How much cheaper is Medicare Advantage compared to Medicare?

50 rows · Feb 15, 2022 · Average cost of Medicare Advantage plans In 2021, the average Medicare Advantage plan premium for plans that offer prescription drug coverage is $40 per month. 1 A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month.

How much does Medicare Advantage cost per month?

Feb 15, 2022 · How much does Medicare Advantage cost per month? In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the …

When to choose Original Medicare vs. Medicare Advantage?

Nov 24, 2020 · According to CMS, the average Medicare Advantage plan premium is $21/month for 2021 — the lowest it’s been since 2007. But there’s wide variation in …

Is Medicare Advantage better than Medicare?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the average maximum out-of-pocket cost for a Medicare Advantage plan?

The average out-of-pocket limit for Medicare Advantage enrollees is $5,091 for in-network services and $9,208 for both in-network and out-of-network services (PPOs) Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B.Jun 21, 2021

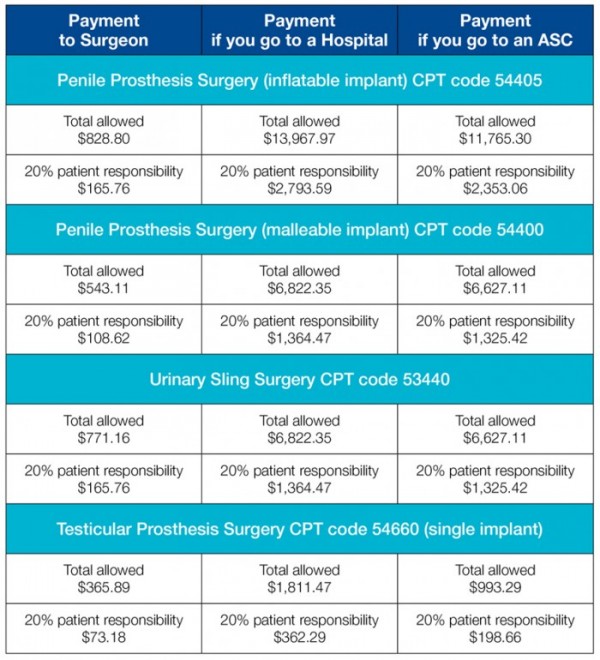

Do Medicare Advantage plans pay the 20 %?

With Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for common health services like office visits or outpatient surgery. Most Medicare Advantage plans use copays instead of coinsurance for these services. That means you pay a fixed cost.Oct 1, 2020

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare Advantage pay 100 percent?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.Jan 7, 2022

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.Nov 8, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

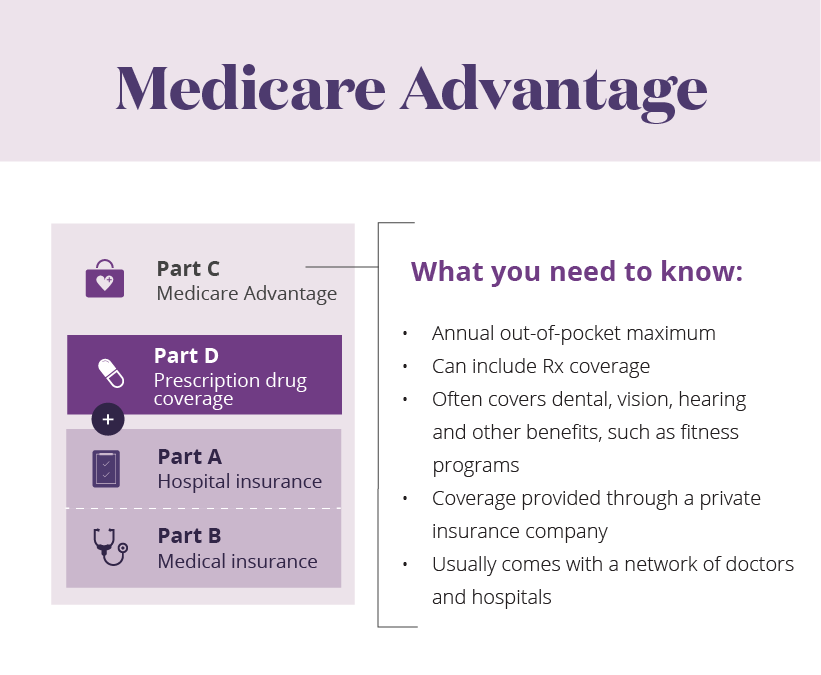

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan. You go.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is copayment in medical terms?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What are the factors that affect Medicare?

