When should a Medicare ABN be given?

- What providers use an ABN form? ...

- Are blanket ABN forms legal? ...

- Are blanket ABN forms legal? ...

- When would you use an ABN? ...

- Is ABN only for Medicare? ...

- What is ABN form for Medicare? ...

- When would you use an ABN? ...

- What is an ABN form used for? ...

- Are ABN forms only for Medicare? ...

- Can ABN be used for Medicaid? ...

Do Medicare replacement plans require an ABN?

my understanding of the ABNs is exactly what you put if it is a service that is covered under certain circumstances but probably not for what you are doing it for, you get the ABN. Replacements follow Medicare regulations, so I would think the same services you would get them for Medicare you would get them for the replacements, but it is always best to check the payor.

How to fill out ABN for Medicare?

Tips on how to fill out the Get And Sign Abn form pdf 2020 on the web:

- To start the document, utilize the Fill camp; Sign Online button or tick the preview image of the form.

- The advanced tools of the editor will guide you through the editable PDF template.

- Enter your official contact and identification details.

- Utilize a check mark to point the choice wherever required.

When to use an ABN?

An advance beneficiary notice (ABN) is a written notice which a physician, provider, or supplier give to a Medicare beneficiary before items or services are furnished when the physician, provider, or supplier believes that Medicare probably or certainly will not pay for some or all of the items or services. The ABN fulfills both mandatory and voluntary notice functions.

Is ABN for Medicare Part A or B?

Medicare Advantage is offered by commercial insurance carriers, who receive compensation from the federal government, to provide all Part A and B benefits to enrollees. Therefore, an ABN is used for services rendered to Original Medicare FFS (Part A and Part B) enrollees.

What is a Medicare ABN and why is it important?

An ABN notifies Medicare that the patient acknowledges that certain procedures were provided. It also gives the patient the opportunity to accept or refuse the item or service and protects the patient from unexpected financial liability if Medicare denies payment.

When would you give a patient an ABN?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

What services require an ABN for Medicare?

You must issue an ABN: When a Medicare item or service isn't reasonable and necessary under Program standards, including care that's: Not indicated for the diagnosis, treatment of illness, injury, or to improve the functioning of a malformed body member. Experimental and investigational or considered research only.

Is an ABN only for Medicare patients?

The ABN, or Advance Beneficiary Notice, is a form that is intended for only for Medicare beneficiaries – not Medicare advantage plans or Medicare part C, just true Medicare.

When should an ABN not be issued?

If the provider does not have a reasonable belief that the service or item that is normally payable will be denied than an ABN is prohibited from being issued. Other circumstances were you are prohibited from issuing an ABN include: To make a beneficiary liable for Medically Unlikely Edit (MUE) denials.

Why is an ABN needed?

An Australian business number (ABN) makes it easier to keep track of business transactions for tax purposes. It is compulsory for businesses with a GST turnover of $75,000 or more to have an ABN and to be registered for GST.

Who uses ABN form?

The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be ...

How does an ABN work?

An ABN (Australian Business Number) is an 11-digit number that the government and community uses to identify your business from others. According to the ATO (Australian Taxation Office), having an ABN is crucial for all companies in the country. This way, they can interact with all government levels with ease.

Who is not eligible for an ABN?

Not everyone is entitled to an ABN. To be entitled to an ABN you must be carrying on a business in Australia. This means that you must have started trading or have undertaken business-like activities towards the commencement of trading.

Is ABN mandatory?

When do I need to get an ABN? If your business has an annual turnover of $75,000 or more, you are required by law to get an Australian Business Number. Businesses with an annual income of less than $75,000 are not required to have an ABN – but there are good reasons why they should.

What does ABN stand for?

Australian Business NumberABN stands for Australian Business Number. It is an eleven-digit number that all businesses must obtain. It identifies the business and is used in commercial transactions and dealings with the Australian Taxation Office.

What is an ABN in Medicare?

An advance beneficiary notice of noncoverage (ABN) lets you know when Medicare may not cover an item or service. You must respond to an ABN in one of three ways. If a claim has been denied for Medicare coverage, you have the right to appeal the decision.

What is an ABN?

