Like all Medigap

Medigap

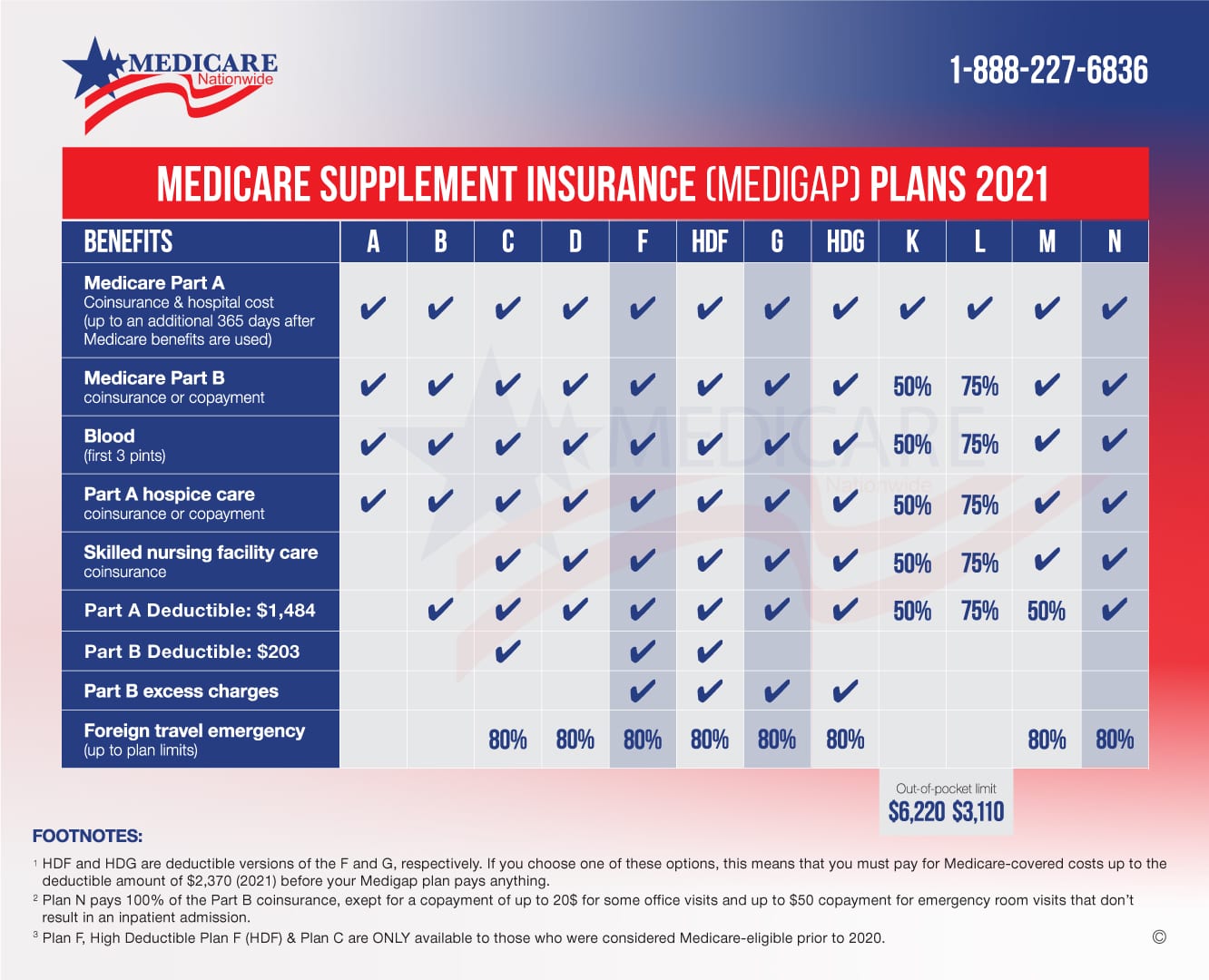

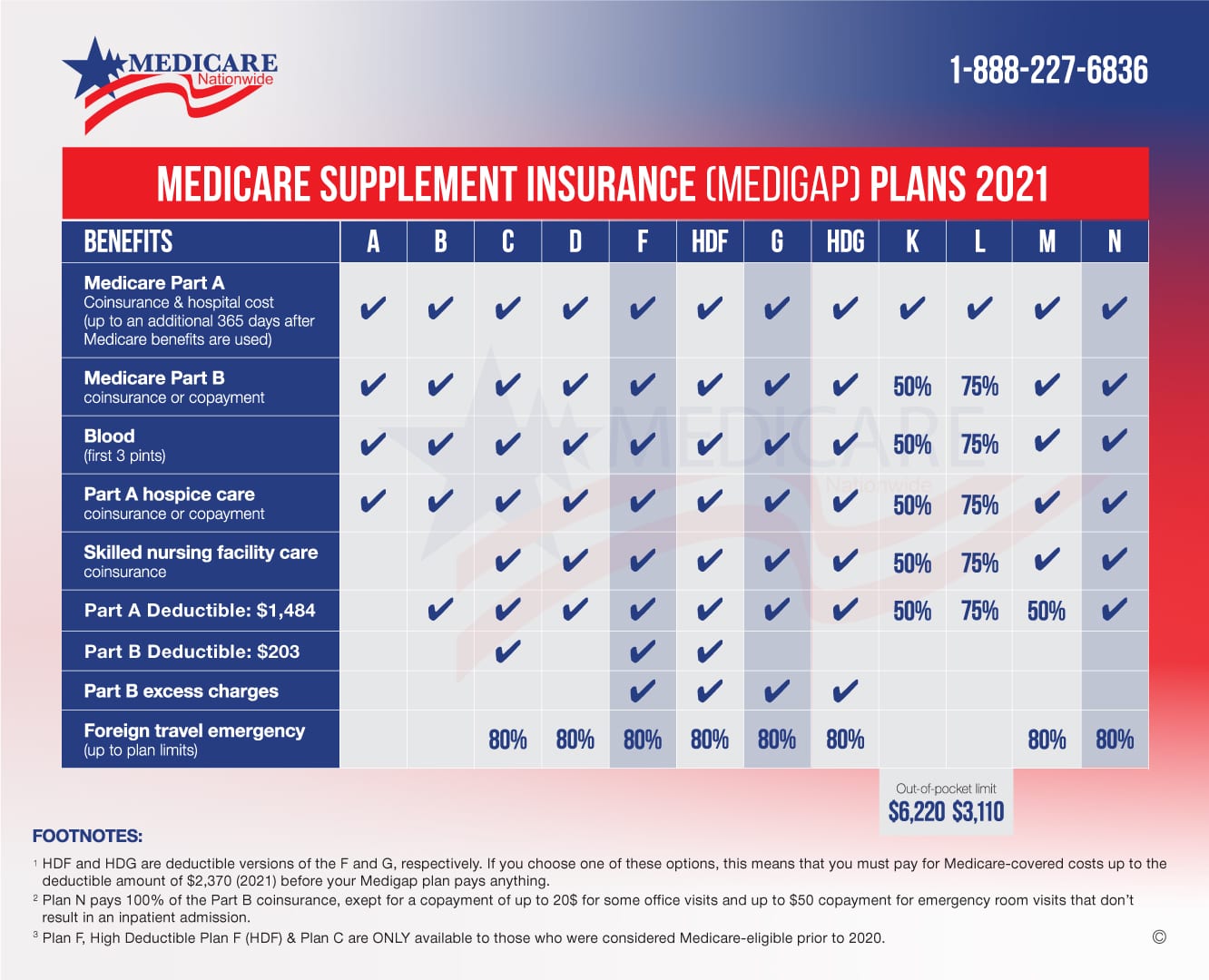

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What medications are not covered by Medicare?

Providers can charge 15% more than what Medicare allows. This is called an excess charge. Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time. However, you can avoid this by simply asking your providers up front if they accept Medicare assignment.

What services are not covered by Medicare?

Medicare doesn’t cover items and services required because of war or an act of war that occur after the effective date of the patient’s current entitlement. D. Personal Comfort Items & Services. Medicare doesn’t cover personal comfort items because …

Who is not covered by Medicare?

Nov 23, 2021 · What Does Medicare Supplement Plan N Not Cover? Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency …

What services are not covered by part?

What Medicare health plans cover. Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM. Preventive & screening services. Part B covers many preventive services. What's not covered by Part A & Part B. Learn about what items and services aren't covered by Medicare Part A or Part B.