Other factors that affect costs are the following: the scope and frequency of healthcare services that a person needs.

How much is Medicare Part B in 2021?

Part B monthly premiums in 2021 are $148.50, although this amount may vary with income.

What are the different types of MSPs?

The four kinds of MSPs include: 1 Qualified Medicare Beneficiary Program: The monthly income limit to enroll is $1,084 for an individual and $1,457 for a married couple. This program helps pay for premiums for Part A and B, along with copayments, coinsurance, and deductibles. 2 Specified Low-Income Medicare Beneficiary Program: The monthly income limit to enroll is $1,296 for an individual and $1,744 for a married couple. This state program helps pay for Part B for people with Part A. 3 Qualifying Individual Program: The monthly income limit is $1,456 for an individual and $1,960 for a married couple. This state program also helps pay for Part B for people with Part A. 4 Qualified Disabled and Working Individuals Program: The monthly income limit is $4,339 for an individual and $5,833 for a married couple. This program helps a working person with a disability pay for Part A premiums.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare Advantage have a cap?

Medicare Advantage plans also put a yearly cap on costs, which is a benefit that Medicare Part A and B do not offer. The costs and benefits of different Medicare plans can vary depending on an individual’s situation, so it is best to consider the pros and cons of each.

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

What is the Medicare Advantage premium for 2020?

What Is the Premium for Medicare Advantage? In 2020, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $25, according to the Kaiser Family Foundation. (The average monthly premium is weighted by enrollment.)

How much is Medicare Part B 2021?

Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate. Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums.

When are Medicare premiums due?

Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made. Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

What is a Part C plan?

In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage (Medicare Part D) and other types of benefits such as dental and vision. The premium you may pay is used to cover the wider range of services available with Medicare Part C. The Medicare-approved private insurance companies ...

How does Medicare work?

This is how the process works: Medicare approves a private insurance company to provide members with Original Medicare. The insurance company becomes responsible for paying members’ claims. Medicare pays the insurance company a flat fee for the cost of paying claims. The insurance company uses this payment to provide members with healthcare ...

What happens if you don't receive Medicare?

If you don’t receive these benefits, you will receive a bill called ‘Notice of Medicare Premium Payment Due’. You can then pay by mailing a check, use your bank’s online billing to make payments every month, or sign-up for Medicare’s bill pay to have the premium come out of your bank account automatically.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Who is Dr. Brent Schillinger?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them:

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

What is the Cares Act?

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES (Coronavirus Aid, Relief, and Economic Security) Act, into law. It expands Medicare's ability to cover treatment and services for those affected by COVID-19.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

What is Medicare Advantage?

Medicare Advantage is a way to get your Medicare benefits through private insurance companies. Although these plans primarily cover Part A and Part B services, many of them also include at least some prescription drug costs.

How much does Eliquis cost with Medicare?

It will also depend on whether you have a coinsurance, copayment, or deductible with your plan. Premiums for Part D tend to be cheap, at around $30 per month.

Why is Eliquis prescribed?

Eliquis is also prescribed to reduce the risk of stroke, or the risk of clotting after certain procedures like hip replacements. Because Eliquis is so popular, especially among folks on Medicare, it’s important to know what your options are as you transition to Medicare coverage.

Do you have to pay deductible for Medicare Advantage?

However, when you have Medicare Advantage, you will still have Part B premiums. In addition to this, you’ll still have to pay a deductible and coinsurance for your Medicare Advantage plan. In addition to this, your premiums can vary. Make sure to check the cost of plans in your area and compare them to Part D plans.

How much does Eliquis cost without insurance?

Without any insurance coverage, a one-month supply of Eliquis can cost over $500. Because the price for this medication is so high, you should make sure that your insurance has you covered.

Is Eliquis generic?

A generic version of Eliquis is not currently available to buy. However, the FDA approved a generic version of Eliquis in early 2020. This generic version will simply be called Apixaban. For now, we can’t tell how much Apixaban will cost. However, it will likely be significantly cheaper than name-brand Eliquis.

How long does Eliquis last?

There are a few other ways to save money on Eliquis: Eliquis offers a $10 copay card that you can apply to every 30 day supply you purchase, for up to 24 months. This card basically gives you a free 30-day supply of Eliquis, no matter what type of insurance you have.