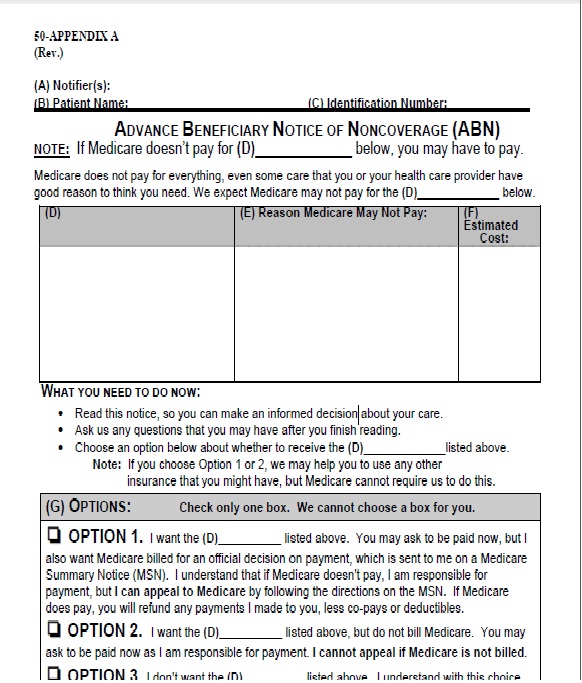

What is an Advance Beneficiary Notice of Noncoverage (ABN)? An Advance Beneficiary Notice of Noncoverage (ABN) is a liability waiver form that is given when a healthcare provider or medical supply company thinks or knows Medicare will not cover something. An ABN will explain:

What is an advance benefit notice for skilled nursing?

A skilled nursing facility may send you a Skilled Nursing Facility ABN if there is a chance that your care or a long-term stay in a facility will not be covered by Medicare Part A. This type of ABN may also be issued if your stay is considered custodial care.

What does it mean to sign an ABN?

By signing an ABN, you are agreeing to the fees that may come with the items and services you are receiving. You are also accepting responsibility to pay for the item or service, even if Medicare denies the claim and will not reimburse you.

What to do if you receive an ABN?

If you have received an ABN, you must respond to confirm how you’d like to proceed. There are three different options to choose from: You want to continue receiving the items or services that may not be covered by your Medicare plan.

Does Medicare cover ABN?

However, an ABN is not required for items or services that Medicare never covers. Some examples would include: routine foot care. hearing aids. dentures. cosmetic surgery. A full list of items and services not covered by Medicare parts A and B can be found here.

Can you appeal a Medicare claim if it is denied?

In this case, you may have to pay up front initially, but the provider will still submit a claim to Medicare. If the claim is denied, you can appeal. If the claim is approved, Medicare will refund the money that you paid. You want to continue receiving the items or services that may not be covered but you do not want to submit a claim to Medicare.

What is an ABN?

The ABN is a formal information collection subject to approval by the Executive Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1995 (PRA). As part of this process, the notice is subject to public comment and re-approval every 3 years. With the latest PRA submission, a change has been made to the ABN. In accordance with Title 18 of the Social Security Act, guidelines for Dual Eligible beneficiaries have been added to the ABN form instructions.

Who completes the signature box on an ABN?

Once the beneficiary reviews and understands the information contained in the ABN, the Signature Box is to be completed by the beneficiary (or representative). This box cannot be completed in advance of the rest of the notice.

What is an ABN in Medicare?

Summary. An Advance Beneficiary Notice (ABN) of non-coverage is a document that healthcare providers can give to people with original Medicare to tell them that their plan does not cover an item or service. Medicare covers most, but not all, medical items and services. If a doctor or medical supplier thinks that Medicare will deny an aspect ...

What is an ABN of non-coverage?

An ABN of non-coverage is a waiver of liability. It transfers the responsibility for payment of a healthcare service or item from Medicare to an individual. Original Medicare pays for medically necessary services. Typically, Medicare Part A covers inpatient hospital services, and Part B covers outpatient medical services. ...

What is the benefit of having an ABN?

