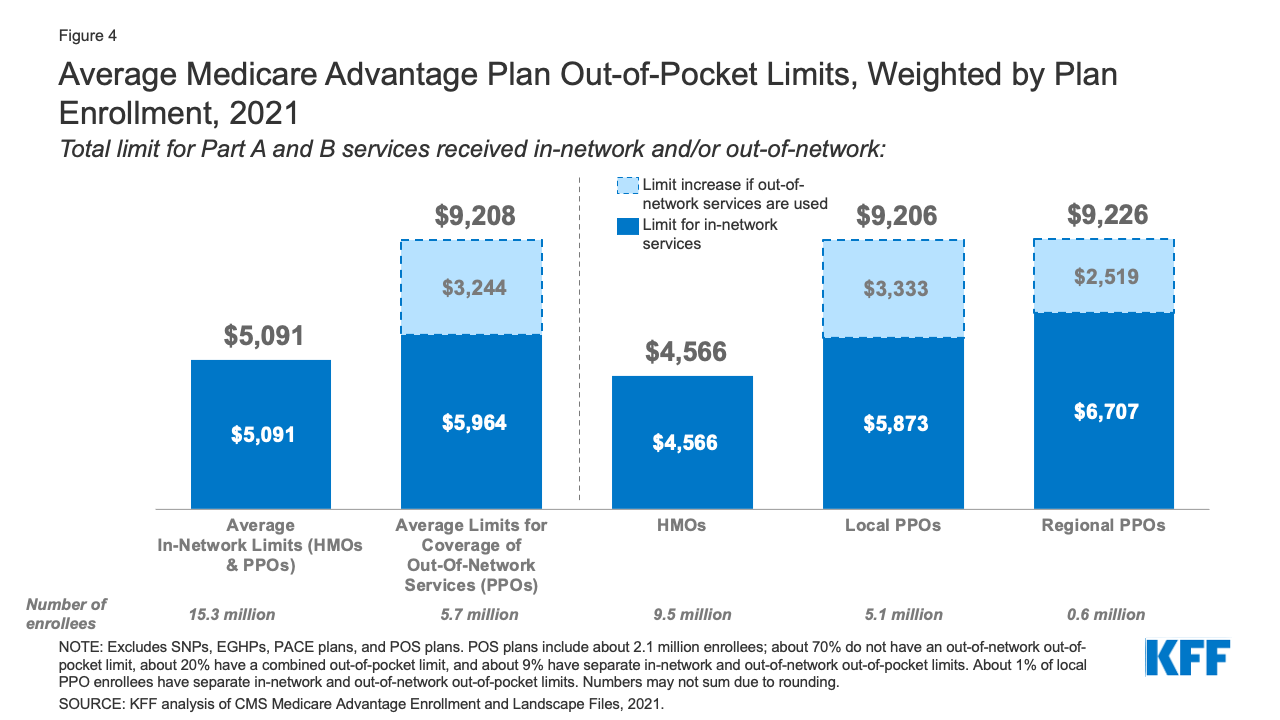

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is a Medicare Supplement policy?

A Medicare Supplement policy, also known as Medigap, helps pays for some coinsurance, copayments, and deductibles that are not included in your Original ...

How many people can you cover with Medicare Supplement?

If you are not sure where to send your Medigap premium payment, contact your insurance provider for clarification. Remember that one Medicare supplement insurance plan covers only one person. If you want coverage for your spouse as well, you must get a separate policy.

How much is the Medigap premium for 2019?

This is an increase of $9.10 from the amount of $135.50 in 2019. Together with your Part B premium, you must pay a monthly premium to your private insurance provider for your Medigap policy. Prices vary from company to company and location plays a large role in the amount.

How old do you have to be to get Medicare Supplement?

In order to be eligible to purchase any Medicare Supplement policy, you must first be 65 years of age and enrolled in Original Medicare Part A (hospital insurance) and Part B (medical insurance). You are responsible for paying your monthly Medicare Part B premium even if you have supplemental insurance that covers other out of pocket expenses. ...

Do you pay Medicare Supplement insurance with Medicare Part B?

You do not pay this premium together with your Original Medicare Part B premium. If you are not sure where ...

Does Medigap cover prescription drugs?

It is also important to note that Medigap policies do not include coverage for prescription drugs. You must enroll in a separate Medicare Prescription Drug Plan (Part D). Medicare Part D plans are also sold by private insurance providers that are approved by Medicare.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.