What does Medicare approved amount mean?

Medicare-Approved Amount: This is the amount a provider can be paid for a Medicare service. It may be less than the actual amount the provider charged.Your provider has agreed to accept this amount as full payment for covered services. Medicare usually pays 80% of the Medicare-approved amount.

What is a Medicare-approved provider?

If a provider agrees to accept Medicare assignment (they are called a “Medicare participating provider”), they agree to accept the Medicare-approved amount as payment in full for any service they provide (assuming it is covered by Medicare).

Do you still owe 20 percent of Medicare approved costs?

However, under Part B, you still owe 20 percent of the Medicare-approved amount for all covered items and services. You can save money on your Medicare approved costs by asking your doctor the following questions before you receive services:

How do I know if my preventive services are approved by Medicare?

Register at www.MyMedicare.gov to view your original Medicare claims, to track your preventive services and print an "On the Go" report to share with your provider. Visit the website to sign up and access your personal Medicare information. See claim. Look for NO in the "Services Approved?" column.

What does it mean Medicare-approved amount?

The approved amount, also known as the Medicare-approved amount, is the fee that Medicare sets as how much a provider or supplier should be paid for a particular service or item. Original Medicare also calls this assignment. See also: Take Assignment, Participating Provider, and Non-Participating Provider.

What is the difference between Medicare-approved amount and amount Medicare paid?

Medicare-Approved Amount: This is the amount a provider can be paid for a Medicare service. It may be less than the actual amount the provider charged. Your provider has agreed to accept this amount as full payment for covered services. Medicare usually pays 80% of the Medicare-approved amount.

What is the difference between the Medicare-approved amount for a service or supply and the actual charge?

BILLED CHARGE The amount of money a physician or supplier charges for a specific medical service or supply. Since Medicare and insurance companies usually negotiate lower rates for members, the actual charge is often greater than the "approved amount" that you and Medicare actually pay.

Why do doctors charge more than Medicare pays?

Why is this? A: It sounds as though your doctor has stopped participating with Medicare. This means that, while she still accepts patients with Medicare coverage, she no longer is accepting “assignment,” that is, the Medicare-approved amount.

Do I have to pay more than the Medicare-approved amount?

If you use a nonparticipating provider, they can charge you the difference between their normal service charges and the Medicare-approved amount. This cost is called an “excess charge” and can only be up to an additional 15 percent of the Medicare-approved amount.

What does approved amount mean?

Approved Amount means the maximum principal amount of Advances that is permitted to be outstanding under the Credit Line at any time, as specified in writing by the Bank.

When a doctor accepts the Medicare-approved amount?

When a doctor, other health care provider, or supplier accepts assignment in Original Medicare, they agree to accept the Medicare- approved amount as the total payment for the service or item. They also agree to bill Medicare for the service or item provided to you. Example: A doctor charges $120 for a service.

Does Medicare ever pay more than 80%?

A. In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Do doctors have to accept what Medicare pays?

Can Doctors Refuse Medicare? The short answer is "yes." Thanks to the federal program's low reimbursement rates, stringent rules, and grueling paperwork process, many doctors are refusing to accept Medicare's payment for services. Medicare typically pays doctors only 80% of what private health insurance pays.

Can a Medicare patient pay out of pocket?

Keep in mind, though, that regardless of your relationship with Medicare, Medicare patients can always pay out-of-pocket for services that Medicare never covers, including wellness services.

Which states allow Medicare excess charges?

Most states, with the exception of those listed below, allow Medicare Part B excess charges:Connecticut.Massachusetts.Minnesota.New York.Ohio.Pennsylvania.Rhode Island.Vermont.

What is Medicare approved amount?

The Medicare-approved amount, or “allowed amount,” is the amount that Medicare reimburses health care providers for the services they deliver. Learn more about the Medicare-approved amount and how it affects your Medicare costs. There’s a lot of terminology for Medicare beneficiaries to learn, and among them is “Medicare-approved amount” ...

What does Medicare cover?

The Medicare-approved amount applies mostly to services covered by Medicare Part B, which covers outpatient services like doctor’s appointments, and it also covers durable medical equipment (DME) such as wheelchairs and blood sugar test strips.

How much does Medicare coinsurance increase?

The higher the Medicare-approved amount, the higher your coinsurance billed amount will likely be. If the Medicare-approved amount for the X-rays in the example above was $250 instead of $200, that would increase the total cost of the visit to $400, which would also increase the cost of your coinsurance payment to $80 (20% of $400).

How much is coinsurance for Medicare Part B?