The advantage of having an ABN. Receiving an ABN allows a person to decide if they want to use or receive a service or item and pay the cost out of pocket. This prevents unexpected bills for something that Medicare may not cover. Although the ABN warns that Medicare may not pay for a service, if the person appeals, ...

What happens when you receive an ABN?

When a person receives an ABN, they must decide if they want to continue to receive the care. If they opt to continue, they must accept the financial responsibility for the service — at least initially. The service provider can send Medicare a bill for an official decision on the payment.

What is option 3 in Medicare?

Option 3. The individual chooses not to use or receive the item or service. The individual must sign the form once they have chosen their preferred option. When they do so, they are agreeing to pay any fees for the uncovered services or items, and they understand that Medicare may not refund the payment.

Can Medicare refund a bill?

If successful, Medicare will refund them. The individual still wants to receive the item or service and accepts that they are responsible for the payment. Medicare will not receive a bill, and the individual cannot appeal. The individual chooses not to use or receive the item or service.

Can you appeal a Medicare denied payment?

They may have to pay out of pocket at that time but can ask that the provider also submit the claim to Medicare. If Medicare denies payment, the individual can appeal. If successful, Medicare will refund them. Option 2.

What is an ABN in Medicare?

The ABN allows you to decide whether to get the care in question and to accept financial responsibility for the service (pay for the service out-of-pocket) if Medicare denies payment. The notice must list the reason why the provider believes Medicare will deny payment.

What is an ABN waiver?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

How to get an official decision from Medicare?

To get an official decision from Medicare, you must first sign the ABN, agreeing to pay if Medicare does not, and receive the care. Make sure you request that your provider bills Medicare for the service before billing you (the ABN may have a place on the form where you can elect this option).

Did not receive ABN before service?

You did not receive an ABN from your provider before you were given the service or item; Your provider had reason to believe your service or item would not be covered by Medicare; Your item or service is not specifically excluded from Medicare coverage; and. Medicare has denied coverage for your item or service.

What is a Medicare ABN form?

An ABN form is a written notice that Medicare may not, or will not, pay for services or items recommended by your doctor, healthcare provider or supplier. The form includes the items or services that Medicare isn't expected to pay for, the reasons why and an estimate of the costs.

When will I be given a Medicare ABN form?

Your doctor, healthcare provider or supplier must deliver the ABN form before providing the recommended items or services. In fact, it must be given far in advance so you have time to consider your options without feeling rushed. 1

What options do Medicare ABN forms provide?

ABN forms generally provide you with 3 options. Here are the actual options, plus some additional insight:

Other important facts

Medicare ABNs are for Original Medicare only—not Medicare Advantage plans.

The power of choice

Medicare ABN forms provide you with an opportunity to make informed decisions about your healthcare. For more information on how to fill out the form, check out these ABN form instructions provided by the Centers for Medicare & Medicaid Service (CMS).

What is an ABN in Medicare?

An Advance Beneficiary Notice of Noncoverage (ABN) is a written notice a supplier gives to a Medicare beneficiary before providing an item and/or service. It must be issued when the health care provider (including independent laboratories, physicians, practitioners and suppliers) believes that Medicare may not pay for an item or service which is ...

What happens if a provider does not deliver an ABN?

If the provider does not deliver a valid ABN to the beneficiary when required, the beneficiary cannot be billed for the service and the provider may be held financially liable.

What happens if Medicare is not properly notified?

If the beneficiary was not properly notified of possible disallowed Medicare claims, the RR state that suppliers must refund any amounts collected. The RR provisions require that a beneficiary is notified and agrees to the financial liability.

What does "not all inclusive" mean in Medicare?

Items or Situations Which Do Not Meet Definition of a Medicare Benefit (Not all inclusive) Parenteral or enteral nutrients that are used to treat a temporary (rather than permanent) condition; Enteral nutrients that are administered orally; Infusion drugs that are not administered through a durable infusion pump;

What is considered nondurable items?

Most oral drugs; Oral anticancer drugs when there is no injectable or infusion form of the drug; Nondurable items (that are not covered under any other benefit category ), e.g., compression stockings and sleeves; Durable items that are not primarily designed to serve a medical purpose, e.g., exercise equipment.

Do you have to submit a claim to Medicare?