What does the N plan cover?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).Jan 24, 2022

What is typically not covered by Medicare?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

What is the difference between Plan N and Plan G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Does AARP Medicare Supplement Plan N cover dental?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing.May 12, 2020

Which part of Medicare program does not include a premium?

Inpatient Hospital Insurance and is provided with no premiums to most beneficiaries.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Plan N cover Medicare deductible?

Plan N also completely covers your Medicare Part A deductible, which is one of the more expensive deductibles in Medicare and repeats for each benefit period throughout the calendar year.

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Does Plan N cover excess charges?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount.Nov 23, 2021

What's the difference between Medicare Part G and Part N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.Apr 29, 2021

What part of Medicare covers dental and vision?

Medicare Advantage (Part C) plans can offer coverage for dental and vision health items in addition to also offering the same coverage as Original Medicare. Most also include prescription drug coverage as well as other benefits such as hearing health coverage and gym memberships.

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

Does Medicare pay for hospital services?

Your Medicare Part A hospital benefits provide coverage for inpatient hospital services, skilled nursing, home health, hospice and blood transfusions. While you would normally owe a deductible for your hospital stay, your Medigap Plan will pay that for you. Here’s a quick list of items covered in the hospital by Medicare Supplement Plan N: ...

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

Does Plan N cover Medicare?

Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time. However, you can avoid this by simply asking your providers up front if they accept Medicare assignment. If they do, you need not worry about excess charges.

Is Medicare Plan N standardized?

Though Medicare Plan N is one of the 10 federally standardized Medicare Supplement options , each insurance company can choose whether to sell it or not. Fortunately, this policy is fairly easy to find since many carriers offer it.

Can you transfer financial liability to a patient?

To transfer potential financial liability to the patient, you must give written notice to a Fee-for-Service Medicare patient before furnishing items or services Medicare usually covers but you don’ t expect them to pay in a specific instance for certain reasons, such as no medical necessity .

Does Medicare cover non-physician services?

Medicare normally excludes coverage for non-physician services to Part A or Part B hospital inpatients unless those services are provided either directly by the hospital/SNF or under an arrangement that the hospital/SNF makes with an outside source.

Does Medicare cover personal comfort items?

Medicare doesn’t cover personal comfort items because these items don’t meaningfully contribute to treating a patient’s illness or injury or the functioning of a malformed body member. Some examples of personal comfort items include:

Does Medicare cover dental care?

Medicare doesn’t cover items and services for the care, treatment, filling, removal, or replacement of teeth or the structures directly supporting the teeth, such as preparing the mouth for dentures, or removing diseased teeth in an infected jaw. The structures directly supporting the teeth are the periodontium, including:

Does Medicare cover exceptions?

This booklet outlines the 4 categories of items and services Medicare doesn’t cover and exceptions (items and services Medicare may cover). This material isn’t an all-inclusive list of items and services Medicare may or may not cover.

What is Medicare Plan N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B . It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

How long does Medicare cover hospitalization?

Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance (excluding copays for office visits and ER) and 20% of Medicare-approved expenses or copayments for hospital outpatient services.

How do insurance companies set prices?

But how do companies set these prices? They use one of three price rating systems to set premiums: 1 Community-rated: everyone with the policy pays the same price regardless of age. Pricing can still change based on inflation but cannot increase due to your age. 2 Issue-age-rated: the premium is based on the age you are at the time of purchase. Therefore, it costs less for people who buy at a younger age. The price cannot increase after the issue date due to age. 3 Attained-age-rated: the premium starts low and increases as you age.

How old do you have to be to get Medigap?

Medigap plans are standardized by the federal government. This means that plans of the same letter offer the same benefits, no matter who you buy it from. But keep in mind that insurance companies are allowed to offer additional benefits, so compare plans carefully before you purchase a policy. You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase.

How old do you have to be to get Medicare Supplement?

You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase. There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

Does Medicare cover a doctor's office?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

Does Medigap cover you?

With Medigap plans, there is no insurance network limiting you. Medicare Plan N covers you no matter where you go throughout the country – as long as your provider accepts Medicare.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What are the requirements for Medicare Part D?

Generally, Medicare Part D will cover certain prescription drugs that meet all of the following conditions: 1 Only available by prescription 2 Approved by the Food and Drug Administration (FDA) 3 Sold and used in the United States 4 Used for a medically accepted purpose 5 Not already covered under Medicare Part A or Part B

What is Medicare services?

