What income is included in irmaa?

- Medicare’s IRMAA defines income as:

- “Adjusted gross income plus any tax-exempt interest”

- or

- “Everything on lines 2b and 11 of the 2020 IRS tax form 1040”. ...

- Contributions to Traditional IRA’s and 401 (k)’s will lead to IRMAA and lower Social Security benefits! ...

Who has to pay irmaa?

IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a certain threshold. IRMAA only applies to people who are enrolled in Medicare Part B and/or Medicare Part D.

Does Medicare calculate irmaa annually?

This premium is adjusted each year and can vary depending on your income. You become eligible for Medicare Part ... what’s known as an income-related monthly adjustment amount, or IRMAA, in ...

Is irmaa based on AGI?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Why do I have to pay Irmaa?

What Is IRMAA? IRMAA stands for income-related monthly adjustment amount. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a certain threshold.

What is the Irmaa amount for 2021?

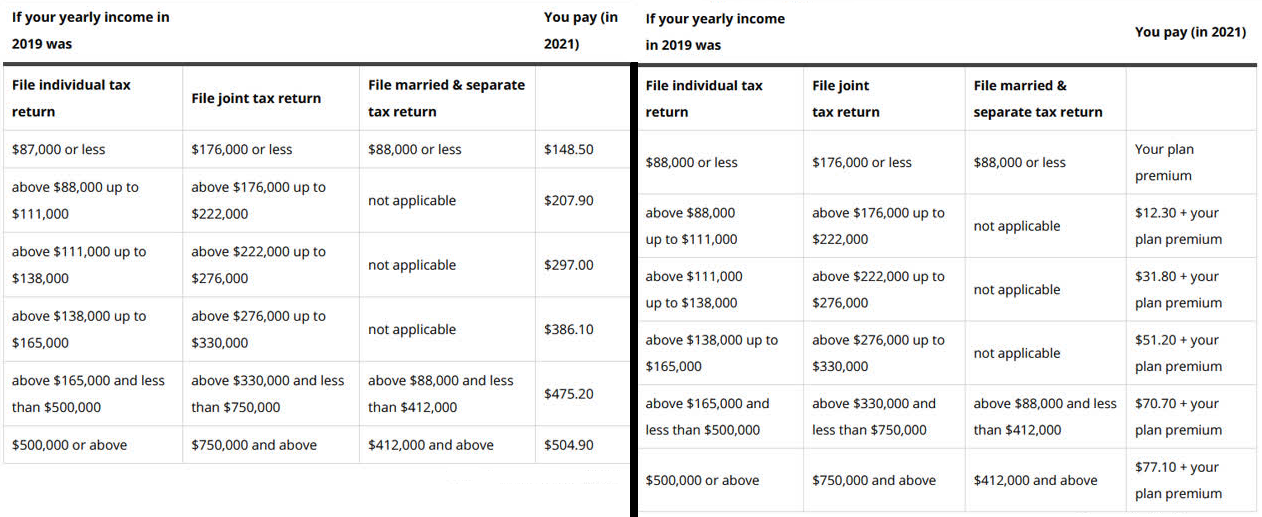

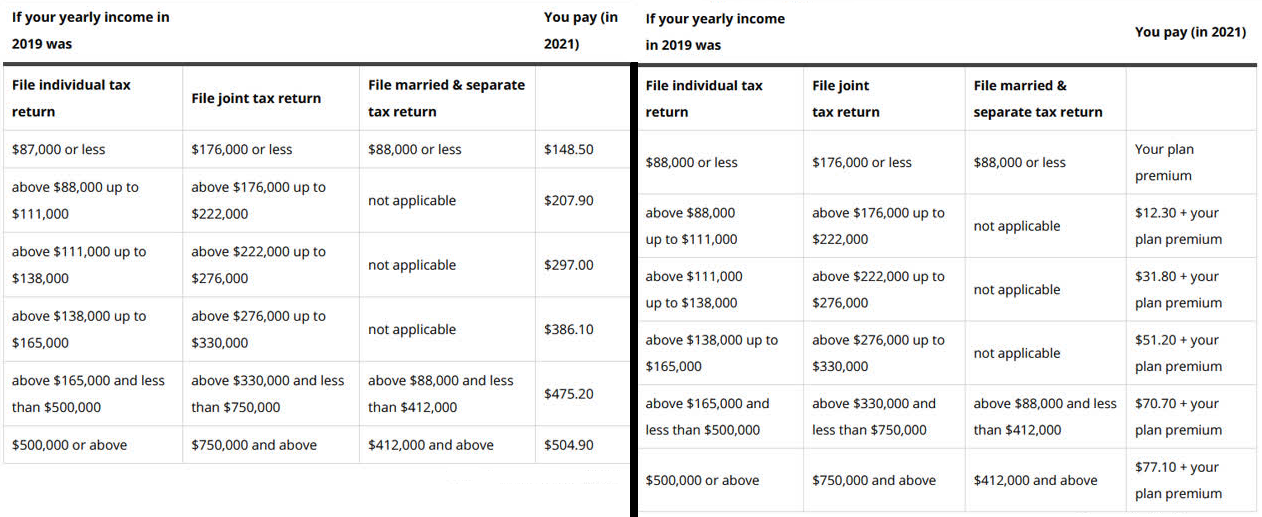

The IRMAA rises as adjusted gross income increases. The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

What is the income threshold for Irmaa?

