What Is MedicareComplete?

- Medicare Advantage Plans. Medicare Advantage Plans are substitutes for Original Medicare coverage and were authorized by Congress to shift some of Medicare's cost burden to private insurance companies.

- MedicareComplete. UnitedHealthcare markets three types of MedicareComplete plans. ...

- Benefits. ...

- Features. ...

- Enrollment and Cost. ...

Full Answer

Is Medicare a good insurance?

Thanks to the program, millions of aging adults have been able to receive coverage. Medicare also covers many younger Americans with disabilities. Medicare is considered helpful because it covers so many people. Many Medicare enrollees qualify for premium -free Part A but must pay a small, out-of-pocket amount every month for Part B.

What are the four types of Medicare?

Medicare coverage is broken down into four different parts:

- 1. Medicare Part A: Hospital insurance Medicare Part A is one half of Original Medicare, the health insurance managed by the federal government, and is hospital insurance. ...

- 3. Medicare Part C: Medicare Advantage plans Many people opt for Medicare Part C, also known as a Medicare Advantage plan, rather than Original Medicare. ...

- 4. ...

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

What is the Original Medicare plan?

These are the top three Medicare Supplement plans for 2022 and this article seeks to remove the confusion regarding these options for having additional coverage on top of the Original Medicare (Part A and Part B). Enrolling in any Medigap is a smart ...

What is the difference between Medicare Advantage and Medicare Complete?

Consider if you want coverage for dental, vision and other extra benefits. Medicare Advantage plans cover everything Original Medicare covers plus more, so if you want things like dental, vision or fitness benefits, a Medicare Advantage plan may be the right choice.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most complete Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What type of insurance is AARP Medicare Complete?

AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What parts of Medicare are free?

Medicare Part AWhile Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the cheapest Medicare plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

Does AARP Medicare Complete require referrals?

AARP HMO plans If you have to see a specialist, you'll usually need a referral from your primary care doctor. Most AARP Medicare Advantage plans have a few exceptions to this rule. If you need flu shots, vaccines, or preventive women's healthcare services, you may receive them from a specialist without a referral.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What is the difference between AARP and UnitedHealthcare?

Although AARP is not an insurance company, it offers healthcare insurance plans through United Healthcare. The plans include Medicare Part D prescription drug coverage and Medigap. United Healthcare is a nationwide health insurance company, with reported 2019 revenue of $242.2 billion.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

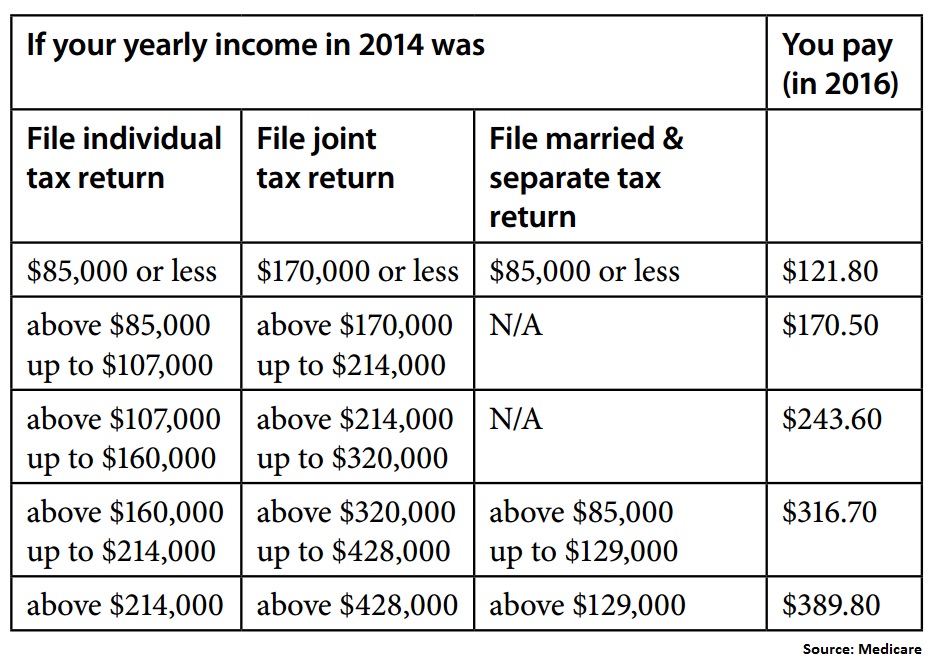

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is Medicare Advantage?

Medicare Advantage plans are offered through private companies, which develop agreements with Medicare to provide some Medicare benefits to those who sign up with them. The AARP MedicareComplete plans are available through the insurance provider UnitedHealthcare. Some medical care services continue to be covered through Medicare instead ...

What are the different types of Medicare?

UnitedHealthcare offers four types of MedicareComplete plans. One type is HMO plans, which are health maintenance organizations that require participants to pursue care within a network of providers. Another type is point-of-service plans, which maintains a network of providers but allows participants to seek coverage for certain services outside of the network for a higher price. The third type is the preferred provider organization, which allows participants to seek a provider for any covered service outside of the network; this comes with higher costs for participants. The fourth type is private fee-for-service, which provides the most flexibility in choosing your desired doctor who takes Medicare and accepts the plan's payment terms.

Do you have to pay deductible for a health insurance plan?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, limiting the medical expenses participants pay in a year. They receive routine eye exams, access to a nurse by phone around the clock and coverage for emergency care anywhere in the world.

Does AARP MedicareComplete have a deductible?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, ...

When was Medicare for All passed?

What began as a bill in the House of Representatives of the United States in 2003, the United States National Health Care Act, also known as the Expanded and Improved Medicare for All Act, has now become known more simply as Medicare for All, or Universal Health Care. The purpose of the bill that Representative John Conyers introduced ...

Is health insurance a one size fits all?

Other groups support the right of the people to have private insurance if they wish, and not to be obligated to have a one-size-fits-all type of health insurance managed by the government.

Is Medicare for all a viable solution?

This is another reason that many lawmakers are trying to find a viable solution with a Medicare for all act. Many United States lawmakers propose that the government create a program like Medicare insurance, extended to make it accessible to all Americans, not only for those who are the age of 65 or have a disability.

What is assignment in Medicare?

Assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

What is an ABN in Medicare?

A. Advance Beneficiary Notice of Noncoverage (ABN) In Original Medicare, a notice that a doctor, supplier, or provider gives a person with Medicare before furnishing an item or service if the doctor, supplier, or provider believes that Medicare may deny payment.

Can you appeal a Medicare plan?

Your request to change the amount you must pay for a health care service, supply, item or prescription drug. You can also appeal if Medicare or your plan stops providing or paying for all or part of a service, supply, item, or prescription drug you think you still need.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/10-23-2019/t_fd43b5f25eda4e768c5c9e3a968067c7_name_image.jpg)