What is the new social security bill called?

The new version of the bill, called Social Security 2100: A Sacred Trust, has changes aimed at drawing support from President Joe Biden and from Republicans. The reintroduction follows the Social Security Administration’s latest estimates that the trust funds that support the program will be depleted in just 13 years.

Will Senate Republicans Sunset Social Security and Medicare if they win?

Senate Minority Leader Mitch McConnell flatly said that, if the Republicans win control of the Senate, sunsetting Social Security and Medicare “would not be a part of our agenda.”

Are Social Security and Medicare entitlements?

And as of this writing, a Google search pulls up numerous recent instances of recent letters-to-the-editor, such as this one at the East Oregonian ("The GOP leadership has started referring to Social Security and Medicare as “entitlements” . . . but . . . these are benefits we have earned and paid for with deductions from our paychecks . . . .

Will Trump's budget protect Medicare and Social Security?

His budgets have sought cuts. President Trump vowed Thursday that he “will protect Medicare and Social Security” — a promise akin to one he made as a candidate in 2016. But throughout his first term, he repeatedly tried to cut these programs in his proposed budgets.

What is Social Security and Medicare together called?

Together, Medicare and Social Security payroll taxes are known as FICA taxes (Federal Insurance Contributions Act taxes).

What does the government call Social Security?

In fact, Social Security payments have been called "benefits" for the entirety of their existence, with retirement payments first identified in the Social Security Act of 1935 as "Old-Age Benefit Payments."

Did Congress pass Social Security?

The Ways & Means Committee Report on the Social Security Act was introduced in the House on April 4, 1935 and debate began on April 11th. After several days of debate, the bill was passed in the House on April 19, 1935 by a vote of 372 yeas, 33 nays, 2 present, and 25 not voting.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

When did Congress borrow from Social Security?

In other words, the borrowing fund was required to make the loaning fund whole at the end of the process. This authority was used twice, once in November 1982 and once in December 1982. The total amount borrowed was $17.5 billion.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Who passed Social Security and Medicare?

The Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.

Who signed Medicare into law?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law. His gesture drew attention to the 20 years it had taken Congress to enact government health insurance for senior citizens after Harry Truman had proposed it.

What did Ronald Reagan do to Social Security?

In 1981, Reagan ordered the Social Security Administration (SSA) to tighten up enforcement of the Disability Amendments Act of 1980, which resulted in more than a million disability beneficiaries having their benefits stopped.

Can someone who has never worked collect Social Security?

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

Who changed Social Security?

President Franklin D. Roosevelt signed the Social Security Act on Aug. 14, 1935. The law created a program that would pay monthly benefits to retired workers starting at age 65 or older.

What President gave Social Security to immigrants?

President Roosevelt signs Social Security Act, August 14, 1935.

Conquering the Market Starts Here ..

Don't get overwhelmed by the daily ups and downs of the stock market. Sign up for FREE access to our Money and Markets daily emails and take control of the markets!

Money & Markets Watchlist

Create and track your own list of stock investments. Track the performance of up to 50 stocks. Just login or create an account to get started.