Medicare considers services needed for the diagnosis, care, and treatment of a patient’s condition to be medically necessary. These supplies and services cannot be primarily for the convenience of the provider or beneficiary. Always ask your doctor to clarify if you’re not sure whether a specific service or item is covered by Medicare.

Does Medicare pay for dental care?

Medicare Part A (hospital Insurance) might pay for certain dental services that you get while you’re in a hospital. Foot care : Medicare does not cover routine foot care (such as removal of calluses or nail-cutting), but Part B covers medically necessary podiatrist services to treat foot injuries or diseases. ...

Does Medicare cover hearing aids?

Hearing care : Medicare won’t cover routine hearing exams, hearing aids, and exams to get fitted for hearing aids. However, you may be covered if your doctor orders a diagnostic hearing exam to see if you need further treatment.

Does Medicare cover homemaker services?

You must be taking the most direct route and traveling “without unreasonable delay.”. Homemaker services : Medicare won’t cover homemaker services, such as cooking and cleaning. An exception is if the beneficiary is in hospice care, and the homemaker services are included in the care plan. Long-term care : Medicare doesn’t cover long-term ...

Does Medicare cover nursing home stays?

However, Medicare won’t cover nursing home stays if personal care is the only care you need.

Does Medicare cover personal comfort items?

Personal comfort items : Medicare does not cover personal comfort items used during an inpatient hospital stay, such as shampoo, toothbrushes, or razors. It doesn’t cover the cost of a radio, television, or phone in your hospital room if there’s an extra charge for those items.

What is Medicare Supplement Plan N?

The takeaway. Medicare Supplement Plan N is a popular Medigap plan that covers many of your out-of-pocket costs from Medicare. Like every Medicare supplement plan, Medigap Plan N has pros and cons, and costs will vary based on where you live.

What is a Medigap Plan N?

Medigap Plan N is a “plan” and not a “part” of Medicare, such as Part A and Part B, which cover your basic medical needs. Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. These plans can cover costs like premiums, copays, and deductibles.

What are the benefits of Medicare Supplement?

Medicare supplement Part N covers the cost of the following: 1 Medicare Part A deductible 2 Medicare Part A coinsurance and hospital stays up to 365 days 3 Medicare Part B coinsurance for outpatient care and procedures 4 Medicare Part B copays at doctors’ offices 5 blood transfusion (up to the first 3 pints) 6 hospice care and skilled nursing facility coinsurance 7 80 percent of healthcare costs while traveling outside the United States

How much does Plan N cost?

With Plan N, you’ll pay $20 for some doctor’s visits and $50 if you go to the emergency room. Plan N also doesn’t cover Part B excess charges, which is the fee you pay if your healthcare provider charges more than Medicare will pay for services.

What is a plan N?

Like the other nine Medigap plans, Plan N is a privately administered type of Medicare supplement insurance. It’s designed to help you cover specific out-of-pocket costs for your healthcare that Medicare Part A and Medicare Part B don’t cover. Plan N covers things like Medicare Part A coinsurance, an amount you must pay out-of-pocket ...

Does Medicare cover Part B?

80 percent of healthcare costs while traveling outside the United States. Medicare supplement Plan N doesn’t cover the deductible for Medicare Part B . This is because of a change in Medicare law that prohibits all Medigap plans from covering the Medicare Part B deductible. While Medigap Plan N covers 100 percent of your Plan B coinsurance, ...

Does Medigap cover vision?

Medigap only covers Medicare-approved services. Therefore, it won’t cover things like long-term care, vision, dental, hearing aids, eyeglasses, or private-duty nursing. Medicare supplement Part N covers the cost of the following: Medicare supplement Plan N doesn’t cover the deductible for Medicare Part B. This is because of a change in Medicare law ...

What does Medicare not cover?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: 1 Long-Term Care#N#Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes. Individuals may need long-term supports and services at any age. Medicare and most health insurance plans don’t pay for long-term care.#N#(also called#N#custodial care#N#Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom. It may also include the kind of health-related care that most people do themselves, like using eye drops. In most cases, Medicare doesn't pay for custodial care.#N#) 2 Most dental care 3 Eye exams related to prescribing glasses 4 Dentures 5 Cosmetic surgery 6 Acupuncture 7 Hearing aids and exams for fitting them 8 Routine foot care

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.