Medicare Part B typically requires a coinsurance payment of 20% of the Medicare-approved amount for covered care after you meet your annual Part B deductible. Using the example above, your 20% coinsurance payment for your visit to the health clinic would likely be $70 (20% of $350).

What is an excess charge for Medicare?

These providers reserve the right to charge up to 15% more than the Medicare-approved amount in what is known as an “excess charge.”

How much does Medicare pay for X-rays?

The X-rays may have a Medicare-approved amount of $200. And the brace itself might have a Medicare-approved amount of $50. (Note: these costs are hypothetical and are not based on actual Medicare costs for the services or items mentioned.) Based on the above costs, the health clinic would be allowed by Medicare to charge $350 total for ...

What is a participating provider?

Participating provider. A participating provider “accepts Medicare assignment,” meaning they agree to accept the Medicare-approved amount as full payment for their service or item. They bill Medicare using what are called CPT codes .

What is Medicare approved amount?

The Medicare-approved amount is the total payment that Medicare has agreed to pay a health care provider for a service or item. Learn more your potential Medicare costs. The Medicare-approved amount is the amount of money that Medicare will pay a health care provider for a medical service or item.

How much can a provider charge for not accepting Medicare?

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount. Let’s consider an example: You’ve been feeling some pain in your shoulder, so you make an appointment with your primary care doctor.

What is Medicare Supplement Insurance?

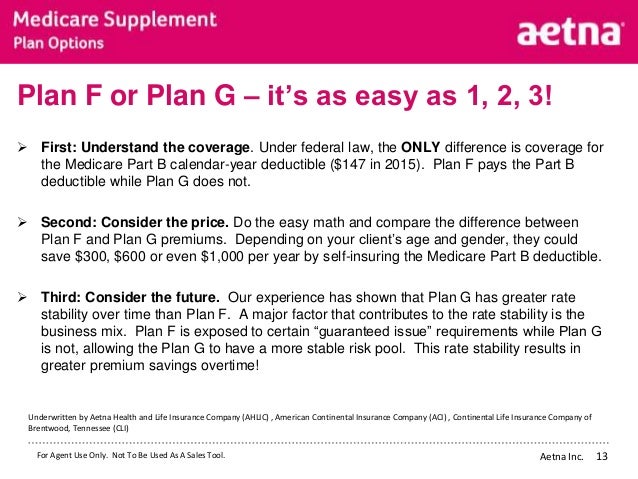

Some Medicare Supplement Insurance plans (also called Medigap) provide coverage for the Medicare Part B excess charges that may result when a health care provider does not accept Medicare assignment.

What is Medicare Part B excess charge?

What are Medicare Part B excess charges? You are responsible for paying any remaining difference between the Medicare-approved amount and the amount that your provider charges. This difference in cost is called a Medicare Part B excess charge. By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over ...

What does it mean when a doctor accepts Medicare assignment?

If a doctor or supplier accepts Medicare assignment, this means that they agree to accept the Medicare-approved amount for a service or item as payment in full. The Medicare-approved amount could potentially be less than the actual amount a doctor or supplier charges, depending on whether or not they accept Medicare assignment.

How much does Medicare pay for a doctor appointment?

Typically, you will pay 20 percent of the Medicare-approved amount, and Medicare will pay the remaining 80 percent .

Does Medicare cover a primary care appointment?

This appointment will be covered by Medicare Part B, and you have already satisfied your annual Part B deductible. Your primary care doctor accepts Medicare assignment, which means they have agreed to accept Medicare as full payment for their services. Because you have met your deductible for the year, you will split the Medicare-approved amount ...

What is Medicare approved amount?

The Medicare-approved amount is the amount that Medicare pays to a healthcare provider or medical supplier who accepts assignment for Medicare-covered services. If a person visits a healthcare provider or supplier who does not accept assignment, they may have to pay an additional amount for the services or items.

How much is the deductible for Medicare?

They must also meet the annual deductible of $203 before Medicare funds any treatment. If a person chooses to go to a nonparticipating healthcare provider, they may have to pay an additional amount for the services or items. For example: A person visits their Medicare-participating doctor about a pain in their ankle.

How much is Medicare Part B deductible 2021?

A person pays a percentage of the Medicare-approved amount after they have paid their Medicare Part B annual deductible, which is $203 in 2021. The amount varies depending on several factors, including whether the healthcare provider is participating in the Medicare program.

How much can a non-participating provider charge for Medicare?

A nonparticipating provider can charge up to 15% more than the Medicare-approved amount, although there is a limit to the charges. A person is then responsible for the difference in cost between the amount that their healthcare provider charges and the Medicare-approved amount. The cost difference is called the Medicare Part B excess charge.

How much is Medicare Part A in 2021?