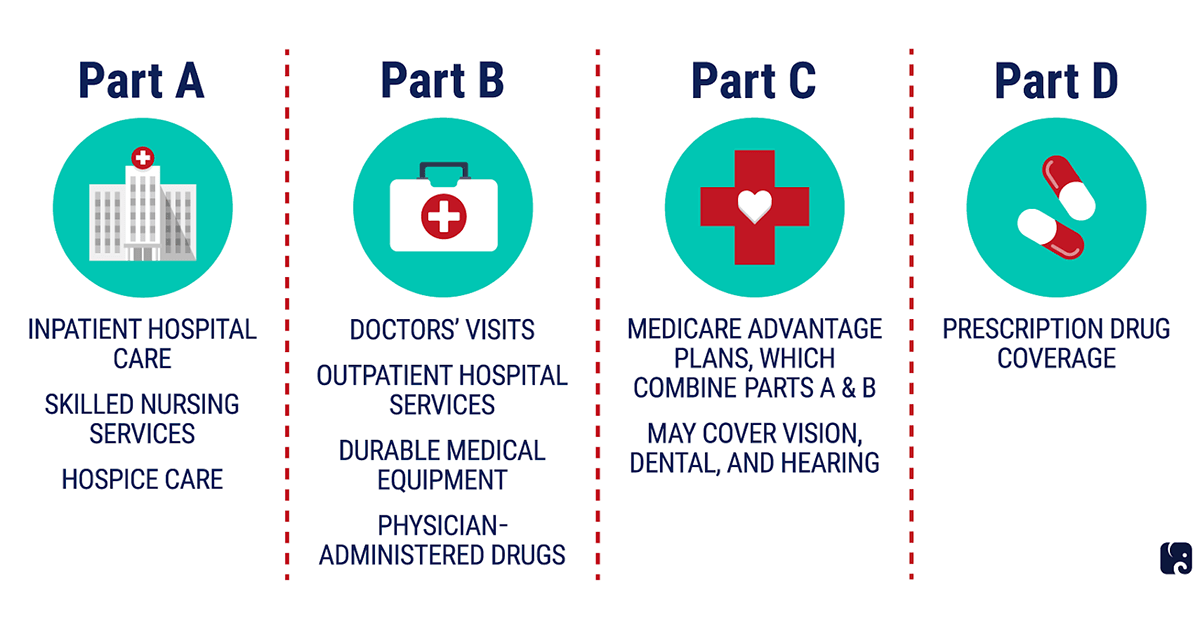

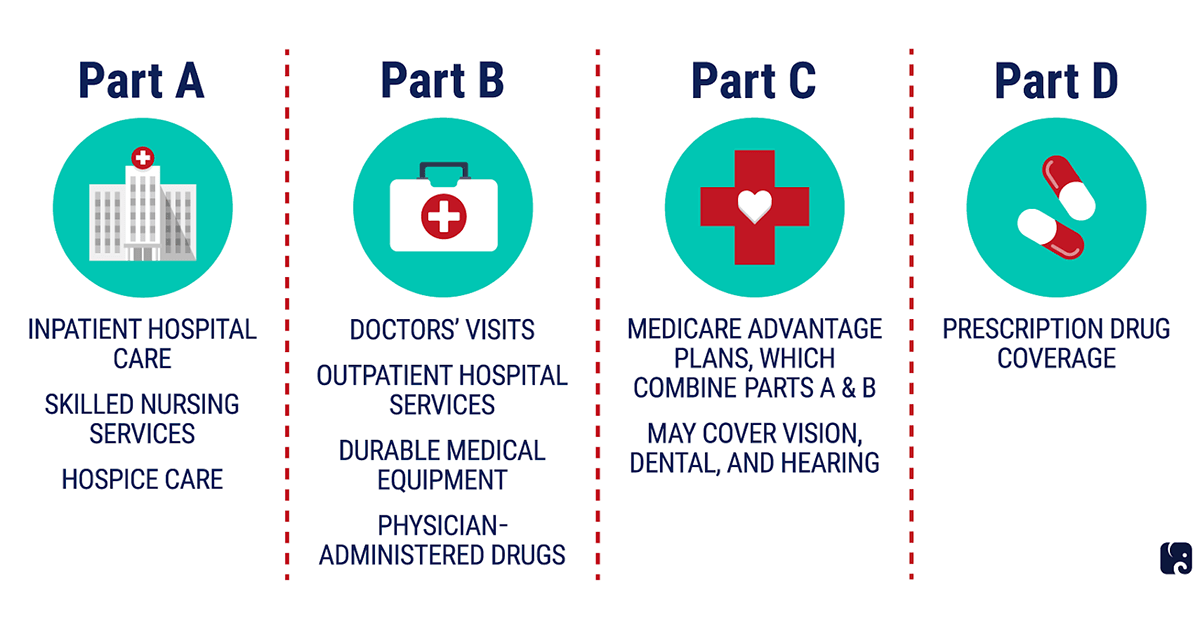

What is Medicare and Medicaid?