Per Section 1848 (g) (4) of the Social Security Act, suppliers are not required to submit a claim to Medicare when an item (s) is categorically excluded from Medicare benefits (e.g. tub/shower stools, personal comfort items, etc.); however, if a beneficiary requests a supplier submit a claim, a supplier must comply.

Does Medicare deny a claim?

Prior to rendering a service in which Medicare may consider not medically necessary, a supplier should notify the beneficiary, in writing, that Medicare will likely deny his/her claim and that he/she will be responsible for payment.

What is an ABN form?

The Advance Beneficiary Notice of Non-coverage (ABN), Form CMS-R-131 helps Medicare Fee-For-Service (FFS) beneficiaries make informed decisions about items and services Medicare usually covers but may not cover because they are medically unnecessary. If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable.

What is the meaning of "you" on an ABN?

On the ABN form, the term “you” refers to the beneficiary who signs the ABN. In the ABN interactive tutorial instructions, “you” refers to the provider issuing the form. If you reproduce the ABN form, remove the letters before issuing it to the beneficiary. Go to the ABN Interactive Tutorial. ABN FORM TUTORIAL.

What happens if a Medicaid beneficiary denies a claim?

If the beneficiary has full Medicaid coverage and Medicaid denies the claim (or will not pay because the provider does not participate in Medicaid), the ABN could allow the provider to shift financial liability to the beneficiary per Medicare policy, subject to any state laws that limit beneficiary liability.

What happens if Medicare denies coverage?

If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable. When Medicare coverage denial is expected, all health care providers and suppliers must issue an ABN in order to transfer financial liability to the beneficiary, including:

How long is an ABN valid?

An ABN is valid if you: Use the most recent version of it. Use a single ABN for an extended course of treatment for no longer than 1 year. Complete the entire form.

What to do if a beneficiary refuses to sign an ABN?

If the beneficiary or the beneficiary’s representative refuses to choose an option or sign the ABN, you should annotate the original copy indicating the refusal to choose an option or sign the ABN. You may list any witnesses to the refusal, although Medicare does not require a witness.

Do you need an ABN for Medicare Advantage?

The beneficiary wants the item or service before Medicare gets the advance coverage determination. Do not use an ABN for items and services you furnish under Medicare Advantage (Part C) or the Medicare Prescription Drug Benefit (Part D). Medicare does not require you to notify the beneficiary before you furnish items or services ...

What is an ABN in Medicare?

Most of us are familiar with the term ABN and have a general idea of when it should be used, but there are some important rules to remember when working with Medicare-Fee-For-Service patients. Not being adequately informed on these guidelines can lead to costly mistakes for your practice.

What does it mean when a provider is denied an ABN?

If the provider does not have a reasonable belief that the service or item that is normally payable will be denied than an ABN is prohibited from being issued.

What is a GA ABN?

GA – ABN was issued and signed by the beneficiary as required by Medicare (Beneficiary liable) GX – ABN was issued and signed by the beneficiary as voluntary (Beneficiary liable) GY – Indicates that the service is not a benefit of Medicare in any definition (Can be billed in combination with GX if patient signed an ABN. Beneficiary is liable.)

What is the 5 year rule for Medicare?

Note: The 5 year rule includes when an ABN is declined or refused. When the beneficiary signs the form and agrees to proceed with the service or item, you may seek payment from the patient. Keep in mind that if Medicare pays part or all of the service, a prompt refund to the beneficiary will be required. Changes of Mind.

Why is Medicare not paying for an item?

In addition, the reason for denial is because it is not medically reasonable and necessary.

What are the circumstances where you are prohibited from issuing an ABN?

Other circumstances were you are prohibited from issuing an ABN include: To make a beneficiary liable for Medically Unlikely Edit (MUE) denials. To make a beneficiary liable who is under great duress or in a medical emergency. To make a beneficiary liable for a code that was paid as part of a bundle service.

Can a beneficiary refuse to sign a corrected form?

A copy of the corrected form should be given to the beneficiary. In some cases the beneficiary may refuse to select an option or sign the form. If this occurs, the staff members will need to note the refusal to sign or select and list any witness present at the time of refusal.