In addition, some Medicare MSA plans may cover extra Benefits for an extra cost, like:

- Dental

- Vision

- Hearing

- Long-term care not covered by Medicare

Full Answer

Do MSA plans have drug coverage?

MSA plans do not offer drug coverage. You must enroll in a standalone drug plan if you want drug coverage. Copays and Out of Pocket Limits. Premiums for Medicare Advantage plans are typically lower than Medicare Supplement premiums, but they may have higher maximum out of pocket limits.

What is the best health plan for Medicare?

- Standard Medicare benefits for people 65+ and older who meet certain other requirements such as disabilities.

- Covers Medicare-eligible costs, and you pay the rest out-of-pocket, which may include premiums, deductibles and coinsurance.

- You can use your coverage with any doctor or hospital that accepts Medicare in the U.S.

Are there different Medicare plans?

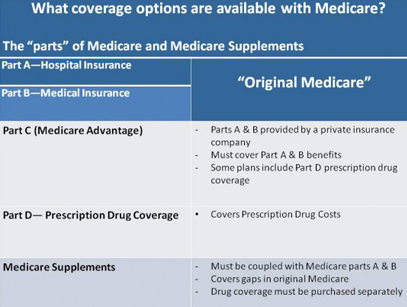

There are several different types of Medicare plans. The choices vary from the services covered to the type of administrators who manage the plan. People who are eligible for Medicare commonly choose the Original Medicare Plan or a Medicare Advantage Plan. The Original Medicare Plan is a fee-for-service plan managed by the federal government.

Do MSA plans have networks?

MSA plans may or may not have contracted providers, but MSA plans cannot restrict access to a network of providers. • The plan will cover Medicare costs once an enrollee meets the yearly deductible. Only Medicare Part A and Part B expenses can count towards the plan deductible. • Plans cover costs beyond an out-of-pocket spending limit ...

What does MSA cover?

Medicare MSA plans cover the Medicare services that all Medicare Advantage Plans must cover. In addition, some Medicare MSA plans may cover some extra benefits like dental, vision, and hearing services. You may pay a premium for this extra coverage.

Do MSA plans have coverage?

In demonstration MSA plans, some MSA provisions are waived to make the plans more like other consumer-directed health plans, such as health savings accounts (HSAs), available in the private sector. MSAs and Prescription Drug Coverage – MSA plans do not offer Medicare Part D prescription drug coverage.

How is an MSA different than other plans?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

What are MSA expenses?

You can use the money in your MSA account for non-medical expenses, such as groceries, rent, or utility bills. However, the amount you spend for non-medical purposes will not count toward your deductible and will be considered taxable income.

Can MSA be used for dental?

You can continue to use the carryover funds in the Limited-use MSA for dental and vision expenses incurred in 2020.

Does MSA cover Part D?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. However, if you join a Medicare MSA Plan, you can also join a Medicare Prescription Drug Plan to add this coverage.

What is the deductible for MSA plans?

The plan's yearly deductible is $3,000. The plan pays for all Medicare-covered services once Mr. Anderson meets the deductible.

What happens to money left in a MSA at the end of the year?

Any money left in your account at the end of the year will remain in your account. If you stay with the Medicare MSA Plan the following year, the new deposit will be added to any leftover amount.

How much does Medicare contribute to an MSA?

After reaching your deductible, your MSA plan covers 100% of the cost for Medicare-covered services. Funds contributed to an MSA are not taxed as long as they are used to pay for qualified medical expenses.

What is the maximum amount that can be contributed to an MSA?

How much can I contribute to an MSA? The annual limit to contributions are 65% of your insurance deductible if you have single coverage, or 75% if you have family coverage.

What is the difference between MSA and HSA?

MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans. Medicare funds MSAs, while individuals make contributions to HSAs.

What is MSA in Medicare?

A Medicare MSA is meant to help enrollees control their medical expenses. Beneficiaries have the risk of paying more out-of-pocket for healthcare services than do those in other Medicare Advantage plans, but those who do not anticipate having significant medical expenses may find the plans economically attractive.

What is MSA plan?

Medicare Medical Savings Account (MSA) Plans are a type of Medicare Advantage plan that offers enrollees a combination of a high-deductible health insurance plan and a Medical Savings Account from which qualified medical expenses can be paid . Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until ...

What is MSA insurance?

Medicare MSAs combine a medical savings account with a high deductible health insurance plan. The plans are offered by private insurers, and cover any medical expense that Original Medicare covers once the deductible has been met. The Medical Savings Account portion of the MSA plan is funded by Medicare, which pays the private insurer to set up ...

