Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. Each year the Medicare premiums, deductibles, and coinsurance rates are adjusted according to the Social Security Act. For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts.

Full Answer

What is the maximum premium for Medicare Part B?

Part B also covers durable medical equipment, home health care, and some preventive services. What Medicare health plans cover. Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM. Preventive & screening services. Part B covers many preventive services. What's not covered by Part A & Part B

How much are Medicare Part B premiums?

Apr 16, 2021 · The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

What are the rules for Medicare Part B?

Medicare Part B | What Does Medicare Part B Cover 2021 Original Medicare consists of two parts: Medicare Part A provides for hospital insurance, while Medicare Part B . Together, these two components are equal to Original Medicare, the federally administered health care program for seniors and certain persons with disabilities.

Who is eligible for Medicare Part B reimbursement?

Nov 24, 2021 · In 2021, the Medicare Part B deductible is $233 per year. This represents the amount of money you must pay out of your own pocket for covered services and items before your Part B coverage kicks in for the rest of the year. Part B coinsurance

What does Medicare Part B entitle you to?

Medicare Part B (Medical Insurance) Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services.

What benefits fall under Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.Sep 11, 2014

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Does Medicare Part B cover 80 %?

Medicare Part B pays 80% of most doctor's services, outpatient treatments, and durable medical equipment (like oxygen or wheelchairs). You pay the other 20%. Medicare also pays for mental health care costs.Nov 17, 2020

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

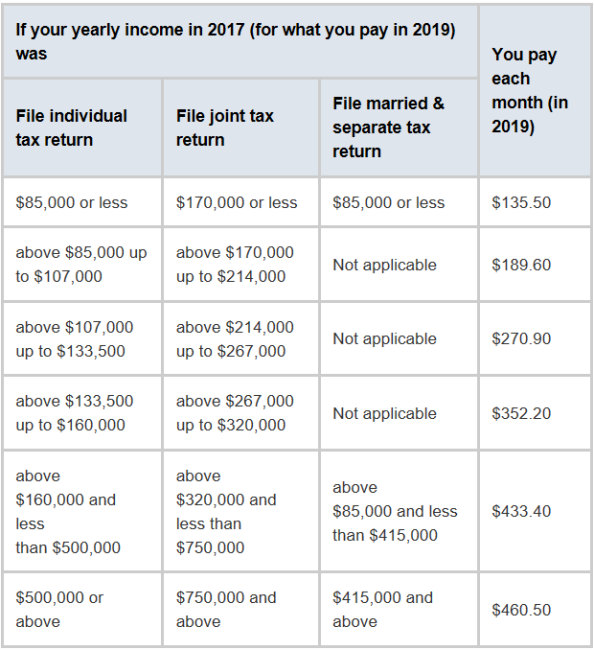

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What is the Medicare 80/20 rule?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

Does Medicare pay 100 percent of hospital bills?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

What is not covered by Medicare Part B?

What doesn’t Medicare Part B cover? 1 Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. 2 Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services. 3 Routine dental care 4 Routine vision care 5 Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. 6 Hearing aids 7 24-hour home health care 8 Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it.

What does Medicare Part B cover?

Routine vision care. Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. Hearing aids. 24-hour home health care. Long-term care, such as you might get in a nursing home.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

Does Medicare cover custodial care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it. Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What Does Medicare Part B Cost?

There is a premium associated with Health Insurance Part B by 2020, this premium is $144.60/month for most people who are 65 years old. If you enroll one of the highest income groups in medicare, you may have to pay more than that. This is the MRI (Monthly Adjustment of Income Premiums for Part B).

How Do I Sign Up for Medicare Part B?

Registering for Part B of the Medicare plan is very easy to do. First, if you already receive social security at age 65, you will automatically be enrolled in Parts A and B of health insurance. They will start on the first day of the month when he turns 65.

How Does Part B Work with My Medigap Plan?