The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you're married), but as discussed below, there's an appeals process if your financial situation has changed.

Is Irmaa deducted from Social Security?

IRMAA is an extra charge added to your premium. If you are receiving Social Security benefits, the Part B premiums will be deducted from this payment. If you are not receiving Social Security benefits, you will pay the Part B premiums directly to Social Security.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

Who is eligible for Irmaa reimbursement?

To be eligible for reimbursement, plan members and/or dependent must be enrolled in the SWSCHP Medicare Part D plan. Copy of member and/or your eligible dependent's Form(s) SSA-1099 issued SSA in January as proof of the monthly Medicare Part D premium paid in prior calendar year.

Do you have to apply for Irmaa every year?

They will be automatically added to your premium bills. Each year, the SSA reevaluates whether an IRMAA should apply to your Medicare premiums. So, depending on your income, an IRMAA could be added, updated, or removed.

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

What are the Irmaa brackets for 2020?

IRMAA income brackets generally increased from $1,000 to $3,000 for individual tax filers, and between $2,000 and $6,000 for married couples filing jointly.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

What are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Does Medicare distribution increase adjusted gross income?

The amount distributed is added to your taxable income, so exercise caution when you’re receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Can realized capital losses reduce Medicare premiums?

As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums. The inverse is also true and now may be more applicable to you: realized capital losses can reduce your MAGI, and could potentially reduce your Medicare Part B and Part D premiums.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

Who calculates IRMAA?

The Centers for Medicare & Medicaid Services ( CMS) calculate IRMAA and publish this amount yearly in the Federal Register. Once the IRMAA calculations are complete, CMS inform the Social Security Administration (SSA). The SSA determine whether a person must pay more than the standard premium.

How many income levels are there in IRMAA?

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What is the Medicare premium for 2021?

In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), which their Internal Revenue Service (IRS) tax return will report.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

How often does Medicare add to your income?

The amounts are based on a person’s adjusted gross income, and Medicare adds them every month. This amount can change each year based on a person’s income. If a person believes that there is a mistake with the assessment, they can go through an appeal process.

How to get extra help for Medicare?

Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: 1 have Medicare Part A, Part B, or both 2 live in the United States 3 have income and assets below specified limits

Does IRMAA change?

IRMAA may change each year, depending on a person’s income. Medicare is a federal insurance plan for people aged 65 and over. Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include:

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How much does IRMAA affect Medicare?

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works. For the part of the population that does not pay the higher premium amounts, Medicare pays approximately 75% of the cost of the Medicare Part B premium. The beneficiary is left with approximately 25% ...

What is the IRMAA determination for Social Security?

This means that the IRMAA determination ends up being based on a tax return from a couple of years ago. For example, the 2020 IRMAA determination is based on 2018 tax return.

What is the Medicare monthly adjustment number?

If you want information about this, have questions about the Medicare income-related monthly adjustment amount, or anything else related to your transition to Medicare, feel free to contact us here or call 877.506.3378.

How much is Medicare premium 2020?

The beneficiary is left with approximately 25% of the premium – $144.60/month in 2020. For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

Do I pay higher Medicare premiums?

Likewise, you pay a higher Medicare Part D IRMAA premium if you fall into one of the higher income categories. The higher premium amount is applied regardless of which company you choose for your Part D plan. The IRMAA is applied on top of the premium that you would normally be paying for Part D.

What does IRMAA stand for?

The acronym for that extra charge is IRMAA, which stands for Income Related Monthly Adjustment Amount.

Does NYC Health Benefits reimburse Medicare Part B?

The reimbursement claim form and instructions are available in the Forms section of this website. However, the IRMAA surcharge for Medicare Part D is not reimbursed.

What is Medicare Part D IRMAA?

Medicare Part D IRMAA stands for Income-Related Monthly Adjustment Amounts that affects higher income beneficiaries. Basically, the government is making you pay more for being successful. Those who belong to that bracket have to pay an additional amount to their monthly Medicare Part B and Part D monthly premiums as required by Medicare.

When will the SSA notify you of your insurance?

Once the assessment is done, the SSA will notify you at the end of November. If you have just purchased Part D coverage, you will be notified as soon as your policy kicks in. For example, if you purchased Part D coverage after the assessment, you will be notified by the SSA on January 1, if you are included in the IRMAA.

Can IRMAA be deducted from Social Security?

Generally, most people have their Part D IRMAA deducted from their Social Security benefits. However, if you aren’t a recipient of Social Security benefits or the amount of your benefit is not enough to pay for Part D IRMAA, the CMS will directly bill you.

Is IRMAA paid monthly?

Remember that Part D IRMAA is paid monthly and not quarterly like Part B.