What happens to MSA funds after they are exhausted?

Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until the maximum out-of-pocket deductible is met. These plans resemble the Health Savings Accounts that many employees receive from their employers if they choose a high-deductible health insurance plan, though in the case of Medicare MSAs, ...

How to determine what a Medicare plan will cost?

The best way to determine what a plan will cost is by asking plan representatives about these details. You will need to continue paying your Medicare Part B premium but will not need to pay a monthly premium for the Medicare MSA plan itself.

What are the advantages of MSA?

Advantages of a Medicare MSA Plan. Medicare MSA plans offer the advantage of flexibility and control. Enrollees are able to choose their own medical providers and pay a good portion of their qualified medical expenses with funds that are provided by Medicare through the private insurer that provides their high deductible Medicare Advantage health ...

When do you have to pay deductible for MSA?

Unlike other Medicare Advantage plans, if you join an MSA plan after January 1, your yearly deductible will be prorated to the number of months left in the year. Though some of these plans have a network of providers that charge lower contracted fees, not all do, and MSA enrollees can seek care from any provider that accepts Medicare.

What type of insurance is included in MSA?

Join an MSA if you have any other type of health insurance, including Medicaid, Veterans Affairs benefits, Federal Employee Health Benefits, or many kinds of employer or retiree insurance. Have any employer or retiree coverage that would pay during your MSA deductible.

What is MSA insurance?

Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

How to find out if you have MSA?

Call 1-800-MEDICARE or your State Health Insurance Assistance Program (SHIP) to find out if there is an MSA plan available in your area. To enroll in an MSA plan, call Medicare or the plan directly. Be sure to make an informed decision by contacting a plan representative to ask questions before enrolling.

How long do you have to pay out of pocket for MSA?

Once you have used the money in the account, you have to pay out of pocket until you reach your deductible. Remember, you will typically have high out-of-pocket costs for your care until you reach your deductible. After reaching your deductible, your MSA plan covers 100% of the cost for Medicare-covered services.

Is MSA contribution taxed?

Your plan chooses the bank account and the amount it contributes. Generally the plan’s contribution is lower than the full deductible. Funds contributed to an MSA are not taxed, as long as they are used to pay for qualified medical expenses. You cannot deposit more money into the account.

Does MSA cover out of network care?

MSA plans may have provider networks. You may pay less for your care when using in-network providers or facilities. All MSA plans also must cover out-of-network care, but you may pay a higher cost. Medicare MSA plans are not available everywhere.

Does MSA cover medical expenses?

MSA plans also come with a bank account where your plan deposits funds once each year for your medical expenses, which you can use to pay for your deductible. Your plan chooses the bank account and the amount it contributes.

What is a Medicare MSA plan?

A Medicare MSA plan is one of the six types of Medicare Advantage — also called Part C — plans offered to consumers by private insurance companies in partnership with Medicare. As with all Medicare Advantage plans, you can enroll in an MSA plan when you become eligible for Medicare Parts A and B.

MSA deductibles, deposits and costs

There are typically no premiums for MSA plans, but you must pay Part B premiums, which, for most people, are $148.50 per month in 2021 (high-income participants pay a surcharge on these premiums).

Who are MSA plans good for?

MSA plans tend to work best for people who are relatively healthy and who don’t take expensive medications or use many health services. Only about 5,600 Medicare beneficiaries chose MSA plans in 2019 — down from 6,040 in 2018, according to the Kaiser Family Foundation .

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

The bottom line

Medicare MSA plans combine a high-deductible health plan with a medical savings account that’s funded by the government. While they’re not widely used, they may appeal to Medicare beneficiaries who want a flexible approach to their healthcare spending and who expect to need few healthcare services.

What Is a Medicare Advantage MSA?

A Medicare Medical Savings Account (MSA) Plan is a plan available to most people eligible for Medicare who live where these plans are offered. An MSA has two separate components: a medical savings account and a high-deductible Medicare Advantage plan (“Part C”).

How a Medicare Advantage MSA Plan Works

The first step to getting an MSA plan is to select a high-deductible MSA plan. You can do this when you first sign up for Medicare or during the annual open enrollment period between October 15 and December 7. You won't pay a monthly premium for your Medicare Advantage MSA, however, you must continue to pay your monthly Medicare Part B premium. 1

The Bottom Line

A Medicare Medical Savings Account (MSA) plan isn’t right for everyone. But it might be a good fit if you appreciate the flexibility of choosing any Medicare-approved provider, and if you can afford to pay a high deductible before your coverage kicks in.

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.