Medicare Part A has an annual deductible, which is $1,484 in 2021, and a fee schedule for hospitalization. Medicare pays approved costs above a person’s coinsurance amount. These apply as follows for each benefit period in 2021: $0 coinsurance for days 1–60. $371 coinsurance per day for days 61–90.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Do providers charge for Medicare deductible?

Healthcare providers and suppliers agree to charge a person for only the Medicare deductible and coinsurance amount. They may also wait for Medicare to pay its share before asking for the remaining payment from the person who received the service or item.

Medicare Allowed Amount Definition

Maximum amount on which payment is based for covered health care services. This may be called “eligible expense,” “payment allowance” or “negotiated rate.” If your provider charges more than the medicare allowed amount, patient no need to pay that amount when they are participating with Medicare insurance.

Medicare Maximum Allowable Reimbursements

Unless otherwise indicated, for these Rules, the Medicare procedures and guidelines are effective upon adoption and implementation by the CMS. The particular procedure or guideline to be used is that which is in effect on the date the service is rendered.

How much does Medicare pay?

Medicare pays 80 percent, then you receive a bill for the remaining 20 percent. Doctors who are not Medicare-approved can ask you for full payment up front. You will be responsible for getting reimbursed by Medicare for 80 percent of the Medicare-approved amount of your bill.

What is Medicare Part B excess charge?

Doctors who do not accept Medicare assignment may charge you up to 15 percent more than what Medicare is willing to pay. This amount is known as a Medicare Part B excess charge. You are responsible for Medicare Part B excess charges in addition to the 20 percent of the Medicare-approved amount you already pay for a service.

What is a Medigap Plan F?

The two Medigap plans that cover Part B excess charges are: Medigap Plan F. Plan F is no longer available to most new Medicare beneficiaries.

What happens if a doctor doesn't accept Medicare?

Your doctor doesn’t accept assignment. If you instead go to a doctor who doesn’t accept Medicare assignment, they might charge you $345 for the same in-office test. The extra $45 is 15 percent over what your regular doctor would charge; this amount is the Part B excess charge. Instead of sending the bill directly to Medicare, ...

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers outpatient services, such as doctor visits and preventive care. Medicare Part A and Medicare Part B are the two parts that make up original Medicare. Some of the services Part B covers include: flu vaccine. cancer and diabetes screenings. emergency room services.

How much does a general practitioner charge for an in-office test?

Your doctor accepts assignment. Your general practitioner who accepts Medicare might charge $300 for an in-office test. Your doctor would send that bill directly to Medicare, rather than asking you to pay the entire amount. Medicare would pay 80 percent of the bill ($240).

Can a doctor accept Medicare?

Not every medical professional accepts Medicare assignment. Doctors who accept assignment have agreed to accept the Medicare-approved amount as their full payment. A doctor who doesn’t accept assignment may charge you up to 15 percent more than the Medicare-approved amount. This overage is known as a Part B excess charge.

How much does a doctor charge for Medicare?

A doctor has the option, in most states, of charging up to 15% ABOVE the Medicare-approved payment schedule. These so-called Medicare Part B Excess charges of up to 15% above the Medicare-approved amount are passed on to the patient and billed directly to you after the fact.

What is Medicare Part B excess charge?

Medicare Part B Excess charges are charges that fall under the doctor charges/outpatient part of Medicare (Part B). These charges are not charged by all medical providers, but in most states, providers do have the option of charging these “excess” charges. So what are Part B Excess charges?

How to avoid Part B excess charges?

Beyond that, you can always check with your regular doctors to see if he/she does use “balance billing” (i.e. if they charge Part B Excess charges). If so, you can choose a doctor that does not.

How often do Medicare summary notices come out?

Medicare Summary Notices are sent out four times a year — once a quarter — but you don't have to wait for your notice to arrive in the mail. You can also check your account online at MyMedicare.gov. Claims typically appear on your electronic statement 24 hours after processing. 6.

How to contact Medicare if you have questions?

If the doctor's office cannot resolve your concerns, contact Medicare at 1-800-MEDICARE (1-800-633-4227) . 12. Service Provided.

What is the number to call for Medicare fraud?

If you think a provider or a business is involved in fraud, call us at 1-800-MEDICARE (1-800-633-4227) . Some examples of fraud include offers for free medical services, or billing you for Medicare services you didn't get. If we determine that your tip led to uncovering fraud, you may qualify for a reward.

Is Medicare summary notice a bill?

Your Medicare Summary Notice is not a bill. It is a statement you should review for accuracy and keep for your personal records. Very important: Never send a health care provider payment for charges listed on a Medicare Summary Notice until you've received a bill for the service directly from the provider.