Full Answer

What does AARP Medicare supplement plan I cover?

Dec 04, 2021 · Covers the Part A deductible of $1,556 for the first 60 days, $389 per day for days 61 to 90, and $778 per day for days 91 and beyond while using 60 lifetime reserve days. Once lifetime reserve days have been used, 100% of eligible costs are covered for 365 days more.

What are the top 5 Medicare supplement plans?

Likewise, what does AARP Medicare Supplement cover? It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare -approved amount for doctor services and 50 percent for mental health services.

What is the best Medicare supplement plan?

Mar 07, 2022 · The primary goal of a Medicare Supplement insurance (Medigap) plan is to help cover some of the out-of-pocket costs of Original Medicare (Parts A & B). As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly. Learn more about costs …

What are some benefits that AARP UnitedHealthcare plan F provides?

Aug 18, 2020 · The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles. The plans vary in...

What does Medicare Supplement plan I cover?

Plan I includes the Basic Benefits, Pays the Part A deductible and Skilled Nursing Coinsurance. Plan I Includes Foreign Travel Emergency benefits. Plan I includes at home recovery.

What does AARP supplemental cover?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

Does AARP Medicare Supplement cover deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.Jan 4, 2022

What is the monthly premium for AARP Medicare Supplement?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

Is AARP A Supplement or Advantage plan?

AARP offers Medicare Advantage and Medicare supplement (Medigap) plans through the UnitedHealthcare insurance company. Medigap plans are a type of supplemental insurance that is sold by private insurers.

Does AARP plan k cover Medicare Part B deductible?

Medigap Plan K is one of two Medigap plans that includes a yearly out-of-pocket limit, which is $6,220 in 2021. After your out-of-pocket costs have reached this limit (which includes the yearly Part B deductible), Medigap Plan K may cover 100% of your Medicare-covered costs for the rest of the year.

What is the deductible for AARP plan G?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.Sep 21, 2021

Does AARP plan g cover Medicare coinsurance?

Plan G is designed to cover the gaps in Original Medicare coverage. It pays for your Medicare Part A coinsurance, copays, deductibles, and Medicare Part B coinsurance and copays.Sep 29, 2021

What is the difference between Medigap Plan F and G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

Is AARP the same as UnitedHealthcare?

AARP Medicare Supplement Insurance plans are insured by UnitedHealthcare and offer many options for plan types.Mar 3, 2022

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

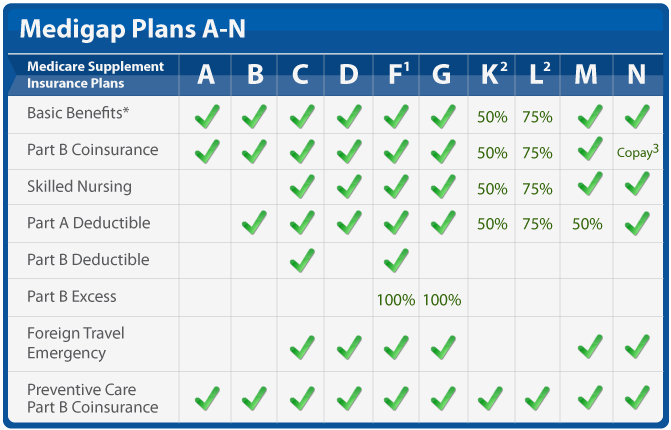

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

How long does Medicare cover hospital coinsurance?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.) Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How much does AARP cost?

AARP membership $12 the first year, and then $16 annually. When someone has an AARP Medigap plan, they can use any Medicare-approved doctor or healthcare provider across the U.S. Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans.

How does Medigap work?

The premiums for AARP Medigap plans vary depending on a person’s location, and on the method a company uses to set prices. The three systems include: 1 community rated, where everyone who has the policy pays the same premium, regardless of their age 2 issue-age rated, where the premium is based on a person’s age when they first get a policy, but does not increase because of age 3 attained-age rated, where the premium is age-related and may increase as a person gets older

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare cover copays?

Original Medicare pays a proportion of covered healthcare costs. However, Medicare beneficiaries must also pay copays, coinsurance, and an annual deductible. Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs.

What states have Medigap plans?

Each plan of the same letter must offer the same benefits across all the states, with the exception of Massachusetts, Minnesota, and Wisconsin. However, costs can vary from state to state, and between the different insurance companies.

Does Medicare cover hearing aids?

Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses. Depending on where a person lives and when they became eligible for Medicare, they can choose from up to 10 different Medigap policies.

What is Medicare Supplement Plan F?

Medicare Plan F is the most comprehensive of the standardized supplements sold by AARP (Insured by UnitedHealthcare Insurance Company). Although AARP does not offer this policy to everyone, or in all states (see above), where offered the plan covers the following: Part A deductible.

Does Plan F cover everything?

Plan F may offer expansive coverage, but it does not cover everything. Beneficiaries are still required to pay their Medicare Part B premium payments each month, and you may have a Part A premium if you did not pay Social Security taxes for at least 40 calendar quarters (10 years).