What income is included in irmaa?

Nov 13, 2021 · What is the income-related monthly adjusted amount (IRMAA)? For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on your modified adjusted gross income.

Who has to pay irmaa?

IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes. How Does IRMAA Work? IRMAA is an increased premium that some Medicare beneficiaries pay based on their income.

Does Medicare calculate irmaa annually?

Nov 28, 2021 · The income-related monthly adjustment amount (IRMAA) is an extra charge added to your premium. It is a sliding scale with a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher the beneficiary's range of modified adjusted gross income (MAGI), the higher the IRMAA.

Is irmaa based on AGI?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What is Irma in Medicare?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA.

What income is Irmaa based on?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.Nov 11, 2021

How long do you pay Irmaa?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

What is the Irmaa amount for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.90Married filing jointly12 more rows•Dec 6, 2021

Does Social Security income count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

Is Irmaa based on adjusted gross income?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it's specific to Medicare.

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

Are Irmaa payments tax deductible?

Yes, IRMAA is allowed as a medical deduction on Schedule A, which could come off against your adjusted gross income (AGI). Put the amount in Medicare D Premiums Deducted From Your Benefit.Jun 1, 2019

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•Mar 28, 2022

What is the Medicare Part D Irmaa for 2022?

The standard premium for Medicare Part B in 2022 is $170.10 per month. Part D premiums are sold by private insurers so there is no “standard” premium. The average premium for a standalone Part D prescription drug plan in 2022 is $47.59 per month.Feb 15, 2022

What is the Irmaa for 2022?

2022 IRMAA BracketsPart B Premium2022 Coverage (2020 Income)Standard * 1.4Single: <= $114,000 Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $142,000 Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $170,000 Married Filing Jointly: <= $340,0003 more rows

WHAT IS THE MAGI for 2020?

In 2020, that maximum amount is $6,000 for most individuals and $7,000 for those at age fifty or older. If your income falls between $124,000 and $139,000 (or $196,000 and $206,000 for married couples), the amount you can contribute each year decreases.Jul 24, 2020

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How much is Medicare premium 2020?

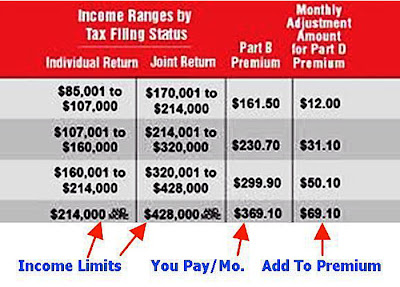

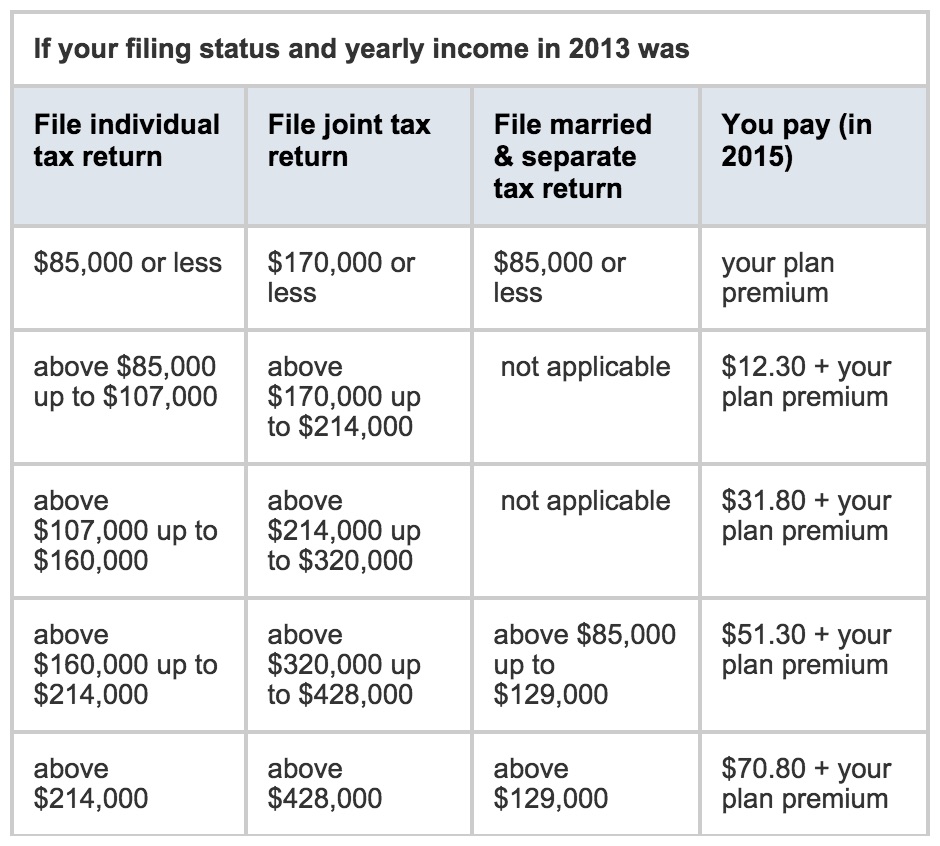

The beneficiary is left with approximately 25% of the premium – $144.60/month in 2020. For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

How many income levels are there in IRMAA?

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What are the parts of Medicare?

Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include: Original Medicare, which includes Part A and Part B. Medicare Part A pays hospital costs. Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care.

How to get extra help for Medicare?

Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: 1 have Medicare Part A, Part B, or both 2 live in the United States 3 have income and assets below specified limits

What is the Medicare premium for 2021?

In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), which their Internal Revenue Service (IRS) tax return will report.

What is extra help?

have a disability. are blind. are aged 65 and over. Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: have Medicare Part A, Part B, or both. live in the United States. have income and assets below specified limits.

Who handles Medicare Part B appeals?

The Office of Medicare Hearing and Appeals handle all appeals for Medicare Part B premiums. Individuals have the right to appeal if they believe that the adjusted premium is incorrect.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

What is MAGI income?

MAGI may include one-time only income, such as capital gains, the sale of property, withdrawals from an Individual Retirement Account (IRA) or conversion from a traditional IRA to a Roth IRA. One-time income will affect your Medicare premium for only one year. ….

How much is Medicare Part B in 2021?

Sadly, the public policy target ends up hurting these people anyway. In 2021, the standard Medicare Part B premium is $148.50 per month. However, if your modified adjusted gross income ( MAGI) from 2 years ago is above a certain amount, you are faced with an Income Related ...

What happens if you divorce your spouse?

You divorced, or your marriage was annulled, You became a widow or widower, You or your spouse stopped working or reduced work hours, You or your spouse lost income-producing property due to a disaster or other event beyond your control,

Who is Megan Russell?

Megan Russell has worked with Marotta Wealth Management most of her life. She loves to find ways to make the complexities of financial planning accessible to everyone. She is the author of over 700 financial articles. Her most popular post is " The Complete Guide to Your Washing Machine " while one of her favorites is " Funding a 3-Year-Old’s Roth IRA ."