If you have or are receiving a Medigap plan, your Part B of Medicare will be used as the primary coverage (along with Part A). The Medigap plan will fill the “gaps” that are not covered by Parts A and B. The different Medigap plans cover different gaps. You can read more about this on the Medigap coverage table.

How much is Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203 per year. This represents the amount of money you must pay out of your own pocket for covered services and items before your Part B coverage kicks in for the rest of the year. Once your Part B deductible is met, you pay 20 percent of the Medicare-approved amount for covered services.

How much is the Part B premium for 2021?

In 2021, the standard Part B premium is $148.50 per month. Some beneficiaries may pay more than the standard Part B premium because they have a higher income. This extra amount is called the Income-Related Monthly Adjustment Amount (IRMAA).

What is Medicare Part B?

Medicare Part B is also known as medical insurance and helps cover medical services and supplies that help treat health conditions or prevent disease.

Does Medicare Part B cover dental care?

Medicare Part B doesn’t cover routine dental care , such as teeth cleanings, dental X-rays or other services.

What is Part B coinsurance?

Once your Part B deductible is met, you pay 20 percent of the Medicare-approved amount for covered services. The Medicare-approved amount is the amount that Medicare has determined it will reimburse for each service or item it covers. This 20 percent cost is known as the Medicare Part B coinsurance.

What is Medicare Part B excess charge?

Some health care providers do not accept Medicare reimbursement as full payment for their services. These providers reserve the right to charge up to 15 percent more than the Medicare-approved amount for their services or items, which is known as an “excess charge .”.

What happens if you don't enroll in Medicare Part B?

If you choose not to enroll in Medicare Part B during this time, you may face a late enrollment penalty if you decide to sign up at a later time. The late enrollment penalty is equal to 10 percent of the standard Part B premium for each full 12-month period that you were eligible for Part B but did not have it.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

When does Medicare coverage start?

That takes place yearly from January 1st through March 31st. Coverage begins July 1st of the same year you enroll. The Annual Election Period runs from October 15th-December 7th of every year. That is only for those currently enrolled in Medicare.

What are the requirements for Medicare?

Medicare coverage requirements for those under 65 include: 1 Entitled to Social Security benefits for a total of 24 months 2 Currently receiving a disability pension from the Railroad Retirement Board 3 Diagnosed with Lou Gehrig’s disease (which would qualify you immediately) 4 Permanent kidney failure that requires regular dialysis treatment (or had a kidney transplant) 5 Or your spouse paid Social Security taxes for a specified period (depending on your age)

What age do you have to be to get Medicare?

Medicare Coverage Age. Turning 65 means you’re eligible for Medicare coverage. If you’ve been collecting Social Security Disability Insurance for over 24 months, you may be Medicare-eligible before 65. At the beginning of the 25th month, you’re automatically enrolled in Medicare.

How long do you have to work to get Social Security?

citizen or permanent legal resident of the United States for a minimum of 5 years. Worked long enough (40 credits or about ten years) to get Social Security or Railroad Retirement benefits. Are an employee of the government.

When did Medicare start?

Medicare is a federal health insurance coverage formed in 1965 . It covers people 65 and over; but, people with disabilities may qualify before 65. With so many U.S. citizens utilizing Medicare, we wanted to take a closer look at who has Medicare and how they use it.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What are the conditions that women on Medicare have?

A few of these conditions include hypertension, osteoporosis, and arthritis.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

What does Medicare not cover?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: 1 Long-Term Care#N#Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes. Individuals may need long-term supports and services at any age. Medicare and most health insurance plans don’t pay for long-term care.#N#(also called#N#custodial care#N#Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom. It may also include the kind of health-related care that most people do themselves, like using eye drops. In most cases, Medicare doesn't pay for custodial care.#N#) 2 Most dental care 3 Eye exams related to prescribing glasses 4 Dentures 5 Cosmetic surgery 6 Acupuncture 7 Hearing aids and exams for fitting them 8 Routine foot care

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.