Medicare, Medicaid, and Social Security are benefits provided by the government through specific taxes collected for the sole purpose of funding them. That means every law abiding citizen of the United States is entitled to collect those benefits without needing any further permission from the government.

How much will Social Security grow in the next decade?

The vast majority of savings from spending caps, deep defense cuts, and rising tax revenues have simply fed the Social Security and Medicare beast, which will grow by another $130 billion annually over the next decade.

How much is the deficit in Medicare?

Over the next 30 years, according to data from the Congressional Budget Office, Medicare will run a $40 trillion cash deficit, Social Security will run a $19 trillion cash deficit, and the interest on the resulting program debt will be $23 trillion. (To inflation-adjust these figures, trim by 1/3.)

Why is Social Security an unearned entitlement?

It is an unearned entitlement because the US congress has increased the benefits without requiring people to pay enough for those increased benefits. Here is a more detailed explanation.

What is welfare provision?

And the provision of welfare is a means to knit the society into community, as well as to enhance social stability and the conditions for decent life. In those societies, public libraries, parks, public schools, care for children and old people and those in between are part of what the society is organized to do.

Can Congress reduce SSDI?

Only Congress can do that. SSDI (Social Security Disability Income) and SSI (Supplemental Security Income) are separate benefits paid to recipients who have not fully paid into the SS system, or not paid in at all. Trump has suggested reducing these benefits, but until Congress moves, he can’t do anything with it.

Can Trump fix Medicare?

Medicare, like social security, has similar underfunding problems that only Congress can fix. Trump can’t fix it with an executive order. The article cited by the questioner has both the law and the author’s opinions. I agree that the law is correctly stated, but disagree with many of the author’s conclusions.

Fact check: 'Record' job gains still leave the U.S. labor market in worse shape than Great Recession

On the last night of his party’s convention, President Trump bragged about “record” job gains in recent months, but the 9.1 million jobs he touts come with some qualifiers.

Trump usually includes new material in major speeches. Not tonight

President Trump spoke for roughly 70 minutes on Thursday, one of the longest convention speeches in modern history.

Trump speech missing several of his favorite talking points

While President Trump launched attack after attack on Joe Biden, he left out a number of his favorite topics of criticism in his acceptance speech.

Fact check: Trump claims Biden wants to 'close all charter schools.' That's false

"Biden also vowed to oppose school choice and close all charter schools, ripping away the ladder of opportunity for Black and Hispanic children," Trump claimed on Tuesday night.

Fact check: Trump repeats out-of-context Biden comment to mislead on police stance

President Trump, arguing that Americans wouldn't be safe under Joe Biden, repeated a claim Mike Pence made Wednesday, quoting the former vice president as saying, "Yes, absolutely," as a response to whether he'd broadly support cutting funding for law enforcement.

Fact check: Trump boasts of delivering PPE early in pandemic, doesn't mention ongoing shortages

"We shipped hundreds of millions of masks, gloves and gowns to our frontline health care workers.

Trump mentions Kenosha, not Jacob Blake

Midway through his speech Thursday, Donald Trump mentioned Kenosha, Wisconsin — but did not make mention of Jacob Blake, who was shot seven times in the back by the city's police.

Can the government take more money if Congress re-raise taxes?

The same reason that the bank robber gave: " it's where the money is .". Yes, it is true that the government could take in more revenue if Congress chose to re-raise taxes, and it's beyond the scope of this article to discuss the question of what tax rates should look like.

Is Social Security an entitlement?

Social Security is an entitlement because everyone who meets the eligibility criteria (40 "quarters" of eligible earnings) is entitled to a benefit. No one is dependent on Congress to appropriate spending every year in order to receive their Social Security checks.

Is Snap a federal program?

SNAP is a federal entitlement program. This means anyone who is eligible will receive benefits. You will not be taking away benefits from someone else if you apply. By comparison, Section 8 housing vouchers are a government program that is not an entitlement.